1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Medical Equipment?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Home Medical Equipment

Home Medical EquipmentHome Medical Equipment by Type (/> Blood Glucose Monitors, Blood Pressure Monitors, Hearing Aids, Rehabilitation Equipment, Sleep Apnea Devices, Other), by Application (/> Retail Pharmacies, Hospital Pharmacies, Online), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

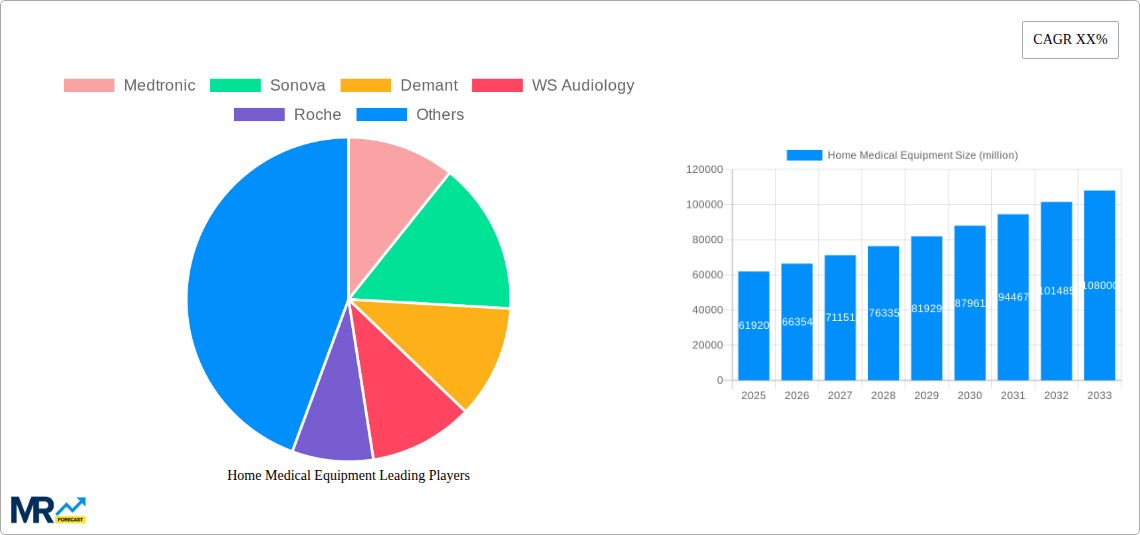

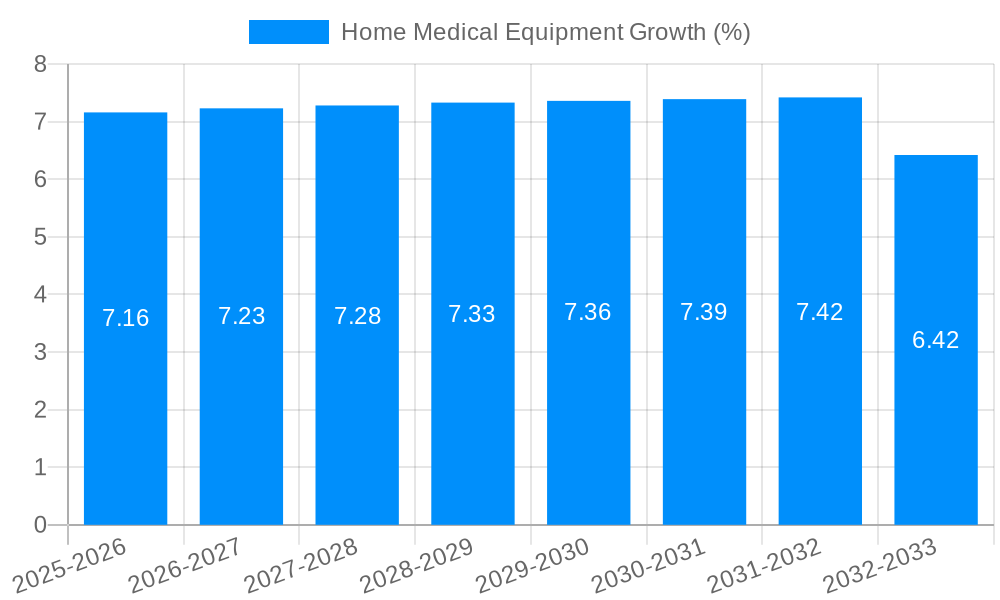

The global Home Medical Equipment (HME) market is poised for significant expansion, projected to reach an estimated market size of approximately USD 61,920 million by 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) estimated in the range of 7-9% throughout the forecast period (2025-2033). This upward trajectory is primarily driven by an aging global population, which necessitates an increased demand for chronic disease management and post-acute care solutions within home settings. Furthermore, the growing prevalence of lifestyle-related chronic conditions such as diabetes, hypertension, and sleep apnea, coupled with technological advancements leading to more user-friendly and integrated HME devices, are key enablers of this market surge. The convenience and cost-effectiveness associated with home-based care, compared to institutional settings, are also powerful catalysts.

