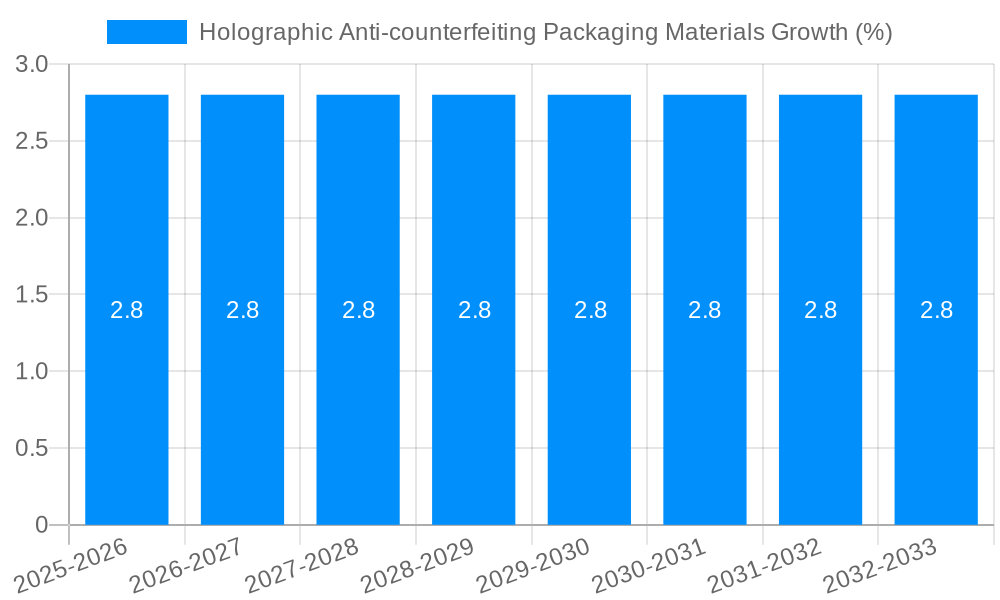

1. What is the projected Compound Annual Growth Rate (CAGR) of the Holographic Anti-counterfeiting Packaging Materials?

The projected CAGR is approximately 2.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Holographic Anti-counterfeiting Packaging Materials

Holographic Anti-counterfeiting Packaging MaterialsHolographic Anti-counterfeiting Packaging Materials by Type (Dominant, Recessive), by Application (Pharmaceutical, Food and Beverages, Consumer Electronics, Cosmetics, Clothing and Apparel, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

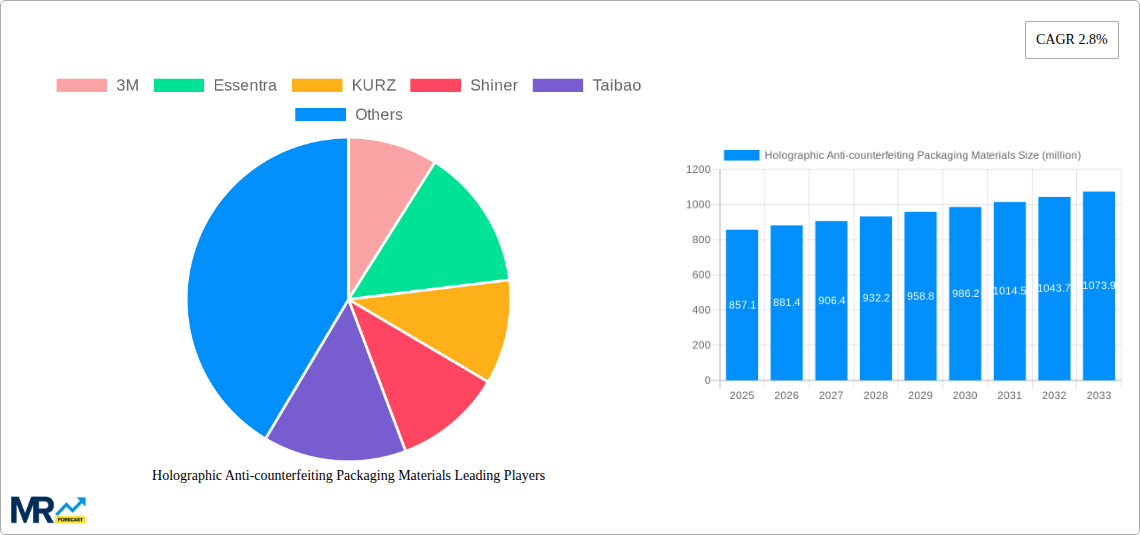

The global holographic anti-counterfeiting packaging materials market is poised for steady growth, projected to reach approximately USD 857.1 million in value. This expansion is driven by an increasing global awareness of the pervasive issue of product counterfeiting and the resultant financial and reputational damage across various industries. Manufacturers are actively investing in sophisticated holographic solutions to secure their products, enhance brand integrity, and build consumer trust. The market's Compound Annual Growth Rate (CAGR) of 2.8% underscores a consistent demand for these advanced security features. Key applications benefiting from these materials include pharmaceuticals, where product authenticity is critical for public health and safety, and the food and beverage sector, which faces significant losses due to counterfeit goods. Furthermore, the growing adoption by consumer electronics, cosmetics, and apparel industries, driven by the need to combat sophisticated fake products, also contributes significantly to market expansion. The landscape is characterized by continuous innovation in holographic technologies, leading to more advanced and difficult-to-replicate security features.

