1. What is the projected Compound Annual Growth Rate (CAGR) of the In Vitro ADME Testing Services?

The projected CAGR is approximately 9.29%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

In Vitro ADME Testing Services

In Vitro ADME Testing ServicesIn Vitro ADME Testing Services by Type (/> Biologics, Small Molecules), by Application (/> Lood to Plasma Ratio, Caco-2 Permeability, Cytochrome (CYP) Enzyme Induction / Inhibition, Metabolic Stability, Plasma Protein Binding, Reaction Phenotyping, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

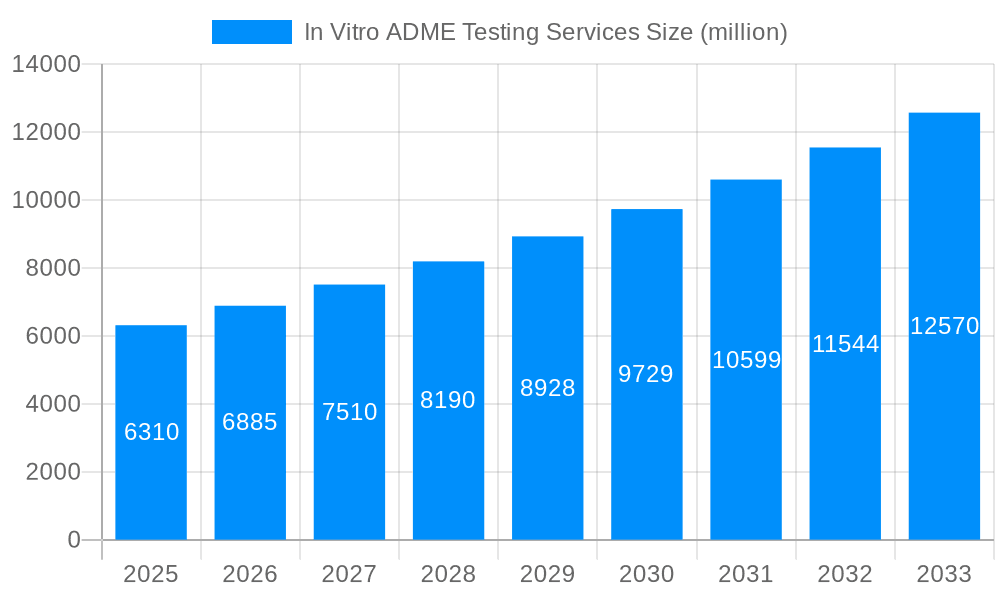

The global In Vitro ADME Testing Services market is poised for robust expansion, projected to reach an estimated USD 6.31 billion in 2025, with a compelling Compound Annual Growth Rate (CAGR) of 9.29% through 2033. This significant growth trajectory is primarily fueled by the pharmaceutical and biotechnology industries' increasing reliance on early-stage drug discovery and development to mitigate costly late-stage failures. The escalating demand for efficient and cost-effective drug candidate screening, coupled with stringent regulatory requirements for drug safety and efficacy, are major market drivers. Furthermore, advancements in assay technologies, the rise of personalized medicine, and the growing outsourcing trend by pharmaceutical companies to specialized contract research organizations (CROs) are all contributing to this dynamic market expansion.

