1. What is the projected Compound Annual Growth Rate (CAGR) of the HVAC Components?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

HVAC Components

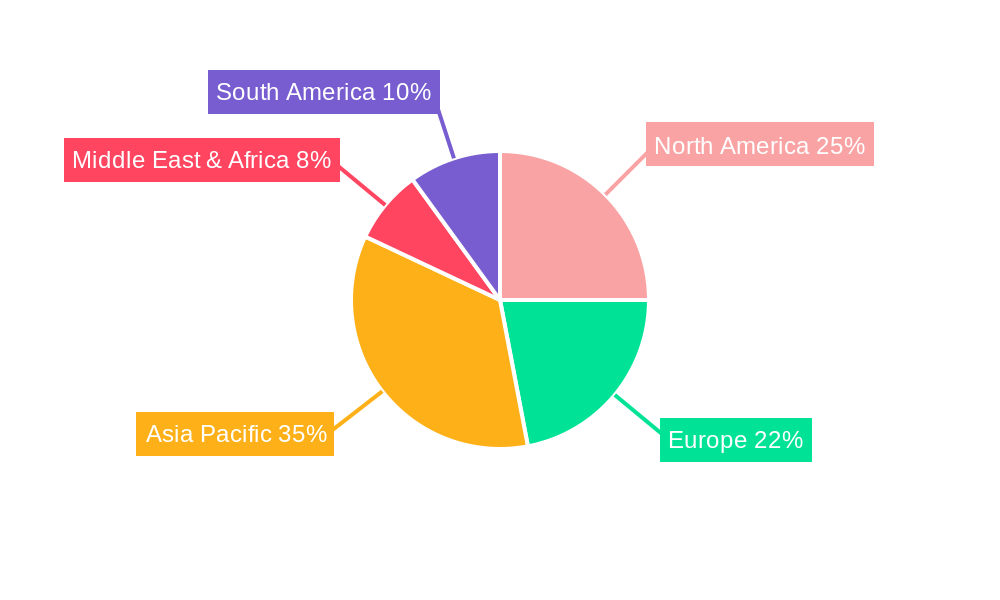

HVAC ComponentsHVAC Components by Type (Cooling Equipment, Fans and Air Handling Equipment, Pipeline System, Control System), by Application (Residential, Commercial, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

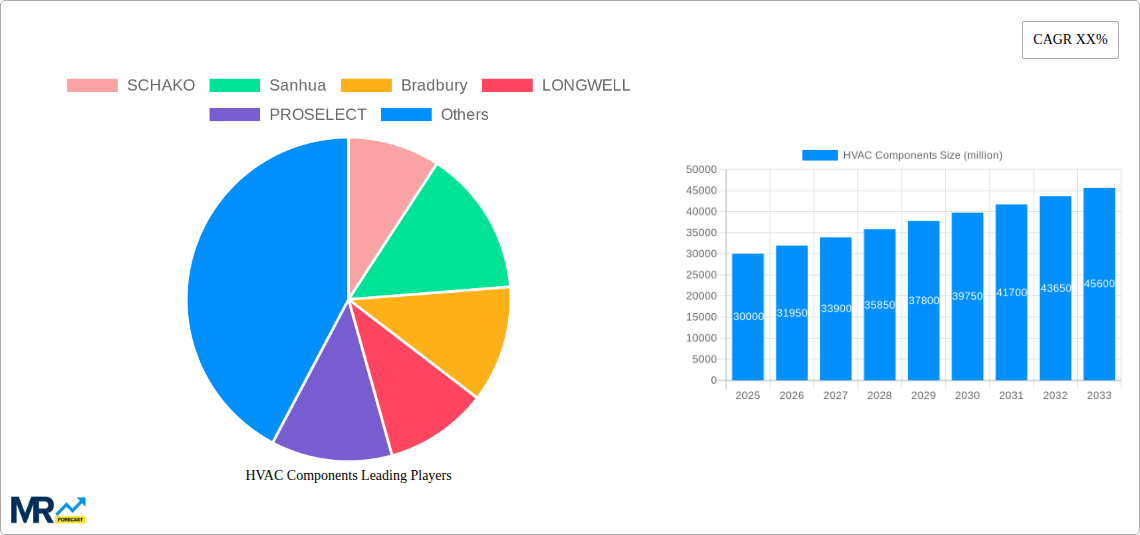

The global HVAC Components market is poised for significant expansion, projected to reach an estimated USD 30,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.5% anticipated through 2033. This impressive growth is fueled by a confluence of escalating demand for improved indoor air quality, increasing urbanization, and a heightened focus on energy efficiency across residential, commercial, and industrial sectors. The rising awareness of the health benefits associated with well-ventilated spaces, coupled with stringent government regulations promoting energy-efficient building designs, are primary growth catalysts. Furthermore, the ongoing development and adoption of smart building technologies, which integrate advanced control systems and IoT-enabled components for optimized performance and remote management, are also playing a crucial role in driving market expansion. The increasing prevalence of retrofitting older buildings with modern HVAC systems to enhance their energy performance further contributes to this positive market trajectory.