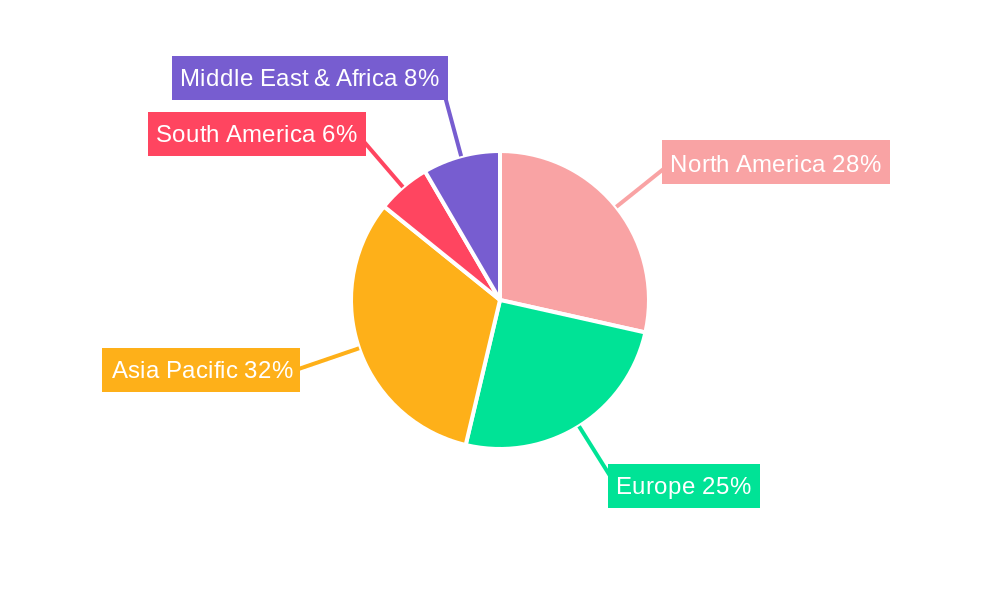

The market is segmented into dominant and recessive types, catering to diverse security requirements and cost considerations. While dominant holograms offer high visibility and immediate identification, recessive holograms provide a subtler yet equally effective layer of security. The competitive environment features a robust presence of key players such as 3M, Avery Dennison, and Sun Chemical, alongside specialized holographic technology providers like Essentra and Kurz. These companies are focused on research and development to introduce innovative solutions, including optically variable devices (OVDs), advanced security inks, and integrated track-and-trace functionalities. Geographically, Asia Pacific is expected to emerge as a significant growth engine, propelled by a rapidly expanding manufacturing base and increasing demand for genuine products in economies like China and India. North America and Europe remain mature markets with a strong existing demand for high-security packaging. Restrains such as the initial implementation cost of advanced holographic technologies and the need for standardized regulations across regions are being addressed through ongoing technological advancements and collaborative efforts within the industry.

This comprehensive report offers an in-depth analysis of the global Holographic Anti-counterfeiting Packaging Materials market, projecting significant growth over the Study Period (2019-2033), with the Base Year and Estimated Year both set to 2025. The Forecast Period (2025-2033) anticipates robust expansion, building upon insights from the Historical Period (2019-2024).

XXX predicts that the global Holographic Anti-counterfeiting Packaging Materials market will witness a substantial compound annual growth rate (CAGR) of over X.X% during the forecast period, reaching an estimated market size of $XXX million by 2033. This growth is intrinsically linked to the escalating global threat of counterfeiting across diverse product categories, ranging from high-value pharmaceuticals and premium food and beverages to rapidly expanding consumer electronics and luxury cosmetics. As regulatory bodies and brand owners alike intensify their efforts to safeguard product integrity and consumer trust, the demand for advanced, multi-layered authentication solutions like holographic materials is set to surge. The evolution of holographic technologies, encompassing intricate optical elements, dynamic security features, and enhanced overt and covert markers, is a key trend. This includes the increasing adoption of advanced holographic films and labels that are difficult to replicate, offering a strong visual deterrent and providing verifiable authenticity. Furthermore, the integration of these materials with digital authentication platforms, such as QR codes and NFC tags, is gaining traction, enabling consumers and supply chain partners to easily verify product legitimacy. The market is also experiencing a shift towards more sustainable and eco-friendly holographic solutions, driven by growing environmental consciousness and stricter regulations. Innovations in material science are leading to the development of biodegradable holographic films and the reduction of hazardous chemicals in the manufacturing process. The report will delve into these trends, analyzing their impact on market dynamics and forecasting their influence on future market trajectories.

