1. What is the projected Compound Annual Growth Rate (CAGR) of the Interventional Cardiology Devices?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Interventional Cardiology Devices

Interventional Cardiology DevicesInterventional Cardiology Devices by Type (/> Angioplasty Balloons, Angioplasty Stents, Catheters, Plaque Modification Devices, Hemodynamic Flow Alteration Devices), by Application (/> Hospitals, Ambulatory Surgical Centers), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

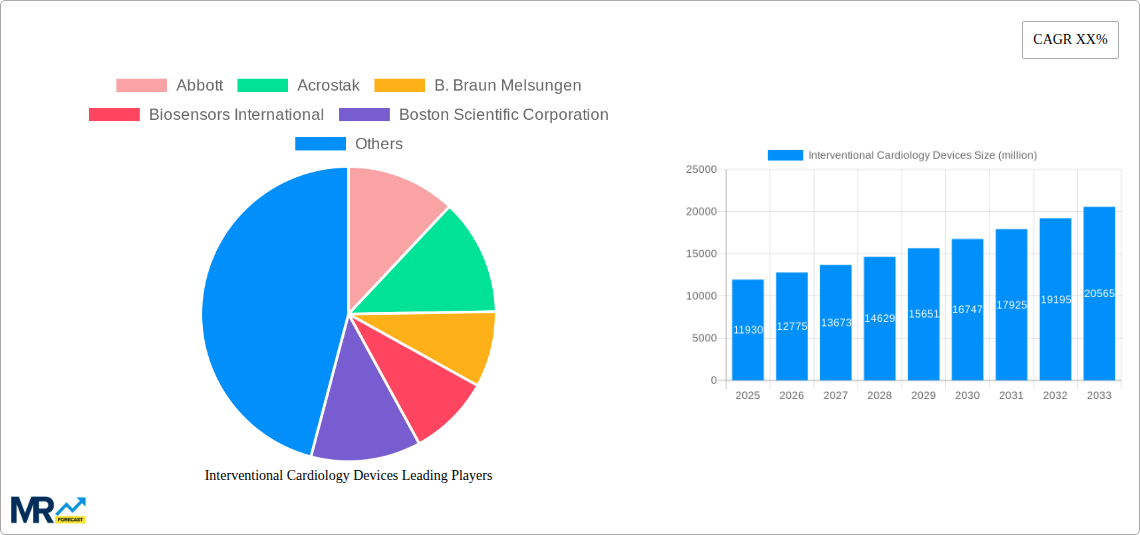

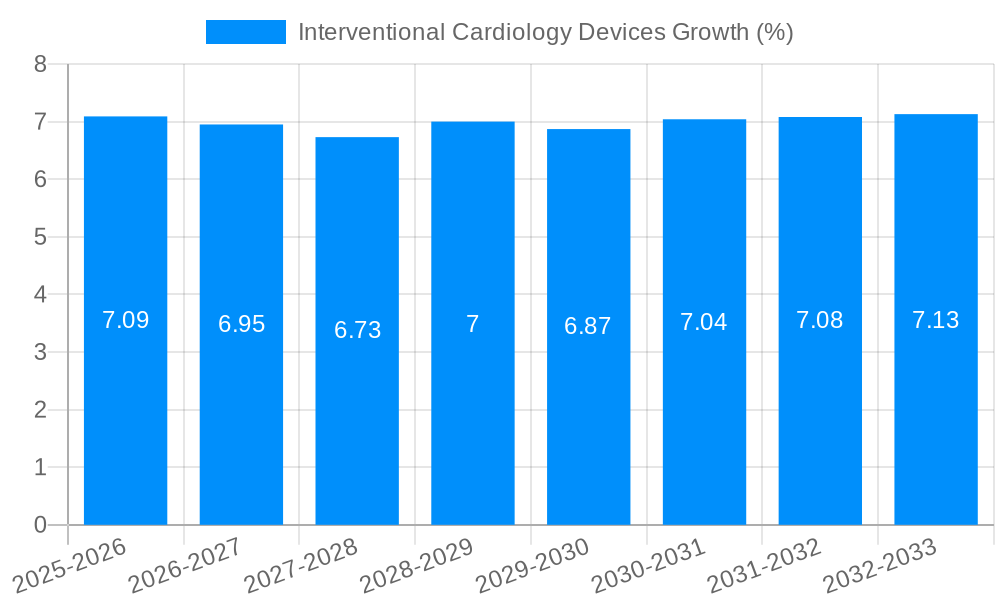

The global Interventional Cardiology Devices market is poised for substantial growth, projected to reach a significant market size of $11,930 million in 2025. This expansion is fueled by an estimated Compound Annual Growth Rate (CAGR) of approximately 7.5%, indicating a robust and sustained upward trajectory for the market throughout the forecast period. The increasing prevalence of cardiovascular diseases (CVDs) worldwide, coupled with an aging global population, forms the bedrock of this growth. Advanced healthcare infrastructure and a growing emphasis on minimally invasive procedures further bolster demand for interventional cardiology devices, offering patients safer and more effective treatment options with shorter recovery times compared to traditional open-heart surgery. Technological advancements, such as the development of next-generation stents with improved drug-eluting capabilities and sophisticated imaging-guided catheter systems, are continuously enhancing treatment outcomes and driving market innovation.

