1. What is the projected Compound Annual Growth Rate (CAGR) of the Implantable Presbyopia Correction Devices?

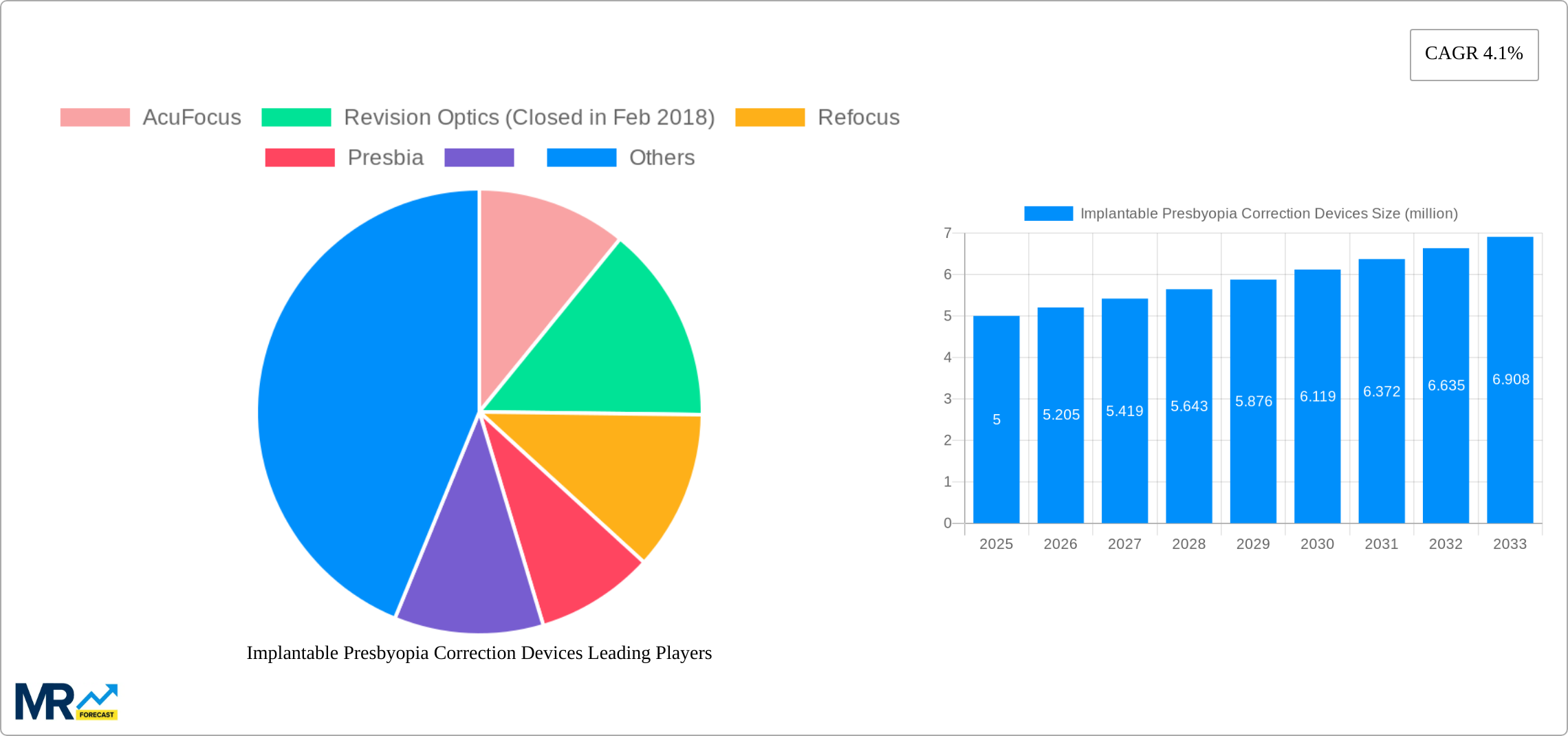

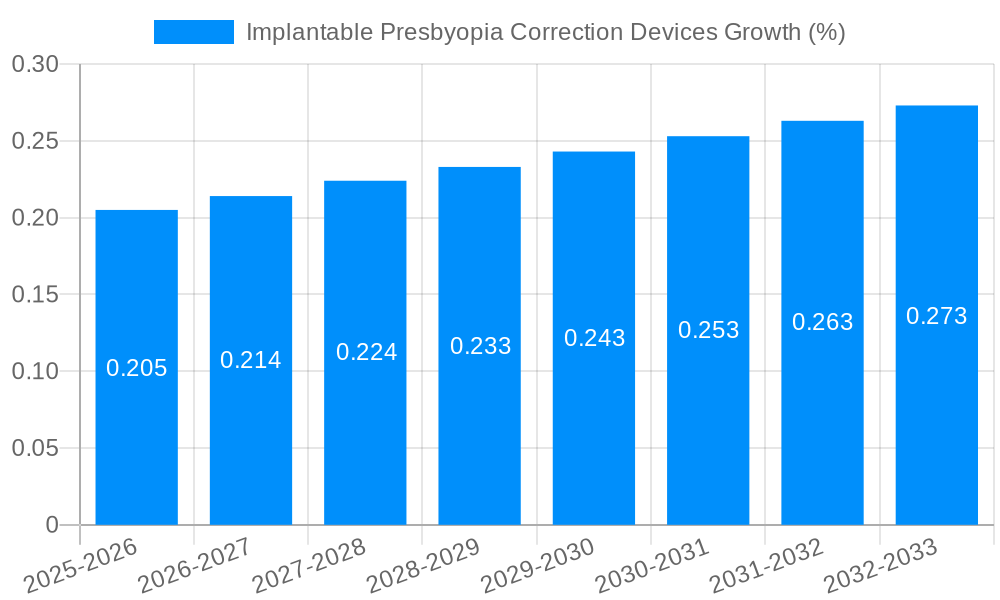

The projected CAGR is approximately 4.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Implantable Presbyopia Correction Devices

Implantable Presbyopia Correction DevicesImplantable Presbyopia Correction Devices by Type (Corneal Inlays, Scleral Implants), by Application (Age 40-50, Age 50-65, Age above 65), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

