1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Drug Delivery Service?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Home Drug Delivery Service

Home Drug Delivery ServiceHome Drug Delivery Service by Type (/> Prescription Drugs, Wellness Supplement, Diagnostics Kits, OTC Drugs), by Application (/> Pharmacy Stores, Healthcare Institutions, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

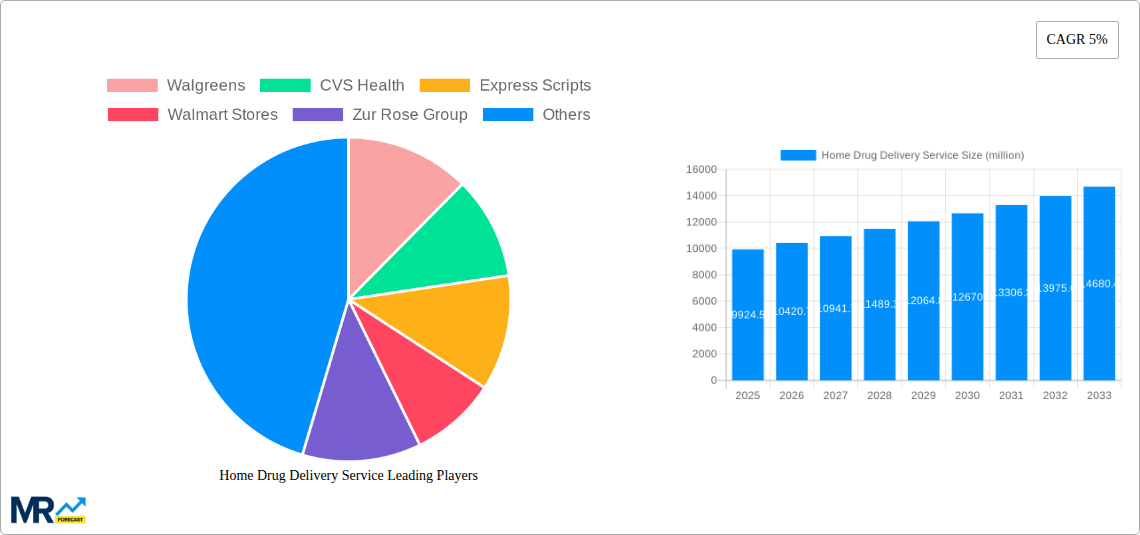

The global Home Drug Delivery Service market is poised for significant expansion, projected to reach an impressive USD 9,924.5 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5% anticipated throughout the forecast period. This growth is primarily fueled by an increasing demand for convenient and accessible healthcare solutions, especially among aging populations and individuals with chronic conditions. The burgeoning e-commerce landscape and advancements in logistics technology have further accelerated the adoption of home delivery services for pharmaceuticals, empowering patients to manage their health from the comfort of their homes. Factors such as the rising prevalence of chronic diseases, a growing preference for personalized medicine, and government initiatives promoting telehealth and remote patient monitoring are also contributing to this upward trajectory.

The market is segmented into various product types, including Prescription Drugs, Wellness Supplements, Diagnostics Kits, and Over-the-Counter (OTC) Drugs, with Prescription Drugs expected to hold a dominant share due to their essential nature and recurring demand. Application-wise, Pharmacy Stores are anticipated to lead, reflecting the established trust and existing infrastructure of these retail outlets in drug dispensing. However, the increasing integration of healthcare institutions and the emergence of direct-to-consumer models, often facilitated by digital platforms, signal a dynamic shift in service delivery. Key players like Walgreens, CVS Health, Walmart Stores, and Amazon (PillPack) are actively investing in expanding their home delivery capabilities, leveraging technology and strategic partnerships to enhance their market presence and cater to evolving consumer needs. This competitive landscape is driving innovation in areas such as same-day delivery, specialized packaging for temperature-sensitive medications, and integration with telehealth platforms, all aimed at improving patient outcomes and satisfaction.

Here's a unique report description for a Home Drug Delivery Service, incorporating your specified elements:

The Home Drug Delivery Service market is on an unprecedented upward trajectory, poised for substantial growth from 2019 to 2033. Driven by evolving consumer expectations for convenience and the accelerating digital transformation within the healthcare sector, this market is projected to reach figures in the tens of millions of units delivered annually by the estimated year of 2025, with further expansion anticipated through the forecast period. The historical period (2019-2024) has witnessed a foundational build-up, marked by increased adoption of e-pharmacies and a growing comfort level among consumers with receiving medications and health-related products at their doorstep. Key market insights reveal a significant shift away from traditional brick-and-mortar pharmacy visits for routine refills and the procurement of non-prescription items. The COVID-19 pandemic acted as a powerful accelerant, normalizing the concept of home delivery for essential medical supplies and highlighting the critical role of these services in maintaining public health access, particularly for vulnerable populations. This has led to sustained investment in robust logistics infrastructure and user-friendly digital platforms. Furthermore, a growing emphasis on chronic disease management and preventative healthcare is fueling demand for regular deliveries of prescription drugs and wellness supplements, creating a consistent revenue stream for market players. The integration of advanced technologies like AI-powered prescription management and same-day delivery options are no longer novelties but are becoming essential competitive differentiators. The market is characterized by an expanding product portfolio, moving beyond just prescription medications to encompass diagnostics kits, over-the-counter (OTC) drugs, and a wider array of wellness and personal care items. This diversification caters to a broader consumer base and captures a larger share of the healthcare spending. The increasing penetration of smartphones and internet access, particularly in developing economies, is also a crucial factor contributing to the widespread adoption of these services.