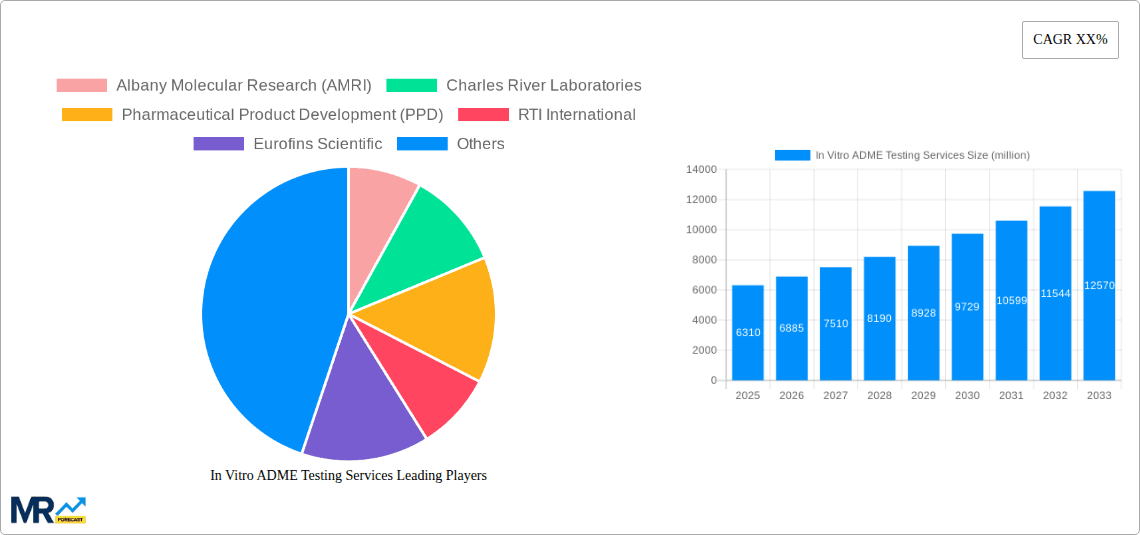

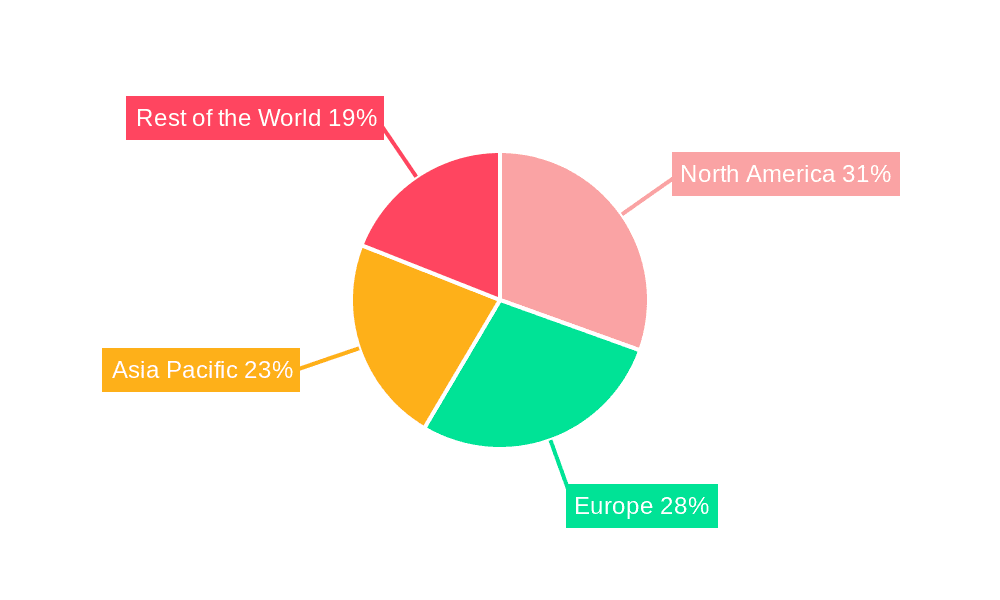

The market is segmented across key areas, including Biologics and Small Molecules for drug types, and various applications such as determining Blood to Plasma Ratio, Caco-2 Permeability, Cytochrome (CYP) Enzyme Induction/Inhibition, Metabolic Stability, Plasma Protein Binding, and Reaction Phenotyping. The growing complexity of biologic drugs and the need for precise characterization of drug behavior in the body are driving innovation and demand within these specific testing areas. Geographically, North America and Europe are expected to continue leading the market due to the strong presence of leading pharmaceutical R&D hubs and significant investments in drug development. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by increasing R&D investments, a burgeoning contract research outsourcing sector, and a large pool of skilled scientists. Key players in this competitive landscape include Albany Molecular Research (AMRI), Charles River Laboratories, Pharmaceutical Product Development (PPD), RTI International, and Eurofins Scientific, among others, who are actively engaged in expanding their service portfolios and geographical reach to capture market opportunities.

This report offers an in-depth analysis of the global In Vitro ADME (Absorption, Distribution, Metabolism, Excretion) Testing Services market, providing a granular view of its evolution and future trajectory. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033, this research delves into critical market dynamics. The historical period of 2019-2024 lays the groundwork for understanding past trends and performance. The estimated market size for 2025, projected to be in the tens of billions of dollars, underscores the significant economic impact and growth potential of this specialized sector within pharmaceutical R&D. This comprehensive report is designed for stakeholders seeking to understand market segmentation, regional dominance, technological advancements, and the competitive landscape.

The In Vitro ADME Testing Services market is currently experiencing a period of robust growth, driven by an escalating demand for efficient and cost-effective drug development processes. The shift towards early-stage pharmacokinetic profiling, crucial for identifying potential drug candidates with favorable ADME properties, has been a defining trend. This proactive approach significantly reduces the risk of late-stage failures, a costly endeavor for pharmaceutical and biotechnology companies. The market is witnessing an increasing reliance on advanced in vitro models that more accurately mimic human physiology, thereby enhancing predictive power. This includes the growing adoption of 3D cell cultures, organ-on-a-chip technologies, and microphysiological systems. The digital transformation within drug discovery, encompassing AI and machine learning applications, is also influencing ADME testing by enabling faster data analysis and prediction of compound behavior. Furthermore, the escalating complexity of novel drug modalities, particularly biologics and gene therapies, necessitates specialized in vitro ADME assays that go beyond traditional small molecule profiling. Regulatory agencies' increasing emphasis on reducing animal testing further fuels the demand for sophisticated in vitro alternatives. The global market, estimated to reach over 70 billion by 2025, is poised for sustained expansion, with the forecast period (2025-2033) anticipating continued double-digit compound annual growth rates. The historical performance from 2019-2024 has shown a steady upward trajectory, setting a strong foundation for future market expansion. This trend signifies the indispensability of in vitro ADME testing in modern drug development pipelines. The continuous innovation in assay development and assay miniaturization is also contributing to market growth by increasing throughput and reducing the cost per test.

