1. What is the projected Compound Annual Growth Rate (CAGR) of the High Voltage GIS Substation?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High Voltage GIS Substation

High Voltage GIS SubstationHigh Voltage GIS Substation by Type (Isolated Phase GIS, Integrated 3 Phase GIS, Hybrid GIS, Others), by Application (Electric Power, Manufacturing, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

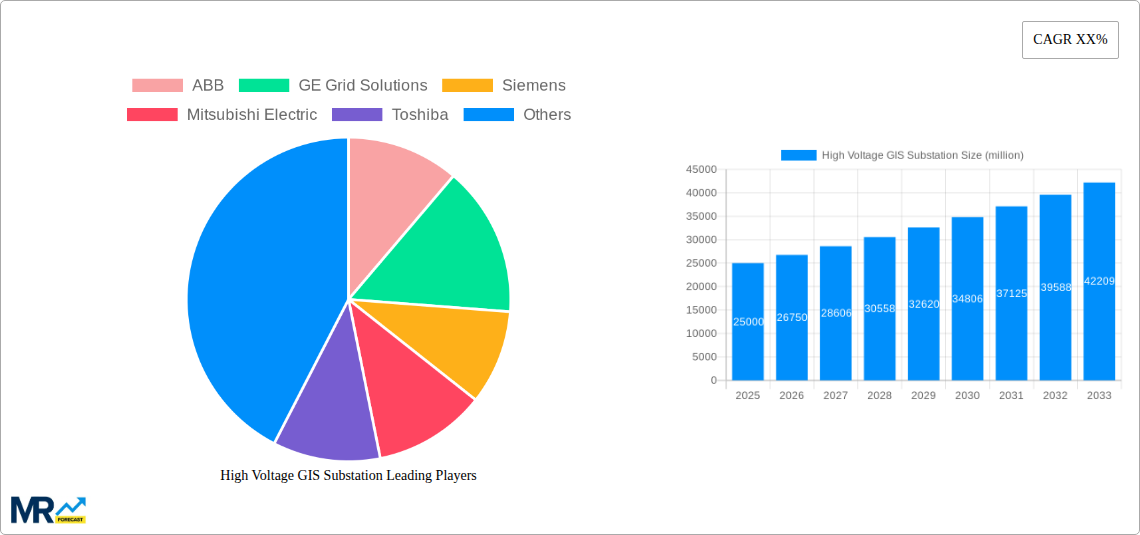

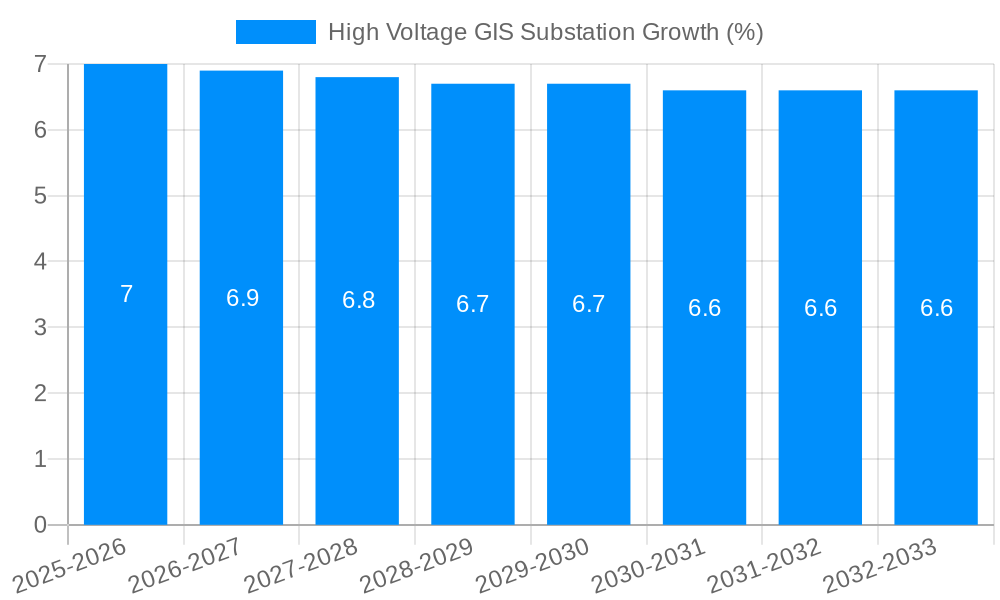

The global High Voltage GIS Substation market is projected to experience significant expansion, with an estimated market size of approximately $25,000 million in 2025 and a Compound Annual Growth Rate (CAGR) of around 7.5% during the forecast period of 2025-2033. This robust growth is primarily fueled by the increasing global demand for electricity, coupled with the imperative to upgrade aging power infrastructure and expand grids to meet the needs of burgeoning populations and industrialization. The transition towards renewable energy sources, which often require decentralized and more resilient substation solutions, also acts as a powerful catalyst. Furthermore, the inherent advantages of Gas Insulated Substations (GIS), such as their compact footprint, enhanced safety, reduced environmental impact, and lower maintenance requirements compared to traditional Air Insulated Substations (AIS), are driving their adoption across various applications, particularly in densely populated urban areas and challenging geographical terrains. Key market drivers include government investments in smart grid technologies, the need for increased grid reliability and efficiency, and the growing preference for environmentally friendly solutions.

