1. What is the projected Compound Annual Growth Rate (CAGR) of the Household COVID-19 Testing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Household COVID-19 Testing

Household COVID-19 TestingHousehold COVID-19 Testing by Type (/> Testing Product, Software), by Application (/> Hospital, Clinic, Household, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

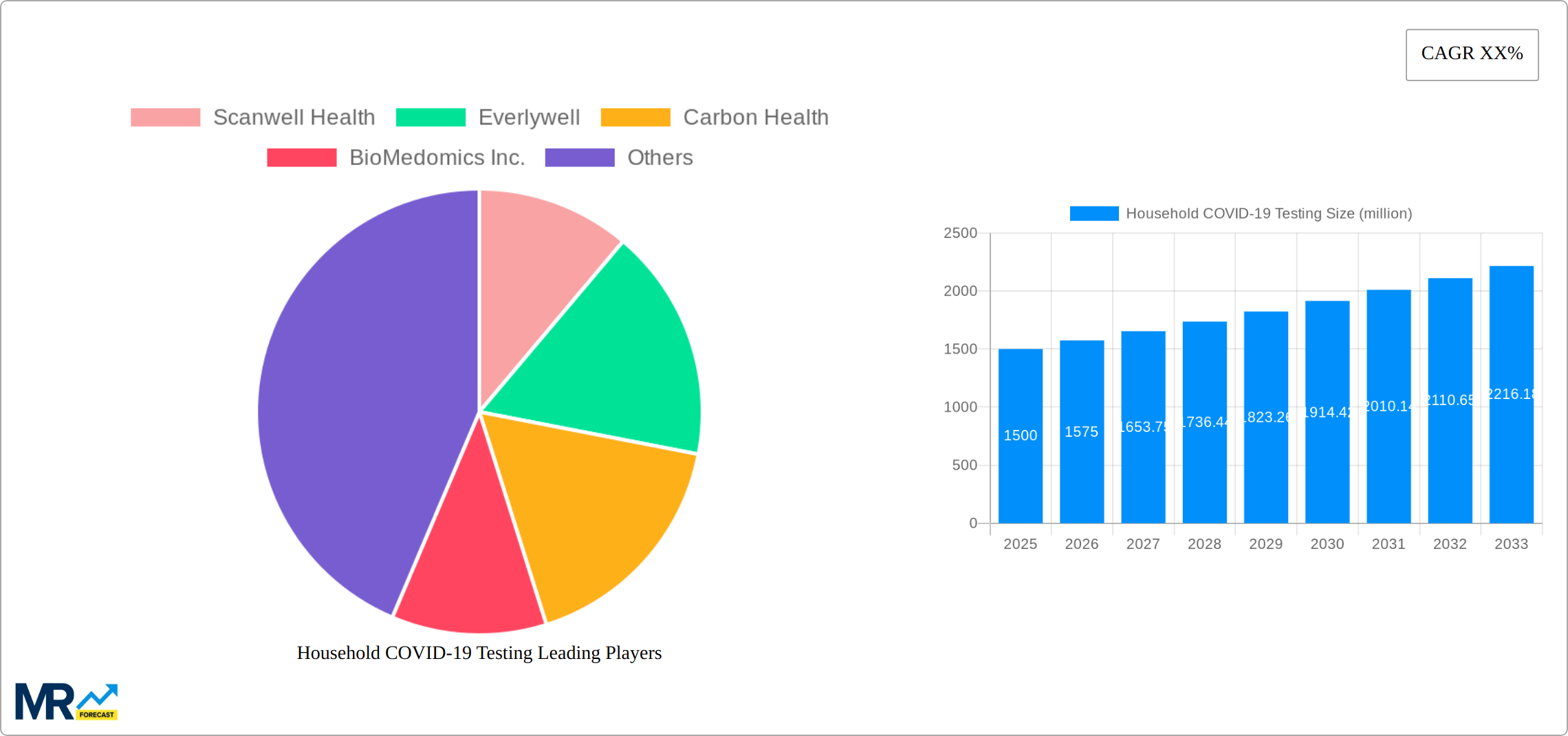

The global household COVID-19 testing market experienced significant growth during the pandemic, driven by increased awareness of the virus, readily available at-home testing kits, and government initiatives promoting widespread testing. While the initial surge has subsided, the market remains substantial, with a projected continued expansion throughout the forecast period (2025-2033). Factors like the ongoing threat of new variants, increased accessibility of testing, and the development of more convenient and accurate at-home tests contribute to this sustained growth. The market is segmented by test type (antigen, PCR, etc.), distribution channel (online, retail pharmacies, etc.), and geography. Key players in the market, such as Scanwell Health, Everlywell, Carbon Health, and BioMedomics Inc., are continually innovating to meet evolving consumer demands and improve test accuracy and user-friendliness. Competition is