1. What is the projected Compound Annual Growth Rate (CAGR) of the HIV Self-Testing?

The projected CAGR is approximately 11.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

HIV Self-Testing

HIV Self-TestingHIV Self-Testing by Type (Blood, Oral Fluid, Urine), by Application (Hospital, Clinic), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

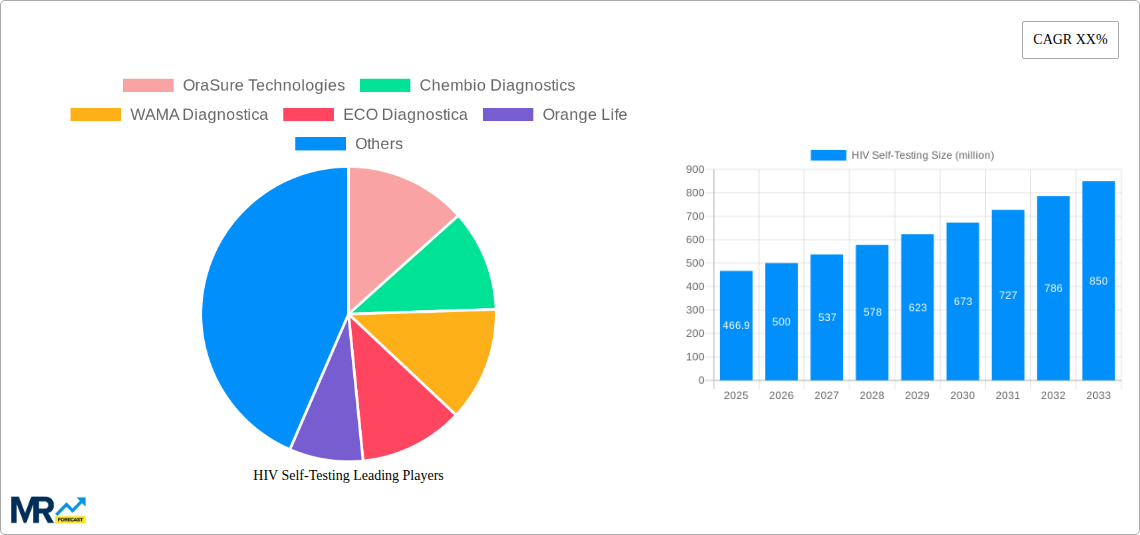

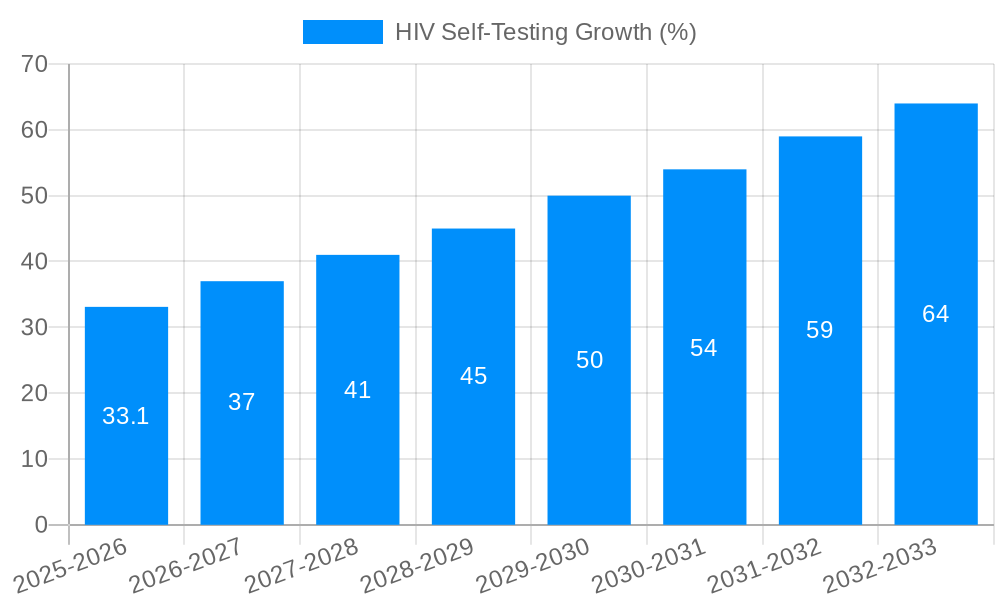

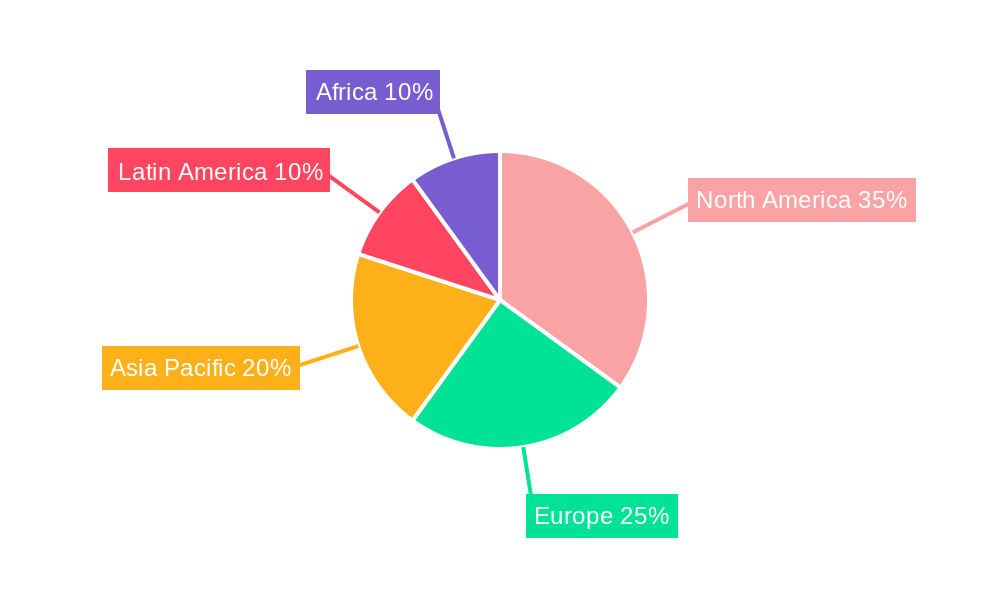

The HIV self-testing market, valued at $218.1 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.5% from 2025 to 2033. This expansion is driven by several key factors. Increased awareness of HIV and the benefits of early diagnosis are empowering individuals to take control of their health. The convenience and privacy offered by self-testing kits are significantly reducing barriers to testing, particularly in underserved communities where stigma and access to traditional testing centers remain challenges. Technological advancements, leading to more accurate and user-friendly tests, further fuel market growth. The rising adoption of point-of-care testing (POCT) in clinics and hospitals also contributes to the market's expansion. While the market is currently dominated by blood-based tests, oral fluid tests are gaining traction due to their less invasive nature and increased ease of use. This shift will likely contribute to higher market penetration, particularly in regions with limited access to healthcare facilities. The geographic distribution reflects global health priorities, with North America and Europe currently holding significant market shares, however, strong growth is anticipated in emerging markets of Asia Pacific and Africa due to increasing awareness and government initiatives.

The market segmentation reveals strong demand across various applications, with hospitals and clinics leading the way. However, the increasing availability of at-home self-tests is expected to shift this balance over the forecast period. Competitive dynamics are shaped by a mix of established players like OraSure Technologies and Chembio Diagnostics, alongside emerging companies. While challenges exist, such as ensuring accurate test interpretation and managing potential misinformation, the overall market outlook remains