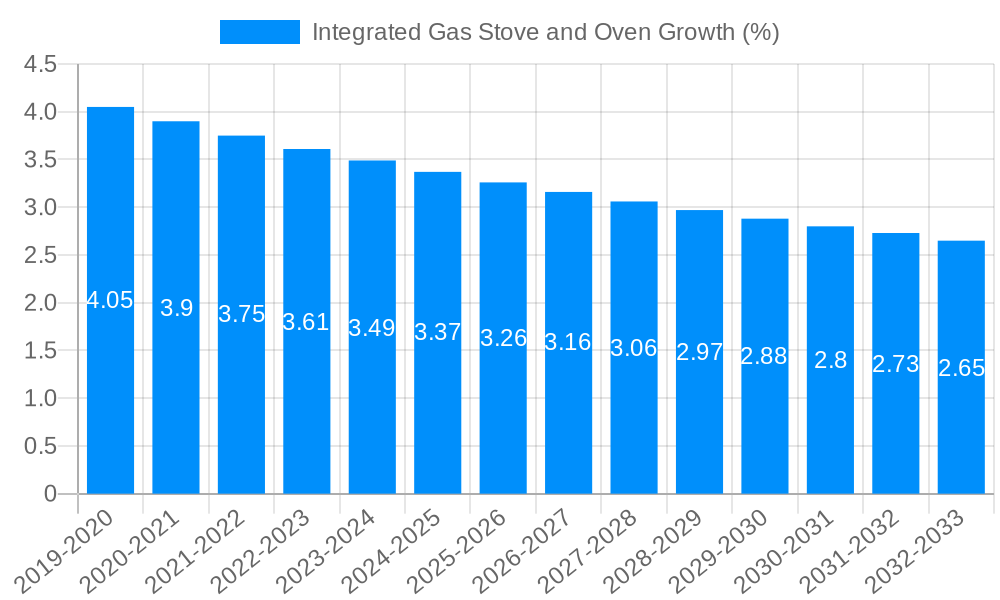

1. What is the projected Compound Annual Growth Rate (CAGR) of the Integrated Gas Stove and Oven?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Integrated Gas Stove and Oven