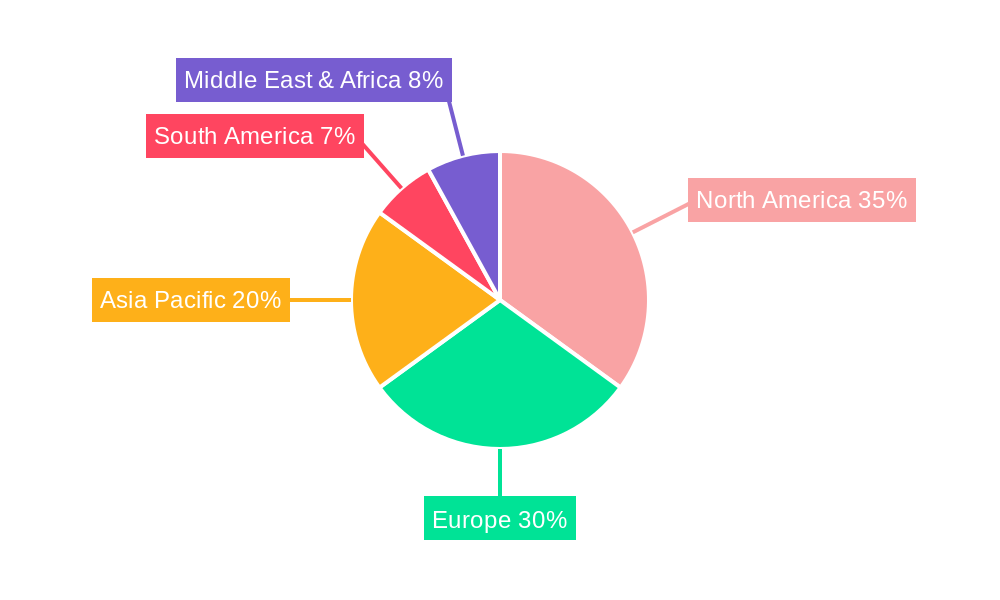

Key drivers for the Interventional Cardiology Devices market include the rising incidence of coronary artery disease (CAD) and other cardiac ailments, a growing awareness among patients and physicians regarding the benefits of interventional procedures, and favorable reimbursement policies in developed and developing economies. The market is segmented into crucial product categories such as Angioplasty Balloons, Angioplasty Stents, Catheters, Plaque Modification Devices, and Hemodynamic Flow Alteration Devices, each playing a vital role in treating various cardiovascular conditions. Hospitals and Ambulatory Surgical Centers are the primary end-use segments, reflecting the widespread adoption of these devices in clinical settings. Geographically, North America and Europe currently lead the market due to advanced healthcare systems and high adoption rates, but the Asia Pacific region is expected to witness the fastest growth, driven by increasing healthcare expenditure, a burgeoning patient population, and improving access to advanced medical technologies. Restraints such as high device costs and the need for specialized training for healthcare professionals are present, but the overwhelming clinical benefits and ongoing innovation are expected to mitigate these challenges.

