1. What is the projected Compound Annual Growth Rate (CAGR) of the In Vivo Bioassays Services?

The projected CAGR is approximately 25.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

In Vivo Bioassays Services

In Vivo Bioassays ServicesIn Vivo Bioassays Services by Type (/> Hormone Testing Services, Vaccine Assay Services, Drug Testing Services, other), by Application (/> Pharmaceutical, Cytology, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

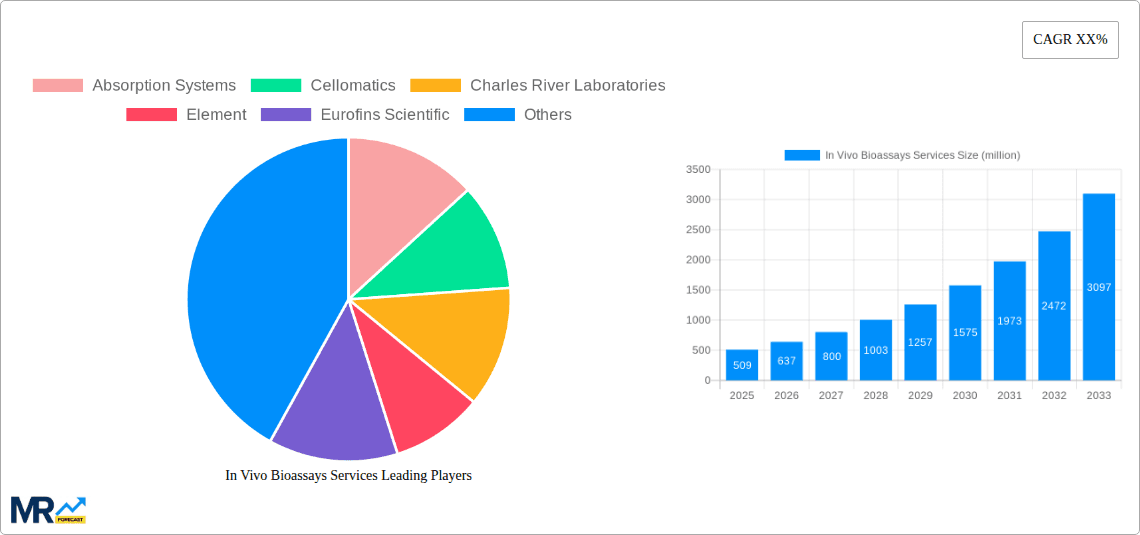

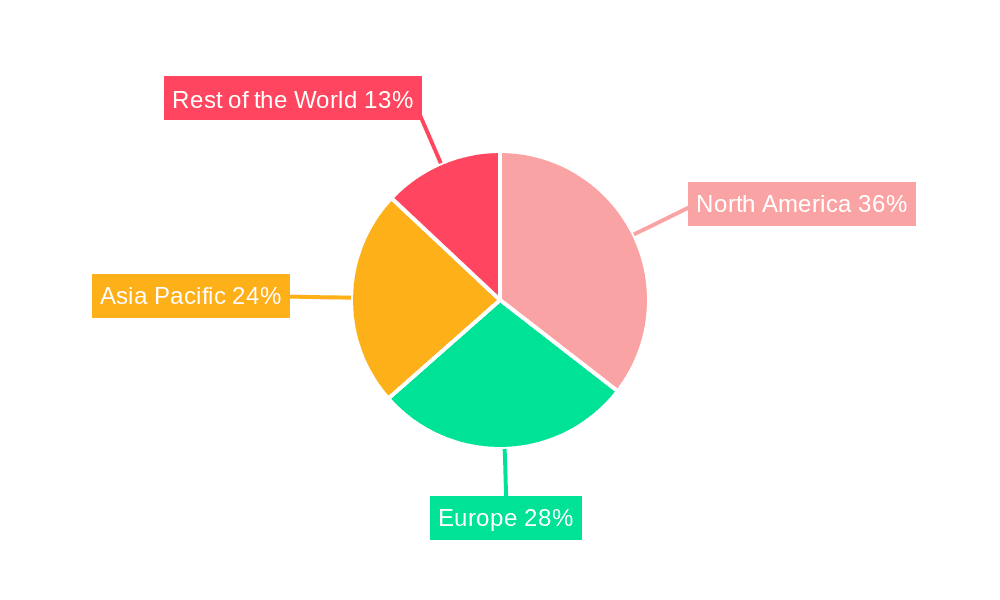

The global In Vivo Bioassays Services market is poised for exceptional growth, demonstrating a robust market size of $509 million in 2025. This impressive valuation is driven by a remarkable Compound Annual Growth Rate (CAGR) of 25.2%, indicating a dynamic and expanding sector. The primary drivers for this surge are the increasing demand for preclinical drug development and the escalating need for comprehensive vaccine efficacy testing. Pharmaceutical companies are heavily investing in in vivo bioassays to accurately assess the safety and efficacy of new drug candidates before human trials, thereby reducing development costs and time-to-market. Furthermore, the heightened global focus on public health and the rapid development of novel vaccines against emerging infectious diseases are creating significant opportunities for bioassay service providers. Emerging economies, particularly in the Asia Pacific region, are showing substantial growth potential, fueled by government initiatives to boost pharmaceutical research and development and the presence of a burgeoning contract research organization (CRO) landscape.

The In Vivo Bioassays Services market is characterized by a diverse range of applications and service types, catering to the intricate needs of the life sciences industry. Hormone testing services and vaccine assay services are key segments, reflecting the ongoing advancements in endocrinology research and the critical need for reliable vaccine evaluation. Drug testing services also represent a significant portion of the market, vital for regulatory compliance and quality control throughout the drug lifecycle. The pharmaceutical sector stands out as the predominant end-user, leveraging these services for critical research and development phases. While the market enjoys strong growth, potential restraints include the high cost associated with conducting in vivo studies and the increasing ethical considerations and regulatory scrutiny surrounding animal testing. However, technological advancements, such as the development of more sophisticated animal models and improved data analysis techniques, are mitigating these challenges and further propelling the market forward. Leading companies such as Absorption Systems, Cellomatics, Charles River Laboratories, and Eurofins Scientific are actively expanding their service portfolios and geographical reach to capitalize on this burgeoning market.