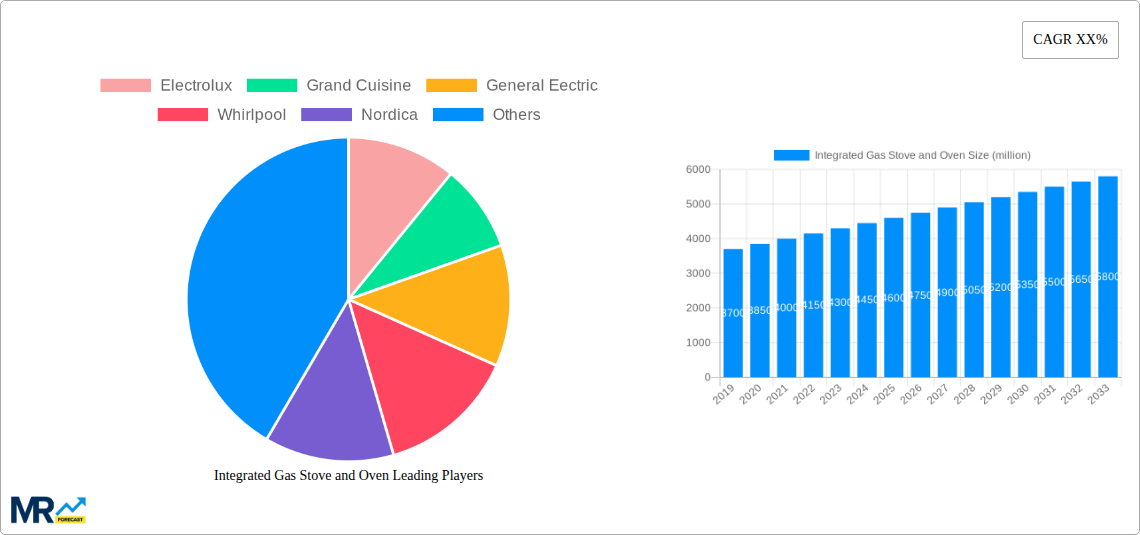

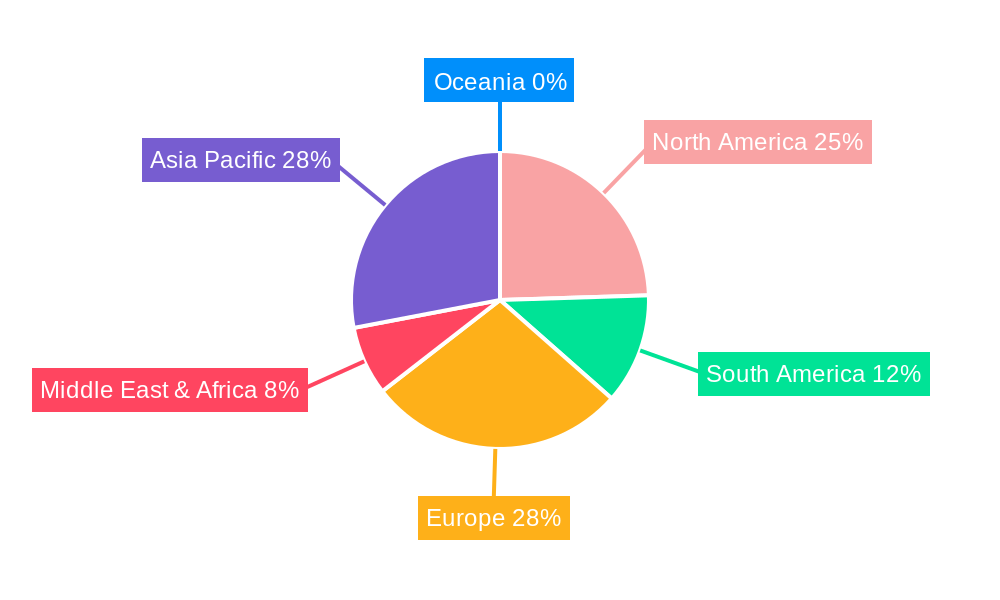

Integrated Gas Stove and OvenIntegrated Gas Stove and Oven by Type (Deep Well Type, Side Suction Type, Others), by Application (Household, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global market for integrated gas stove and oven appliances is poised for significant growth, projected to reach a market size of approximately $4,500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 5.8% through 2033. This robust expansion is fueled by several key drivers, including the increasing consumer preference for sophisticated and space-saving kitchen solutions. As urbanization continues to rise, particularly in emerging economies, the demand for compact yet feature-rich appliances like integrated gas stoves and ovens is expected to surge. Furthermore, a growing emphasis on home renovation and interior design, coupled with rising disposable incomes, is contributing to the adoption of these premium kitchen appliances in both household and commercial settings. The technological advancements, leading to enhanced safety features, improved energy efficiency, and innovative functionalities such as smart connectivity, are also playing a crucial role in attracting consumers and driving market penetration.

The market is segmented into Deep Well Type, Side Suction Type, and Others, with the Side Suction Type likely to witness substantial demand due to its sleek design and efficient ventilation capabilities, appealing to modern kitchen aesthetics. Applications span Household and Commercial sectors, with the Household segment dominating due to sustained demand from residential renovations and new home constructions. Geographically, Asia Pacific is anticipated to emerge as a dominant region, driven by rapid urbanization, a growing middle class, and increasing adoption of Western kitchen standards in countries like China and India. North America and Europe, mature markets with high consumer awareness and demand for premium appliances, will continue to be significant contributors. However, the market also faces restraints, such as the initial high cost of integrated units compared to separate appliances and the increasing competition from induction and electric alternatives, which offer different advantages. Despite these challenges, the overall outlook for the integrated gas stove and oven market remains highly positive, driven by innovation and evolving consumer lifestyles.

Here is a report description for Integrated Gas Stove and Oven, incorporating your specifications:

The global integrated gas stove and oven market, valued at approximately XXX million units in the historical period of 2019-2024, is poised for significant evolution through 2033. The study period, spanning from 2019 to 2033, with a base year and estimated year of 2025, highlights a dynamic landscape driven by burgeoning consumer demand for enhanced kitchen functionality and sophisticated cooking experiences. Within the household segment, the increasing preference for modern and integrated kitchen designs is a primary trend. Consumers are increasingly seeking appliances that offer a seamless aesthetic and multi-functional capabilities, leading to higher adoption rates for integrated units over traditional standalone stoves and ovens. The forecast period of 2025-2033 is expected to witness a substantial CAGR, propelled by innovations in energy efficiency and smart technology integration. Manufacturers are responding to this by developing models with advanced features such as precise temperature control, multiple cooking modes, and connectivity options, catering to a more discerning consumer base. Furthermore, the commercial sector, encompassing restaurants, hotels, and catering services, continues to be a robust segment, demanding durable, high-performance, and efficient cooking solutions. The industrial application, though smaller in market share, also presents opportunities for specialized, heavy-duty integrated gas stove and oven systems designed for high-volume food production. The "Others" category within types is likely to expand, encompassing innovative designs that blur the lines between traditional appliances and bespoke kitchen installations. The market is characterized by a growing emphasis on safety features, such as flame failure devices and child lock mechanisms, alongside a rising awareness of environmental impact, pushing for more energy-efficient gas consumption and reduced emissions. This interplay of technological advancement, evolving consumer preferences, and industry-specific demands will shape the trajectory of the integrated gas stove and oven market for the foreseeable future, with a projected market size reaching XXX million units by 2033.