positive. Continued investment in research and development, coupled with effective public health campaigns promoting self-testing, will be crucial for sustained market growth and maximizing the positive impact on global HIV prevention efforts. Future growth will hinge on continued investment in research, improved accessibility, and targeted public health campaigns that address misconceptions and foster wider adoption.

The global HIV self-testing market is experiencing robust growth, projected to reach multi-million unit sales by 2033. Driven by increased awareness of HIV/AIDS, advancements in testing technologies, and a growing preference for convenient at-home testing options, the market exhibits significant potential. Analysis of the historical period (2019-2024) reveals a steadily increasing adoption rate, particularly in regions with high HIV prevalence. The estimated market value for 2025 signifies a crucial turning point, showcasing a considerable leap in market penetration. The forecast period (2025-2033) anticipates continued expansion, propelled by factors such as improved accessibility, affordability, and the integration of self-testing into broader public health initiatives. Oral fluid tests are gaining popularity due to their ease of use and reduced stigma associated with blood collection. The shift towards decentralized testing, facilitated by self-testing kits, is significantly impacting the market landscape, moving away from solely relying on clinical settings. This trend, coupled with ongoing technological advancements aiming at enhancing accuracy and user-friendliness, paints a promising picture for future market growth. Furthermore, governmental initiatives and public health campaigns advocating for self-testing are contributing substantially to the market's expansion, thereby impacting millions of lives by improving early detection and timely intervention. Data from the study period (2019-2033) underscore the market's trajectory, highlighting the crucial role self-testing plays in combating the HIV epidemic. The base year 2025 serves as a benchmark against which future projections are evaluated, underscoring the consistent, upward trend observed in the industry. The market is poised for continued growth, reaching several millions of units by the end of the forecast period.

