1. What is the projected Compound Annual Growth Rate (CAGR) of the Hot Food Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Hot Food Packaging

Hot Food PackagingHot Food Packaging by Type (Flexible Packaging, Rigid Packaging, World Hot Food Packaging Production ), by Application (Take Away, Restaurants, Institutional Catering, Others, World Hot Food Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

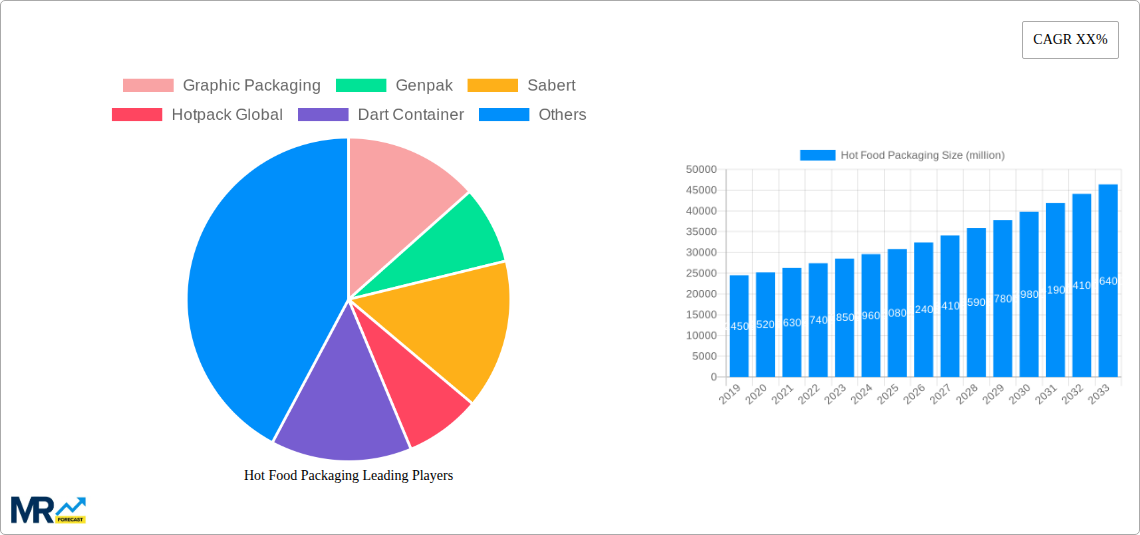

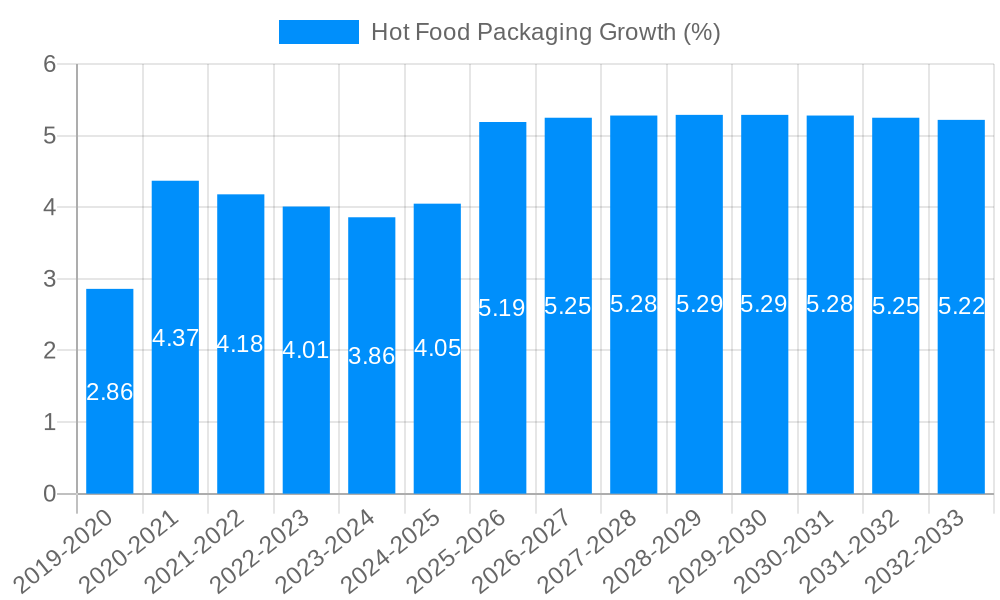

The global hot food packaging market is poised for significant expansion, driven by evolving consumer lifestyles and the burgeoning food service industry. With an estimated market size of approximately $28,000 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of around 5.5% through 2033, the industry is expected to reach over $43,000 million by the end of the forecast period. This robust growth is primarily fueled by the increasing demand for convenient and ready-to-eat meals, the exponential rise of the takeaway and food delivery sector, and the expansion of institutional catering services in corporate environments and educational institutions. Consumers are increasingly seeking packaging solutions that not only preserve food quality and temperature but also offer convenience, sustainability, and aesthetic appeal. The ongoing shift towards digitalization in food ordering and delivery further propels the need for reliable and efficient hot food packaging.