Here is a unique report description for In Vivo Bioassays Services, incorporating your specified elements:

This report provides an in-depth analysis of the global In Vivo Bioassays Services market, projecting significant growth and evolving dynamics. Spanning the Study Period of 2019-2033, with a Base Year of 2025 and an Estimated Year also of 2025, this comprehensive research offers critical insights into the market's trajectory during the Historical Period (2019-2024) and its projected expansion through the Forecast Period (2025-2033). The global market for In Vivo Bioassays Services is estimated to be valued at USD 5,850 million in the base year of 2025, with projections indicating a substantial rise to USD 10,200 million by 2033, demonstrating a compound annual growth rate (CAGR) of 7.3%.

The In Vivo Bioassays Services market is currently experiencing a dynamic evolution, driven by a confluence of scientific advancements and increasing regulatory demands. Key market insights reveal a pronounced shift towards more sophisticated and specialized bioassays, moving beyond traditional efficacy testing to encompass complex toxicological profiling, immunogenicity assessments, and pharmacokinetic/pharmacodynamic (PK/PD) studies. The increasing complexity of drug development pipelines, particularly in the biopharmaceutical sector, necessitates the use of in vivo models to accurately predict human responses. Furthermore, the growing emphasis on personalized medicine is spurring demand for bioassays that can assess drug responses in genetically diverse animal models, mirroring human genetic variations. Regulatory bodies worldwide are continuously refining guidelines, mandating more stringent in vivo testing to ensure the safety and efficacy of novel therapeutics before market approval. This regulatory push, coupled with a robust pipeline of novel biologics, vaccines, and gene therapies, forms the bedrock of current market trends. The market is also witnessing an increasing adoption of advanced imaging techniques and sophisticated data analysis platforms within in vivo bioassays, enhancing the precision and interpretability of results. The rise of contract research organizations (CROs) offering specialized in vivo bioassay services is another significant trend, providing pharmaceutical and biotechnology companies with access to expertise, advanced infrastructure, and flexibility, thereby accelerating research timelines. The growing investment in research and development by pharmaceutical companies, fueled by the need to address unmet medical needs and the expiration of patents on blockbuster drugs, is directly translating into increased outsourcing of these critical testing services. The market's trajectory is further shaped by a growing awareness and implementation of the 3Rs principles (Replacement, Reduction, and Refinement) in animal testing, leading to the development and adoption of more refined and efficient in vivo models.