The market is segmented into key product categories, with Cooling Equipment and Fans and Air Handling Equipment expected to dominate due to their foundational role in maintaining comfortable and healthy indoor environments. Pipeline Systems and Control Systems are also experiencing substantial growth, driven by the need for efficient distribution of conditioned air and intelligent management of HVAC operations. Geographically, Asia Pacific, led by China and India, is emerging as a dynamic growth engine, characterized by rapid industrialization, burgeoning construction activities, and a growing middle-class population with increased disposable income for enhanced living standards. North America and Europe, while mature markets, continue to exhibit steady growth, propelled by technological advancements, a strong emphasis on sustainability, and replacement demands for aging infrastructure. Key players such as SCHAKO, Sanhua, and LONGWELL are at the forefront, investing in innovation and strategic partnerships to capture market share in this evolving landscape.

This comprehensive report delves into the intricate world of HVAC Components, offering an in-depth analysis of market dynamics, trends, and future projections. Spanning a study period from 2019 to 2033, with a base year of 2025 and a detailed forecast period of 2025-2033, this report leverages historical data from 2019-2024 to provide a robust understanding of the market's evolution. We will explore the global HVAC Components market, estimated to reach \$XX million by 2025, with projections indicating significant growth in the coming years.

The HVAC Components market is experiencing a profound transformation driven by a confluence of technological advancements, evolving regulatory landscapes, and shifting consumer preferences. XXX, a key insight from our analysis, highlights the increasing integration of smart technologies within HVAC systems. This trend is not merely about connected thermostats; it encompasses intelligent sensors, predictive maintenance capabilities, and sophisticated control algorithms that optimize energy efficiency and occupant comfort. The demand for components that support these smart functionalities, such as advanced microcontrollers, wireless communication modules, and sophisticated actuators, is on an upward trajectory. Furthermore, the emphasis on sustainability and energy conservation is a dominant force. This translates into a growing demand for high-efficiency components, including advanced heat exchangers, variable speed drives for motors, and low-GWP (Global Warming Potential) refrigerants. Manufacturers are heavily investing in research and development to produce components that minimize environmental impact without compromising performance. The market is also witnessing a surge in demand for customized and modular HVAC solutions, particularly in commercial and industrial applications. This allows for greater flexibility in system design and installation, catering to specific building requirements and operational needs. The rise of modular air handling units, customizable ductwork, and adaptable control systems underscores this trend. Moreover, the shift towards electrification in the broader energy sector is also influencing HVAC components, with an increasing focus on electric heating and cooling solutions, driving innovation in components like heat pumps and electric compressors. The growing awareness of indoor air quality (IAQ) is another significant trend, leading to increased demand for components that enhance filtration, ventilation, and humidity control. This includes advanced filters, energy recovery ventilators (ERVs), and smart humidifiers/dehumidifiers. The market is also seeing a steady demand for durable and reliable components across all segments, driven by the need for longevity and reduced maintenance costs in critical infrastructure.

Several powerful forces are propelling the HVAC Components market forward, creating a dynamic and expanding landscape. The relentless pursuit of energy efficiency stands as a primary driver. With escalating energy costs and growing environmental concerns, governments and consumers alike are demanding HVAC systems that consume less power. This translates directly into a higher demand for components that enable greater efficiency, such as advanced compressors, variable speed drives, high-performance heat exchangers, and intelligent control systems that optimize energy usage based on real-time conditions. Regulatory mandates and government incentives aimed at reducing carbon emissions and promoting energy conservation further bolster this trend. Building codes are becoming stricter, requiring new installations and retrofits to meet higher efficiency standards, thereby driving the adoption of advanced components. The burgeoning global construction industry, particularly in emerging economies, is another significant catalyst. The expansion of residential, commercial, and industrial infrastructure necessitates the installation of new HVAC systems, directly fueling the demand for a wide range of components. As urbanization continues to accelerate, the need for comfortable and healthy indoor environments in densely populated areas intensifies, creating a sustained demand for HVAC solutions. Furthermore, the increasing awareness of indoor air quality (IAQ) is becoming a critical factor. Concerns about allergies, respiratory illnesses, and the overall well-being of occupants are driving the demand for HVAC components that enhance air filtration, ventilation, and purification. This includes advanced filters, energy recovery ventilators, and advanced humidification/dehumidification systems. The ongoing technological advancements, particularly in digitization and smart technologies, are also playing a pivotal role. The integration of IoT capabilities, advanced sensors, and intelligent control systems allows for more efficient operation, predictive maintenance, and enhanced user experience, creating a demand for innovative and connected HVAC components.