Several potent forces are driving the remarkable expansion of the Home Drug Delivery Service market. Foremost among these is the unyielding demand for convenience and accessibility. Consumers, increasingly pressed for time and seeking seamless healthcare experiences, are readily embracing services that eliminate the need for physical travel to pharmacies. This is particularly relevant for individuals with mobility issues, chronic conditions, or those residing in remote areas. The rapid digitization of the healthcare industry, fueled by advancements in e-health platforms and mobile applications, has created a fertile ground for the growth of online pharmacies and their subsequent delivery networks. These digital interfaces offer user-friendly prescription management, easy reordering, and transparent pricing, significantly enhancing the customer experience. Furthermore, the growing prevalence of chronic diseases necessitates continuous medication management, making regular home delivery an indispensable solution for many patients. The expanding elderly population, a demographic often facing greater challenges with regular pharmacy visits, is a key segment actively benefiting from and contributing to this trend. Finally, the increasing focus on preventative healthcare and wellness has broadened the scope of home drug delivery beyond prescription medications to include vitamins, supplements, and even at-home diagnostic kits, further broadening the market's appeal and reach.

Despite its promising trajectory, the Home Drug Delivery Service market faces several significant challenges and restraints that could temper its growth. A primary concern revolves around regulatory hurdles and stringent compliance requirements. The pharmaceutical industry is heavily regulated, and ensuring adherence to all local and international laws regarding prescription drug dispensing, storage, and transportation can be complex and costly for service providers. Data privacy and security are paramount concerns, given the sensitive nature of health information. Breaches in patient data could lead to severe reputational damage and legal repercussions, demanding robust cybersecurity measures. The logistical complexities of delivering temperature-sensitive medications, often requiring specialized cold-chain infrastructure, add another layer of operational challenge and cost. Furthermore, the last-mile delivery aspect, especially in densely populated urban areas or remote rural regions, can be inefficient and expensive, impacting profit margins. Building and maintaining consumer trust, particularly for first-time users, is crucial; any negative experience with delayed deliveries, incorrect orders, or compromised product integrity can deter future engagement. Finally, intense competition among established players and the emergence of new entrants could lead to price wars and pressure on profitability, making it challenging for smaller companies to gain significant market share.

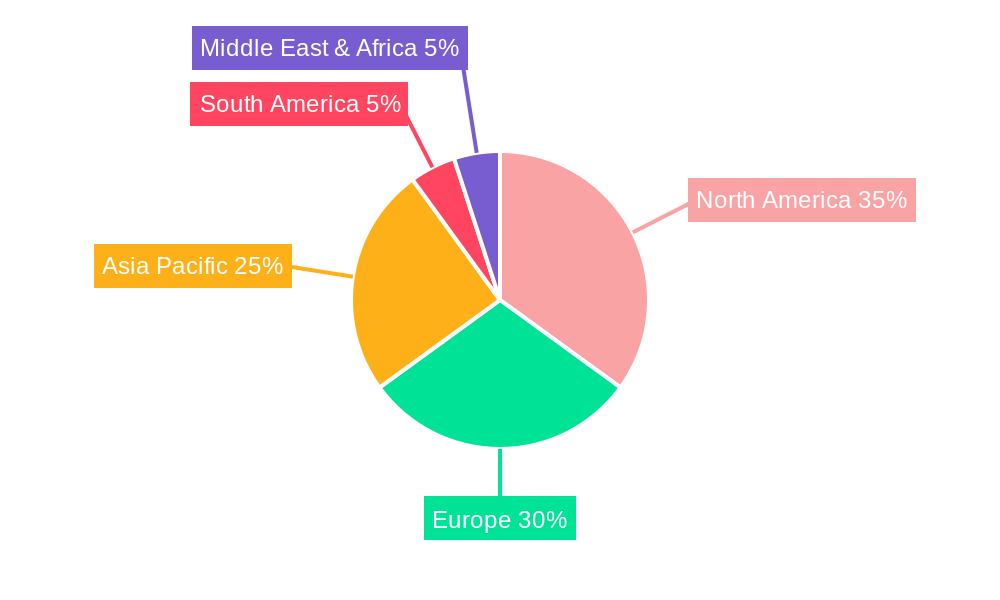

The Home Drug Delivery Service market is experiencing a dynamic interplay of regional dominance and segment specialization, with several key areas poised to lead the market's expansion.