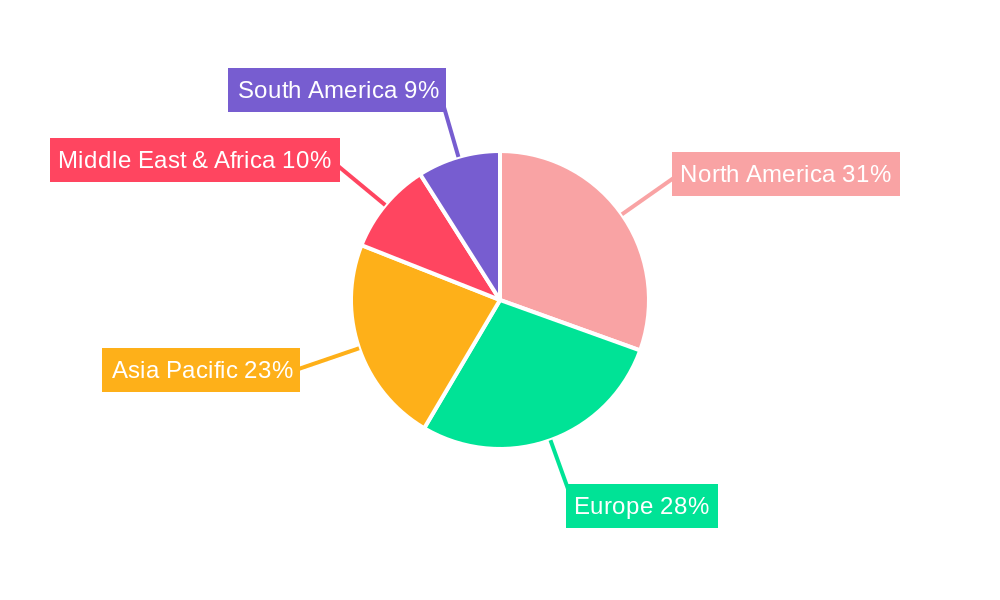

The HME market is characterized by diverse segments, with Blood Glucose Monitors, Blood Pressure Monitors, and Hearing Aids currently leading the demand due to their widespread use in managing prevalent chronic conditions. Rehabilitation Equipment and Sleep Apnea Devices are also witnessing substantial growth as awareness and adoption of home-based treatment modalities increase. Distribution channels are evolving, with a notable shift towards online sales alongside traditional retail and hospital pharmacies, reflecting changing consumer purchasing habits. Geographically, North America and Europe currently dominate the market, owing to advanced healthcare infrastructure and higher disposable incomes. However, the Asia Pacific region is anticipated to exhibit the fastest growth, driven by rising healthcare expenditure, increasing awareness, and a large, underserved patient population. Key players like Medtronic, Abbott Laboratories, Roche, and Omron are actively investing in research and development, product innovation, and strategic partnerships to capture a larger market share and address the evolving needs of patients and healthcare providers.

