1. What is the projected Compound Annual Growth Rate (CAGR) of the High Performance Fuel Injector?

The projected CAGR is approximately 5.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High Performance Fuel Injector

High Performance Fuel InjectorHigh Performance Fuel Injector by Type (GDI (Direct Injection), SDI (Semi-direct Injection), TBI (Throttle Body Injection)), by Application (Gasoline Automotive, Diesel Automotive), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

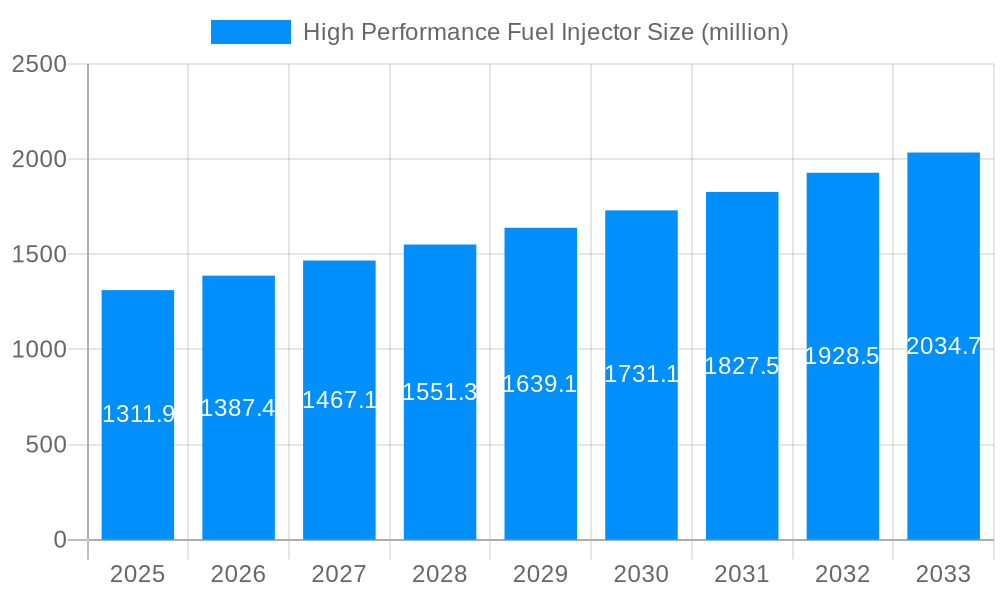

The global High Performance Fuel Injector market is poised for substantial growth, projected to reach approximately $1311.9 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 5.7% extending through 2033. This robust expansion is primarily fueled by the escalating demand for enhanced engine performance and fuel efficiency in both gasoline and diesel automotive applications. The automotive industry's continuous pursuit of higher horsepower, improved combustion, and reduced emissions necessitates advanced fuel delivery systems. Key drivers include the increasing proliferation of performance vehicles, the aftermarket tuning segment's demand for upgraded components, and evolving emission standards that encourage more precise fuel injection. Furthermore, technological advancements in injector design, such as direct injection (GDI) systems, are playing a pivotal role in optimizing fuel atomization and combustion, leading to greater power output and better fuel economy.

