1. What is the projected Compound Annual Growth Rate (CAGR) of the Ingestible Sensors?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ingestible Sensors

Ingestible SensorsIngestible Sensors by Type (Temperature Sensor, Pressure Sensor, PH Sensor, Image Sensor, World Ingestible Sensors Production ), by Application (Medical, Sports and Fitness, Others, World Ingestible Sensors Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

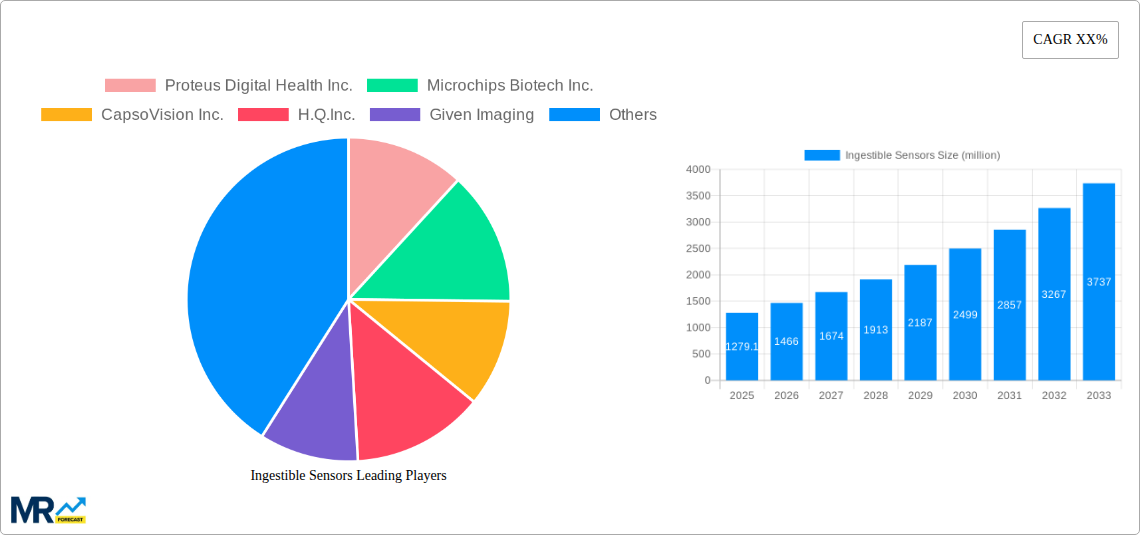

The global ingestible sensors market is poised for substantial growth, projected to reach an estimated USD 1279.1 million in 2025. This burgeoning market is driven by a confluence of factors, including the increasing prevalence of chronic diseases, a growing demand for remote patient monitoring solutions, and advancements in miniaturization and sensor technology. The rising healthcare expenditure globally, coupled with an aging population, further fuels the adoption of these innovative diagnostic tools. Medical applications, particularly in the diagnosis and management of gastrointestinal disorders, are expected to dominate the market share, with significant potential in areas like personalized medicine and drug delivery monitoring. The sports and fitness sector is also emerging as a key growth area, with athletes leveraging ingestible sensors for performance optimization and health tracking. This surge in demand signifies a paradigm shift towards proactive and personalized healthcare management.

