1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial X-ray Inspection Systems?

The projected CAGR is approximately 4.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Industrial X-ray Inspection Systems

Industrial X-ray Inspection SystemsIndustrial X-ray Inspection Systems by Type (Digital Radiography (DR) Type, Computed Tomography (CT) Type), by Application (General Industry, Automotive Industry, Electronics Industry, Packaging, Lithium Battery Industry, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

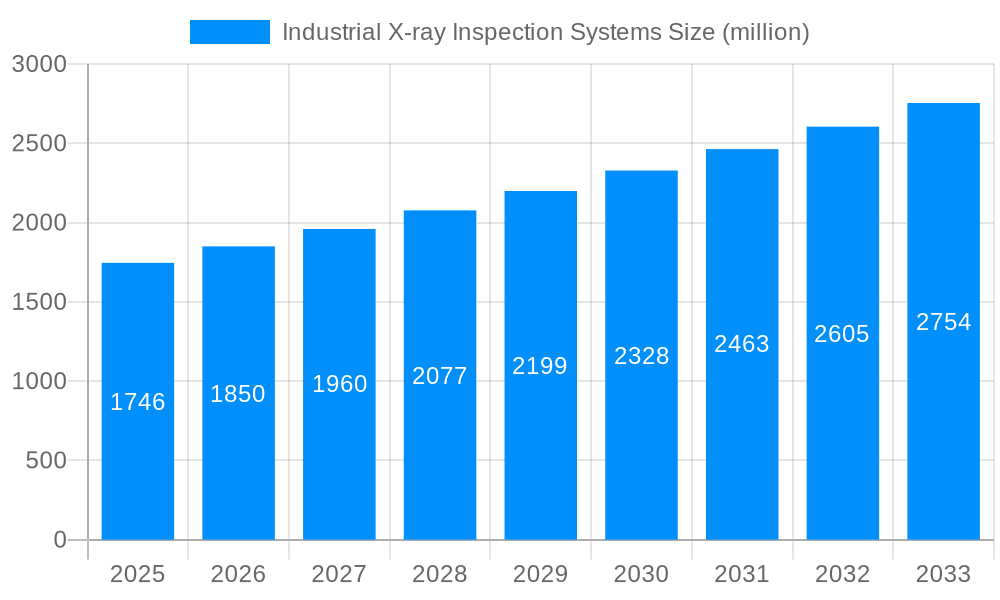

The global Industrial X-ray Inspection Systems market is poised for robust expansion, projected to reach an estimated \$1746 million by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 4.2% anticipated throughout the forecast period of 2025-2033. This steady upward trajectory reflects the increasing adoption of advanced inspection technologies across a diverse range of industries. Key drivers for this market surge include the escalating demand for enhanced product quality and safety, particularly within the automotive, electronics, and packaging sectors, where intricate components require precise non-destructive testing. Furthermore, stringent regulatory standards and the growing complexity of manufactured goods necessitate sophisticated inspection solutions, fueling the demand for industrial X-ray systems. The market's dynamism is also shaped by technological advancements, with innovations in digital radiography (DR) and computed tomography (CT) offering improved resolution, speed, and data analysis capabilities.

The Industrial X-ray Inspection Systems market is characterized by a diverse segment landscape, with Digital Radiography (DR) and Computed Tomography (CT) types catering to distinct application needs. The automotive industry, driven by advancements in electric vehicles and the increasing sophistication of automotive electronics, stands as a significant application segment. Similarly, the booming electronics industry, with its miniaturization trends and stringent quality control requirements, is a major consumer of these systems. The packaging sector also relies on X-ray inspection for contaminant detection and quality assurance. While the market benefits from strong growth drivers, potential restraints such as high initial investment costs for advanced systems and a shortage of skilled personnel for operation and maintenance need to be strategically addressed by market players. The Asia Pacific region, particularly China and Japan, is expected to exhibit significant growth due to its extensive manufacturing base and increasing investments in automation and quality control.