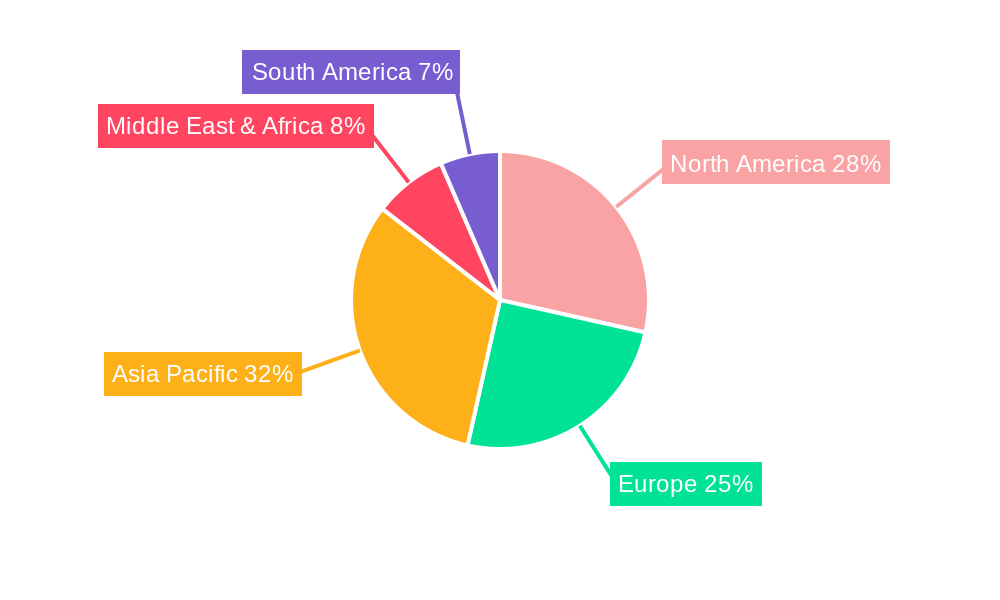

Key trends shaping the market include a strong emphasis on sustainable and eco-friendly packaging materials, such as compostable and recyclable options, as regulatory pressures and consumer awareness concerning environmental impact grow. Innovations in material science are leading to the development of advanced packaging that offers superior insulation, leak resistance, and microwave-safe properties. The market is segmented into flexible and rigid packaging, with rigid packaging currently holding a dominant share due to its structural integrity and premium perception, particularly for applications like take away and restaurant dining. However, flexible packaging is witnessing accelerated growth due to its cost-effectiveness and versatility. Geographically, Asia Pacific, led by China and India, is emerging as a dynamic growth hub, driven by rapid urbanization, a growing middle class, and increased disposable income, alongside North America and Europe which continue to be substantial markets.

This report delves into the dynamic global hot food packaging market, offering a granular analysis from the historical period of 2019-2024 to a forward-looking forecast extending to 2033, with 2025 serving as both the base and estimated year. The study encompasses production volumes in millions of units, providing a quantitative framework for understanding market evolution. We will examine the intricate interplay of product types, dominant applications, significant industry developments, and the strategic positioning of key market players.

The global hot food packaging market is undergoing a profound transformation driven by evolving consumer preferences, technological advancements, and an increasing emphasis on sustainability. XXX The past few years, from 2019 to 2024, have witnessed a significant surge in demand for convenient and on-the-go food options. This trend is largely attributed to the accelerated adoption of food delivery services and the continued growth of the quick-service restaurant (QSR) sector. Consumers are increasingly seeking packaging solutions that maintain food temperature and integrity during transit, while also offering ease of use and minimal mess. Consequently, there's a pronounced shift towards materials that offer superior insulation properties and robust construction.

Looking ahead, the forecast period from 2025 to 2033 will be characterized by an even greater focus on eco-friendly and compostable packaging alternatives. XXX The rising global awareness of plastic waste and its environmental impact is compelling manufacturers and consumers alike to explore sustainable options. This includes a greater adoption of biodegradable plastics, paper-based solutions, and innovative compostable materials. Furthermore, smart packaging solutions, incorporating features like temperature indicators and tamper-evident seals, are expected to gain traction as they enhance consumer experience and food safety. The rise of minimalist and aesthetically pleasing designs is also a notable trend, as brands leverage packaging to enhance their visual appeal and communicate their sustainability credentials. The integration of novel functionalities, such as microwave-safe properties and leak-proof designs, will continue to be a key area of innovation, catering to the diverse needs of consumers and food service providers. The market is also seeing a diversification in packaging formats, moving beyond traditional containers to embrace multi-compartment solutions that allow for the segregation of different food items, thereby preserving texture and flavor. This multi-faceted evolution is shaping a more responsible, convenient, and consumer-centric hot food packaging landscape.

