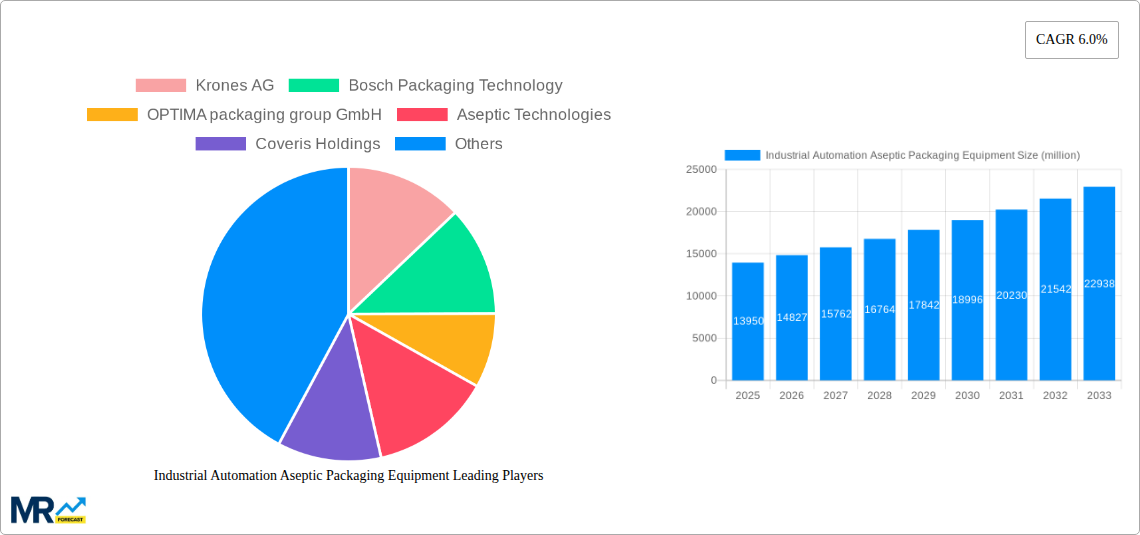

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Automation Aseptic Packaging Equipment?

The projected CAGR is approximately 6.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Industrial Automation Aseptic Packaging Equipment

Industrial Automation Aseptic Packaging EquipmentIndustrial Automation Aseptic Packaging Equipment by Type (Liquid Packaging, Solid Packaging), by Application (Electrical And Electronics, Pharmaceuticals And Medical Devices, Food and Drinks, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global industrial automation aseptic packaging equipment market, valued at $13.95 billion in 2025, is projected to experience robust growth, driven by increasing demand for sterile and safe food and beverage products. A compound annual growth rate (CAGR) of 6.0% from 2025 to 2033 indicates a significant market expansion, reaching an estimated value exceeding $24 billion by 2033. Key drivers include the rising prevalence of foodborne illnesses, necessitating advanced aseptic packaging solutions, and the growing adoption of automation technologies across the food and pharmaceutical industries to improve efficiency and reduce production costs. Furthermore, the increasing consumer preference for convenient, shelf-stable products is fueling demand for innovative aseptic packaging equipment capable of high-speed and precise filling and sealing. Stringent regulatory standards regarding food safety and hygiene are also contributing to market expansion, requiring manufacturers to invest in advanced aseptic packaging technologies. Competitive pressures and technological advancements are driving innovation in areas such as flexible packaging materials and improved automation systems, enhancing market growth.

Despite these positive factors, certain challenges exist within the market. High initial investment costs associated with implementing advanced aseptic packaging equipment can be a barrier for smaller companies. Maintaining stringent hygiene and sanitation protocols within the production environment adds to operational complexities and expenses. Nevertheless, the long-term benefits of improved product quality, enhanced shelf life, reduced waste, and increased efficiency outweigh these initial hurdles. The market is segmented by packaging type (e.g., bottles, pouches, cartons), automation level, and application (food and beverage, pharmaceuticals), with significant growth anticipated in emerging economies due to increasing disposable incomes and evolving consumer preferences. Leading companies like Krones AG, Bosch Packaging Technology, and others are continuously innovating to meet growing market demands and maintain a competitive edge.