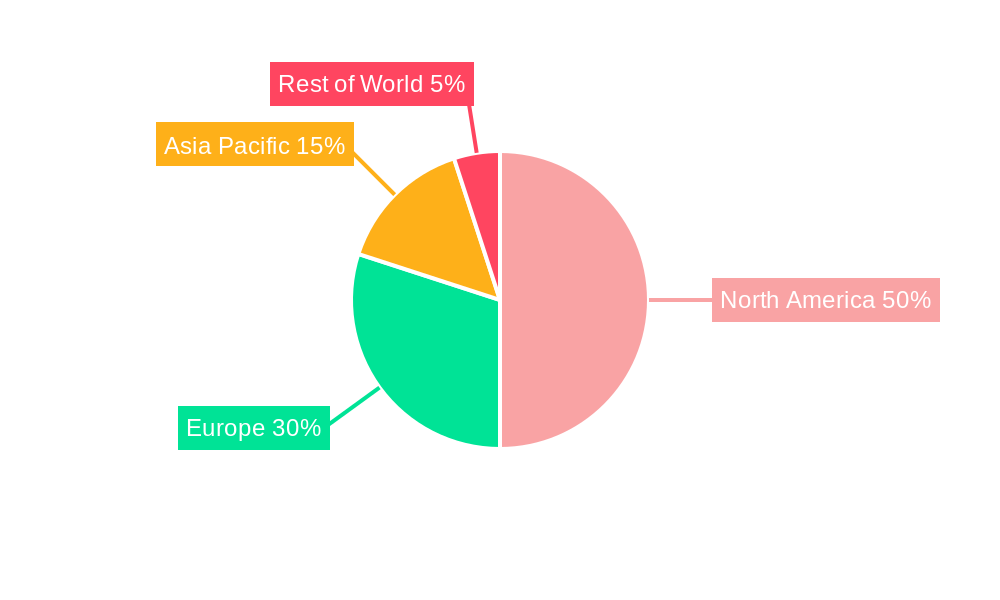

The implantable presbyopia correction devices market, valued at approximately $5 million in 2025, is projected to experience steady growth, driven by a rising geriatric population globally and increasing awareness of minimally invasive presbyopia correction options. This market segment is fueled by advancements in surgical techniques and the development of innovative implantable devices like corneal inlays and scleral implants, offering patients a long-term solution to age-related vision impairment. The 4.1% CAGR suggests a gradual but consistent expansion, with significant opportunities across various age segments (40-50, 50-65, and above 65). North America, particularly the United States, is expected to dominate the market initially, given the higher adoption rates of advanced medical technologies and established healthcare infrastructure. However, growing disposable incomes and increasing healthcare spending in regions like Asia-Pacific (particularly China and India) are poised to drive significant growth in the coming years. Market restraints include the high cost of procedures, potential complications associated with surgery, and the availability of alternative corrective options like spectacles and refractive surgery. The market will likely see continued innovation in implant design, improved surgical techniques and ultimately improved patient outcomes which further propels market growth.

The segmentation by device type (corneal inlays and scleral implants) and age group reveals differing market dynamics. Corneal inlays, currently the more established technology, are likely to maintain a significant market share. However, advancements in scleral implants may lead to increased competition in the future. The age group 50-65 is expected to represent a substantial portion of the market due to the peak incidence of presbyopia within this demographic. The competitive landscape, featuring key players like AcuFocus and Refocus, is likely to remain relatively concentrated, with mergers and acquisitions potentially shaping the market’s future. Further research and development focused on enhanced efficacy, reduced invasiveness, and affordability are critical for sustained market expansion.

The implantable presbyopia correction devices market is experiencing significant growth, driven by the burgeoning aging population globally and a rising demand for minimally invasive procedures offering improved vision correction. The market, valued at approximately $XXX million in 2025, is projected to reach $YYY million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033). This growth is fueled by advancements in implant technology, leading to safer and more effective procedures with improved patient outcomes. The historical period (2019-2024) witnessed a steady increase in market size, setting the stage for the accelerated growth predicted in the forecast period. This upward trajectory is further bolstered by increased awareness among patients regarding the benefits of these devices, coupled with the growing acceptance of advanced ophthalmic surgeries. While corneal inlays currently dominate the market, scleral implants are emerging as a strong contender, particularly for specific patient profiles. The market is further segmented by age groups, with the 50-65 age bracket currently representing a substantial portion of the user base, followed closely by the age group above 65. However, the 40-50 age group is exhibiting increasing adoption rates as individuals seek earlier intervention to address age-related vision changes. Competitive landscape analysis reveals a dynamic market with key players vying for market share through technological innovations and strategic partnerships. Overall, the market demonstrates significant potential for continued expansion, driven by technological advancements, expanding patient populations, and increasing physician adoption.

Several factors are propelling the growth of the implantable presbyopia correction devices market. Firstly, the steadily increasing global geriatric population creates a larger pool of potential patients requiring vision correction. As the population ages, the incidence of presbyopia, the age-related loss of near-focus vision, naturally rises, directly boosting the demand for effective treatment options. Secondly, technological advancements have led to the development of safer, more precise, and effective implantable devices, resulting in improved surgical outcomes and enhanced patient satisfaction. These improvements reduce risks and complications, encouraging wider adoption among both patients and surgeons. Thirdly, a growing preference for minimally invasive procedures is driving the market's expansion. Implantable devices offer a less invasive alternative to conventional refractive surgeries or spectacles, appealing to individuals seeking a long-term solution with minimal recovery time. Finally, increasing awareness among patients about the availability and effectiveness of these devices through improved marketing and educational initiatives is crucial to fostering higher adoption rates. This improved awareness, combined with the convenience and long-term benefits they provide, significantly contributes to market growth.

