1. What is the projected Compound Annual Growth Rate (CAGR) of the Intravenous Line Connectors?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Intravenous Line Connectors

Intravenous Line ConnectorsIntravenous Line Connectors by Type (Negative Fluid Displacement Intravenous Lineconnectors, Positive Fluid Displacement Intravenous Lineconnectors, Neutral Fluid Displacement Intravenous Lineconnectors, World Intravenous Line Connectors Production ), by Application (Hospital, Clinic, Others, World Intravenous Line Connectors Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

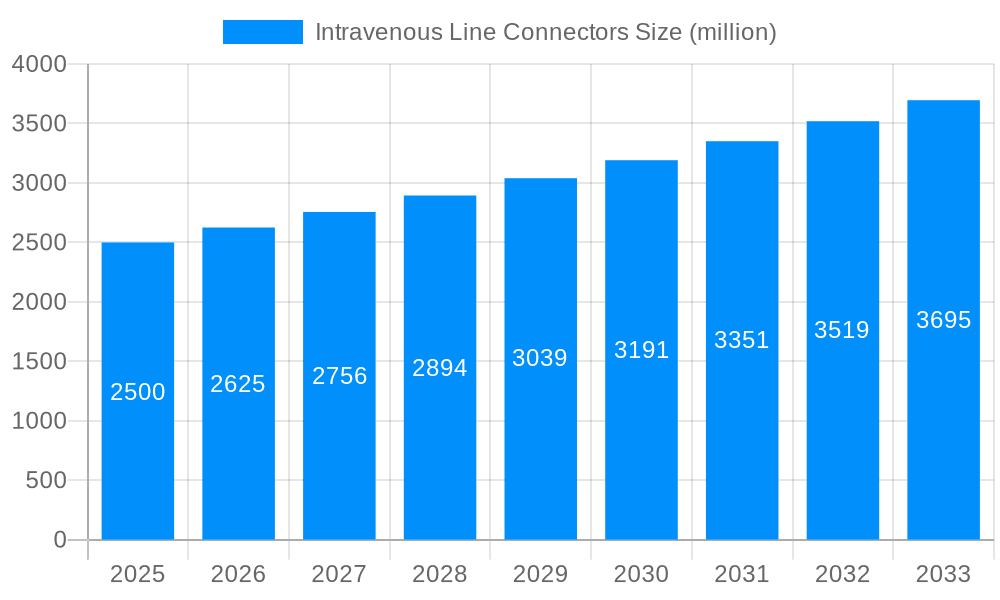

The global Intravenous (IV) Line Connectors market is poised for significant expansion, projected to reach an estimated USD 2.5 billion in 2025 with a robust Compound Annual Growth Rate (CAGR) of 5% through 2033. This growth trajectory is fueled by several key drivers, including the increasing prevalence of chronic diseases worldwide, a growing aging population requiring extended medical care, and the continuous advancements in medical device technology that enhance patient safety and treatment efficacy. The rising demand for minimally invasive procedures and the expanding healthcare infrastructure, particularly in emerging economies, also contribute substantially to market expansion. Furthermore, the heightened focus on infection control and the development of advanced connector designs that minimize the risk of contamination are critical factors bolstering market growth. The market's evolution is characterized by a strong emphasis on developing innovative solutions that streamline IV therapy administration, reduce healthcare-associated infections, and improve patient outcomes.

