1. What is the projected Compound Annual Growth Rate (CAGR) of the Integrated Robotic Automation Solution?

The projected CAGR is approximately 10.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Integrated Robotic Automation Solution

Integrated Robotic Automation SolutionIntegrated Robotic Automation Solution by Type (Industrial Robotic, Collaborative Robotic), by Application (Automotive, Electronics, Aerospace, Pharmaceutical, Consumer Goods, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The integrated robotic automation solutions market is experiencing substantial growth, driven by escalating automation demands across diverse industries. Key growth drivers include the widespread adoption of Industry 4.0 technologies, the imperative for enhanced operational efficiency, and the increasing requirement for superior product quality and consistency. Businesses are strategically implementing these solutions to optimize production, maximize resource utilization, and elevate overall productivity. The market is witnessing a significant trend towards advanced robotics, such as collaborative robots (cobots) and Artificial Intelligence (AI)-powered systems, offering enhanced flexibility, precision, and seamless integration. Declining hardware and software costs are further accelerating accessibility for a broader business spectrum. While initial investment and skilled labor requirements present challenges, these are being addressed through intuitive interfaces and accessible training programs. Market segmentation by application (e.g., manufacturing, logistics, healthcare) and geography reveals significant potential in rapidly industrializing emerging economies.

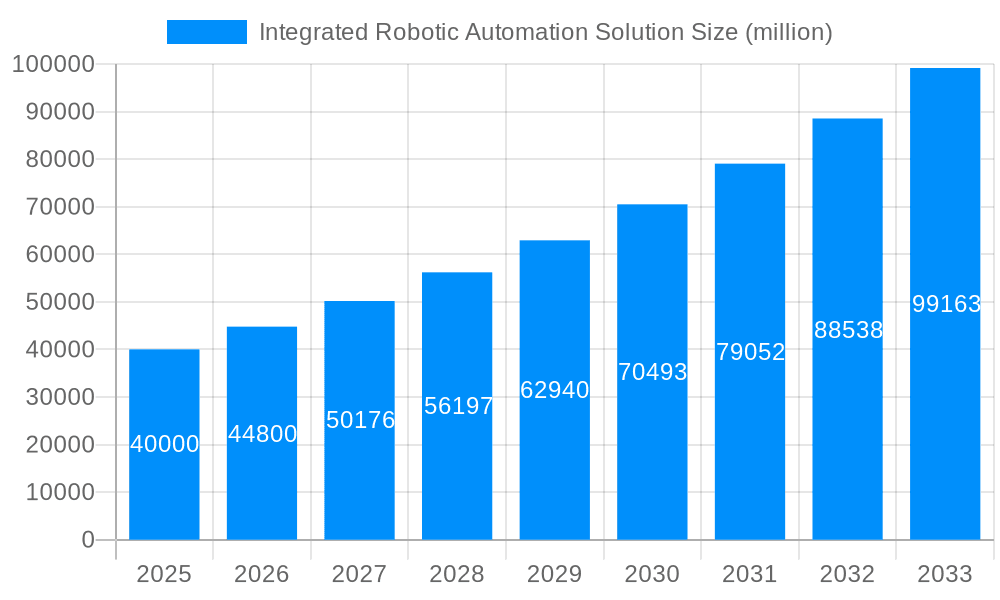

The integrated robotic automation solutions market is projected for strong expansion from 2025 to 2033, with an estimated Compound Annual Growth Rate (CAGR) of 10.4%. This sustained growth is propelled by continuous technological advancements, including sophisticated machine learning for improved robotic capabilities and the expansion of applications into sectors like agriculture and pharmaceuticals. Companies are prioritizing modular and scalable solutions to meet varied customer needs. Cloud-based platforms for robotic system management will also significantly contribute to market expansion. The competitive arena is characterized by intense activity from established leaders and emerging innovators, with strategic consolidations and collaborations expected to shape market dynamics. Robust cybersecurity measures are vital for fostering trust and driving adoption. The market size is anticipated to reach 232.5 billion by the end of the forecast period.

The integrated robotic automation solution market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. The study period from 2019-2033 reveals a consistent upward trajectory, driven by increasing adoption across diverse sectors. The base year of 2025 shows a market size in the millions, with estimations indicating a significant surge during the forecast period (2025-2033). Analysis of historical data (2019-2024) reveals a steady increase in demand, underpinned by technological advancements and a rising awareness of the benefits of automation. Key market insights include the increasing demand for flexible and adaptable automation systems, a shift towards collaborative robots (cobots) for improved human-robot interaction, and a growing focus on integrating automation across the entire value chain. This integrated approach leads to greater efficiency gains compared to isolated automation deployments. The market is witnessing a convergence of technologies, including AI, machine learning, and IoT, further enhancing the capabilities and applications of integrated robotic automation systems. Businesses are increasingly prioritizing efficiency, productivity, and reduced operational costs, making integrated robotic solutions a crucial investment. The competitive landscape is dynamic, with established players and new entrants continuously innovating to capture market share. Furthermore, the growing emphasis on data-driven decision-making is driving demand for integrated systems capable of collecting and analyzing real-time operational data. This data provides valuable insights into process optimization and predictive maintenance, maximizing the return on investment in robotic automation.

