1. What is the projected Compound Annual Growth Rate (CAGR) of the Human Plasma Fractionation Product?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Human Plasma Fractionation Product

Human Plasma Fractionation ProductHuman Plasma Fractionation Product by Type (/> Immune Globulin, Coagulation Factor, Albumin, Other), by Application (/> Hospital, Retail Pharmacy, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

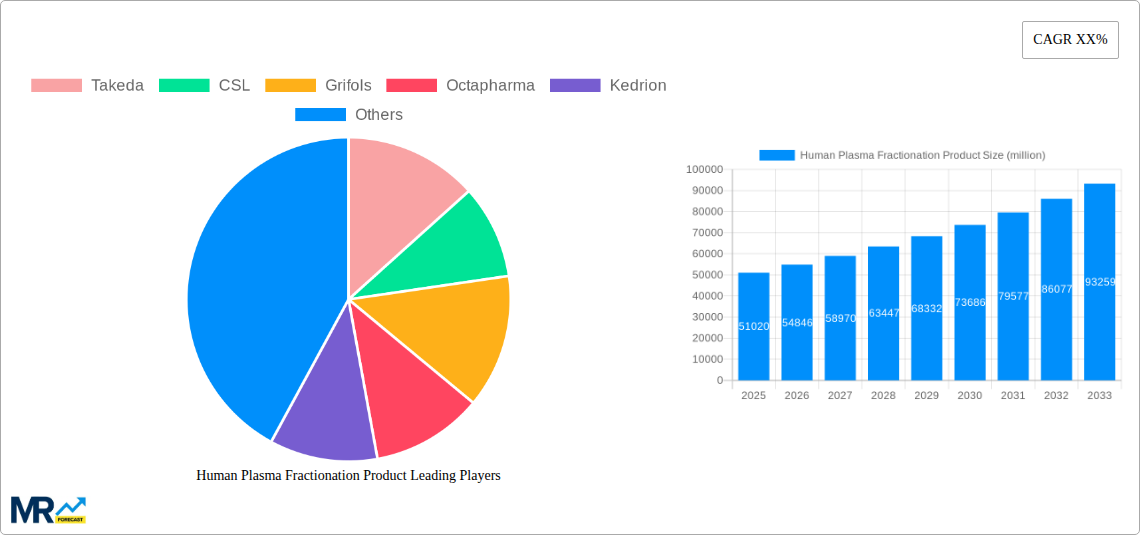

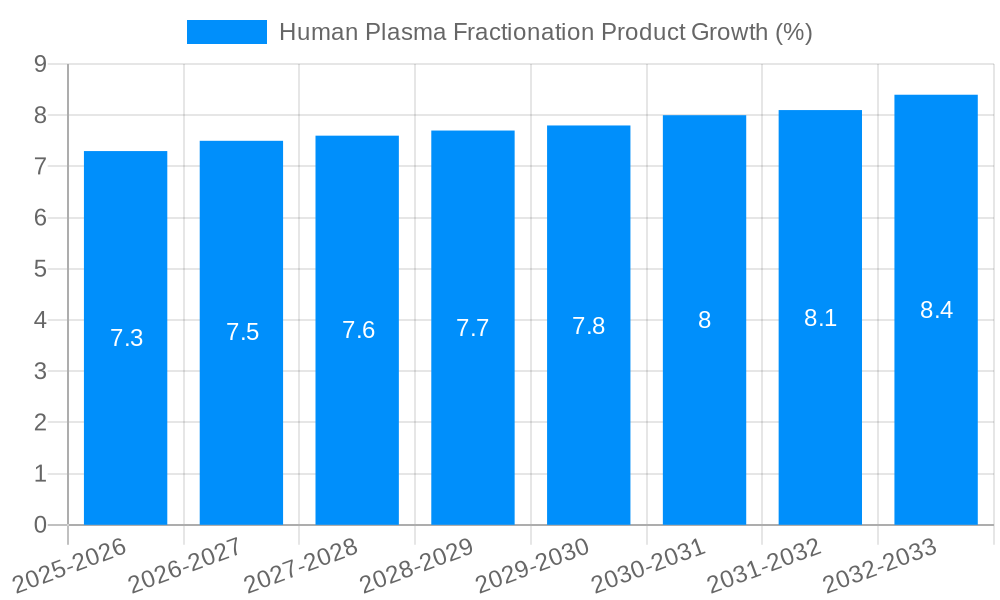

The global Human Plasma Fractionation Product market is projected to reach a substantial valuation of USD 51,020 million, demonstrating robust growth driven by an estimated Compound Annual Growth Rate (CAGR) of 7.5%. This significant expansion is underpinned by several critical factors, including the increasing prevalence of rare and chronic diseases requiring plasma-derived therapies, advancements in fractionation technologies leading to improved product purity and efficacy, and a growing awareness among healthcare professionals and patients regarding the therapeutic benefits of these products. The rising demand for immunoglobulin therapies to treat immune deficiencies, neurological disorders, and autoimmune conditions, alongside the continuous need for coagulation factors to manage hemophilia and other bleeding disorders, are key volume drivers. Furthermore, the expanding application of albumin in critical care settings for volume resuscitation and in surgical procedures further bolsters market demand. The market is characterized by a dynamic competitive landscape with major players like Takeda, CSL, and Grifols investing heavily in research and development to introduce novel therapeutics and expand manufacturing capacities to meet escalating global needs.

