1. What is the projected Compound Annual Growth Rate (CAGR) of the In Vivo Pharmacology?

The projected CAGR is approximately 7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

In Vivo Pharmacology

In Vivo PharmacologyIn Vivo Pharmacology by Type (Animal Disease Models, Ex Vivo Pharmacology & Biomarkers, PD/PK, Others), by Application (Ncology/Immuno-oncology, Metabolic Disorders, Inflammatory Diseases, CNS Diseases), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

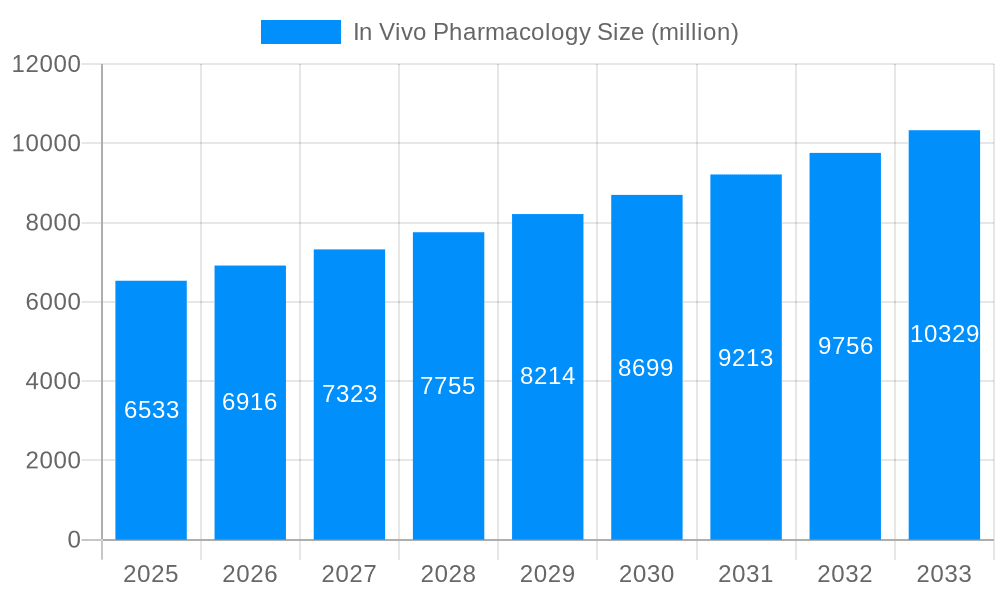

The In Vivo Pharmacology market, valued at $6,533 million in 2025, is projected to experience robust growth, driven by the increasing demand for preclinical drug development services and the rising prevalence of chronic diseases necessitating innovative therapeutic solutions. The market's Compound Annual Growth Rate (CAGR) of 5.6% from 2025 to 2033 signifies a steady expansion, fueled by advancements in technologies like high-throughput screening and sophisticated animal models that enhance the accuracy and efficiency of drug discovery. Key drivers include the growing pharmaceutical and biotechnology industries' reliance on in vivo studies for efficacy and safety assessment before human clinical trials. Emerging trends such as personalized medicine and the growing adoption of AI/ML in drug discovery are further propelling market growth. While regulatory hurdles and ethical concerns related to animal testing pose restraints, the overall market outlook remains positive, driven by continuous innovation and the undeniable need for rigorous preclinical testing.