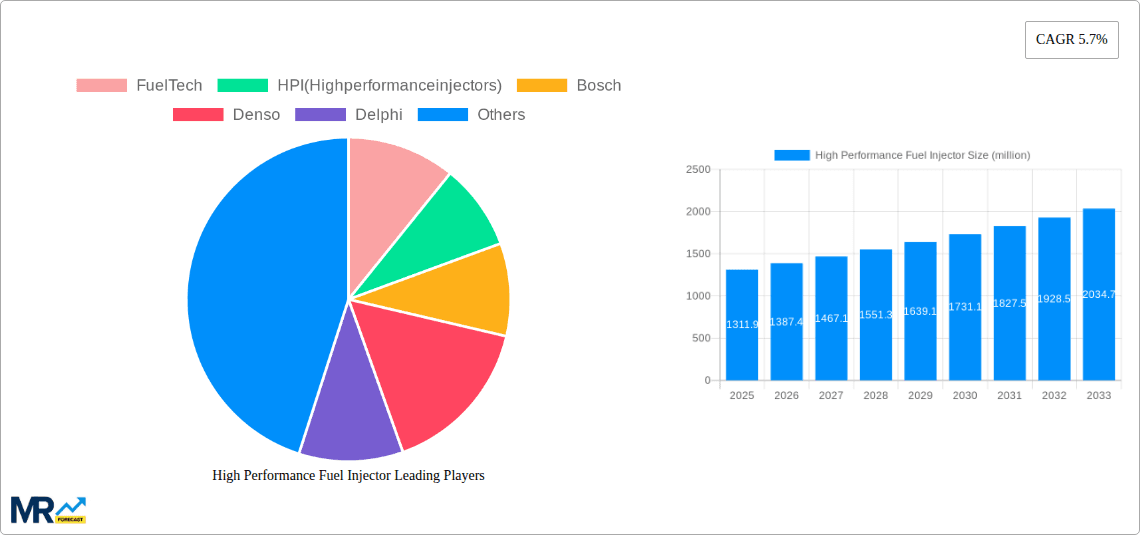

The market segmentation reveals a strong emphasis on both gasoline and diesel automotive applications, indicating a broad spectrum of demand across various vehicle types. The competitive landscape is dynamic, featuring established automotive giants like Bosch, Denso, and Delphi, alongside specialized performance component manufacturers such as FuelTech and Edelbrock. Emerging trends indicate a growing interest in smart fuel injection systems with integrated sensors and electronic control units for real-time adjustments. However, potential restraints such as the high cost of advanced injector technologies and stringent regulatory hurdles for new product development could temper growth in certain segments. Nonetheless, the overarching trend towards vehicle electrification, while a long-term consideration, is currently balanced by the sustained demand for high-performance internal combustion engines, particularly in emerging markets and the enthusiast community, ensuring continued relevance and growth for high-performance fuel injectors in the foreseeable future.

This report provides an in-depth analysis of the global High Performance Fuel Injector market, offering valuable insights and actionable intelligence for stakeholders. Covering the Study Period: 2019-2033, with a Base Year: 2025, this research delves into the market dynamics, trends, and future outlook. The Estimated Year: 2025 represents our projected snapshot of the market, while the Forecast Period: 2025-2033 outlines the anticipated growth trajectory. The Historical Period: 2019-2024 lays the groundwork for understanding past market performance and evolution.

The high-performance fuel injector market is experiencing a significant transformation driven by escalating demands for enhanced engine efficiency, reduced emissions, and increased power output across automotive and industrial applications. A key trend is the relentless innovation in GDI (Direct Injection) technology, which continues to gain traction due to its superior fuel atomization and precise delivery capabilities, leading to improved combustion and reduced fuel consumption. The market is witnessing a substantial shift away from traditional TBI (Throttle Body Injection) systems towards more sophisticated direct injection methods. The increasing adoption of advanced materials and manufacturing techniques, such as micro-machining and advanced coatings, is enabling the production of injectors with tighter tolerances and superior durability. This technological advancement is crucial for handling the higher pressures and more aggressive fuel formulations associated with performance engines. Furthermore, the integration of smart technologies, including pressure sensors and advanced control algorithms, is becoming a focal point, allowing for real-time adjustments and optimized fuel delivery under diverse operating conditions. This is particularly evident in the Gasoline Automotive segment, where enthusiasts and manufacturers alike are seeking ways to extract maximum performance while adhering to stringent emission regulations. The growing popularity of aftermarket tuning and performance upgrades further fuels the demand for specialized, high-flow injectors. The report anticipates a notable surge in the demand for injectors capable of handling higher fuel flow rates and operating under extreme pressures, catering to both OEM performance variants and the vibrant aftermarket tuning community. The influence of stringent global emission standards, such as Euro 7 and EPA regulations, is also a critical driver, pushing manufacturers to develop injectors that facilitate cleaner combustion and minimize particulate matter and NOx emissions. This necessitates a move towards finer fuel atomization and more precise control over the injection event. The report will meticulously examine how these trends are shaping the competitive landscape, influencing product development strategies, and ultimately dictating market growth across various application segments and geographical regions. The continuous pursuit of performance gains, coupled with environmental consciousness, positions the high-performance fuel injector market for sustained and dynamic evolution throughout the forecast period. The development of advanced injector designs that can accommodate alternative fuels and the increasing electrification of vehicle powertrains, which might necessitate specialized fueling solutions for hybrid systems, are also emerging areas of interest that will be thoroughly explored. The interplay between OEM innovation and aftermarket demand will be a key theme, highlighting how both segments contribute to the overall market expansion.