Despite the robust growth trajectory, the HVAC Components market is not without its hurdles. One of the most significant challenges is the increasing cost of raw materials. Fluctuations in the prices of metals like copper, aluminum, and steel, as well as rare earth elements used in some advanced components, can impact manufacturing costs and, consequently, the final price of components. This volatility can make it difficult for manufacturers to maintain stable pricing and profit margins, potentially impacting investment in research and development. Another considerable restraint is the complexity of supply chains. The global nature of HVAC component manufacturing means that disruptions in one part of the world, whether due to geopolitical events, natural disasters, or trade disputes, can have ripple effects across the entire industry. This can lead to production delays, shortages, and increased lead times, frustrating both manufacturers and end-users. The stringent and evolving regulatory landscape, while driving innovation, can also pose a challenge. Keeping abreast of and complying with diverse and often country-specific regulations regarding refrigerants, energy efficiency, and safety standards requires significant investment in testing, certification, and product redesign. The skilled labor shortage in manufacturing and installation is another pervasive issue. The specialized knowledge required to design, manufacture, and install complex HVAC systems and their components is becoming increasingly scarce, hindering production capacity and impacting the quality of installations. Furthermore, the competitive nature of the market, with numerous players vying for market share, can lead to price wars and reduced profitability, particularly for smaller manufacturers. Finally, the ongoing need for significant capital investment in advanced manufacturing technologies and research and development to stay competitive can be a barrier for some companies, especially those with limited financial resources.

The HVAC Components market is characterized by a dynamic interplay of regional strengths and segment dominance. North America, particularly the United States, is poised to maintain a significant market share due to its established infrastructure, high disposable incomes, and a strong emphasis on energy efficiency and technological adoption. The robust commercial construction sector, coupled with stringent building codes mandating high-performance HVAC systems, fuels the demand for advanced Cooling Equipment and Control Systems. The residential segment in North America is also a major contributor, driven by the constant need for comfort and the increasing trend of smart home integration, which necessitates sophisticated control components.

In terms of segments, Cooling Equipment is expected to continue its reign as a dominant force. This includes a wide array of products such as air conditioners, chillers, and heat pumps. The increasing global temperatures, coupled with rising urbanization and the need for comfortable indoor environments in both residential and commercial spaces, are the primary drivers for this segment's dominance. The market is witnessing a significant shift towards more energy-efficient cooling solutions, including inverter-based systems and those utilizing environmentally friendly refrigerants, which directly boosts demand for advanced cooling components.

Another segment demonstrating substantial growth and holding a significant market position is Fans and Air Handling Equipment. This segment encompasses components like fans, blowers, air filters, and air handling units (AHUs). The growing awareness of indoor air quality (IAQ) is a critical factor driving demand in this segment. As people spend more time indoors and concerns about pollutants, allergens, and pathogens rise, the need for efficient ventilation and air purification systems becomes paramount. This translates into a higher demand for high-efficiency fans, advanced filtration media, and integrated AHUs that can manage airflow, temperature, and humidity effectively. The commercial sector, in particular, with its stringent IAQ requirements for offices, hospitals, and educational institutions, is a major consumer of these components.

Control Systems are also emerging as a dominant segment, driven by the proliferation of smart technologies and the Internet of Things (IoT). This segment includes thermostats, sensors, actuators, and building management systems (BMS). The demand for integrated and automated HVAC solutions that offer enhanced energy management, remote monitoring, and predictive maintenance capabilities is soaring. The smart home revolution and the increasing adoption of energy-efficient building management systems in commercial properties are key growth catalysts. These control systems allow for granular management of HVAC operations, leading to significant energy savings and improved comfort levels, thereby making them indispensable components in modern HVAC systems. The forecast period is expected to witness even greater integration of artificial intelligence and machine learning within these control systems, further solidifying their market dominance.

The HVAC Components industry is experiencing robust growth fueled by several key catalysts. The escalating demand for energy-efficient solutions, driven by rising energy costs and environmental regulations, is a primary growth engine. Furthermore, the expanding global construction sector, particularly in developing nations, necessitates the installation of new HVAC systems, thereby increasing the demand for components. The increasing awareness and concern for indoor air quality are also significant growth catalysts, driving innovation in filtration, ventilation, and purification components. Finally, technological advancements, including the integration of smart technologies and IoT, are creating new opportunities and driving the adoption of advanced, connected components.

This report provides a truly comprehensive overview of the HVAC Components market. Beyond the quantitative analysis of market size and growth projections, it delves into the qualitative aspects that shape the industry's future. The report offers granular insights into the competitive landscape, including detailed company profiles, strategic initiatives, and product portfolios of key players like SCHAKO, Sanhua, Bradbury, and others. It meticulously examines the influence of regulatory frameworks and sustainability trends on component development and market adoption. Furthermore, the report sheds light on emerging technologies and their potential to disrupt the market. The detailed segmentation by component type, application, and region ensures that stakeholders can identify specific opportunities and tailor their strategies accordingly. The extensive historical data and robust forecasting methodologies provide a reliable roadmap for businesses seeking to navigate and capitalize on the evolving HVAC Components market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include SCHAKO, Sanhua, Bradbury, LONGWELL, PROSELECT, Hart & Cooley, Accord Ventilation Products, T.A. Industries, Grille Tech, Air Master Equipments Emirates, Advanced Architectural Grilleworks, Truaire, Red Dot Corporation, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "HVAC Components," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the HVAC Components, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.