Here's a unique report description for Interventional Cardiology Devices, incorporating your specified elements:

This comprehensive report offers an in-depth analysis of the global Interventional Cardiology Devices market, a dynamic sector poised for significant growth driven by technological advancements and an increasing prevalence of cardiovascular diseases. Spanning the historical period of 2019-2024, the base and estimated year of 2025, and a robust forecast period extending to 2033, this report provides actionable insights for stakeholders. We meticulously examine market trends, key drivers, prevailing challenges, and pinpoint dominant market segments and regions. The report also highlights crucial industry developments and identifies leading players, offering a 360-degree view of this vital healthcare market.

The Interventional Cardiology Devices market is experiencing a transformative period, marked by a relentless pursuit of minimally invasive solutions and enhanced patient outcomes. During the study period of 2019-2033, a prominent trend is the increasing adoption of bioresorbable scaffolds, offering a promising alternative to traditional metallic stents, thereby reducing the long-term risk of stent thrombosis and restenosis. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into device design and procedural guidance is revolutionizing how cardiologists approach interventions. AI-powered imaging analysis tools are enabling more precise lesion identification and characterization, while ML algorithms are contributing to predictive modeling for patient risk stratification and personalized treatment plans. The market is also witnessing a surge in the development of advanced imaging catheters, such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT), which provide real-time, high-resolution anatomical visualization, leading to improved stent deployment and lesion coverage. Hemodynamic flow alteration devices are gaining traction as non-stent options for managing specific conditions like severe aortic stenosis and chronic total occlusions, offering novel therapeutic avenues. The shift towards a more patient-centric approach is evident in the growing demand for devices that minimize invasiveness, reduce recovery times, and improve the overall quality of life post-procedure. For instance, the market for transcatheter aortic valve implantation (TAVI) devices, a key segment within hemodynamic flow alteration, has seen exponential growth, driven by its efficacy in high-risk surgical patients and its expanding indications for intermediate-risk patients. This trend is expected to continue, supported by ongoing clinical trials and regulatory approvals. Additionally, the miniaturization of devices and improved catheter deliverability are enabling the treatment of increasingly complex anatomies and peripheral vascular lesions, broadening the scope of interventional cardiology. The focus on smart devices, equipped with sensor technology for real-time data monitoring and feedback, is also an emerging trend, paving the way for remote patient management and personalized therapy adjustments. With an estimated market volume in the tens of millions of units in the base year of 2025, this sector is projected to see a compound annual growth rate (CAGR) that underscores its significance and expansive potential.

The burgeoning Interventional Cardiology Devices market is being propelled by a confluence of powerful driving forces, fundamentally reshaping cardiovascular care. A primary catalyst is the escalating global burden of cardiovascular diseases (CVDs), including coronary artery disease, heart failure, and valvular heart disease. As populations age and lifestyle-related risk factors like obesity and diabetes become more prevalent, the demand for effective and minimally invasive treatment options is soaring. Interventional cardiology offers a compelling alternative to traditional open-heart surgery, characterized by shorter hospital stays, faster recovery times, and reduced patient morbidity. This patient-centric advantage significantly contributes to market expansion. Technological innovation is another critical engine. Continuous advancements in material science, engineering, and imaging have led to the development of more sophisticated and effective devices. From advanced stent designs with improved drug elution profiles to novel catheter technologies enabling precise navigation and deployment, innovation is consistently pushing the boundaries of what's possible. The increasing preference for percutaneous coronary interventions (PCIs) over coronary artery bypass grafting (CABG) for certain patient profiles, driven by favorable clinical outcomes and patient tolerance, is a testament to this progress. Furthermore, favorable reimbursement policies and growing healthcare expenditure in both developed and emerging economies are creating a fertile ground for market growth. Governments and private insurers are increasingly recognizing the cost-effectiveness and improved patient outcomes associated with interventional procedures, leading to broader coverage and accessibility. The expanding geriatric population, a demographic with a higher incidence of cardiovascular issues, further fuels the demand for these life-saving interventions. The development and commercialization of novel therapeutic devices, such as those targeting structural heart disease and complex arrhythmias, are also opening up new treatment paradigms and expanding the addressable market.

