1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Wireless Charging Systems?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Industrial Wireless Charging Systems

Industrial Wireless Charging SystemsIndustrial Wireless Charging Systems by Type (Dedicated System, General purpose System), by Application (AGV, Robot, Forklift, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

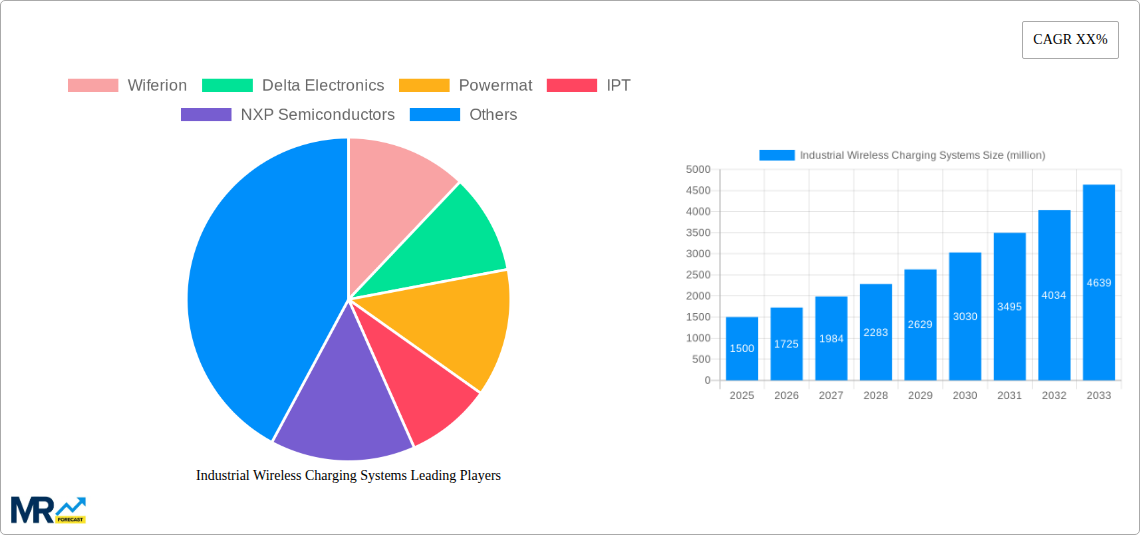

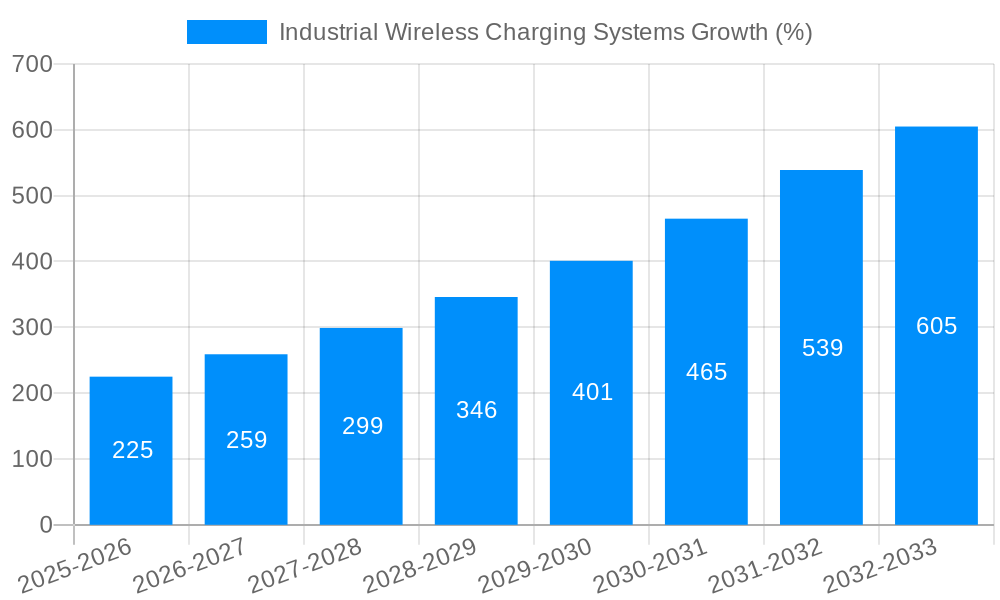

The Industrial Wireless Charging Systems market is experiencing robust growth, driven by the increasing demand for automation, efficiency improvements, and reduced maintenance in industrial settings. The market's expansion is fueled by several key factors. Firstly, the rising adoption of robotics and automated guided vehicles (AGVs) in manufacturing, warehousing, and logistics necessitates reliable and convenient power solutions, making wireless charging a compelling alternative to traditional wired methods. Secondly, the inherent safety advantages of eliminating trailing cables in hazardous environments significantly contribute to market growth. Wireless charging mitigates risks associated with cable tripping, damage, and electrical hazards, thereby enhancing workplace safety. Finally, the technological advancements in wireless power transfer technologies, including increased efficiency and power output, are further propelling market adoption. While high initial investment costs for infrastructure deployment can be a restraining factor, the long-term cost savings associated with reduced maintenance, improved operational efficiency, and enhanced safety profiles are quickly outweighing these concerns. We estimate the market size in 2025 to be $1.5 billion, growing at a CAGR of 15% from 2025 to 2033.