The global industrial automation aseptic packaging equipment market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. This surge is driven by the increasing demand for safe, shelf-stable food and beverage products, coupled with the escalating need for efficient and cost-effective packaging solutions. The historical period (2019-2024) witnessed steady growth, laying the foundation for the significant expansion anticipated during the forecast period (2025-2033). The estimated market value in 2025 is substantial, representing a significant milestone in the industry's trajectory. Key market insights reveal a strong preference for automated systems across various segments, including dairy, beverages, and pharmaceuticals. This preference is fueled by the advantages of increased production speed, reduced labor costs, improved product quality and consistency, and minimized contamination risks. Furthermore, technological advancements such as advanced robotics, AI-powered quality control, and predictive maintenance are enhancing the capabilities and efficiency of these systems. The market is also witnessing a growing adoption of flexible packaging solutions, catering to diverse product formats and consumer preferences. This trend is pushing manufacturers to adopt more adaptable and versatile automated aseptic packaging lines, leading to increased capital investment in the sector. The competition is fierce, with established players and emerging companies constantly innovating to offer superior solutions and gain market share. This competitive landscape fuels innovation and drives continuous improvement within the industry, ultimately benefiting consumers with higher quality and more efficient product delivery. The overall trend points towards a continued upward trajectory, shaped by a confluence of factors favoring automation and technological sophistication in aseptic packaging.

Several key factors are driving the growth of the industrial automation aseptic packaging equipment market. The primary driver is the escalating demand for safe and extended-shelf-life products, particularly in the food and beverage industry. Consumers are increasingly conscious of food safety and prefer products that remain fresh for longer periods. Aseptic packaging, which eliminates the need for preservatives by sterilizing both the product and the packaging separately, perfectly addresses this demand. Automation plays a crucial role in achieving this process efficiently and at scale. Secondly, stringent regulatory requirements related to food safety and hygiene are prompting manufacturers to adopt automated systems. These systems ensure consistent processing and minimal human intervention, thereby reducing the risk of contamination and complying with industry standards. The rising labor costs, particularly in developed economies, further incentivize the adoption of automation. Automated systems significantly reduce labor requirements, leading to substantial cost savings and improved productivity. Finally, the increasing focus on sustainability and reducing waste within the packaging industry is also contributing to the market growth. Automated aseptic packaging lines offer opportunities for optimizing material usage, reducing packaging waste, and enhancing resource efficiency. These factors collectively contribute to a market environment where automation is not just a desirable feature but a necessary component for competitiveness and sustainability.

Despite the significant growth potential, the industrial automation aseptic packaging equipment market faces several challenges. High initial investment costs associated with implementing automated systems can be a significant barrier for smaller businesses, particularly in emerging markets. The complexity of these systems requires specialized technical expertise for installation, operation, and maintenance. A shortage of skilled professionals capable of handling these advanced technologies can impede adoption and efficient operation. Furthermore, the integration of automated systems into existing production lines can be complex and disruptive, requiring significant planning and coordination. This integration process can lead to temporary production halts and associated costs. The need for frequent upgrades and maintenance to maintain optimal performance adds to the overall cost of ownership. Technological advancements necessitate periodic upgrades to maintain competitiveness, which can be financially demanding for manufacturers. Finally, concerns regarding the reliability and durability of automated systems, especially in harsh operational environments, can also hinder widespread adoption. Ensuring system uptime and preventing costly breakdowns are crucial concerns for manufacturers. Overcoming these challenges will be key to unlocking the full potential of the industrial automation aseptic packaging equipment market.