This report offers an in-depth examination of the global Industrial X-ray Inspection Systems market, providing critical insights into its present trajectory and future potential. Spanning a comprehensive study period from 2019 to 2033, with a particular focus on the Base Year of 2025, the report meticulously analyzes historical trends from 2019-2024 and projects future growth through the Forecast Period of 2025-2033. The estimated market size in 2025 is projected to be in the high hundred million to low billion dollar range, poised for significant expansion driven by technological advancements and increasing adoption across diverse industrial sectors.

The industrial X-ray inspection systems market is experiencing a dynamic evolution, characterized by an accelerating shift towards digital technologies and an expanding application spectrum. The transition from traditional film-based radiography to Digital Radiography (DR) and Computed Tomography (CT) systems is a dominant trend, driven by the inherent advantages of digital solutions, including faster inspection times, enhanced image quality, improved data management, and reduced consumables. DR systems, known for their speed and efficiency in detecting surface and subsurface defects, are gaining traction in high-volume production environments. Meanwhile, CT systems are emerging as indispensable tools for detailed, three-dimensional defect analysis and metrology, offering unparalleled insights into the internal structures of components. The market is witnessing a growing demand for higher resolution detectors, advanced software algorithms for automated defect detection and analysis, and integrated inspection solutions that seamlessly fit into production lines. Furthermore, miniaturization of X-ray sources and detectors is enabling more compact and portable inspection systems, opening up new possibilities for on-site inspections and challenging environments. The increasing sophistication of AI and machine learning is also being integrated into these systems to enhance defect recognition accuracy and reduce reliance on human interpretation. As industries strive for zero-defect manufacturing and enhanced product reliability, the demand for precise and efficient non-destructive testing methods like industrial X-ray inspection systems is expected to surge. The integration of Industry 4.0 principles, including IoT connectivity and cloud-based data analysis, is also shaping the future of these systems, enabling remote monitoring, predictive maintenance, and enhanced quality control across the entire manufacturing lifecycle. The growing emphasis on product safety and regulatory compliance across various sectors, particularly in automotive and aerospace, further bolsters the adoption of advanced X-ray inspection solutions.

The industrial X-ray inspection systems market is propelled by a confluence of powerful forces that underscore its growing importance in modern manufacturing. A primary driver is the relentless pursuit of enhanced product quality and reliability across all industrial sectors. As manufacturing processes become more complex and components increasingly intricate, the need for non-destructive testing (NDT) methods capable of identifying even the most minute defects becomes paramount. Industrial X-ray inspection systems excel in this regard, offering unparalleled precision in detecting internal flaws, voids, inclusions, and structural anomalies that would otherwise go unnoticed, leading to product failures and reputational damage. Furthermore, stringent regulatory requirements and industry standards, particularly in highly regulated sectors like automotive, aerospace, and medical device manufacturing, mandate rigorous inspection protocols to ensure safety and compliance. This regulatory pressure acts as a significant catalyst for the adoption of advanced X-ray inspection technologies. The ongoing advancements in digital radiography and computed tomography technologies are also playing a crucial role. Innovations in detector technology, X-ray source design, and image processing software are leading to higher resolution, faster inspection speeds, and more comprehensive data analysis capabilities, making these systems more attractive and cost-effective for a wider range of applications. The drive towards miniaturization and automation within manufacturing environments further fuels demand for compact, integrated X-ray inspection solutions that can be seamlessly incorporated into production lines, thereby increasing throughput and reducing manual intervention. The burgeoning demand for electric vehicles, particularly lithium batteries, represents a significant growth area, as the internal integrity of battery components is critical for safety and performance.