Several potent forces are collaboratively propelling the growth of the global hot food packaging market. Foremost among these is the burgeoning food delivery and takeaway sector, which has experienced exponential growth, particularly in recent years. The convenience offered by these services, coupled with evolving urban lifestyles, has made ready-to-eat meals a staple for a significant portion of the population. This directly translates to a heightened demand for packaging that can effectively preserve the temperature, texture, and taste of hot food during transit. Another crucial driver is the expansion of the quick-service restaurant (QSR) industry globally. QSRs, inherently reliant on efficient and attractive packaging for their high volume of sales, are consistently seeking innovative solutions that enhance brand perception and customer satisfaction. Furthermore, the increasing disposable income in developing economies is contributing to a greater propensity for consumers to dine out or opt for convenient meal solutions, thereby boosting the demand for hot food packaging. The growing emphasis on food safety and hygiene standards also plays a pivotal role, pushing for packaging that offers superior protection against contamination and spoilage, thereby increasing the need for robust and reliable packaging solutions.

Despite the robust growth trajectory, the hot food packaging market is not without its hurdles. One of the most significant challenges is the increasing stringency of environmental regulations and consumer pressure to reduce single-use plastics. This is forcing manufacturers to invest heavily in research and development for sustainable alternatives, which can often be more expensive than traditional materials, impacting profit margins. The fluctuating costs of raw materials, such as paper pulp and petroleum-based plastics, can also create price volatility and unpredictability in the market, making it difficult for businesses to plan effectively. Furthermore, the logistical complexities and costs associated with implementing new, eco-friendly packaging solutions, including the need for new machinery and disposal infrastructure, can act as a significant restraint, especially for smaller businesses. The performance limitations of some biodegradable or compostable materials, such as their susceptibility to heat and moisture, can also pose challenges in maintaining food quality for hot food applications. Consumer education regarding the proper disposal of different types of packaging, particularly compostable materials, is also an ongoing challenge that needs to be addressed to ensure the effectiveness of these sustainable initiatives.

The global hot food packaging market is poised for significant dominance by specific regions and segments, driven by a confluence of economic, demographic, and regulatory factors.

Regions/Countries Dominating the Market:

Segment Dominating the Market:

The synergy between these dominant regions and the "Take Away" application segment creates a powerful engine for market expansion. North America's established infrastructure and consumer habits, coupled with the explosive growth potential in the Asia Pacific, especially driven by the insatiable demand for convenient "Take Away" options, will shape the future landscape of the hot food packaging industry. European markets, while driven by sustainability, also contribute significantly to the overall demand for effective "Take Away" solutions. The continuous evolution of this segment, influenced by technological advancements in delivery and consumer preferences for speed and quality, will ensure its sustained dominance in the coming years.

The hot food packaging industry is experiencing robust growth fueled by several key catalysts. The escalating demand for convenience, driven by busy lifestyles and the booming food delivery and takeaway sector, is a primary growth engine. Consumers' increasing preference for on-the-go meals and the expansion of quick-service restaurants (QSRs) directly translate to higher packaging consumption. Furthermore, rising disposable incomes, particularly in emerging economies, are empowering more consumers to opt for readily available meal solutions, thereby boosting market penetration. The industry is also witnessing significant innovation in material science, with a growing emphasis on sustainable and eco-friendly packaging solutions, such as biodegradable and compostable options, which are gaining favor with environmentally conscious consumers and regulatory bodies.

This comprehensive report provides an in-depth analysis of the global hot food packaging market, offering invaluable insights for stakeholders. It meticulously details market size and projected growth from 2019 to 2033, with a particular focus on the base year 2025. The report explores key market trends, including the significant shift towards sustainable and eco-friendly packaging materials like biodegradable and compostable options. It identifies and elaborates on the primary growth drivers, such as the surge in food delivery services and the expansion of the quick-service restaurant industry. Crucially, the report addresses the challenges and restraints impacting market expansion, including regulatory hurdles and the volatile costs of raw materials. With a focus on market segmentation, it pinpoints the dominant regions and applications, offering strategic insights into areas of high potential. The report also profiles leading companies and highlights their contributions to market innovation and expansion through significant developments. This extensive coverage ensures that readers gain a holistic understanding of the hot food packaging landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Graphic Packaging, Genpak, Sabert, Hotpack Global, Dart Container, Georgia-Pacific, Anchor Packaging, Pactiv, D&W Fine Pack, Berry Global, Dopla, WestRock, Huhtamaki, WinCup, Linpac Packaging, Coveris, Novolex, Be Green Packaging, GRACZ, Southern Champion Tray, Amcor, Vegware, Union Packaging, Fabri-Kal, King Yuan Fu Packaging, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Hot Food Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Hot Food Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.