The high-performance fuel injector market is being propelled by a confluence of powerful forces, with the automotive industry's unwavering pursuit of enhanced engine performance and fuel efficiency standing at the forefront. Modern vehicle manufacturers are continually striving to deliver more power and torque from smaller, more efficient engines. This necessitates sophisticated fuel delivery systems capable of precisely metering fuel under demanding conditions. The increasing prevalence of performance-oriented vehicles, including sports cars, luxury sedans with performance variants, and even high-performance SUVs, directly translates to a higher demand for specialized fuel injectors. These injectors are engineered to deliver greater fuel flow rates and maintain optimal spray patterns under increased engine loads and higher revolutions per minute. Furthermore, the burgeoning aftermarket tuning and modification sector plays a pivotal role. Enthusiasts worldwide invest heavily in upgrading their vehicles for enhanced performance, with fuel injectors being a common and effective upgrade. This segment is characterized by a demand for injectors that can support significant power gains and handle modifications such as turbocharging and supercharging. Regulatory pressures, while seemingly a constraint, also act as a driving force for innovation. Stringent emission standards worldwide compel manufacturers to develop more efficient combustion processes. High-performance fuel injectors, particularly advanced GDI systems, are instrumental in achieving cleaner combustion by enabling precise fuel atomization and control, thereby reducing harmful emissions. The report will analyze how these evolving regulatory landscapes are spurring the development of next-generation injector technologies. Finally, technological advancements in injector design and manufacturing, such as the development of more robust materials, advanced solenoid technology, and precise piezoelectric actuators, are enabling the creation of injectors that are more durable, responsive, and capable of handling extreme operating parameters, further fueling market growth.

Despite the robust growth prospects, the high-performance fuel injector market faces several significant challenges and restraints that could impede its expansion. One of the primary challenges is the increasing complexity and cost associated with advanced injector technologies. The development and manufacturing of sophisticated GDI and SDI injectors, which often involve intricate internal components, high-precision machining, and advanced materials, can lead to higher unit costs. This can make them less accessible for certain market segments or budget-conscious consumers, particularly in the aftermarket. Furthermore, the intricacy of integration with modern engine control units (ECUs) presents another hurdle. High-performance injectors often require specific calibration and tuning to achieve optimal performance and efficiency. This necessitates specialized knowledge and sophisticated diagnostic tools, which can be a barrier for independent workshops and DIY enthusiasts. The durability and longevity of injectors operating under extreme conditions also remain a concern. High-performance engines often subject fuel injectors to higher pressures, temperatures, and more aggressive fuel blends, which can accelerate wear and reduce their lifespan. Ensuring consistent performance and reliability over extended periods under such demanding operational cycles is a continuous engineering challenge. Counterfeiting and the prevalence of low-quality aftermarket products also pose a threat. The demand for performance upgrades can unfortunately lead to the proliferation of imitation parts that do not meet the required specifications, potentially leading to engine damage and customer dissatisfaction, thereby impacting the reputation of genuine high-performance components. Lastly, the evolving powertrain landscape, with the rise of electrification and alternative fuels, presents a long-term challenge. While hybrid powertrains still require internal combustion engines and thus fuel injectors, the eventual shift towards fully electric vehicles will undoubtedly reduce the overall market size for traditional fuel injection systems in the long run. The report will thoroughly examine how these challenges are being addressed by industry players and what strategies are being employed to mitigate their impact on market growth.

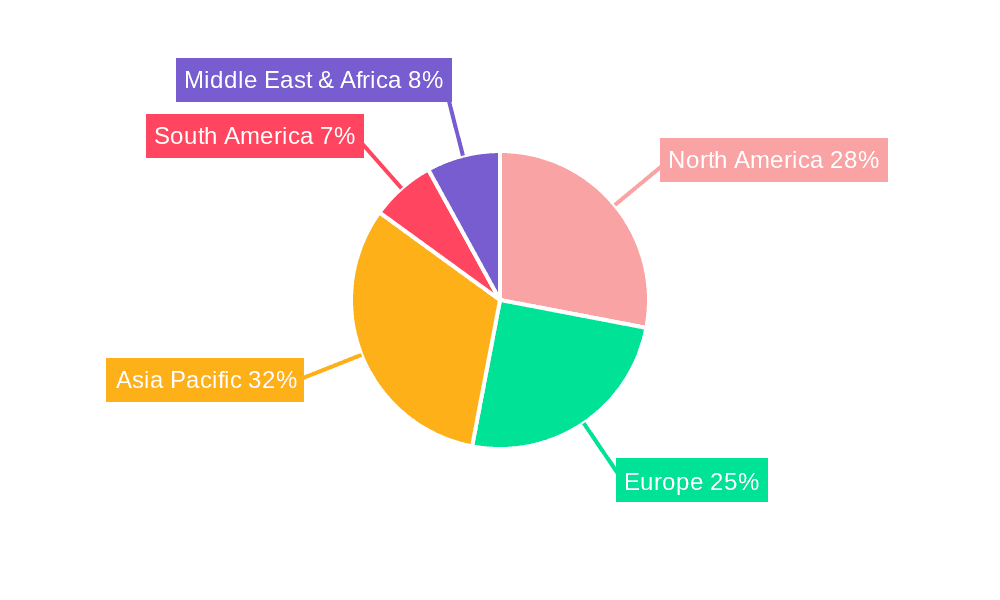

The high-performance fuel injector market is poised for significant growth, with certain regions and segments demonstrating exceptional dominance and future potential. In terms of geographical regions, North America, particularly the United States, is expected to remain a powerhouse in the high-performance fuel injector market. This dominance is fueled by a deeply ingrained automotive culture that embraces performance tuning and modification. The sheer volume of Gasoline Automotive applications, coupled with a robust aftermarket industry that actively seeks out and installs high-performance components, positions North America as a key growth engine. The presence of major automotive manufacturers and a substantial number of performance parts suppliers further solidifies its leading position.