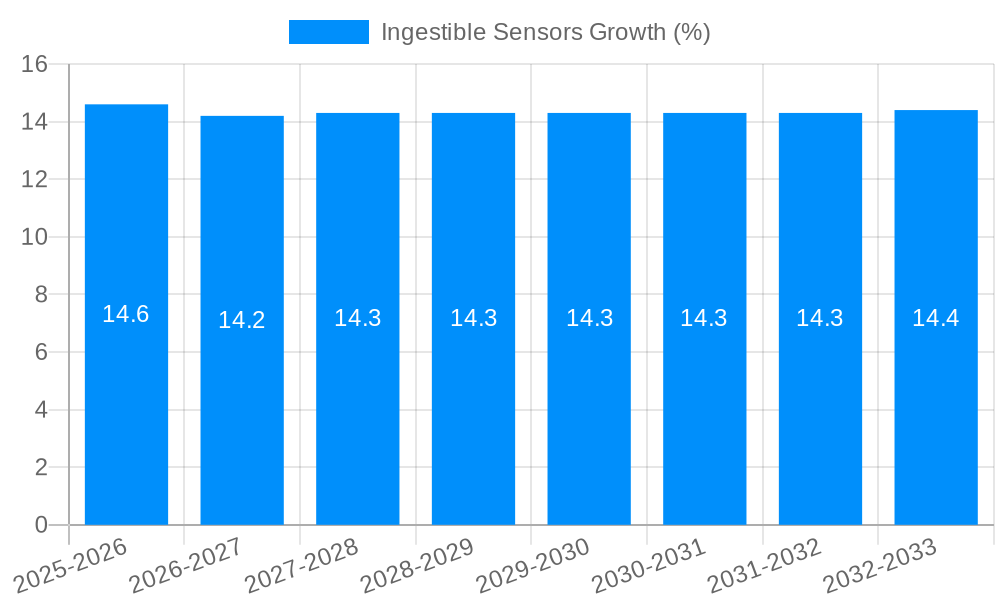

The market's projected Compound Annual Growth Rate (CAGR) of approximately 15-20% over the forecast period (2025-2033) indicates a robust expansion trajectory, driven by continuous innovation and increasing market penetration. Key trends include the development of multi-functional sensors capable of detecting various physiological parameters simultaneously and the integration of artificial intelligence and machine learning for data analysis and predictive insights. However, challenges such as regulatory hurdles, data security concerns, and the relatively high cost of early-stage adoption may present some restraints. Despite these challenges, the long-term outlook for ingestible sensors remains exceptionally bright, with ongoing research and development promising enhanced functionalities and wider accessibility, ultimately transforming patient care and wellness across diverse segments.

The global ingestible sensors market is poised for a significant and transformative expansion, projected to reach a staggering $5.2 billion by 2033, up from an estimated $1.1 billion in 2025. This impressive Compound Annual Growth Rate (CAGR) of approximately 14.5% during the forecast period of 2025-2033 underscores the burgeoning demand for sophisticated, non-invasive health monitoring solutions. During the historical period of 2019-2024, the market laid a foundational groundwork, witnessing early adoption and technological refinements. The base year of 2025 serves as a critical inflection point, marking the transition into a phase of accelerated growth driven by advancements in miniaturization, power efficiency, and data analytics.

The evolution of ingestible sensors extends beyond mere pill-sized devices; it encompasses a sophisticated ecosystem of interconnected technologies. The World Ingestible Sensors Production landscape is increasingly characterized by the integration of microelectronics with biocompatible materials, enabling these tiny devices to accurately track a multitude of physiological parameters within the human body. Key market insights reveal a growing emphasis on personalized medicine, where real-time data from ingestible sensors allows for tailored treatment regimens and proactive health management. This trend is further amplified by the increasing prevalence of chronic diseases, where continuous monitoring can significantly improve patient outcomes and reduce healthcare burdens.

Furthermore, the development of intelligent ingestible sensors capable of not only collecting data but also providing localized therapeutic interventions is a major area of innovation. The projected market trajectory indicates a substantial shift towards these "smart pills" that can release medication precisely when and where it's needed, optimizing efficacy and minimizing side effects. The World Ingestible Sensors Production is witnessing a surge in research and development focused on enhancing the accuracy and reliability of sensor readings, as well as improving the power sources and data transmission capabilities of these miniature devices. The rising healthcare expenditure globally, coupled with a growing consumer awareness of preventative health measures, further solidifies the positive outlook for this dynamic market. The capacity of these sensors to offer unprecedented insights into gastrointestinal health, drug adherence, and systemic physiological functions positions them as indispensable tools for the future of healthcare.

The exponential growth of the ingestible sensors market is underpinned by a confluence of powerful driving forces. Foremost among these is the relentless pursuit of enhanced patient care and improved diagnostic capabilities. The ability of these tiny, swallowable devices to gather continuous, real-time physiological data from within the gastrointestinal tract offers an unparalleled level of insight that traditional external monitoring methods simply cannot match. This granular data empowers healthcare professionals to make more informed decisions, leading to earlier and more accurate diagnoses of a wide range of conditions, particularly those affecting the digestive system. Moreover, the increasing focus on personalized medicine, where treatment plans are tailored to individual patient needs and responses, is a significant catalyst. Ingestible sensors provide the objective data necessary to fine-tune medication dosages, monitor drug absorption, and assess treatment efficacy with remarkable precision.