Several key factors are driving the expansion of the HIV self-testing market. Firstly, increasing public awareness campaigns and educational initiatives are empowering individuals to take control of their health and proactively seek HIV testing. The reduced stigma surrounding HIV testing, coupled with the convenience and privacy offered by self-testing kits, are significantly increasing uptake. Technological advancements resulting in more accurate, user-friendly, and affordable tests are also playing a crucial role. The shift towards decentralized testing, facilitated by self-testing, enables broader access to testing, particularly in underserved communities and areas with limited healthcare infrastructure. This improved accessibility directly contributes to increased early diagnosis rates, facilitating early intervention and preventing further transmission. Moreover, government support through funding and policy initiatives that promote self-testing programs are bolstering the market's growth trajectory. Finally, the integration of self-testing into broader public health strategies is further accelerating market penetration, contributing to a significant increase in the number of tests administered annually, impacting millions of individuals.

Despite the positive growth trajectory, several challenges hinder the widespread adoption of HIV self-testing. One significant hurdle is ensuring accurate test results and proper interpretation of instructions by users, requiring robust user education programs. Concerns regarding the potential for incorrect test results, leading to either false reassurance or unnecessary anxiety, need careful consideration and management through clear communication and support mechanisms. Limited access to post-test counseling and follow-up care, particularly in resource-constrained settings, remains a significant challenge. Accessibility issues, including affordability and geographical barriers, may hinder self-testing uptake in certain populations. Furthermore, the lack of awareness and trust in self-testing technologies in some communities requires targeted educational campaigns to build confidence and address misconceptions. Finally, regulatory complexities and varying approvals across different countries can create barriers to market entry and widespread distribution, influencing overall market accessibility and growth patterns. Addressing these challenges is crucial for unlocking the full potential of HIV self-testing in combating the global HIV/AIDS epidemic.

The market is witnessing substantial growth across various regions, but certain segments are exhibiting faster expansion.

Oral Fluid Tests: This segment is projected to dominate due to its ease of use, reduced invasiveness, and decreased stigma compared to blood tests. The non-invasive nature contributes significantly to higher acceptance rates, particularly among younger populations. The convenience factor also drives wider adoption in various settings.

Clinic Application: Clinics remain a pivotal point for HIV self-testing distribution and post-test counseling. Though home testing is growing, clinics still offer a structured setting for individuals to access tests and receive necessary support, ensuring accurate interpretation of results and appropriate follow-up care. The reliable infrastructure within clinics further enhances the effectiveness of self-testing initiatives.

Geographic Dominance: While growth is widespread, regions with high HIV prevalence and strong public health infrastructure are likely to lead in terms of market volume. This is partly due to substantial government investment, effective public awareness campaigns, and the establishment of comprehensive healthcare systems that seamlessly integrate self-testing strategies into their broader public health programs. Areas with robust logistics networks are also better poised to facilitate the distribution and effective implementation of self-testing programs, contributing further to the growth observed in these specific regions. The strategic investment in community health workers and outreach programs in several regions has also improved accessibility and uptake, leading to impressive growth numbers. These factors contribute towards the significant expansion observed in some areas and indicate future growth potential.

The HIV self-testing market is experiencing significant growth driven by several key factors. These include increasing public awareness campaigns promoting self-testing as a convenient and private option for HIV screening, coupled with technological advancements leading to more user-friendly and accurate tests. Government initiatives supporting self-testing programs, improving access to these tests, particularly in underserved communities, are also significantly bolstering market expansion. The combination of these factors is fueling a strong upward trend in the self-testing market, impacting the lives of millions across the globe.

This report provides a comprehensive overview of the HIV self-testing market, encompassing market size projections, growth drivers, challenges, and key players. It offers insights into different testing types (blood, oral fluid, urine), application segments (hospital, clinic), and regional variations. This in-depth analysis empowers stakeholders with valuable knowledge to make informed decisions and contribute to effective HIV/AIDS prevention strategies, positively impacting millions of individuals and communities worldwide.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.5%.

Key companies in the market include OraSure Technologies, Chembio Diagnostics, WAMA Diagnostica, ECO Diagnostica, Orange Life, Ebram Produtos Laboratoriais, .

The market segments include Type, Application.

The market size is estimated to be USD 218.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "HIV Self-Testing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the HIV Self-Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.