Several key factors are fueling the growth of the integrated robotic automation solution market. The primary driver is the escalating need for enhanced productivity and efficiency across various industries. Manufacturers, logistics providers, and other businesses are increasingly seeking to streamline operations, reduce labor costs, and improve product quality through automation. The advancements in robotics technology, particularly in areas like artificial intelligence (AI) and machine learning (ML), are enabling more sophisticated and adaptable robotic systems capable of handling complex tasks. This increasing sophistication translates into wider applicability across different industrial processes and workflows. Furthermore, the rising availability of affordable and user-friendly robotic solutions is democratizing access to automation, allowing smaller and medium-sized enterprises (SMEs) to adopt these technologies. Government initiatives and financial incentives aimed at promoting industrial automation in many regions are also contributing to market expansion. The trend towards Industry 4.0 and the increasing interconnection of devices and systems create a fertile ground for the implementation of integrated robotic automation solutions. Finally, the growing demand for customized products and shorter production cycles necessitate flexible automation solutions that can adapt quickly to changing requirements. This need is perfectly met by integrated systems.

Despite the significant growth potential, the integrated robotic automation solution market faces several challenges. High initial investment costs can be a major barrier, particularly for SMEs with limited budgets. The complexity of integrating various robotic systems and software applications can also be a significant hurdle, requiring specialized expertise and substantial integration efforts. Concerns regarding job displacement due to automation remain a societal concern that needs careful consideration. Furthermore, the lack of skilled workforce to operate and maintain these complex systems represents a bottleneck for broader adoption. Ensuring data security and protecting sensitive information within interconnected robotic systems is also crucial and presents a significant technical challenge. Finally, regulatory compliance and standardization issues can vary across different geographical regions, adding complexity to the deployment of integrated solutions. Overcoming these challenges will require collaboration between industry stakeholders, governments, and educational institutions to foster innovation, develop workforce skills, and create a supportive regulatory environment.

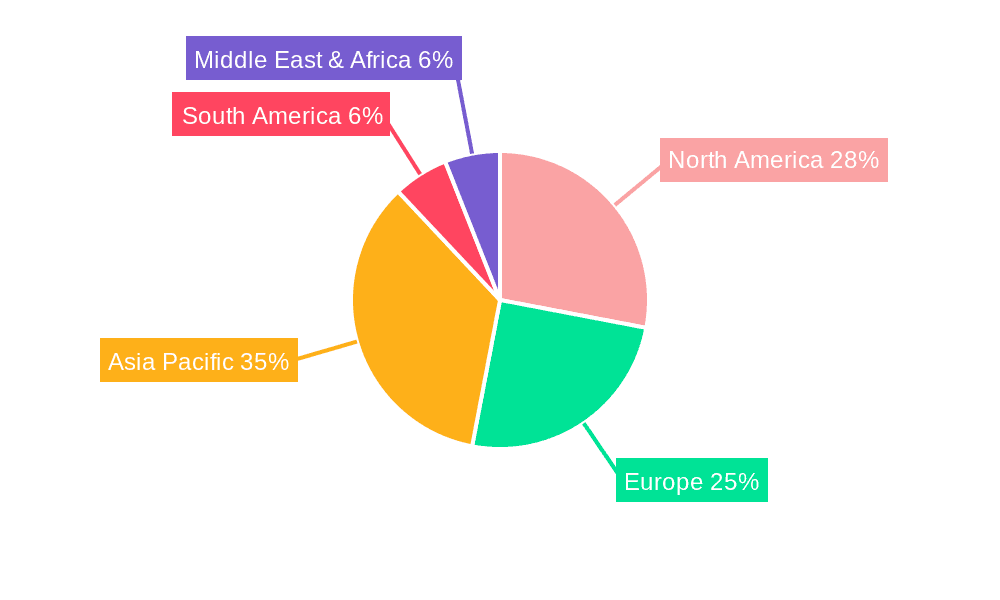

North America: This region is expected to hold a significant market share due to the high adoption rate of automation technologies, particularly in industries like automotive and manufacturing. The presence of major automation companies and a robust technological infrastructure further contributes to its dominance.

Europe: Europe is another significant market, driven by strong industrial automation practices and government initiatives supporting Industry 4.0. Germany and other leading industrial nations in the region are actively investing in robotic automation solutions.