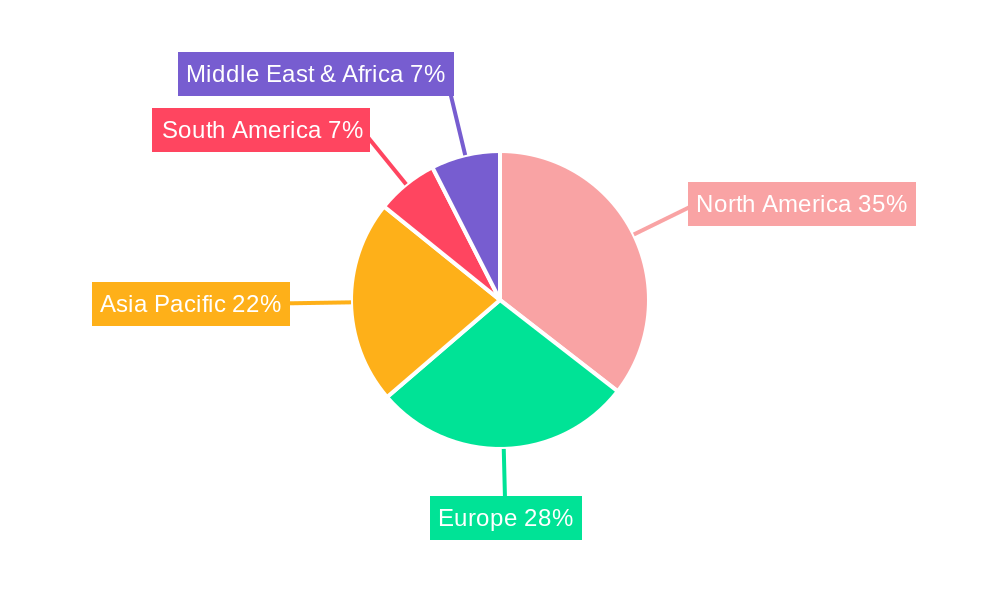

The market segmentation reveals a diverse application base, with hospitals being the primary consumers due to the critical nature of plasma-derived therapies. Retail pharmacies are also gaining traction as an important distribution channel, particularly for at-home treatment options for chronic conditions. Geographically, North America and Europe currently lead the market, attributed to well-established healthcare infrastructures, high healthcare expenditure, and early adoption of advanced medical treatments. However, the Asia Pacific region is poised for significant growth, fueled by a large and growing patient pool, increasing healthcare accessibility, and rising disposable incomes, leading to greater demand for these life-saving therapies. While the market is experiencing a strong upward trajectory, potential restraints include the stringent regulatory pathways for product approval, the high cost associated with plasma collection and fractionation, and the inherent risks associated with viral contamination, although advancements in safety protocols are continuously mitigating these concerns.

The global human plasma fractionation product market is poised for significant expansion, driven by an increasing prevalence of rare and chronic diseases, a growing elderly population susceptible to various conditions, and advancements in therapeutic protein development. The market, valued at an estimated USD XXX million in the base year of 2025, is projected to witness a robust compound annual growth rate (CAGR) of X.X% throughout the forecast period of 2025-2033. This upward trajectory is underpinned by the critical role of plasma-derived therapies in treating a spectrum of debilitating conditions, from immunodeficiency disorders and hemophilia to critical care situations requiring albumin. The study period spanning from 2019 to 2033 provides a comprehensive view of the market's evolution, with historical data from 2019-2024 highlighting initial growth patterns and the base year of 2025 serving as a pivotal point for future projections. Key market insights reveal a sustained demand for immunoglobulin products, particularly in developed economies, owing to their efficacy in managing autoimmune diseases and primary immunodeficiencies. Coagulation factors are also experiencing a steady rise, fueled by improved diagnostic capabilities and increased awareness surrounding bleeding disorders. While albumin remains a cornerstone in critical care settings, its growth is relatively more stable. The "Other" category, encompassing a diverse range of plasma-derived proteins, is expected to contribute significantly to market expansion, driven by ongoing research and development into novel applications. The market’s landscape is characterized by strategic collaborations, mergers and acquisitions, and substantial investments in expanding manufacturing capacities to meet the escalating global demand. Furthermore, the increasing adoption of these life-saving therapies in emerging economies, coupled with supportive regulatory frameworks, is anticipated to further propel market growth in the coming years.