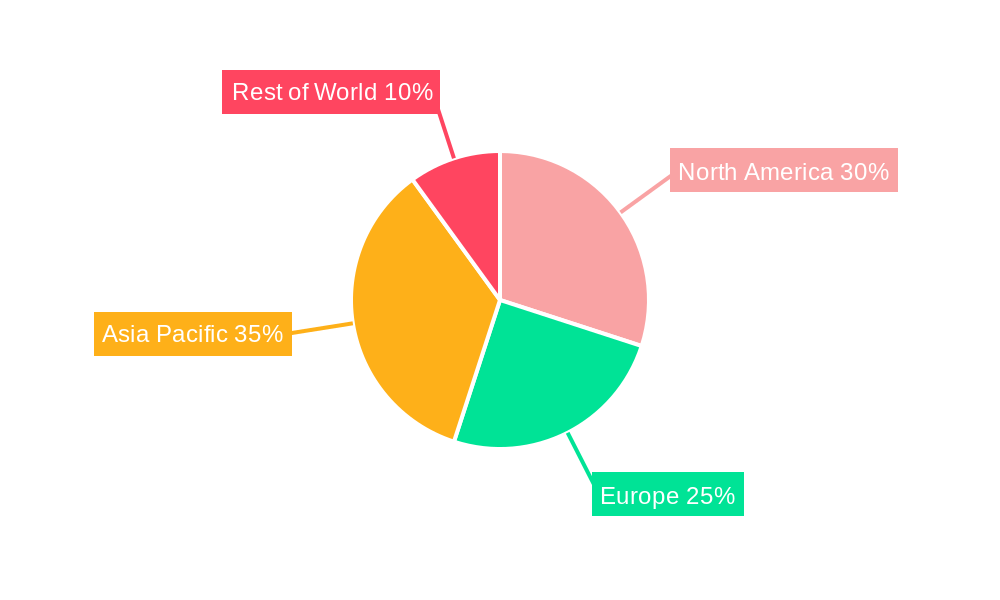

North America and Europe: These regions are expected to maintain significant market share due to high adoption rates of advanced technologies, stringent regulatory requirements, and a large consumer base with high disposable incomes. Established players and strong industry infrastructure contribute to the dominance of these regions.

Asia-Pacific: This region is projected to witness the fastest growth, driven by rapid industrialization, increasing demand for processed food and beverages, and a rising middle class with changing consumption patterns. However, the initial investment costs associated with automation may pose a barrier to some smaller manufacturers.

Segments: The dairy segment is expected to hold a substantial share, fueled by increasing consumption of dairy products and the need for extended shelf life. The beverage segment is also projected to witness significant growth, driven by the demand for aseptic packaging of juices, nectars, and ready-to-drink beverages. Pharmaceutical aseptic packaging is also gaining traction, driven by the need for sterile and safe packaging of pharmaceutical products.

Detailed Analysis: North America's established infrastructure and regulatory landscape, alongside robust consumer demand for safe and convenient food and beverage products, ensures strong adoption rates of advanced aseptic packaging equipment. In Europe, similar trends are observed, complemented by strong regulatory oversight and a focus on sustainable packaging solutions. The Asia-Pacific region presents a significant opportunity for growth due to rapid industrialization and a burgeoning middle class, yet the penetration of advanced technology may lag behind due to higher initial costs for smaller-scale businesses. The specific segment dominance will likely be influenced by local consumer preferences, regulatory frameworks, and the overall economic development of a given region. For example, countries with a strong dairy industry might see greater adoption within the dairy segment.

Several factors are accelerating the growth of the industrial automation aseptic packaging equipment market. Increased consumer demand for convenient, safe, and shelf-stable food and beverages is a primary driver. Stringent regulatory guidelines on food safety and hygiene further propel adoption, as does the rising cost of labor in many regions, making automation a cost-effective alternative. Technological advancements, such as the development of more efficient and reliable aseptic packaging machinery and advanced robotics, are improving the effectiveness and capabilities of these systems. Finally, the growing emphasis on sustainability and reduced waste in the packaging industry is motivating manufacturers to adopt automated systems for efficient resource management and waste reduction.

This report provides an in-depth analysis of the industrial automation aseptic packaging equipment market, covering historical data, current market trends, and future projections for the period 2019-2033. The study encompasses a detailed examination of market drivers, challenges, and growth catalysts. It includes comprehensive profiles of leading players, analyzes key regional markets, and explores segment-specific dynamics. The report aims to offer invaluable insights for businesses involved in the production, supply, and use of industrial automation aseptic packaging equipment.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.0%.

Key companies in the market include Krones AG, Bosch Packaging Technology, OPTIMA packaging group GmbH, Aseptic Technologies, Coveris Holdings, IC Filling Systems, Oystar, Schuy Maschinenbau, DS Smith, SIDEL, GEA Group, FBR-ELPO.

The market segments include Type, Application.

The market size is estimated to be USD 13950 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Industrial Automation Aseptic Packaging Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Industrial Automation Aseptic Packaging Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.