fierce, with companies vying for market share through strategic partnerships, technological advancements, and targeted marketing campaigns. The market's future trajectory will be shaped by factors like government regulations, public health policies, and the emergence of new infectious diseases.

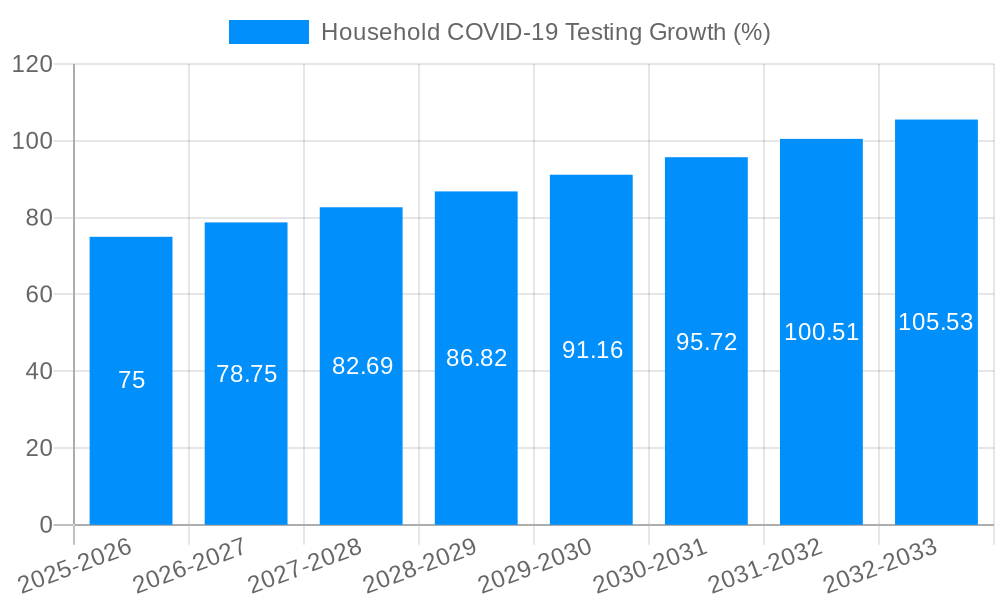

Despite the decline from pandemic peak levels, the household COVID-19 testing market retains significant value and is projected to maintain a steady Compound Annual Growth Rate (CAGR) of approximately 5% from 2025 to 2033. This relatively modest CAGR reflects a transition from the emergency phase of the pandemic to a more sustainable, albeit still important, market for at-home testing. Ongoing demand for rapid and convenient testing options, especially for individuals with underlying health conditions or those exposed to COVID-19, will support market growth. Furthermore, the potential for future pandemics or recurring outbreaks underscores the long-term relevance of this market. However, price competition and the availability of free or subsidized testing in certain regions will pose challenges to market growth. Growth will also be influenced by advancements in testing technology and the emergence of multi-pathogen tests capable of detecting various respiratory illnesses simultaneously.