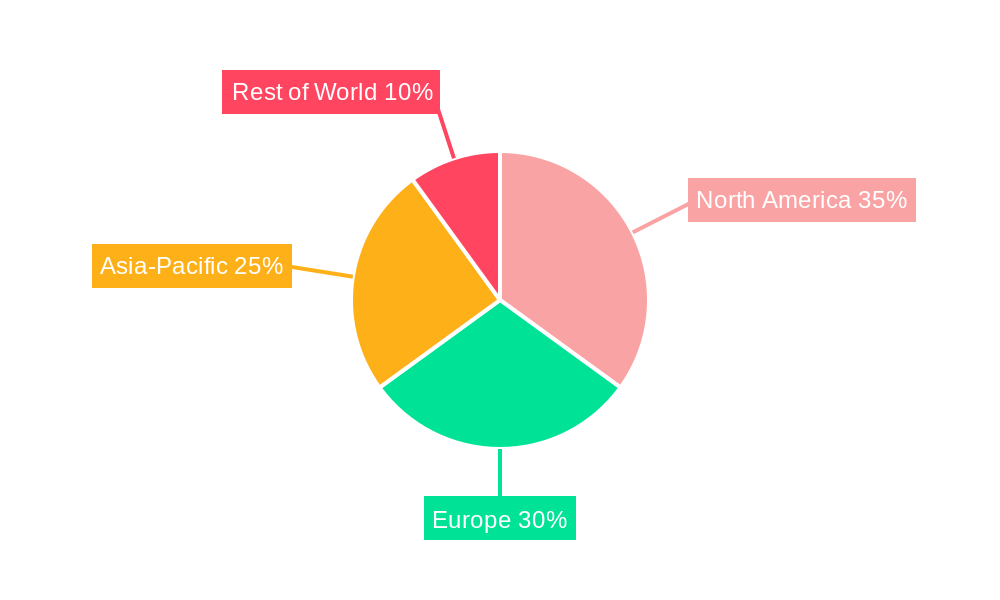

The competitive landscape is characterized by a mix of established players and emerging companies innovating in wireless charging technologies. Key players like Wiferion, Delta Electronics, and Infineon are leveraging their expertise in power electronics and semiconductor technologies to develop and supply advanced wireless charging solutions. Meanwhile, companies such as Momentum Dynamics and WiBotic are focusing on niche applications and specialized solutions within the industrial sector. The market is expected to witness further consolidation and strategic partnerships in the coming years as companies seek to expand their market reach and enhance their product offerings. Regional growth will be diverse, with North America and Europe leading initially, followed by a surge in adoption across Asia-Pacific due to rapid industrialization and automation initiatives in manufacturing hubs such as China and Japan. The consistent technological advancements in resonant and inductive coupling technologies will further drive market expansion, along with ongoing miniaturization and enhanced power transfer efficiency.

The industrial wireless charging systems market is experiencing explosive growth, projected to reach several million units by 2033. This surge is fueled by the increasing demand for efficient, reliable, and safe power solutions across various industrial sectors. The historical period (2019-2024) witnessed significant adoption in niche applications, laying the groundwork for widespread deployment during the forecast period (2025-2033). Our analysis indicates a Compound Annual Growth Rate (CAGR) significantly above the global average for industrial automation, driven primarily by the advantages of wireless charging over traditional wired systems. These advantages include enhanced operational safety by eliminating tripping hazards and the potential for damage from exposed wires, increased system flexibility allowing for easier equipment repositioning and relocation, reduced maintenance costs through the elimination of wear and tear on wired connections, and improved efficiency in demanding environments. The estimated market size in 2025 is already substantial, indicating the burgeoning interest and investment in this technology. While the base year (2025) shows strong adoption, the forecast suggests exponential growth driven by technological advancements in power transfer efficiency, system scalability and the integration of wireless charging into newer equipment designs across various industries. The market is segmented by charging technology (resonant, inductive, etc.), power level, application (AGV, robotics, etc.), and industry vertical (manufacturing, logistics, etc.). Key insights reveal a clear preference for higher power systems within the manufacturing and logistics sectors, owing to the robust energy demands of industrial machinery and automated guided vehicles (AGVs). Furthermore, the rising adoption of Industry 4.0 principles, emphasizing automation and connectivity, directly correlates with the increasing demand for wireless charging solutions that support these advancements.