Another pivotal driver is the growing emphasis on drug adherence and the management of chronic diseases. For patients with complex medication regimens, ensuring consistent and correct intake can be a significant challenge. Ingestible sensors, by confirming that a pill has been swallowed and by tracking its journey, provide a tangible solution to this problem. This not only improves therapeutic outcomes but also reduces the economic burden associated with ineffective treatments and hospital readmissions. The expanding geriatric population worldwide, which often contends with multiple chronic conditions and medication challenges, further amplifies the demand for such innovative monitoring solutions. As healthcare systems grapple with aging populations and rising chronic disease prevalence, the cost-effectiveness and efficacy offered by ingestible sensors present a compelling proposition for widespread adoption.

Despite the immense potential, the widespread adoption of ingestible sensors faces a series of significant hurdles. A primary concern revolves around regulatory approvals and the stringent validation processes required for medical devices that are ingested. Obtaining clearance from regulatory bodies such as the FDA in the United States and the EMA in Europe can be a protracted and costly endeavor, necessitating extensive clinical trials to demonstrate safety and efficacy. This can slow down the pace of market entry for new technologies and limit the number of available products. Furthermore, the cost of these advanced sensors, while expected to decrease with mass production, can still be a barrier for some healthcare providers and patients, particularly in regions with limited healthcare budgets. The initial investment in sensor technology, coupled with the infrastructure needed for data management and analysis, can be substantial.

Another critical challenge lies in the patient acceptance and comfort level with swallowing a digital device. While designed to be biocompatible and unobtrusive, the psychological aspect of ingesting a sensor can be a deterrent for some individuals, especially those with existing anxieties or phobias. Educating patients and building trust in the technology are therefore crucial for overcoming this restraint. Technical limitations, such as battery life and data transmission reliability within the complex environment of the gastrointestinal tract, also present ongoing challenges. Ensuring consistent and accurate data capture over extended periods, and overcoming potential signal interference, requires continuous innovation. Finally, the secure handling and privacy of the sensitive health data collected by these sensors are paramount concerns. Robust cybersecurity measures and clear data governance policies are essential to build and maintain patient confidence.

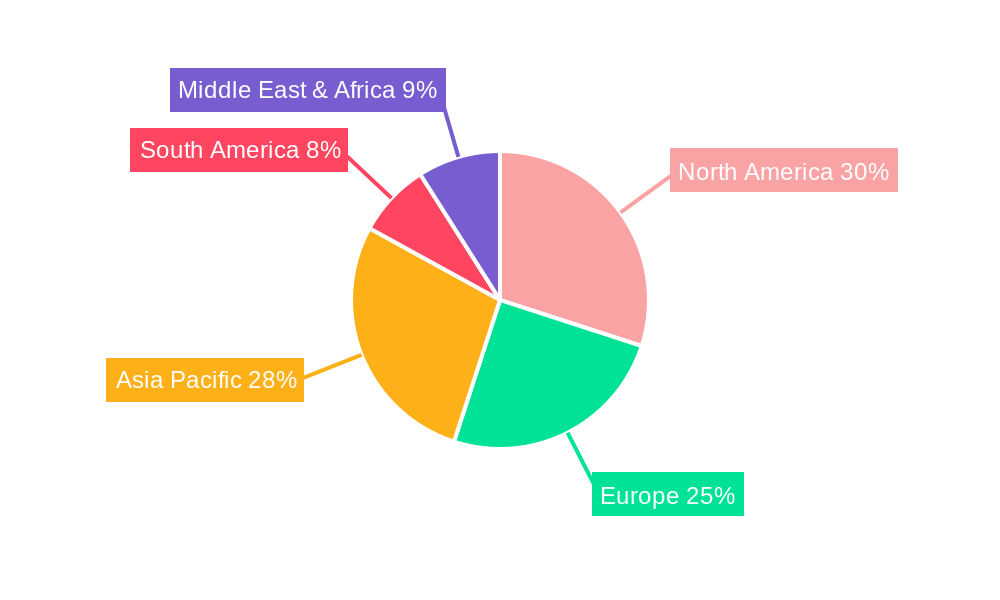

The global ingestible sensors market is characterized by a dynamic interplay between geographical regions and specific product segments, with the Medical application segment and North America emerging as dominant forces.