The home medical equipment (HME) market is undergoing a significant transformation, driven by a confluence of factors that are reshaping how healthcare is delivered and experienced. Between 2019 and 2033, the market is projected to witness robust growth, with the estimated year of 2025 highlighting a pivotal point. This period is characterized by an increasing demand for convenient, accessible, and personalized healthcare solutions, pushing the boundaries of traditional medical settings. The aging global population, coupled with a rising prevalence of chronic diseases such as diabetes, hypertension, and sleep apnea, forms the bedrock of this escalating demand. Patients are increasingly opting for managing their health from the comfort of their homes, facilitated by advancements in technology that enable continuous monitoring and remote care. XXX insights reveal a substantial shift towards technologically advanced HME devices that offer greater accuracy, ease of use, and connectivity. For instance, smart blood glucose monitors that sync with smartphones and wearable blood pressure monitors are becoming mainstream, empowering individuals with real-time health data and fostering proactive disease management. The COVID-19 pandemic further accelerated this trend, underscoring the importance of decentralized healthcare and the need for robust home-based care infrastructure. This has led to a surge in the adoption of telehealth services and the associated HME devices that support remote consultations and monitoring. Moreover, the growing awareness among consumers regarding preventative healthcare and the benefits of early detection is also contributing to market expansion. Innovations in areas like hearing aids, with their miniaturization and advanced digital processing capabilities, and sophisticated rehabilitation equipment designed for home use, are expanding the scope of the HME market. The market is also seeing a diversification of product offerings and an increasing integration of artificial intelligence and machine learning to provide predictive analytics and personalized treatment recommendations. This evolution signifies a move from basic medical supplies to sophisticated diagnostic and therapeutic tools, all designed to enhance patient outcomes and improve quality of life within the home environment.

Several powerful forces are propelling the growth of the home medical equipment market. Foremost among these is the undeniable demographic shift towards an aging global population. As individuals live longer, the incidence of age-related chronic conditions such as cardiovascular diseases, diabetes, and mobility issues naturally increases, creating a sustained demand for medical equipment that can be used in a home setting. This demographic trend is amplified by the increasing prevalence of chronic diseases across all age groups, driven by lifestyle factors and environmental influences. Furthermore, a significant driver is the growing preference for home-based healthcare. Patients and their families are increasingly recognizing the benefits of managing health conditions from the comfort and familiarity of their own homes, which often leads to better adherence to treatment plans, reduced stress, and a higher quality of life. This is further supported by advancements in medical technology that make sophisticated HME devices more accessible, user-friendly, and capable of providing continuous monitoring and data transmission. The integration of digital technologies, including the Internet of Medical Things (IoMT), wearable sensors, and telehealth platforms, is revolutionizing how HME devices function, enabling remote patient monitoring and personalized interventions. Government initiatives and healthcare policy reforms in many regions are also encouraging home-based care, recognizing its potential to reduce healthcare costs and improve patient outcomes. The push towards value-based care models, which prioritize patient well-being and cost-effectiveness, incentivizes the adoption of HME solutions that can prevent hospital readmissions and manage chronic conditions effectively.

Despite its promising growth trajectory, the home medical equipment market is not without its challenges and restraints. A primary concern revolves around the complexities of reimbursement policies. Navigating the intricate web of insurance coverage, Medicare, and Medicaid regulations can be a significant hurdle for both manufacturers and consumers, often leading to delays in device acquisition and impacting affordability. This can create a disparity in access, with individuals lacking comprehensive insurance coverage facing substantial out-of-pocket expenses. Another significant challenge is the need for robust technological infrastructure and digital literacy among patients. While HME devices are becoming more advanced, their effective use often relies on reliable internet connectivity, smartphones, and a certain level of comfort with technology. This can be a barrier for older individuals or those in underserved regions with limited access to digital resources. Furthermore, concerns regarding data privacy and security are paramount. As HME devices collect sensitive patient information, ensuring the secure transmission and storage of this data is critical to maintaining patient trust and complying with evolving privacy regulations. The lack of standardized training and support for patients and caregivers on the proper use and maintenance of complex HME devices can also lead to suboptimal outcomes and increased risk of errors. The initial cost of advanced HME devices can also be a restraining factor, especially for individuals with limited financial resources. Lastly, the fragmented nature of the HME market, with numerous manufacturers and distributors, can lead to inconsistencies in product quality, service, and availability, creating confusion for consumers and hindering market consolidation.