Several powerful forces are propelling the In Vivo Bioassays Services market forward. Foremost among these is the burgeoning pipeline of novel biopharmaceuticals, including monoclonal antibodies, gene therapies, and cell therapies. These complex modalities necessitate rigorous in vivo evaluation to ascertain their safety, efficacy, and immunogenicity, creating sustained demand for specialized bioassay services. The increasing global prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular disorders, continues to fuel research and development efforts, leading to a constant stream of new drug candidates requiring in vivo validation. Furthermore, the ongoing advancements in biotechnology, including gene editing technologies like CRISPR-Cas9 and advancements in animal model development, enable the creation of more accurate and predictive in vivo systems, thereby enhancing the value proposition of these services. The stringent regulatory landscape imposed by agencies such as the FDA, EMA, and PMDA mandates comprehensive in vivo testing for drug approval, acting as a significant market driver. Companies are increasingly relying on specialized CROs to navigate these complex regulatory requirements and conduct high-quality in vivo studies, as outsourcing offers cost-effectiveness and access to specialized expertise. The growing emphasis on vaccine development, particularly in the wake of global health crises, is also a substantial contributor to market growth.

Despite the promising growth, the In Vivo Bioassays Services market faces several significant challenges and restraints. The most prominent restraint is the ethical and societal concern surrounding animal testing. Growing public pressure and evolving ethical guidelines are pushing for the reduction, refinement, and replacement of animal models, leading to increased scrutiny and potential limitations on in vivo study designs. The development and validation of alternative in vitro and in silico methods, while progressing, are not yet sufficiently advanced to completely replace in vivo assessments for all endpoints, particularly for complex systemic effects. Furthermore, the high cost associated with conducting in vivo studies, including animal acquisition, housing, specialized personnel, and experimental procedures, can be a significant barrier for smaller biotechnology companies and academic institutions. The time-intensive nature of in vivo experiments also poses a challenge, as these studies can often span months or even years, potentially delaying drug development timelines. Regulatory hurdles and the complexity of obtaining approvals for animal studies in different regions can also create delays and add to the overall cost. The availability of skilled personnel with expertise in handling animals and conducting complex bioassays is also a factor, with a potential shortage in some regions impacting service delivery. Finally, the inherent variability in biological systems can lead to challenges in reproducing results consistently, necessitating robust experimental design and statistical analysis.

The pharmaceutical segment, by application, is poised to be the dominant force in the In Vivo Bioassays Services market throughout the forecast period. This dominance stems from the foundational role of in vivo bioassays in the drug discovery and development lifecycle. Pharmaceutical companies invest heavily in preclinical testing to assess the safety and efficacy of novel drug candidates before they enter human trials. This includes a wide array of bioassays such as efficacy studies, pharmacokinetics, pharmacodynamics, and toxicology assessments. The sheer volume of drug candidates in development, coupled with the stringent regulatory requirements for drug approval, ensures a consistent and substantial demand for these services.

North America, particularly the United States, is expected to emerge as a leading region in the In Vivo Bioassays Services market. This leadership is attributed to several key factors:

Within the Type segment, Drug Testing Services will likely witness substantial growth, driven by the ongoing efforts in drug discovery and development across various therapeutic areas. This includes not only the testing of novel drug candidates but also the comprehensive evaluation of existing drugs for new indications or improved formulations.

The In Vivo Bioassays Services industry is experiencing robust growth fueled by several key catalysts. The ever-expanding pipeline of complex biopharmaceuticals, including biologics and gene therapies, requires sophisticated in vivo validation to demonstrate safety and efficacy. Increased investment in pharmaceutical R&D, driven by the pursuit of novel treatments for unmet medical needs and the global rise in chronic diseases, directly translates into higher demand for bioassay services. Furthermore, the stringency of global regulatory requirements for drug approval necessitates comprehensive in vivo testing, ensuring a consistent market need. The growing trend of outsourcing by pharmaceutical and biotech companies to specialized Contract Research Organizations (CROs) also acts as a significant growth accelerator, providing access to expertise and advanced infrastructure.

This report offers unparalleled comprehensive coverage of the In Vivo Bioassays Services market. It delves deep into market segmentation by type, including Hormone Testing Services, Vaccine Assay Services, Drug Testing Services, and others, and by application, encompassing Pharmaceutical, Cytology, and Other uses. The report provides granular analysis of regional markets, with a particular focus on the dominant players and growth drivers in key geographies. It meticulously details the market's historical performance from 2019-2024 and offers robust forecasts for the Forecast Period (2025-2033), underpinned by detailed market sizing and valuation at USD 5,850 million in 2025. This research equips stakeholders with the critical intelligence needed to navigate this evolving landscape, identify strategic opportunities, and mitigate potential risks.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 25.2%.

Key companies in the market include Absorption Systems, Cellomatics, Charles River Laboratories, Element, Eurofins Scientific, FyoniBio, GenScript ProBio, Pacific BioLabs, SGS, Texcell, Veeda, Xenometrix.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "In Vivo Bioassays Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the In Vivo Bioassays Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.