Several factors are accelerating the adoption of industrial wireless charging systems. The foremost driver is the escalating demand for enhanced safety in industrial environments. Eliminating trailing wires minimizes the risk of accidents, injuries, and production downtime caused by tripping hazards or wire damage. Simultaneously, the push for increased operational efficiency plays a crucial role. Wireless charging facilitates easier equipment relocation and repositioning, leading to greater flexibility in production layouts and optimized workflows. The reduced maintenance associated with eliminating wear and tear on physical connections further contributes to cost savings. The burgeoning adoption of automation in industries, particularly with the rise of AGVs and collaborative robots (cobots), is another significant catalyst. Wireless charging seamlessly integrates with autonomous systems, enabling uninterrupted operation and minimizing downtime for recharging. Furthermore, advancements in wireless power transfer technology, improving efficiency and power levels, are making wireless charging a more practical and viable alternative to traditional wired systems. The increasing integration of IoT and smart factory concepts also creates a need for power solutions that match the inherent flexibility and mobility demanded by the connected industrial environment.

Despite the significant advantages, several challenges hinder the widespread adoption of industrial wireless charging systems. Cost remains a barrier, with the initial investment in wireless charging infrastructure often higher than traditional wired solutions, although this gap is steadily narrowing with technological advancements and economies of scale. Concerns about efficiency losses during power transfer, compared to wired systems, persist in certain applications, though improved technologies are addressing these issues. The range limitations of some wireless charging systems necessitate careful planning and placement of charging infrastructure to ensure consistent and reliable power supply. Integration complexities, particularly when retrofitting existing equipment with wireless charging capabilities, can pose significant challenges. Moreover, regulatory compliance and standardization remain crucial aspects, requiring the development of robust safety standards and interoperability protocols to ensure the safe and reliable operation of these systems. Lastly, the durability and longevity of wireless charging systems under demanding industrial conditions necessitate rigorous testing and robust designs to ensure reliability and extended operational lifespan.

North America and Europe: These regions are expected to lead the market due to early adoption of automation technologies and the presence of major industrial players investing in advanced manufacturing practices. The strong regulatory framework and emphasis on worker safety in these regions further fuels the demand for wireless charging solutions.

Asia-Pacific: This region is anticipated to experience rapid growth due to the expansion of manufacturing industries, particularly in countries like China, Japan, and South Korea. The increasing adoption of AGVs and robotics in various sectors, coupled with government initiatives promoting Industry 4.0, will significantly boost market demand.

High-Power Systems: The segment focusing on high-power wireless charging systems will witness substantial growth owing to the energy requirements of heavy-duty equipment used in industries like manufacturing and logistics. The advantages of eliminating wires and improving workplace safety are particularly important when dealing with larger machines and more energy-intensive applications.

Manufacturing and Logistics: These two industrial verticals are projected to be the key drivers of market growth. The need for improved efficiency, safety, and flexibility in automated manufacturing processes and material handling systems will substantially propel the adoption of wireless charging technology within these sectors. The ability to seamlessly integrate wireless charging into existing and new AGVs, robotic arms, and other automated equipment provides significant operational advantages.

The paragraph summarizing the above pointers is: The industrial wireless charging systems market will see significant growth across various geographical regions and segments. North America and Europe will maintain early adoption leadership, while the Asia-Pacific region is poised for rapid expansion driven by manufacturing growth and Industry 4.0 initiatives. High-power charging systems are expected to dominate due to the increasing energy demands of automated equipment. The Manufacturing and Logistics sectors will exhibit the strongest adoption rates, fueled by the pursuit of improved workplace safety, efficiency gains, and seamless integration with Industry 4.0 initiatives. The synergy between advanced automation, robust safety regulations, and efficient power solutions positions this technology for continued market dominance.

Several factors contribute to the growth of the industrial wireless charging systems market. Technological advancements leading to improved efficiency and higher power transfer capabilities are crucial. The increasing adoption of automation and robotics in manufacturing and logistics is a key driver, along with government initiatives promoting Industry 4.0 and smart factories. The rising demand for safer industrial workplaces and the advantages of reduced maintenance costs further propel market growth. These factors collectively position wireless charging as a vital component of modernizing industrial processes.

This report provides a detailed analysis of the industrial wireless charging systems market, covering market size, growth trends, driving factors, challenges, key players, and significant developments from 2019 to 2033. The report offers actionable insights and forecasts to aid stakeholders in making informed business decisions and understanding the evolving dynamics of this rapidly expanding sector. The comprehensive coverage includes detailed segmentation analysis, competitive landscape mapping, and regional market overviews, providing a holistic perspective on the industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Wiferion, Delta Electronics, Powermat, IPT, NXP Semiconductors, ONE POINTECH, Infineon, Momentum Dynamics, Spark Connected, Daihen, Daifuku, WiBotic, Energous, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Industrial Wireless Charging Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Industrial Wireless Charging Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.