Despite the robust growth trajectory, the industrial X-ray inspection systems market faces several challenges and restraints that could temper its expansion. A significant hurdle is the substantial initial investment required for acquiring advanced X-ray inspection systems, particularly high-end CT scanners, which can be a deterrent for small and medium-sized enterprises (SMEs) with limited capital. The complexity of operation and the need for skilled personnel to interpret X-ray images and operate sophisticated software can also pose a challenge. A shortage of adequately trained technicians and operators, coupled with the time and cost associated with their training, can hinder widespread adoption. Furthermore, the stringent safety regulations surrounding the use of X-ray equipment necessitate specialized infrastructure, shielding, and licensing, which can add to the operational costs and complexity for businesses. The evolving nature of technological advancements also presents a challenge; companies must continuously invest in upgrading their equipment to remain competitive, leading to a perpetual cycle of capital expenditure. The availability of alternative NDT methods, such as ultrasound and eddy current testing, which may be perceived as less costly or simpler to implement in certain applications, can also present a competitive restraint. Moreover, the integration of these systems into existing manufacturing workflows can be complex and time-consuming, requiring careful planning and execution to avoid disrupting production. Concerns about data security and privacy, especially with the increasing reliance on digital data and cloud connectivity, can also be a restraint for some organizations. The perceived risk associated with radiation exposure, although meticulously managed with modern safety protocols, can sometimes create apprehension among potential users.

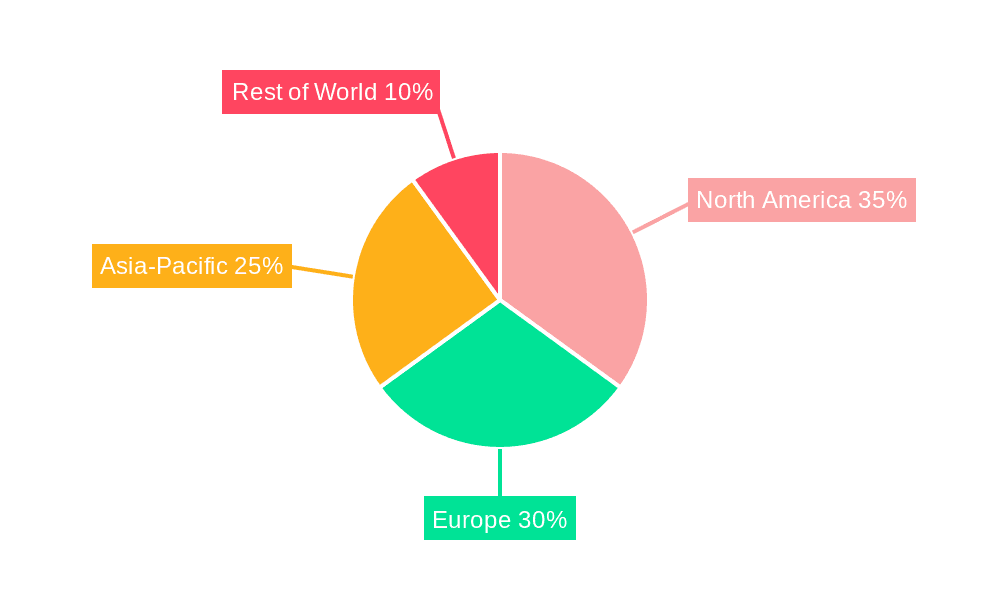

The global industrial X-ray inspection systems market is characterized by regional disparities and segment dominance, with certain areas and applications poised for significant growth.

Dominant Segments:

Computed Tomography (CT) Type: While Digital Radiography (DR) systems offer speed and efficiency, Computed Tomography (CT) systems are emerging as the dominant and most rapidly growing segment. This ascendancy is driven by the increasing demand for in-depth, three-dimensional analysis of complex components. CT provides non-destructive visualization of internal structures, enabling detailed defect identification, metrology, and failure analysis that is crucial for industries like automotive and electronics where intricate designs and high reliability are paramount. The ability of CT to reconstruct internal geometries with high fidelity makes it indispensable for quality control of advanced materials and complex assemblies, particularly in the automotive industry for engine components, castings, and battery systems, and in the electronics industry for intricate printed circuit boards (PCBs) and semiconductor packaging.