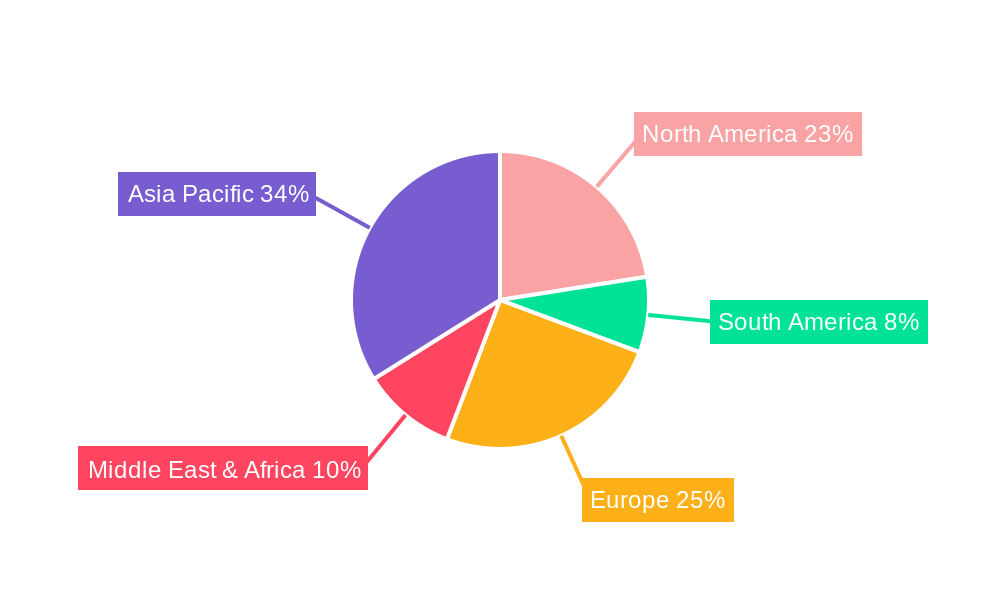

The market is characterized by a diverse range of segments. In terms of Type, Isolated Phase GIS is expected to lead due to its established reliability for high-voltage applications, though Integrated 3 Phase GIS and Hybrid GIS are gaining traction for their space-saving and cost-effectiveness in specific scenarios. The Electric Power sector remains the dominant application, accounting for the largest share, while the Manufacturing sector also presents substantial growth opportunities driven by industrial expansion and automation. Geographically, Asia Pacific, particularly China and India, is anticipated to be the largest and fastest-growing market, owing to rapid industrialization, urbanization, and substantial investments in power infrastructure. North America and Europe are also significant markets, driven by grid modernization initiatives and the replacement of aging substations. Leading companies such as ABB, GE Grid Solutions, and Siemens are at the forefront of innovation, offering advanced GIS solutions and contributing to market expansion through strategic partnerships and technological advancements. However, the high initial cost of GIS installations and the need for specialized expertise for maintenance can pose restraints to market growth in certain regions.

Here's a unique report description for High Voltage GIS Substations, incorporating the requested elements:

The global High Voltage Gas Insulated Switchgear (GIS) substation market is poised for robust expansion, projected to reach a valuation exceeding $500 million by 2033. This significant growth is underpinned by a confluence of factors, including the increasing demand for reliable and efficient power transmission and distribution, the accelerating pace of smart grid initiatives, and the ongoing transition towards renewable energy sources. The historical period from 2019-2024 witnessed steady progress, with the market driven by infrastructure upgrades and the need for compact and safe substation solutions. The base year, 2025, serves as a pivotal point, with estimations indicating continued momentum. For the forecast period of 2025-2033, the market is expected to accelerate, propelled by technological advancements and the growing adoption of GIS technology across various applications.

The inherent advantages of GIS substations, such as their reduced footprint, enhanced safety features, lower maintenance requirements, and superior environmental resilience compared to conventional air-insulated substations, are key drivers. These benefits are particularly crucial in densely populated urban areas and challenging geographical terrains where space is limited and environmental conditions are harsh. The trend towards digitalization and automation within the power sector is further bolstering the demand for GIS substations, as they are more amenable to integration with advanced monitoring and control systems. Furthermore, the increasing integration of renewable energy sources like solar and wind farms, which often require distributed and flexible substation solutions, will also contribute to market growth. The study period of 2019-2033 encompasses a dynamic phase of market evolution, from initial adoption and refinement to widespread implementation and innovation.