The burgeoning holographic anti-counterfeiting packaging materials market is primarily propelled by the relentless rise in sophisticated counterfeit products globally. This illicit trade not only erodes brand value and profitability but also poses significant risks to consumer safety, particularly in sectors like pharmaceuticals and food and beverages. Governments worldwide are enacting stringent regulations and encouraging the adoption of advanced security features to combat this menace, creating a fertile ground for holographic solutions. Moreover, brand owners are increasingly recognizing the importance of protecting their intellectual property and maintaining consumer confidence. The visual appeal and advanced security features offered by holographic materials act as a powerful deterrent to counterfeiters and provide consumers with a tangible assurance of authenticity. The expanding e-commerce landscape further fuels this demand, as online sales present new vulnerabilities for counterfeit infiltration. As consumers become more discerning and aware of the risks associated with fake goods, the demand for products with robust anti-counterfeiting measures, such as holographic packaging, is on the rise. The report will meticulously examine these driving forces, providing quantitative data and qualitative insights into their impact on market growth.

Despite the promising growth trajectory, the holographic anti-counterfeiting packaging materials market is not without its hurdles. One of the primary challenges lies in the cost-effectiveness of implementing advanced holographic solutions, especially for small and medium-sized enterprises (SMEs) or for packaging lower-value products. The initial investment in specialized printing equipment, materials, and design expertise can be substantial, acting as a restraint for wider adoption. Furthermore, the complexity of manufacturing and application for certain sophisticated holographic features can pose technical challenges, requiring specialized knowledge and infrastructure. Another significant restraint is the potential for replication, albeit at a higher cost and effort, by determined counterfeiters who continuously develop new methods to mimic security features. This necessitates ongoing innovation and the development of increasingly complex and layered security solutions. The lack of standardization across different holographic technologies and security features can also create confusion for end-users and hinder seamless integration within supply chains. Lastly, consumer awareness and understanding of the different holographic security features can be a limiting factor; if consumers are not educated on how to identify genuine holograms, their deterrent effect may be diminished. The report will provide a thorough analysis of these challenges, assessing their potential impact on market expansion and outlining potential mitigation strategies.

The Pharmaceutical segment is poised to dominate the holographic anti-counterfeiting packaging materials market. The inherent risks associated with counterfeit pharmaceuticals, including potential adverse health effects, fatalities, and erosion of public trust in healthcare systems, necessitate the highest level of security. The global pharmaceutical market, valued at over $1.5 trillion annually, represents a colossal opportunity for anti-counterfeiting solutions.

Dominance in Pharmaceutical Applications:

Regional Dominance:

The holographic anti-counterfeiting packaging materials industry is experiencing significant growth catalysts. The increasing sophistication of counterfeiters necessitates the continuous development and adoption of more advanced and layered security features, driving innovation in holographic technologies. Heightened regulatory pressures and government initiatives worldwide to combat illicit trade further compel businesses to invest in robust anti-counterfeiting solutions. Moreover, growing consumer awareness regarding the risks associated with counterfeit products is fostering a demand for authenticated goods, pushing brands to implement visible and verifiable security measures. The expansion of e-commerce also presents new vulnerabilities, fueling the need for effective packaging security throughout the digital supply chain.

This report provides a 360-degree view of the Holographic Anti-counterfeiting Packaging Materials market. It meticulously analyzes current trends, historical data, and future projections, offering a detailed understanding of market dynamics. The report identifies and elaborates on the key drivers propelling market growth, alongside a thorough examination of the challenges and restraints that could impede expansion. It forecasts the dominance of specific regions and application segments, providing strategic insights for market participants. Furthermore, the report details the critical growth catalysts, lists the leading industry players with their contributions, and highlights significant technological and market developments. This comprehensive coverage ensures that stakeholders are equipped with the necessary information to navigate this evolving market effectively and make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.8% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.8%.

Key companies in the market include 3M, Essentra, KURZ, Shiner, Taibao, Avery Dennison, Sun Chemical, DNP, NHK SPRING, Flint Group, Toppan, De La Rue, Schreiner ProSecure, UPM Raflatac, AFC Technology Co.,Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD 857.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Holographic Anti-counterfeiting Packaging Materials," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Holographic Anti-counterfeiting Packaging Materials, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.