Automotive Industry: The automotive sector is a leading consumer of industrial X-ray inspection systems and is expected to continue its dominance. The increasing complexity of modern vehicles, the growing adoption of electric vehicles (EVs), and the stringent safety and quality standards imposed by regulatory bodies are key drivers. In ICE vehicles, X-ray inspection is vital for quality control of engine components, transmissions, and safety-critical parts like airbags. For EVs, the integrity of lithium-ion battery packs, including the internal structure of cells, electrodes, and connections, is of paramount importance for performance and safety. X-ray inspection plays a crucial role in detecting defects like delamination, voids, and short circuits within battery components, preventing potential thermal runaway events. Furthermore, the trend towards lightweighting in automotive design, utilizing advanced materials like composites and alloys, necessitates sophisticated NDT methods like X-ray inspection to ensure the structural integrity of these components.

Lithium Battery Industry: This segment is experiencing explosive growth and is projected to be a significant growth catalyst. The global surge in demand for electric vehicles and energy storage solutions has propelled the lithium battery industry to the forefront. The internal structure and integrity of lithium-ion battery cells and components are critical for their performance, lifespan, and safety. Industrial X-ray inspection systems, particularly CT, are vital for detecting microscopic defects such as electrode alignment issues, separator integrity, internal shorts, and voids within the electrolyte. These defects can lead to decreased battery performance, premature degradation, and, in severe cases, safety hazards like thermal runaway. Manufacturers are increasingly relying on advanced X-ray inspection to ensure the quality and reliability of battery components at every stage of production, from raw material inspection to final product testing. The need for high-throughput, automated inspection solutions is also driving innovation in this sector.

Key Regions/Countries:

Asia Pacific: This region is a powerhouse and is expected to maintain its dominance. Countries like China, Japan, South Korea, and Taiwan are major manufacturing hubs for electronics, automotive components, and increasingly, batteries for electric vehicles. The presence of a vast manufacturing base, coupled with significant investments in R&D and technological adoption, fuels the demand for advanced industrial X-ray inspection systems. China, in particular, with its massive manufacturing output and its strategic focus on high-tech industries, is a key market. The country's push towards advanced manufacturing and automation, coupled with stringent quality control mandates, makes it a critical region for X-ray inspection system providers. The rapid growth of the electric vehicle market in China further amplifies the demand for specialized inspection solutions for lithium battery components. Japan and South Korea, with their established automotive and electronics industries, also represent substantial markets.

North America: The North American market, particularly the United States, remains a significant and robust market for industrial X-ray inspection systems. The strong presence of the automotive and aerospace industries, which are early adopters of advanced NDT technologies, contributes significantly to market growth. The ongoing technological advancements in these sectors, including the shift towards electric mobility and the development of next-generation aircraft, necessitate highly reliable inspection solutions. The increasing focus on domestic manufacturing and supply chain resilience also plays a role. Furthermore, the medical device industry in North America, with its high quality and safety standards, is a consistent consumer of advanced X-ray inspection technologies for component inspection.

The industrial X-ray inspection systems industry is propelled by several key growth catalysts. The escalating demand for enhanced product quality and reliability across manufacturing sectors is a primary driver, pushing industries to adopt sophisticated non-destructive testing methods to identify and rectify even the most minuscule defects. Stringent regulatory compliance in critical sectors like automotive, aerospace, and medical devices mandates rigorous inspection protocols, further fueling the adoption of these advanced systems. The rapid evolution of digital radiography and computed tomography technologies, leading to higher resolution, faster inspection speeds, and improved data analysis, makes these solutions more accessible and attractive. The burgeoning growth of the electric vehicle market, with its critical need for ensuring the safety and performance of lithium-ion batteries, presents a significant and rapidly expanding opportunity. Furthermore, the broader trend towards Industry 4.0 and smart manufacturing, emphasizing automation and data-driven decision-making, is encouraging the integration of X-ray inspection systems into interconnected production lines.