Dominating Segments:

Prescription Drugs: This segment is unequivocally the cornerstone of the home drug delivery market. With an estimated delivery volume in the tens of millions of units annually by the base year of 2025, prescription drugs represent the highest value and most consistent demand. The ongoing management of chronic conditions, the aging global population, and the increasing comfort with online healthcare solutions all contribute to the sustained growth of this segment. Patients with conditions requiring regular medication, such as diabetes, hypertension, and cardiovascular diseases, are prime candidates for these services, ensuring a steady stream of recurring orders. The convenience of not having to make frequent trips to the pharmacy for refills, especially for those with busy schedules or mobility limitations, makes prescription drug delivery an indispensable service. The integration of e-prescriptions and pharmacy management software further streamlines this process.

Pharmacy Stores (as an Application): While the delivery itself is the service, the foundational application driving this market is the Pharmacy Store. Companies like Walgreens, CVS Health, and Kroger are leveraging their existing retail footprints and established customer bases to build robust home delivery networks. These brick-and-mortar giants have a significant advantage due to their brand recognition, existing inventory, and licensed pharmacists. Their strategy often involves integrating their online ordering platforms with their physical stores, allowing for rapid fulfillment and diverse delivery options, including same-day and scheduled deliveries. The ability to offer a comprehensive range of products, from prescription drugs to OTC items and wellness supplements, from a single trusted source further solidifies the dominance of this application segment. They are investing heavily in their digital infrastructure and logistics to compete effectively with pure-play online pharmacies.

Dominating Regions/Countries:

North America (particularly the United States): North America, spearheaded by the United States, is currently and is projected to continue dominating the Home Drug Delivery Service market. The region boasts a highly developed healthcare infrastructure, a strong digital economy, a tech-savvy population with high internet and smartphone penetration, and a regulatory environment that, while stringent, has adapted to facilitate e-pharmacy operations. Major players like CVS Health, Walgreens, Express Scripts, and Walmart Stores have established significant market presence and are investing heavily in their delivery capabilities. The presence of innovative startups like Capsule and Alto Pharmacy further fuels competition and drives technological advancements. The base year of 2025 is expected to see millions of prescription deliveries annually in this region alone. The mature market allows for sophisticated logistics, including cold-chain management, and a wide acceptance of online healthcare services.

Asia Pacific (particularly China): The Asia Pacific region, with China as its vanguard, is emerging as a powerhouse for home drug delivery services. Driven by a massive population, rapid urbanization, and significant investments in digital healthcare infrastructure, China's market is experiencing explosive growth. Companies like Meituan are not only delivering food but have expanded their services to include essential medications and health products. The sheer scale of the population and the increasing disposable incomes are creating a vast demand. While regulatory frameworks are still evolving in some parts of the region, the pace of adoption and innovation is remarkable. The focus on expanding healthcare access to underserved populations in rural areas through digital platforms further amplifies the growth potential. By the forecast period (2025-2033), this region is expected to significantly challenge and potentially rival North America in terms of overall delivery volumes.

The synergy between these dominant segments and regions creates a powerful engine for the global Home Drug Delivery Service market. The demand for prescription drugs, facilitated by the established infrastructure of pharmacy stores, is amplified by the widespread adoption of digital services in key geographical markets.

Several key growth catalysts are propelling the Home Drug Delivery Service industry forward. The persistent demand for convenience and accessibility, driven by increasingly time-poor consumers and a growing elderly population, is a primary driver. Technological advancements in e-commerce platforms, mobile applications, and AI-powered logistics enable more efficient and personalized delivery experiences. Furthermore, a growing emphasis on preventative healthcare and chronic disease management necessitates consistent access to medications and wellness products, fueling repeat business. The ongoing digital transformation of the healthcare sector, with increased acceptance of telemedicine and online consultations, naturally extends to the delivery of related products.

This comprehensive report offers an in-depth analysis of the Home Drug Delivery Service market, encompassing the study period from 2019 to 2033. With 2025 designated as both the base and estimated year, the report provides granular insights into the market's current standing and future trajectory. The historical period of 2019-2024 has been meticulously examined to understand the foundational growth and early adoption trends. The forecast period of 2025-2033 outlines the anticipated market evolution, driven by key growth catalysts such as the increasing demand for convenience, technological advancements, and the growing focus on preventative healthcare. The report delves into the diverse segments, including Prescription Drugs, Wellness Supplements, Diagnostics Kits, and OTC Drugs, along with their application across Pharmacy Stores, Healthcare Institutions, and Other channels. It highlights the dominant regions and countries, while also identifying the key players like Walgreens, CVS Health, and Amazon (PillPack), and analyzes significant industry developments and challenges. This report is an essential resource for stakeholders seeking to understand and capitalize on the dynamic opportunities within the global Home Drug Delivery Service market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Walgreens, CVS Health, Express Scripts, Walmart Stores, Zur Rose Group, Phoenix, Capsule, Meituan, Kroger, Amazon (PillPack), Alto Pharmacy, .

The market segments include Type, Application.

The market size is estimated to be USD 9924.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Home Drug Delivery Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Home Drug Delivery Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.