Despite the robust growth trajectory, the Interventional Cardiology Devices market is not without its challenges and restraints. A significant hurdle remains the high cost of advanced interventional devices. While offering improved outcomes, the price of sophisticated stents, valves, and catheters can be a barrier to widespread adoption, particularly in resource-limited regions. This cost factor can also strain healthcare systems, necessitating careful economic evaluations and reimbursement strategies. The increasing regulatory scrutiny and lengthy approval processes for novel devices present another significant restraint. While essential for ensuring patient safety and device efficacy, these processes can delay market entry for innovative products, impacting the pace of innovation and profitability for manufacturers. Ensuring adequate physician training and expertise in performing complex interventional procedures is also crucial. The successful implementation of advanced techniques requires specialized skills and ongoing education, and a shortage of adequately trained interventional cardiologists can limit the adoption of cutting-edge technologies. Post-market surveillance and the management of potential complications, such as stent thrombosis or device migration, remain ongoing concerns. While interventional procedures are generally safe, meticulous patient selection, procedural technique, and appropriate follow-up are paramount to mitigate risks and maintain patient trust. The emergence of alternative therapies, including pharmacotherapy and lifestyle interventions, may also pose a competitive challenge, although interventional devices often address more severe or complex conditions where these alternatives are insufficient. Furthermore, economic downturns and healthcare budget constraints in certain regions can impact the overall demand for elective procedures and capital equipment purchases. The market also faces the challenge of managing device obsolescence as newer, more advanced technologies are continuously developed, requiring companies to invest heavily in research and development to stay competitive.

The Interventional Cardiology Devices market exhibits a distinct dominance pattern, with certain regions and segments poised to lead its expansion.

Dominant Segments:

Dominant Region/Country:

While North America leads, Europe is also a significant market, characterized by advanced healthcare systems and a high demand for interventional cardiology solutions, particularly in countries like Germany, the UK, and France. Emerging markets in Asia-Pacific, especially China and India, are exhibiting rapid growth due to increasing healthcare expenditure, a rising middle class, and a growing awareness of cardiovascular health. However, North America's established infrastructure, technological leadership, and high disease burden solidify its position as the dominant region for interventional cardiology devices in the foreseeable future.

The Interventional Cardiology Devices industry is experiencing a sustained growth spurt fueled by several key catalysts. The escalating prevalence of cardiovascular diseases globally, particularly among aging populations, creates a perpetually expanding patient base. Technological advancements, leading to safer, more effective, and minimally invasive devices, are continuously expanding treatment options and improving patient outcomes. The shift towards preventative and personalized medicine also drives demand for sophisticated diagnostic and therapeutic tools. Furthermore, favorable reimbursement policies in many developed economies and increasing healthcare investments in emerging markets are enhancing access to these life-saving technologies. The development of novel devices for complex conditions, such as structural heart disease and chronic total occlusions, is also opening new avenues for market expansion.

This report provides unparalleled comprehensive coverage of the Interventional Cardiology Devices market, meticulously dissecting trends from 2019-2033. It offers detailed segment analysis, including the performance of Angioplasty Balloons, Angioplasty Stents, Catheters, Plaque Modification Devices, and Hemodynamic Flow Alteration Devices, in terms of volume (in millions of units) and value. Application-wise, it examines the market split between Hospitals and Ambulatory Surgical Centers, projecting their respective contributions through 2033. The report delves deep into market dynamics, identifying the critical driving forces and formidable challenges that shape the industry landscape. It pinpoints dominant regions and countries, offering strategic insights into market penetration and growth opportunities. Leading players are identified, alongside their market share estimations and strategic initiatives. Crucially, the report forecasts future market trajectories, providing essential data for strategic decision-making and investment planning in this vital sector of healthcare.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Abbott, Acrostak, B. Braun Melsungen, Biosensors International, Boston Scientific Corporation, Cordis Corporation, Edwards Lifesciences Corporation.

The market segments include Type, Application.

The market size is estimated to be USD 11930 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Interventional Cardiology Devices," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Interventional Cardiology Devices, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.