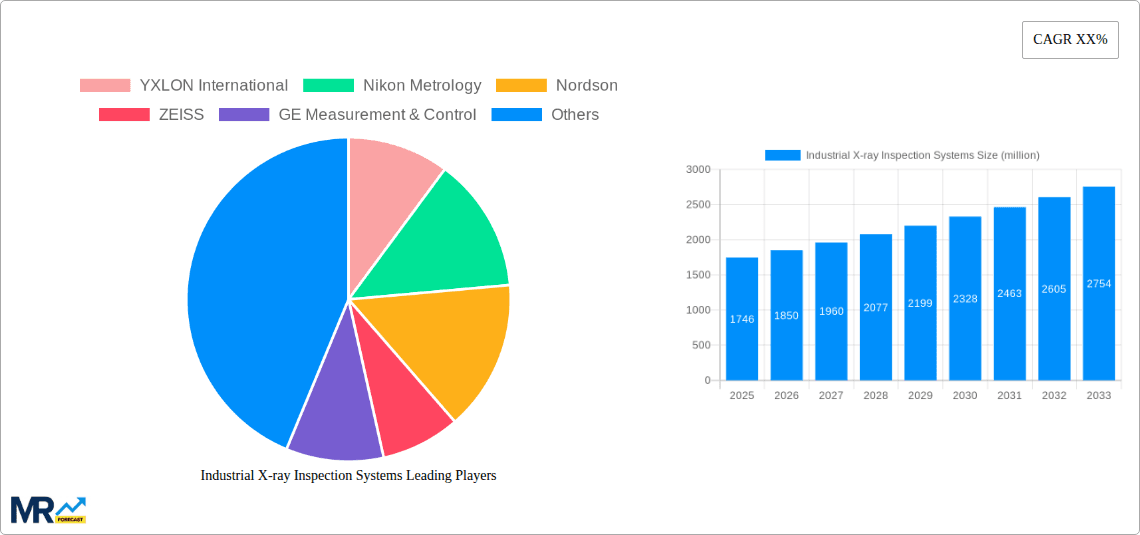

The industrial X-ray inspection systems market is characterized by a competitive landscape with several established and emerging players. Key companies driving innovation and market growth include:

The industrial X-ray inspection systems sector has witnessed several significant developments that have shaped its trajectory:

This comprehensive report provides an exhaustive analysis of the global industrial X-ray inspection systems market, delving into critical trends, driving forces, challenges, and future projections. It offers a detailed breakdown of market dynamics across various segments, including Digital Radiography (DR) Type and Computed Tomography (CT) Type, and their applications in key industries such as General Industry, Automotive Industry, Electronics Industry, Packaging, and Lithium Battery Industry. The report highlights dominant regions and countries, with a particular focus on the Asia Pacific and North America markets. It further elucidates the growth catalysts propelling the industry forward, such as the increasing demand for product quality, stringent regulatory requirements, technological advancements, and the burgeoning electric vehicle market. The report also identifies the leading players, providing a snapshot of the competitive landscape, and details significant developments that have shaped the sector. By integrating historical data from 2019-2024 with robust forecasts for the 2025-2033 period, and establishing 2025 as the base and estimated year, this report offers unparalleled insights for strategic decision-making, investment planning, and market understanding within the industrial X-ray inspection systems domain. The estimated market size in 2025 is projected to reach the hundreds of millions of dollars, indicating substantial growth potential.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.2%.

Key companies in the market include YXLON International, Nikon Metrology, Nordson, ZEISS, GE Measurement & Control, Anritsu Industrial Solutions, North Star Imaging, Ishida, Mettler-Toledo International, VJ Technologies, Sesotec GmbH, Aolong Group, Loma, VisiConsult, DanDong Huari, Guangdong Zhengye, Shimadzu, Toshiba, Innometry, Techvalley Co., Ltd., SEC Co.,Ltd, XAVIS Co., Ltd, Viscom, Omron, ViTrox Corporation, Saki Corporation, Test Research Inc. (TRI), Unicomp Technology, Waygate Technologie, Goepel Electronic.

The market segments include Type, Application.

The market size is estimated to be USD 1746 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Industrial X-ray Inspection Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Industrial X-ray Inspection Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.