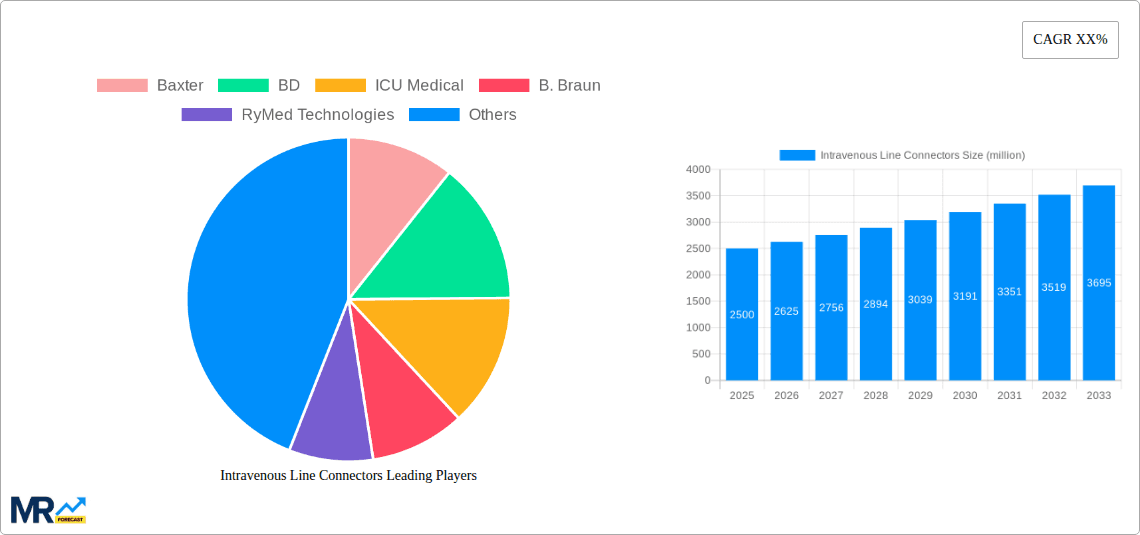

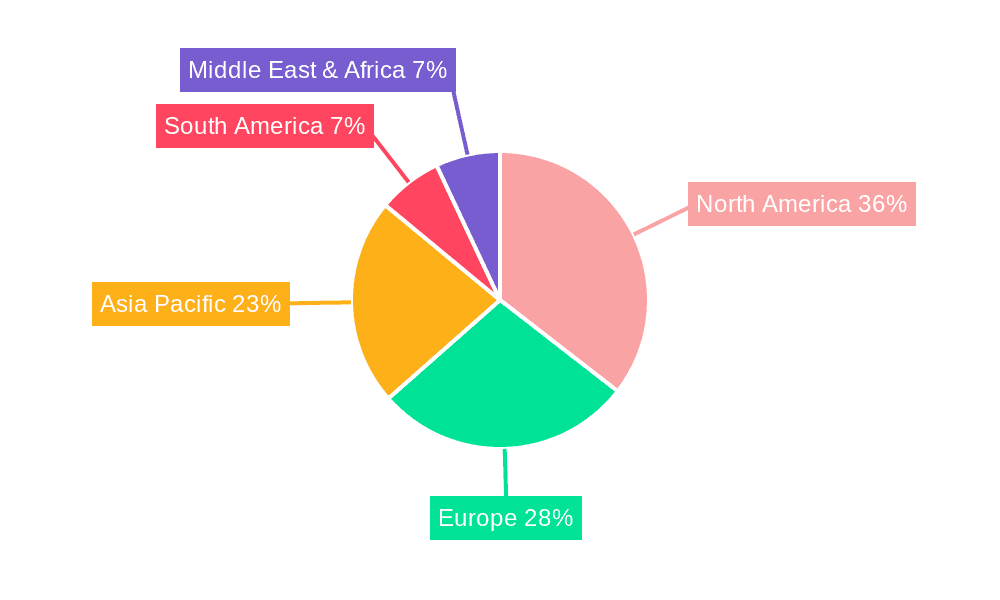

The market is segmented into distinct types based on fluid displacement: Negative Fluid Displacement Intravenous Line Connectors, Positive Fluid Displacement Intravenous Line Connectors, and Neutral Fluid Displacement Intravenous Line Connectors. Negative fluid displacement connectors are anticipated to lead the market due to their enhanced ability to prevent backflow, thereby reducing the risk of infection and air embolism. In terms of application, hospitals are expected to remain the largest segment, driven by high patient volumes and the extensive use of IV therapies. However, clinics and other healthcare settings are also exhibiting considerable growth due to the decentralization of healthcare services and the increasing adoption of outpatient procedures. Geographically, North America currently dominates the market, owing to its advanced healthcare system and high adoption rate of new medical technologies. Asia Pacific, however, is expected to witness the fastest growth, propelled by expanding healthcare expenditure, a rapidly growing patient population, and increasing government initiatives to improve healthcare access and quality. Key players like Baxter, BD, ICU Medical, and B. Braun are instrumental in shaping market trends through continuous product innovation and strategic partnerships.

Here's a report description on Intravenous Line Connectors, incorporating your specific requirements:

The global market for Intravenous (IV) Line Connectors is poised for significant expansion, projected to reach an impressive XXX billion USD by 2033. This robust growth trajectory is underpinned by a confluence of factors, primarily driven by the escalating global healthcare expenditure and the increasing prevalence of chronic diseases. The study period, spanning from 2019 to 2033, with the base year of 2025, highlights a dynamic evolution in IV connector technology and application. During the historical period (2019-2024), the market witnessed steady growth, fueled by the increasing demand for safe and efficient drug delivery systems. The estimated year of 2025 is anticipated to see the market consolidate its gains, setting the stage for accelerated expansion in the forecast period of 2025-2033. A key trend observed is the increasing adoption of needle-free IV connectors, driven by a strong emphasis on infection control and patient safety. These connectors significantly reduce the risk of needlestick injuries and bloodstream infections, making them a preferred choice in hospitals and clinics worldwide. Furthermore, the market is witnessing a surge in demand for advanced connectors with specialized features, such as antimicrobial coatings and enhanced pressure-sensing capabilities, catering to the intricate needs of critical care and specialized therapies. The ongoing technological advancements, coupled with the growing awareness of the benefits of advanced IV connectors, are expected to propel the market to unprecedented heights. The intricate interplay between innovation, patient safety imperatives, and the sheer volume of intravenous procedures performed globally will continue to shape the market landscape, making IV line connectors an indispensable component of modern healthcare delivery. The projected market valuation underscores the critical role these seemingly small devices play in the broader healthcare ecosystem, impacting patient outcomes and operational efficiencies across a vast spectrum of medical interventions.