The global Home Medical Equipment market is poised for significant dominance by North America and Europe, with specific segments like Hearing Aids and Sleep Apnea Devices spearheading this growth.

In North America, the market is fueled by a high prevalence of chronic diseases, an aging population, and a well-established healthcare infrastructure that readily adopts technological advancements. The United States, in particular, exhibits a strong demand for HME due to its advanced healthcare reimbursement systems that often cover a wide range of home-based medical devices. The growing awareness among consumers about managing chronic conditions at home, coupled with the increasing adoption of telehealth and remote patient monitoring, further solidifies North America's leading position. Countries like Canada also contribute significantly with similar demographic trends and a proactive approach towards healthcare innovation.

Europe mirrors many of these trends, with an aging demographic and a high burden of chronic illnesses across nations like Germany, the UK, France, and Italy. The robust social healthcare systems in many European countries often facilitate access to HME devices, making them more affordable for a larger segment of the population. Furthermore, European governments are increasingly investing in digital health initiatives and home-care solutions to manage healthcare costs and improve patient outcomes, which directly benefits the HME market. The strong presence of leading HME manufacturers within Europe also contributes to its market leadership.

While several segments are experiencing substantial growth, Hearing Aids are projected to be a dominant force. This is driven by an aging population, increased awareness of the impact of hearing loss on overall quality of life and cognitive function, and significant technological advancements in hearing aid design, including miniaturization, improved sound processing, and connectivity features. Companies like Sonova, Demant, WS Audiology, and GN ReSound are at the forefront of innovation in this segment.

Similarly, Sleep Apnea Devices are expected to witness substantial market penetration. The rising diagnosis rates of sleep apnea, linked to factors like obesity and stress, coupled with the growing understanding of its severe health implications, are driving demand for Continuous Positive Airway Pressure (CPAP) machines and related accessories. Companies like Medtronic and Philips are key players in this segment. The increasing availability of user-friendly and portable sleep apnea devices, along with growing acceptance of home treatment for this condition, further propels its dominance.

The Rehabilitation Equipment segment also holds significant promise, driven by the increasing number of individuals recovering from strokes, injuries, and surgeries, who require ongoing therapy and support in a home environment. Companies like Invacare and Ottobock are vital in providing advanced mobility aids and therapeutic devices.

The Home Medical Equipment industry is experiencing robust growth fueled by several key catalysts. The accelerating global aging population, coupled with the increasing prevalence of chronic diseases, creates an evergreen demand for accessible and convenient healthcare solutions. Advancements in technology, particularly in areas like IoT, AI, and wearable sensors, are enabling more sophisticated and user-friendly HME devices, fostering remote patient monitoring and personalized care. Furthermore, supportive government initiatives and healthcare policies that promote home-based care and telehealth are instrumental in driving market expansion. The growing consumer awareness and preference for managing health in the comfort of their homes, coupled with the cost-effectiveness of home care compared to institutional settings, are also significant growth catalysts.

This comprehensive report on the Home Medical Equipment market offers an in-depth analysis of its trajectory from 2019 to 2033. It meticulously examines the key market insights, identifying the pivotal trends that are shaping the industry, with a particular focus on the estimated year of 2025. The report delves into the driving forces, such as the aging global population and technological advancements, that are propelling market growth, while also addressing the critical challenges and restraints, including reimbursement complexities and digital literacy gaps. Furthermore, it highlights the dominant regions and segments, with a detailed exploration of the factors contributing to their leadership. Growth catalysts are identified, and a comprehensive list of leading players is provided. Significant historical and projected developments are outlined, offering a roadmap for future innovation and market evolution. This report is designed to equip stakeholders with the critical information needed to navigate and capitalize on the dynamic Home Medical Equipment landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Medtronic, Sonova, Demant, WS Audiology, Roche, Lifescan, GN ReSound, Ottobock, Invacare, Omron, Abbott Laboratories, Enovis, Ascensia, Starkey, Permobil Corp, Ossur, Yuwell, SANNUO, A&D Company, Microlife, .

The market segments include Type, Application.

The market size is estimated to be USD 61920 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Home Medical Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Home Medical Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.