The market's trajectory is characterized by a growing preference for Integrated 3 Phase GIS substations due to their space-saving designs and cost-effectiveness for certain applications. However, Hybrid GIS solutions are also gaining traction, offering a balance between performance and economic feasibility by combining gas-insulated and air-insulated components. The electric power segment remains the dominant application, driven by the continuous need for upgrading and expanding power grids. Manufacturing sectors requiring high power reliability and the "Others" category, which includes specialized industrial applications, are also contributing to the market's diversity. The anticipated market size reflects a sustained upward trend driven by these technological and application-specific shifts.

The High Voltage GIS substation market is experiencing a powerful surge fueled by several interconnected drivers. A primary impetus is the global imperative to modernize and expand electrical power grids. Aging infrastructure in many developed nations and the rapid growth of power demand in emerging economies necessitate substations that are not only efficient and reliable but also capable of handling increasing power flows. GIS technology, with its inherently compact design and enhanced safety, is ideally suited to meet these demands, especially in space-constrained urban environments or sensitive ecological zones.

Furthermore, the accelerating global push towards renewable energy integration is a significant propellant. Solar and wind farms, often located in remote areas or requiring distributed power injection into the grid, demand substations that can be deployed quickly and efficiently. GIS substations, with their modularity and reduced environmental impact, are a natural fit for these applications. The increasing emphasis on smart grid development, characterized by advanced digital monitoring, control, and communication capabilities, also favors GIS technology. Its inherent design allows for easier integration of sophisticated sensors and communication modules, enabling real-time data acquisition and remote operation, crucial for optimizing grid performance and ensuring stability.

Despite the promising growth trajectory, the High Voltage GIS substation market is not without its challenges and restraints. A significant hurdle is the high initial capital investment associated with GIS substations compared to traditional air-insulated substations. The specialized manufacturing processes, advanced materials like sulfur hexafluoride (SF6) gas, and sophisticated engineering required contribute to a higher upfront cost, which can be a deterrent for some utilities, particularly in price-sensitive emerging markets.

Another notable challenge is the environmental concern surrounding SF6 gas, the primary insulating medium used in most GIS. While SF6 is an excellent insulator, it is also a potent greenhouse gas with a high global warming potential. Growing regulatory scrutiny and international agreements aimed at reducing greenhouse gas emissions are leading to increased pressure for the development and adoption of alternative, more environmentally friendly insulating gases or technologies. This necessitates substantial investment in research and development and a potential redesign of existing GIS technologies. Furthermore, complex installation and maintenance procedures can also pose challenges. While maintenance intervals are longer, specialized training and equipment are required for handling SF6 gas and performing intricate component replacements, which can lead to skilled labor shortages and increased operational complexity in certain regions. The limited availability of skilled technicians experienced in GIS technology across all geographies can also act as a restraint on widespread adoption and efficient operation.

The High Voltage GIS substation market is set to witness significant dominance from the Asia Pacific region, driven by China and India, with a substantial contribution expected from Southeast Asian countries. This dominance is rooted in the region's massive investments in power infrastructure development and the ongoing expansion of electricity grids to meet burgeoning energy demands.

Key Regions/Countries:

Key Segments to Dominate:

The interplay of rapid industrialization, urbanization, and a strong focus on renewable energy integration across the Asia Pacific, particularly in China and India, will ensure this region and these segments lead the global High Voltage GIS substation market in terms of both volume and value, with many individual projects potentially exceeding 500 million USD in scope and investment.

The High Voltage GIS substation industry is experiencing significant growth catalysts that are shaping its future. A primary catalyst is the global push for grid modernization and the implementation of smart grid technologies. This involves integrating digital communication, advanced sensors, and automation into substations, enhancing their efficiency, reliability, and resilience. The increasing adoption of renewable energy sources, such as solar and wind power, necessitates more flexible and responsive grid infrastructure, where GIS substations play a crucial role due to their compact size and quick deployment capabilities. Furthermore, the ongoing transition away from SF6 gas, driven by environmental concerns, is spurring innovation in alternative insulating technologies, creating new market opportunities and driving research and development.

The global High Voltage GIS Substation market is characterized by the presence of several prominent players, including:

This comprehensive report provides an in-depth analysis of the High Voltage GIS Substation market, offering granular insights and projections across the study period of 2019-2033. It delves into the intricate details of market dynamics, meticulously dissecting the trends, driving forces, challenges, and growth catalysts that shape the industry. The report presents a robust forecast for the market's future, projecting significant growth driven by technological advancements and the increasing demand for reliable power infrastructure. It offers a detailed examination of leading players, their strategies, and their contributions to market innovation, alongside a comprehensive overview of significant developments that are transforming the sector. The report is designed to equip stakeholders with actionable intelligence, enabling informed decision-making and strategic planning within this dynamic and evolving market, with particular emphasis on market values reaching several hundred millions of USD annually.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include ABB, GE Grid Solutions, Siemens, Mitsubishi Electric, Toshiba, Fuji Electric, Hyundai, Eaton, Hyosung, Schneider Electric, Nissin Electric, Crompton Greaves, Xi’an XD High Voltage, NHVS, Shandong Taikai, Pinggao Electric, Sieyuan Electric, CHINT Group.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "High Voltage GIS Substation," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High Voltage GIS Substation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.