The Intravenous Line Connectors market is experiencing a powerful surge driven by several interconnected forces that are fundamentally reshaping healthcare delivery. Paramount among these is the unrelenting global increase in healthcare spending. As nations invest more in their healthcare infrastructure and services, the demand for essential medical devices like IV connectors naturally escalates. This is further amplified by the growing global burden of chronic diseases such as diabetes, cardiovascular ailments, and cancer, all of which necessitate regular and often long-term intravenous therapies. Consequently, the volume of IV procedures performed annually is on a steep upward curve, directly translating into a higher consumption of IV connectors. Moreover, a significant impetus comes from the unwavering focus on patient safety and infection control within healthcare settings. The implementation of stringent protocols and the increasing awareness of healthcare-associated infections (HAIs) are compelling healthcare providers to adopt safer, needle-free, and closed-system IV connectors. These advanced connectors minimize the risk of accidental needlestick injuries for healthcare professionals and reduce the potential for microbial contamination during fluid administration, thereby safeguarding patient well-being. The proactive stance taken by regulatory bodies worldwide in promoting best practices for IV therapy further solidifies this driving force.

Despite the robust growth trajectory, the Intravenous Line Connectors market is not without its set of challenges and restraints that warrant careful consideration. A primary concern revolves around the high cost of advanced and specialized IV connectors. While these premium products offer enhanced safety and functionality, their higher price point can be a barrier for healthcare facilities with limited budgets, particularly in resource-constrained regions. This can lead to a slower adoption rate of the latest technologies, perpetuating the use of more basic and potentially less safe alternatives. Furthermore, stringent regulatory approval processes for new IV connector designs and materials can significantly prolong the time-to-market for innovative products. Navigating the complex web of global health regulations, which vary by region, adds to the development costs and time, potentially stifling innovation. Lack of standardized protocols across different healthcare systems and countries can also pose a challenge. The absence of universal guidelines for IV connector usage and selection can lead to inconsistencies in practice and complicate the adoption of new technologies on a global scale. Additionally, reimbursement policies for IV connectors can vary significantly, impacting the economic viability of using more advanced and costly options. Inadequate reimbursement can disincentivize healthcare providers from investing in superior products, thus limiting market penetration. Finally, concerns regarding material biocompatibility and potential leachables from certain connector materials, especially in long-term therapies, can also present a restraint, necessitating rigorous testing and validation.

The global Intravenous Line Connectors market is characterized by a dynamic interplay of regional strengths and segment dominance, with North America and Europe currently leading, but with Asia Pacific showing rapid growth.

Dominant Regions/Countries:

North America: This region, encompassing the United States and Canada, has historically been and is projected to remain a dominant force in the IV line connectors market.

Europe: Similar to North America, Europe represents a mature and significant market for IV line connectors.

Asia Pacific: While currently a smaller market share, Asia Pacific is poised for the most rapid growth in the forecast period.

Dominant Segments:

Application: Hospital: Hospitals represent the largest and most significant application segment for IV line connectors.

Type: Positive Fluid Displacement Intravenous Line Connectors: While all types of connectors are essential, Positive Fluid Displacement (PFD) connectors are gaining increasing traction due to their specific benefits.

The dominance of these regions and segments is driven by a combination of factors including economic development, healthcare infrastructure, disease prevalence, regulatory environments, and the relentless pursuit of improved patient safety and clinical outcomes.

Several key factors are acting as powerful growth catalysts for the Intravenous Line Connectors industry. The escalating global healthcare spending, coupled with the burgeoning prevalence of chronic diseases worldwide, ensures a perpetually high demand for intravenous therapies. This foundational demand is further amplified by the unwavering global emphasis on patient safety and the stringent efforts to curb healthcare-associated infections (HAIs). The rise of needle-free and closed-system IV connectors directly addresses these concerns, making them increasingly indispensable. Furthermore, continuous technological advancements, leading to the development of connectors with antimicrobial properties, enhanced fluid dynamics, and compatibility with smart infusion systems, are driving product innovation and adoption. The expanding healthcare infrastructure in emerging economies also presents a significant growth avenue, as these regions increasingly adopt advanced medical practices and technologies.

This comprehensive report provides an in-depth analysis of the global Intravenous Line Connectors market, meticulously dissecting trends, driving forces, challenges, and future projections. It covers the market's evolution from the historical period of 2019-2024, through the estimated base year of 2025, and extends to an extensive forecast period of 2025-2033, with a projected market valuation of XXX billion USD by the end of the study. The report meticulously details the market segmentation across various connector types, including Negative, Positive, and Neutral Fluid Displacement, as well as application segments such as Hospitals, Clinics, and Others. It also delves into regional dynamics, identifying key dominant markets and rapidly growing territories. Furthermore, the report offers insights into the competitive landscape, profiling leading players and significant industry developments, providing a holistic view of this critical segment of the medical device industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Baxter, BD, ICU Medical, B. Braun, RyMed Technologies, Colder Products, Smith Medical, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Intravenous Line Connectors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Intravenous Line Connectors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.