Asia-Pacific: This region is witnessing rapid growth driven by increasing industrialization in countries like China, Japan, and South Korea. The expanding manufacturing sector and rising disposable incomes are driving the demand for automated solutions.

Dominant Segments: The automotive and electronics industries are major drivers of market growth, followed by logistics and warehousing, food and beverage processing, and the pharmaceutical sector. The integration of robots in these industries contributes to enhanced productivity and precision in manufacturing and handling of goods. Within these segments, the demand for collaborative robots (cobots) is rapidly increasing due to their flexibility and safety features, enabling closer human-robot collaboration. The increased need for efficient supply chain management is also boosting the adoption of integrated automation solutions in logistics and warehousing.

The paragraph above explains how these regions and segments are dominating. The high adoption rates in North America and Europe are driven by established industrial bases and technological advancement. The Asia-Pacific region's rapid growth stems from its industrialization and expansion of manufacturing. The automotive and electronics segments lead due to high automation needs in production, assembly, and quality control. The logistics and warehousing segments follow due to the need to handle vast volumes of goods quickly and efficiently.

Several factors are catalyzing the growth of the integrated robotic automation solution industry. The increasing demand for enhanced operational efficiency, improved product quality, and reduced labor costs is a major driving force. Technological advancements, specifically in AI, ML, and IoT, are enabling more sophisticated and adaptive robotic systems. Government initiatives and financial incentives in many countries are further promoting automation adoption. The growing trend towards smart factories and Industry 4.0 is creating a favorable environment for integrated robotic solutions. Furthermore, the increasing availability of cost-effective and user-friendly robotic systems is widening access to automation for businesses of all sizes.

This report provides a comprehensive overview of the integrated robotic automation solution market, encompassing detailed market analysis, key trends, driving forces, challenges, and future outlook. It covers major players, key segments, and geographical regions, offering in-depth insights into the market dynamics and growth opportunities. The report leverages extensive data analysis, including historical data, estimations, and projections, to provide a robust and reliable forecast of market growth for the forecast period. It is designed to assist stakeholders in making informed strategic decisions and capitalizing on emerging market trends.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.4%.

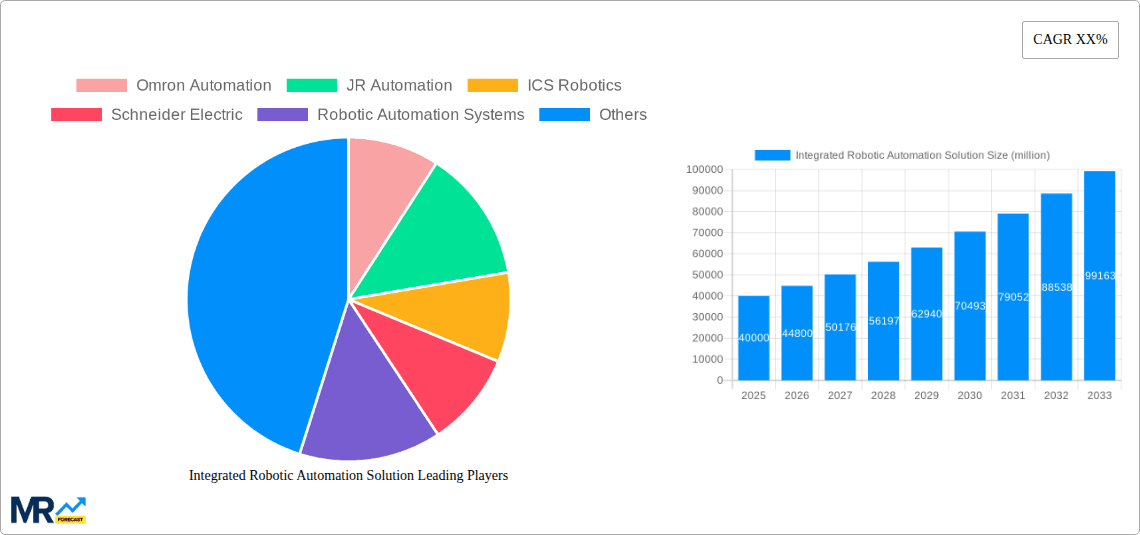

Key companies in the market include Omron Automation, JR Automation, ICS Robotics, Schneider Electric, Robotic Automation Systems, FANUC, Shape Process Automation, Robotic Solutions, enVista, RNA, Acieta, TW Automation, Rockwell Automation, KTC, RSI Automation, Calvary Robotics, CRG Automation, Bauromat.

The market segments include Type, Application.

The market size is estimated to be USD 232.5 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Integrated Robotic Automation Solution," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Integrated Robotic Automation Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.