Several key factors are orchestrating the accelerated growth of the integrated gas stove and oven market. Foremost among these is the escalating urbanization and the resultant proliferation of modular and compact living spaces. As homes become smaller, consumers are actively seeking appliances that optimize space utilization without compromising on functionality. Integrated gas stove and oven units perfectly address this need by combining two essential cooking appliances into a single, cohesive unit, thereby freeing up valuable kitchen real estate. Furthermore, a significant driver is the evolving consumer lifestyle and increasing disposable income in emerging economies. A growing middle class with a penchant for modern amenities and a desire for enhanced culinary experiences is fueling demand for high-end kitchen appliances. The aesthetic appeal of integrated systems, offering a sleek and contemporary look, is also a powerful draw for homeowners undertaking kitchen renovations or new constructions. This trend is further amplified by the increasing awareness and adoption of smart home technologies. The integration of smart features into gas stoves and ovens, such as remote control capabilities, pre-programmed cooking cycles, and voice command integration, is transforming the cooking experience and appealing to a tech-savvy demographic. The pursuit of convenience and efficiency in cooking is paramount, and integrated units, often boasting superior heat distribution and precise temperature control, offer a tangible advantage in this regard.

Despite the optimistic growth trajectory, the integrated gas stove and oven market is not without its impediments. A primary challenge is the higher initial cost associated with integrated units compared to their standalone counterparts. The complex engineering and design required for seamless integration, along with the incorporation of advanced features, contribute to a premium price point, which can be a deterrent for budget-conscious consumers, particularly in price-sensitive markets. Another significant restraint stems from the complex installation and maintenance requirements. Integrated units often necessitate specialized plumbing and electrical work, as well as skilled technicians for both installation and any subsequent repairs. This can lead to increased installation costs and longer downtime in case of malfunctions, creating a point of friction for consumers and commercial users alike. Limited repair options and availability of spare parts can also pose a problem, especially in regions with less developed service networks. The reliance on gas infrastructure is an inherent limitation, restricting the market's penetration in areas where natural gas supply is unreliable or unavailable. This necessitates alternative solutions like LPG, which can sometimes be less convenient or more expensive. Furthermore, while energy efficiency is a growing trend, the perceived energy consumption of gas appliances in comparison to their electric counterparts can still be a concern for some environmentally conscious consumers, despite advancements in gas technology. Finally, stringent safety regulations and certifications in various regions, while necessary, can add to the development costs and time-to-market for new integrated gas stove and oven models.

The integrated gas stove and oven market is characterized by regional disparities in demand and adoption, with certain segments exhibiting particularly strong growth potential.

Dominant Regions/Countries:

Dominant Segments:

Application: Household: The household application segment is unequivocally the largest and most influential segment within the integrated gas stove and oven market. This dominance is driven by a confluence of factors:

Type: Side Suction Type: While Deep Well Type and others represent specific niches, the Side Suction Type of integrated gas stove and oven is gaining considerable traction, especially in the context of modern kitchen designs. This type typically refers to integrated units where the ventilation system is cleverly incorporated, often within the hob itself or a streamlined downdraft extractor.

The integrated gas stove and oven industry is propelled by several potent growth catalysts. The relentless pursuit of sleek, modern kitchen aesthetics by homeowners worldwide is a primary driver, with integrated units offering a seamless and uncluttered look. Furthermore, the increasing demand for multi-functional appliances that optimize space, particularly in urban environments, plays a crucial role. The growing middle class in emerging economies, coupled with rising disposable incomes, is expanding the consumer base for premium kitchen solutions. Technological advancements, including the integration of smart features, enhanced energy efficiency, and improved safety mechanisms, are also significantly boosting adoption rates.

This comprehensive report offers an in-depth analysis of the global integrated gas stove and oven market, providing detailed insights for the study period of 2019-2033, with a focus on the base and estimated year of 2025. It meticulously examines market trends, driving forces, challenges, and restraints, underpinned by historical data from 2019-2024 and projections for the forecast period of 2025-2033. The report delves into regional market dominance, highlighting key countries and segments like Household application and Side Suction Type, with projected market volumes in the millions of units. Growth catalysts, leading players, and significant technological developments are thoroughly explored, painting a complete picture of the industry's current landscape and future trajectory. This report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving integrated gas stove and oven market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Electrolux, Grand Cuisine, General Eectric, Whirlpool, Nordica, Tongyang Magic, Smeg, Lacanche, Glem Gas, Elica SpA, Robert Bosch GmbH, Viking, Westahl, Zhejiang Meida Industrial, Lajoson, Zhejiang Marssenger Kitchenware, HIONE, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Integrated Gas Stove and Oven," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Integrated Gas Stove and Oven, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.