The global household COVID-19 testing market experienced explosive growth during the 2019-2024 historical period, driven primarily by the unprecedented COVID-19 pandemic. Millions of units were sold as individuals and families sought convenient and accessible testing options. While the initial surge in demand has subsided somewhat post-peak pandemic, the market continues to demonstrate significant resilience, with an estimated value of several million units in 2025. This sustained demand reflects a shifting paradigm in healthcare, with individuals taking a more proactive role in managing their health and well-being. The market is now characterized by a transition from emergency-driven demand to a more normalized, albeit still substantial, level of testing for various reasons, including ongoing concerns about new variants, the convenience of at-home testing, and the integration of COVID-19 testing into broader health monitoring routines. Future projections (2025-2033) indicate continued, though more moderate, growth, with the market anticipated to reach multi-million unit sales by 2033. This sustained growth will be fueled by factors such as increased awareness of the importance of early detection, the development of more accurate and user-friendly tests, and the growing adoption of telehealth solutions that integrate at-home testing. The market's evolution is also shaping the landscape for innovative test formats, including rapid antigen tests and PCR tests, each catering to different needs and preferences. The increasing integration of digital health technologies, allowing for seamless results reporting and remote consultation, will further contribute to market expansion. Overall, despite the fluctuating nature of infectious disease outbreaks, the household COVID-19 testing market has firmly established itself as a vital segment within the broader healthcare industry, with a promising trajectory for long-term growth.

Several key factors have propelled the significant growth in the household COVID-19 testing market. The initial and most prominent driver was the COVID-19 pandemic itself, creating an urgent need for rapid and widespread testing capabilities. This necessity spurred innovation and investment in at-home testing solutions, significantly expanding market accessibility. Beyond the pandemic's immediate impact, the convenience and ease of use offered by at-home tests are proving to be crucial sustained drivers. Individuals appreciate the avoidance of potential exposure in clinical settings, reduced wait times for results, and the overall convenience of testing from the comfort of their own homes. The increasing integration of telehealth platforms further enhances this convenience, providing immediate access to medical professionals for interpretation of results and guidance. Moreover, the rising awareness of personal health management and proactive disease prevention among consumers is contributing to the continued demand for at-home testing. Individuals are becoming more empowered to take charge of their health, and at-home testing empowers this shift. Finally, regulatory support and government initiatives aimed at promoting widespread testing have also played a significant role, both during the peak of the pandemic and in maintaining a sufficient level of access to testing afterward. This combination of factors suggests that the demand for household COVID-19 testing will remain substantial for the foreseeable future.

Despite the substantial growth and potential of the household COVID-19 testing market, several challenges and restraints persist. Accuracy and reliability remain paramount concerns. While rapid antigen tests offer convenience, their sensitivity and specificity may be lower compared to laboratory-based PCR tests, potentially leading to false-positive or false-negative results. This necessitates clear and consistent communication regarding test limitations to users and appropriate follow-up procedures. The potential for improper test administration and interpretation also poses a challenge. User errors in following instructions can impact the accuracy of results, highlighting the need for clear, concise, and multi-lingual instructions. Ensuring proper disposal of used test kits to prevent environmental contamination is another area requiring attention and public awareness campaigns. Furthermore, variations in pricing and reimbursement policies across different regions and healthcare systems can create accessibility issues for certain populations, affecting market penetration. Lastly, the evolving nature of the virus and the emergence of new variants necessitate continuous innovation and adaptation in test design to maintain effectiveness and accuracy. Addressing these challenges will be key to ensuring the long-term sustainability and responsible growth of the household COVID-19 testing market.