Several potent forces are propelling the growth of the In Vitro ADME Testing Services market, fundamentally altering the drug discovery and development landscape. Foremost among these is the relentless pressure on pharmaceutical and biotechnology companies to accelerate drug development timelines while simultaneously reducing R&D expenditures. In vitro ADME studies offer a cost-effective and time-efficient means to screen large numbers of compounds early in the discovery phase, thus identifying and prioritizing candidates with optimal pharmacokinetic profiles before investing heavily in expensive in vivo studies. This early risk mitigation is a significant driver, preventing costly late-stage attrition. Furthermore, the increasing complexity of drug candidates, including the rise of biologics and advanced therapeutic modalities, necessitates sophisticated in vitro methods to understand their absorption, distribution, metabolism, and excretion. These complex molecules often exhibit unique ADME properties that cannot be adequately predicted by traditional in vivo models alone. The growing emphasis on personalized medicine and the development of targeted therapies also require a deeper understanding of how individual patient variations might influence drug metabolism and efficacy, further driving the need for detailed in vitro ADME profiling. Regulatory bodies worldwide are also increasingly encouraging and, in some cases, mandating the use of validated in vitro methods to reduce reliance on animal testing, aligning with ethical considerations and global sustainability initiatives. The substantial market value, projected to exceed 75 billion by 2025, is a testament to the critical role these services play.

Despite the robust growth trajectory, the In Vitro ADME Testing Services market is not without its challenges and restraints, which can impact its pace of expansion. A primary hurdle is the inherent limitation of current in vitro models in fully replicating the complex biological environment of the human body. While advancements in 3D cell cultures and organ-on-a-chip technologies are closing this gap, achieving perfect physiological relevance remains an ongoing endeavor. This can sometimes lead to discrepancies between in vitro predictions and in vivo outcomes, necessitating careful validation and interpretation of results. The development and validation of novel, highly predictive in vitro assays also require significant investment in time, resources, and scientific expertise, potentially slowing down the introduction of groundbreaking technologies. Another restraint stems from the evolving regulatory landscape. While regulators are supportive of in vitro methods, the acceptance and standardization of new assay technologies can be a lengthy process, requiring extensive data and justification. Furthermore, the cost of highly sophisticated in vitro ADME testing services, particularly for advanced biologics and complex assays, can still be a barrier for smaller biotech firms or academic research groups with limited budgets. The reliance on specialized equipment and highly trained personnel also contributes to the operational costs for service providers. The global market, while substantial at an estimated 70 billion in 2025, faces these challenges which could temper its ultimate growth potential. The historical performance from 2019-2024, while positive, has been shaped by these ongoing issues.

The In Vitro ADME Testing Services market is characterized by regional dominance and segment specialization, with North America and Europe currently leading the charge, driven by a confluence of factors.

Dominant Regions:

Dominant Segments:

The interplay of these regional and segmental dynamics creates a complex yet dynamic market landscape, with continuous evolution driven by scientific advancements and therapeutic needs. The overall market value, estimated to be in the tens of billions, is shaped by the relative contributions of these segments and regions.

Several key factors are acting as potent catalysts for the growth of the In Vitro ADME Testing Services industry. The continuous drive for cost reduction and efficiency in drug discovery pipelines remains a primary catalyst, as in vitro ADME testing offers a more economical alternative to extensive preclinical animal studies. Furthermore, the increasing complexity of novel drug modalities, such as biologics and gene therapies, necessitates specialized and advanced in vitro assays that can accurately predict their behavior. Growing regulatory pressure to reduce animal testing is also a significant catalyst, pushing for the development and adoption of validated in vitro alternatives. The substantial market size, estimated in the billions for 2025, is further fueled by ongoing technological advancements in assay development and automation, leading to higher throughput and greater accuracy.

This comprehensive report provides an unparalleled exploration of the In Vitro ADME Testing Services market. It delves into the intricate market segmentation, examining the distinct growth trajectories of Biologics and Small Molecules, and dissecting the pivotal applications such as Blood to Plasma Ratio, Caco-2 Permeability, Cytochrome (CYP) Enzyme Induction/Inhibition, Metabolic Stability, Plasma Protein Binding, Reaction Phenotyping, and Other related services. The report meticulously details the historical performance (2019-2024), current market valuation for the base and estimated year (2025), and projects future growth through the forecast period (2025-2033), with an estimated market size in the billions. Key industry trends, driving forces, prevailing challenges, and dominant regions/countries are thoroughly analyzed, offering stakeholders a 360-degree perspective. Furthermore, the report highlights significant developments and identifies leading market players, providing actionable insights for strategic decision-making in this dynamic and critical sector of pharmaceutical R&D.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.29% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.29%.

Key companies in the market include Albany Molecular Research (AMRI), Charles River Laboratories, Pharmaceutical Product Development (PPD), RTI International, Eurofins Scientific, Evotec, Galapagos, Tecan Group, GVK Biosciences, Pharmaron, Sai Life Sciences, Shanghai Medicilon, Syngene International, WuXi AppTec, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "In Vitro ADME Testing Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the In Vitro ADME Testing Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.