The human plasma fractionation product market is experiencing a powerful surge fueled by several interconnected driving forces. Foremost among these is the escalating global burden of chronic and rare diseases. Conditions such as primary immunodeficiencies (PIDs), autoimmune disorders like multiple sclerosis and lupus, and bleeding disorders such as hemophilia require lifelong treatment with plasma-derived therapies. The increasing diagnosis rates of these conditions, owing to improved diagnostic tools and greater medical awareness, directly translate into a higher demand for essential plasma-derived products. Concurrently, the demographic shift towards an aging global population is a significant contributor. Elderly individuals are more prone to a variety of illnesses, including infections, cardiovascular issues, and certain types of cancer, all of which can necessitate the use of plasma-derived albumin for volume expansion and stabilization, or immunoglobulins to bolster immune function. Furthermore, remarkable advancements in the field of biotechnology and pharmaceuticals are continuously unlocking new therapeutic applications for plasma proteins. Research into novel fractionation techniques and the identification of previously untapped therapeutic potentials of various plasma components are expanding the market's scope. The development of more targeted and effective treatments, coupled with a better understanding of disease mechanisms, allows for the tailored use of specific plasma fractions, thereby enhancing patient outcomes and driving market growth.

Despite the robust growth trajectory, the human plasma fractionation product market encounters significant challenges and restraints that can temper its expansion. A primary concern revolves around the supply chain volatility of human plasma. Plasma collection is a voluntary and geographically concentrated process, making it susceptible to fluctuations caused by various factors. These can include seasonal variations in donations, public health crises (as witnessed during the COVID-19 pandemic), regulatory hurdles in certain regions regarding plasma sourcing, and societal attitudes towards blood and plasma donation. The ethical considerations surrounding plasma donation and the potential for exploitation can also influence collection volumes. Another substantial restraint is the high cost associated with plasma-derived therapies. The intricate and expensive manufacturing process, coupled with stringent quality control measures, results in therapies that are often beyond the financial reach of a significant portion of the global population, particularly in low and middle-income countries. This cost barrier significantly limits market penetration in these regions. Furthermore, stringent regulatory approvals are a necessary but time-consuming and resource-intensive aspect of the industry. Obtaining regulatory clearance for new plasma-derived products or expanded indications for existing ones can be a lengthy process, delaying market entry and revenue generation. Finally, the emergence of biosimil and recombinant alternatives for certain plasma-derived proteins, while offering cost benefits, can also pose a competitive threat to traditional fractionation products, forcing established players to innovate and differentiate their offerings.

The human plasma fractionation product market is poised for dominance by North America, particularly the United States, due to a confluence of factors related to healthcare infrastructure, patient population, and research and development capabilities. This region has consistently demonstrated the highest consumption of plasma-derived therapies, driven by its advanced healthcare system, high disposable incomes, and a well-established network of specialized treatment centers. The prevalence of chronic and rare diseases, coupled with a robust reimbursement framework for high-cost therapies, further solidifies North America's leading position. Within this dominant region, North America is projected to continue its stronghold, with the United States spearheading the market.

In terms of segments, the Immune Globulin (IVIG) segment is anticipated to remain the largest and most influential contributor to market growth.

The Hospital application segment is also expected to maintain its leading position.

The human plasma fractionation product industry is propelled by several potent growth catalysts. Key among these is the continuous expansion of therapeutic applications for plasma-derived proteins, driven by ongoing research and clinical trials demonstrating efficacy in novel disease areas. The increasing global prevalence of rare diseases, coupled with improved diagnostic capabilities, translates into a larger patient pool requiring these specialized therapies. Furthermore, advancements in plasma collection and fractionation technologies are leading to higher yields, improved purity, and the development of more stable and effective product formulations, enhancing patient compliance and treatment outcomes. The growing investments in manufacturing capacity by leading players, alongside strategic collaborations and acquisitions, are also critical in meeting the escalating global demand.

This comprehensive report on the Human Plasma Fractionation Product market offers an in-depth analysis of market dynamics, trends, and future projections. It delves into the intricate details of market segmentation by product type (Immune Globulin, Coagulation Factor, Albumin, Other) and application (Hospital, Retail Pharmacy, Other). The report provides a detailed examination of the historical period (2019-2024), base year (2025), and forecast period (2025-2033), utilizing a study period from 2019-2033 to ensure a holistic view. Key market insights, driving forces, challenges, and growth catalysts are meticulously explained, offering a clear understanding of the market's landscape. Furthermore, the report highlights dominant regions and segments, identifies leading players, and chronicles significant industry developments, providing invaluable strategic intelligence for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Takeda, CSL, Grifols, Octapharma, Kedrion, LFB Group, Biotest, BPL, RAAS, CBPO, Hualan Bio, Tiantan Bio, Shuanglin Bio, Boya Bio, Yuanda Shuyang, Weiguang Bio, Nanyue Bio, KM Biologics, .

The market segments include Type, Application.

The market size is estimated to be USD 51020 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Human Plasma Fractionation Product," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Human Plasma Fractionation Product, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.