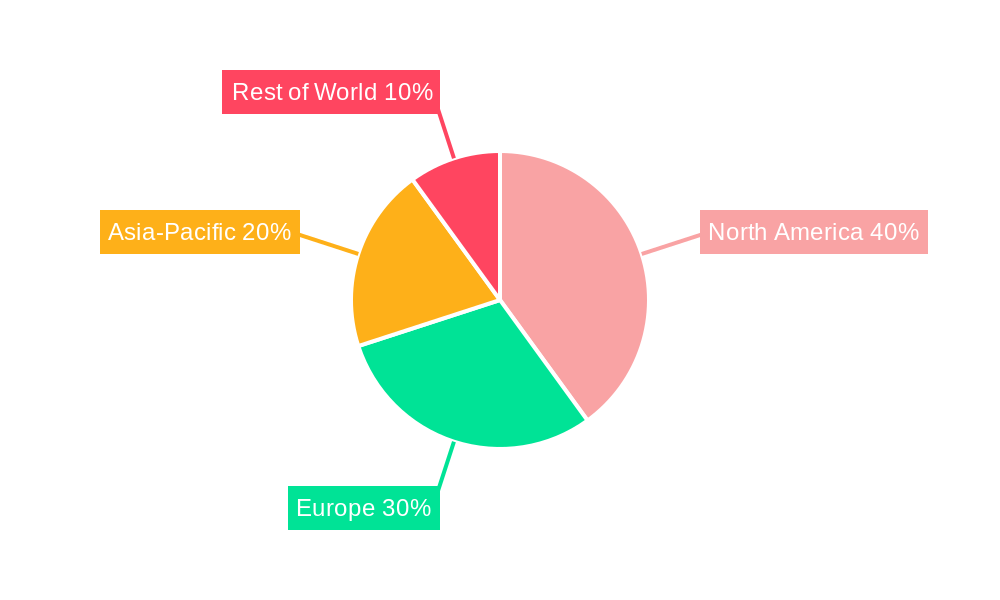

North America (USA and Canada): North America is anticipated to hold a significant market share due to high healthcare expenditure, early adoption of innovative technologies, and strong regulatory support for at-home testing. The high level of awareness about COVID-19 and proactive health management within this region contributes significantly to market demand. The well-established healthcare infrastructure and the presence of major players in at-home testing further fuels this dominance.

Europe (Germany, UK, France): Europe’s established healthcare systems and considerable focus on disease prevention create substantial demand for household COVID-19 testing. Though potentially slightly behind North America in terms of market size, Europe is projected to experience robust growth driven by increasing acceptance of at-home healthcare solutions and government initiatives encouraging widespread testing.

Asia Pacific (China, Japan, India): The Asia Pacific region exhibits high growth potential due to its large population and rising disposable incomes. However, market penetration may be influenced by factors such as variations in healthcare infrastructure across different nations and differences in awareness about at-home testing. However, the burgeoning middle class and increasing digital health adoption are expected to drive substantial market expansion in the coming years.

Rapid Antigen Tests: This segment is likely to dominate due to its convenience, speed, and relatively lower cost compared to PCR tests. The ease of use and quick results appeal to a broad user base, driving high volume sales. However, limitations in accuracy compared to PCR tests need to be addressed through transparent communication and improved test design.

PCR Tests (At-home): While potentially more expensive, the higher accuracy of PCR tests will maintain a significant segment of the market. The demand for more accurate testing in specific situations, like confirmation of infection or for those with higher risk factors, sustains demand for this more precise, though less convenient, option.

The market dominance of these key regions and segments is a dynamic interplay of socio-economic factors, regulatory environments, technological advancements, and consumer behavior. Ongoing monitoring of these factors is critical for accurate market forecasting and business strategy development.

The ongoing evolution of the COVID-19 virus, with the emergence of new variants, continually reinforces the need for readily accessible testing options. The integration of telehealth platforms and digital health technologies simplifies the testing process, making results readily available and connecting users with healthcare professionals for guidance. Furthermore, the increasing consumer preference for convenient and proactive health management solutions significantly contributes to the industry's growth trajectory.

This report provides a comprehensive overview of the household COVID-19 testing market, analyzing past trends, current market dynamics, and future projections. It offers in-depth insights into driving forces, challenges, key players, and significant developments shaping the industry. The report also provides regional and segment-specific analysis, highlighting key opportunities and potential risks for stakeholders. This detailed analysis equips businesses and investors with the necessary information to make informed decisions within this dynamic and evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Scanwell Health, Everlywell, Carbon Health, BioMedomics Inc..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Household COVID-19 Testing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Household COVID-19 Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.