Despite its promising growth trajectory, the implantable presbyopia correction devices market faces certain challenges. The relatively high cost of the implants and procedures acts as a significant barrier to entry for many potential patients, particularly in developing economies. Insurance coverage for these devices varies across regions and countries, limiting accessibility for a substantial portion of the population. Moreover, potential complications associated with the surgical procedure, although relatively infrequent, create a degree of risk aversion among some individuals. The need for skilled ophthalmic surgeons trained in the implantation techniques is another constraint, especially in regions lacking adequate medical infrastructure. Furthermore, the relatively long-term nature of the outcomes necessitates robust post-operative monitoring and follow-up care, impacting healthcare resource allocation. Lastly, the emergence of competing technologies and alternative vision correction solutions, such as laser refractive procedures and multifocal intraocular lenses, may influence market share dynamics. These factors collectively contribute to a complex market environment, necessitating strategic adaptations and innovation to overcome these challenges and maintain sustainable growth.

Age Group 50-65: This age group represents a significant portion of the presbyopia-affected population and is actively seeking vision correction solutions. Their disposable income and willingness to invest in improved quality of life make them a key driver of market growth.

North America and Europe: These regions exhibit high adoption rates owing to advanced healthcare infrastructure, higher disposable incomes, and widespread awareness of implantable presbyopia correction devices. The well-established ophthalmology sector in these regions provides a strong foundation for market expansion.

Corneal Inlays: While scleral implants are gaining traction, corneal inlays currently hold a dominant market share due to their established track record, relative simplicity of implantation, and widespread availability. Their less-invasive nature compared to scleral implants also contributes to their popularity.

The paragraph elaborating on the above points: The 50-65 age group currently represents the largest segment within the market, primarily due to the high prevalence of presbyopia within this demographic and their higher disposable income. These individuals are more likely to actively seek vision correction solutions that enhance their lifestyle and productivity. Geographically, North America and Europe are expected to maintain their leadership positions in the coming years. These regions benefit from advanced healthcare infrastructure, a high density of specialized ophthalmic surgeons, and robust regulatory frameworks supporting the adoption of new technologies. The relatively higher disposable incomes within these populations also drive higher market penetration. In terms of device type, corneal inlays are currently the market leader due to a combination of factors including established clinical efficacy, lower surgical complexity compared to scleral implants, and established manufacturing infrastructure, resulting in broader market availability. However, scleral implants are likely to see increased adoption as technological advancements improve their safety profile and effectiveness. Therefore, the convergence of these factors – age group 50-65, North America and Europe regions, and corneal inlay technology – presents the most promising segment for near-term market dominance.

The implantable presbyopia correction devices industry is experiencing significant growth catalyzed by several key factors. Advancements in implant design and surgical techniques are leading to safer, more effective procedures with improved outcomes and shorter recovery times. Increasing awareness among patients regarding the benefits of these minimally invasive procedures, coupled with rising disposable incomes in key markets, is driving higher adoption rates. Furthermore, the expansion of healthcare infrastructure and the growing number of skilled ophthalmologists specializing in these procedures are contributing to the market's expansion. Finally, supportive government regulations and insurance coverage policies in certain regions are further fueling market growth.

This report provides a detailed analysis of the implantable presbyopia correction devices market, offering comprehensive insights into market trends, driving forces, challenges, and growth opportunities. The report segments the market by device type (corneal inlays and scleral implants), age group, and key regions, providing a granular understanding of the market dynamics. In addition to market sizing and forecasting, the report includes a competitive landscape analysis, highlighting key players and their strategies. It also explores significant industry developments, regulatory landscape, and future outlook for this dynamic and promising market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.1%.

Key companies in the market include AcuFocus, Revision Optics (Closed in Feb 2018), Refocus, Presbia, .

The market segments include Type, Application.

The market size is estimated to be USD 5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Implantable Presbyopia Correction Devices," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Implantable Presbyopia Correction Devices, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.