In terms of applications, the Medical segment is overwhelmingly poised to dominate the market, driven by the critical need for advanced diagnostic and monitoring tools in healthcare. Within this segment, the Image Sensor type is expected to witness substantial growth. Image sensors within ingestible capsules have revolutionized the diagnosis of gastrointestinal disorders by providing direct visualization of the esophagus, stomach, small intestine, and colon. Companies like CapsoVision Inc. and Given Imaging (now part of Medtronic) have been at the forefront of developing sophisticated capsule endoscopy systems that capture high-resolution images, aiding in the detection of conditions such as Crohn's disease, ulcerative colitis, polyps, and gastrointestinal bleeding. The ability to perform minimally invasive diagnostic procedures, offering precise anatomical insights, makes capsule endoscopy invaluable for gastroenterologists. The projected market size for ingestible sensors in the medical application is anticipated to account for over 70% of the total market by 2033, with image sensors representing a significant portion of this share, estimated to contribute $2.5 billion in revenue by the same year. The increasing prevalence of gastrointestinal diseases globally, coupled with the growing demand for early and accurate diagnosis, fuels this dominance.

Geographically, North America, particularly the United States, is expected to be the leading region in the ingestible sensors market. Several factors contribute to this dominance. The region boasts a highly advanced healthcare infrastructure, a robust research and development ecosystem, and significant investments in medical technology. The high disposable income and increasing awareness of personalized health among the consumer base in North America also contribute to a receptive market for innovative healthcare solutions. Furthermore, the presence of major healthcare technology companies and a supportive regulatory environment for novel medical devices facilitate the adoption and commercialization of ingestible sensors. The market in North America is projected to reach $2.1 billion by 2033, driven by early adoption of capsule endoscopy and a growing interest in remote patient monitoring.

Beyond image sensors, other sensor types like Temperature Sensors and PH Sensors are also gaining traction within the medical application. Temperature sensors can monitor internal body temperature, crucial for detecting fever or inflammation, while PH sensors can track the acidity levels in different parts of the GI tract, aiding in the diagnosis of conditions like GERD or malabsorption. The combination of these sensors within ingestible devices offers a comprehensive diagnostic tool.

Several key growth catalysts are propelling the ingestible sensors industry forward. The escalating global burden of chronic diseases, such as inflammatory bowel disease and gastrointestinal cancers, necessitates continuous and precise monitoring, a role perfectly suited for ingestible sensors. Advancements in miniaturization and wireless communication technologies are making these sensors smaller, more powerful, and more user-friendly, increasing their appeal to both patients and healthcare providers. The increasing focus on preventative healthcare and personalized medicine further amplifies demand, as individuals seek proactive ways to manage their well-being. Furthermore, strategic partnerships and collaborations between sensor manufacturers, pharmaceutical companies, and healthcare institutions are accelerating product development and market penetration, driving innovation and expanding the application spectrum of these transformative devices.

This comprehensive report delves deep into the global ingestible sensors market, offering an in-depth analysis of its present landscape and future trajectory. Covering the historical period from 2019-2024 and projecting growth through 2033, it provides crucial insights into market size, segmentation, and key trends. The report meticulously examines the driving forces behind market expansion, including advancements in medical technology and the rising demand for personalized healthcare. It also addresses the inherent challenges and restraints, such as regulatory hurdles and cost considerations, offering a balanced perspective. Furthermore, the report highlights the dominant regions and segments, with a particular focus on the burgeoning medical application and the leading role of North America, and details the specific sensor types that are shaping the market, such as image, temperature, and pH sensors. Growth catalysts and significant industry developments are also thoroughly explored, alongside a comprehensive list of leading players. This report serves as an indispensable resource for stakeholders seeking to understand and capitalize on the transformative potential of ingestible sensors.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Proteus Digital Health Inc., Microchips Biotech Inc., CapsoVision Inc., H.Q.Inc., Given Imaging, Olympus Corp.

The market segments include Type, Application.

The market size is estimated to be USD 1279.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Ingestible Sensors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ingestible Sensors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.