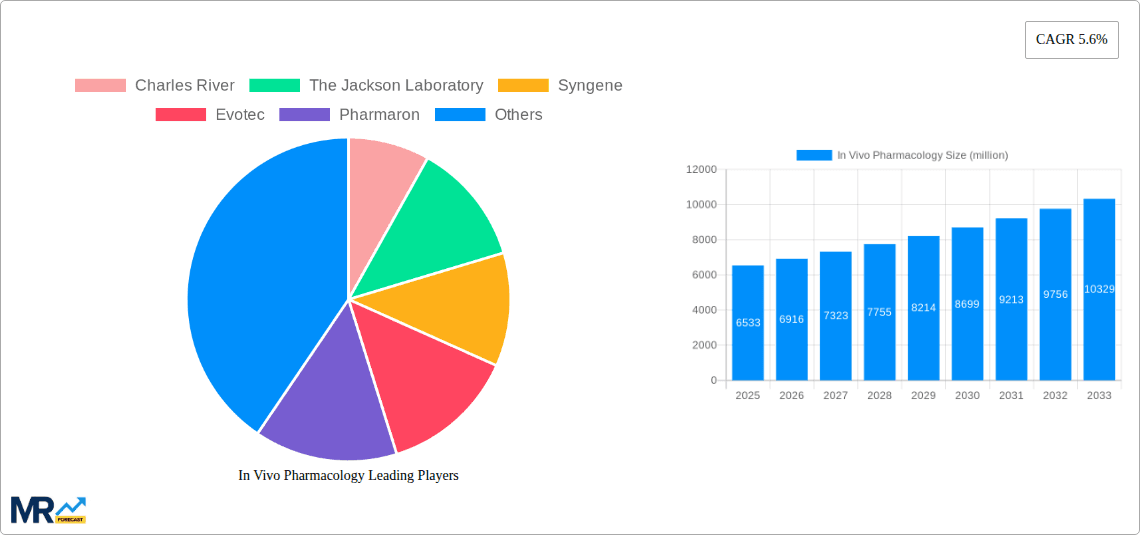

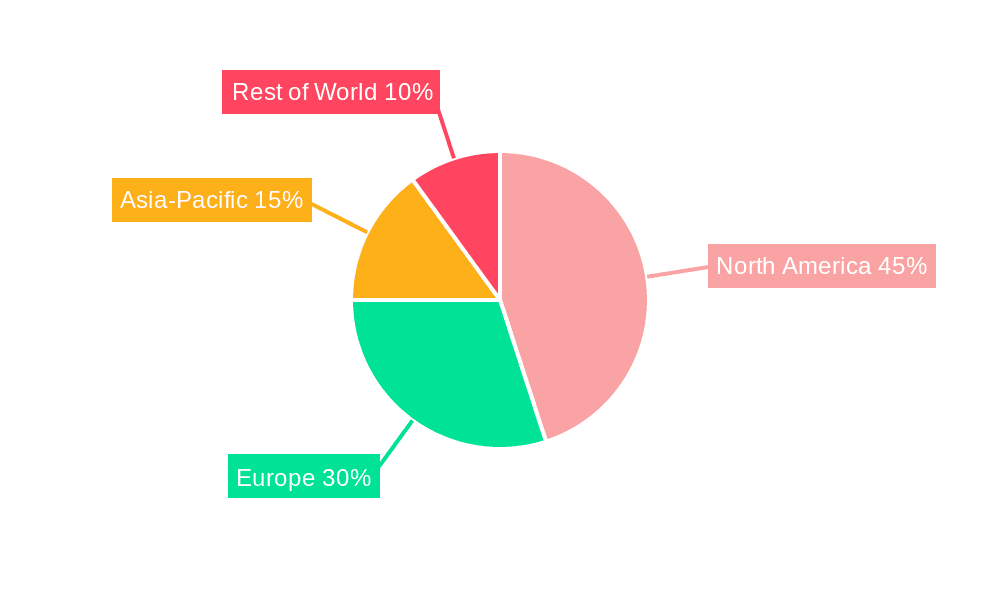

The competitive landscape is characterized by a mix of large multinational pharmaceutical companies and specialized Contract Research Organizations (CROs). Companies like Charles River, The Jackson Laboratory, and Labcorp are key players, leveraging their extensive experience and established infrastructure. The market is also witnessing the emergence of smaller, specialized CROs offering niche services, focusing on specific therapeutic areas or technologies. Geographic expansion into developing economies with rising healthcare expenditure presents significant growth opportunities. The North American and European regions currently dominate the market, but Asia-Pacific is expected to witness significant growth due to increasing investment in R&D and a burgeoning pharmaceutical industry. The consistent market expansion is expected to continue, influenced by the persistent need for effective drug development and the innovative advancements within the field.

The in vivo pharmacology market is experiencing robust growth, projected to reach USD XXX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This significant expansion is driven by a confluence of factors, including the increasing demand for preclinical drug development services, the rising prevalence of chronic diseases necessitating new therapeutic interventions, and substantial investments in research and development by both pharmaceutical giants and emerging biotech companies. The historical period (2019-2024) witnessed steady market growth, laying a solid foundation for the accelerated expansion anticipated in the coming years. The base year for this analysis is 2025, with estimations based on comprehensive market research and data analysis. Key market insights reveal a shift towards more sophisticated and integrated in vivo models, reflecting a growing understanding of the complexities of human disease and the need for more predictive preclinical studies. This trend is reflected in the increasing adoption of advanced technologies, including high-throughput screening, personalized medicine approaches, and the development of more human-relevant animal models. Furthermore, the outsourcing of in vivo pharmacology services is gaining traction, enabling pharmaceutical companies to focus on their core competencies while benefiting from the specialized expertise of contract research organizations (CROs). This strategic shift is contributing to cost-efficiency and accelerated drug development timelines. The market's dynamism is further fueled by continuous regulatory advancements and a growing emphasis on data integrity and reproducibility in preclinical research, thus enhancing the credibility and reliability of in vivo pharmacology studies.

Several key factors are propelling the growth of the in vivo pharmacology market. Firstly, the burgeoning pharmaceutical industry, driven by the need to address a rising global disease burden, is significantly increasing its investment in research and development. This translates into a higher demand for preclinical services, including in vivo pharmacology studies, which are crucial for assessing the safety and efficacy of novel drug candidates before clinical trials commence. Secondly, advancements in technology are revolutionizing in vivo pharmacology. The development of sophisticated animal models, coupled with innovative analytical techniques such as high-throughput screening and advanced imaging, allows for more accurate and efficient evaluation of drug efficacy and toxicity. This increased efficiency leads to faster drug development cycles and reduces overall costs. Thirdly, the increasing awareness and adoption of personalized medicine approaches are creating a higher demand for tailored in vivo studies to assess the effectiveness of targeted therapies in specific patient populations. The focus on personalized medicine necessitates more sophisticated and nuanced experimental designs, driving the market towards more complex and specialized services. Finally, the outsourcing trend within the pharmaceutical industry contributes to the growth of the in vivo pharmacology market. Pharmaceutical and biotechnology companies are increasingly outsourcing their preclinical research to CROs, allowing them to concentrate on other aspects of drug development. This trend is creating substantial opportunities for CROs specializing in in vivo pharmacology.

Despite its significant growth potential, the in vivo pharmacology market faces several challenges and restraints. A primary concern is the ethical considerations surrounding the use of animals in research. Stringent regulations and growing public awareness regarding animal welfare are leading to increased scrutiny of animal models and protocols, requiring researchers to implement rigorous ethical guidelines and minimize animal use. This increases costs and complexity of studies. The high cost of conducting in vivo studies is another significant restraint. The complexity of experimental designs, coupled with the cost of maintaining animal facilities and employing qualified personnel, makes in vivo research a resource-intensive endeavor. This can limit access for smaller companies and researchers with limited budgets. Furthermore, the variability inherent in animal models poses a challenge to the reproducibility and reliability of research findings. Inter-individual differences in animal responses can affect the results, making it essential to use large sample sizes and sophisticated statistical analysis, further increasing costs and complexity. Finally, the growing emphasis on the translation of preclinical findings to clinical trials remains a hurdle. Discrepancies between preclinical results and clinical outcomes are common and can lead to drug failures. Improving the predictivity of in vivo models to better reflect human physiology remains a key focus of ongoing research.

North America: This region is expected to dominate the market due to the presence of a large number of pharmaceutical and biotechnology companies, robust regulatory frameworks supportive of drug development, and high levels of investment in research and development. The concentration of leading CROs in the region also significantly contributes to its market dominance.

Europe: Europe represents a substantial market for in vivo pharmacology, driven by a growing number of biotech companies, strong regulatory bodies, and collaborations between academic institutions and industry.

Asia-Pacific: This region is experiencing rapid growth, fueled by increasing investments in healthcare infrastructure, growing awareness of chronic diseases, and a surge in outsourcing of preclinical research to CROs located in countries like India and China. Cost-effectiveness also makes this region attractive.

Segments: While specific segment market share data isn’t available without proprietary data, several segments drive growth:

Specialized Models: The demand for specialized animal models (e.g., genetically modified mice, humanized mice) that better mimic human diseases is rapidly increasing, contributing to market expansion. These models provide more accurate and predictive results, leading to more efficient drug development.

High-Throughput Screening (HTS): HTS technologies are becoming increasingly important for accelerating the drug discovery process, allowing researchers to evaluate the effects of thousands of compounds in a short period. The use of automation and sophisticated data analysis enhances this efficiency, thus driving this segment's growth.

Contract Research Organizations (CROs): The increasing outsourcing of in vivo pharmacology services to CROs is a major market driver, fueled by the cost-effectiveness and specialized expertise offered by these organizations.

The paragraph above details the reasons for the dominance of these regions and segments, connecting the drivers identified previously to the specific strengths of each area and market niche.

Several factors are catalyzing growth within the in vivo pharmacology industry. The increasing prevalence of chronic diseases, particularly in aging populations globally, creates a constant demand for novel therapeutic interventions. This, combined with continuous advancements in technologies like genomics and proteomics, that enable development of targeted therapies, leads to a higher need for accurate and efficient in vivo testing. Furthermore, government initiatives aimed at promoting research and development in the pharmaceutical sector, along with the strategic investments from major pharmaceutical companies, further fuel the expansion of the market.

This report provides a comprehensive overview of the in vivo pharmacology market, encompassing market size estimations, growth drivers, restraints, key players, and significant industry developments. The analysis covers the historical period (2019-2024), the base year (2025), the estimated year (2025), and the forecast period (2025-2033), offering a detailed and insightful perspective on this dynamic market. The report also examines key regional and segmental trends, providing valuable insights for stakeholders involved in drug discovery and development.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7%.

Key companies in the market include Charles River, The Jackson Laboratory, Syngene, Evotec, Pharmaron, Aurigene Pharmaceutical, Jubilant Biosys, Labcorp, Inotiv, Takeda Pharmaceutical, EXUMA Biotech, Novartis, Be Biopharma, Alderley Oncology, Sygnature Discovery, GenScript ProBio, Zai Lab, Sinclair Research, Eli Lilly, Gubra.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "In Vivo Pharmacology," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the In Vivo Pharmacology, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.