Another region demonstrating considerable influence is Europe. The European market is characterized by a strong demand for high-performance vehicles across various segments, from luxury sports cars to powerful diesel variants. The stringent emission regulations in Europe, while a challenge, also drive innovation in GDI and SDI technologies that enable cleaner and more efficient performance. The significant number of performance-oriented aftermarket tuning companies and a discerning consumer base keen on achieving both power and efficiency contribute to Europe's strong market presence.

Looking at Asia Pacific, the market is experiencing rapid expansion, driven by the burgeoning automotive industry in countries like China, Japan, and South Korea. The increasing disposable incomes in these regions are leading to a greater demand for performance vehicles, both from OEMs and through aftermarket modifications. The report will highlight the growing importance of GDI (Direct Injection) as the preferred technology in this region, owing to its ability to meet both performance and emission standards. Countries like Japan, with its established reputation for automotive engineering excellence, and South Korea, with its rapidly growing domestic automotive brands, are significant contributors.

In terms of dominant segments, the Gasoline Automotive application segment is expected to lead the market growth. This is directly attributable to the widespread adoption of GDI technology in modern gasoline engines designed for performance. The demand for higher horsepower, improved fuel economy, and reduced emissions in gasoline vehicles directly translates to a greater need for sophisticated high-performance fuel injectors. The aftermarket tuning community for gasoline vehicles is vast and actively engaged in upgrading fuel systems to extract maximum potential from their engines.

Within the Type of injector, GDI (Direct Injection) is the undisputed leader and is projected to continue its dominance throughout the forecast period. GDI systems offer superior control over fuel atomization and delivery compared to traditional port injection systems. This precision is crucial for achieving optimal combustion, leading to increased power output, improved fuel efficiency, and lower emissions – all key requirements for high-performance applications. The technological advancements in GDI injectors, including higher injection pressures, finer spray patterns, and faster response times, are continuously pushing the boundaries of engine performance.

The report will provide detailed market share analysis, growth projections, and key influencing factors for each of these dominant regions and segments, offering a comprehensive understanding of where the market's momentum lies. The interplay between OEM adoption and aftermarket demand within these leading segments will be a critical focus of the analysis.

Several key factors are acting as potent growth catalysts for the high-performance fuel injector industry. The relentless pursuit of enhanced engine performance and fuel efficiency by automotive manufacturers is a primary driver. As engines become smaller and more powerful, the demand for precise and efficient fuel delivery systems, like high-performance injectors, escalates. The thriving aftermarket performance tuning and modification sector provides a consistent demand for upgraded injectors, allowing enthusiasts to unlock greater power from their vehicles. Furthermore, the continuous technological advancements in injector design, including improved materials, faster actuation, and advanced control systems, enable the creation of more capable and reliable injectors, driving adoption. Finally, the increasing focus on cleaner combustion and stricter emission regulations indirectly fuels the demand for advanced GDI and SDI injectors that can optimize fuel delivery for reduced environmental impact.

The global high-performance fuel injector market is characterized by the presence of a diverse range of established players and innovative newcomers. These companies are at the forefront of research, development, and manufacturing of advanced fuel injection technologies.

The high-performance fuel injector sector has witnessed numerous significant developments, shaping the market and driving technological advancements:

This comprehensive report offers an exhaustive analysis of the High Performance Fuel Injector market, providing granular insights into market size, segmentation, competitive landscape, and future trends. It meticulously examines the Study Period: 2019-2033, with a Base Year: 2025 and detailed analysis for the Forecast Period: 2025-2033. The report delves into key segments such as GDI, SDI, and TBI types, and their application in Gasoline Automotive, Diesel Automotive, and Industry. It provides critical information on market drivers, challenges, regional dynamics, and the strategic initiatives of leading players like FuelTech, Bosch, Denso, and others. With a focus on actionable intelligence, this report is an indispensable resource for manufacturers, suppliers, investors, and industry stakeholders seeking to capitalize on the evolving opportunities within this dynamic market. The report will provide an in-depth understanding of the market's trajectory, enabling informed decision-making and strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.7%.

Key companies in the market include FuelTech, HPI(Highperformanceinjectors), Bosch, Denso, Delphi, Magneti Marelli, Edelbrock, Keihin, Woodward, Continental, Stanadyne, BorgWarner, Siemens, Nostrum High Performance, Toyota, Honda, Hyundai Kefico, Cosworth, Hitachi, Renesas, TI Automotive, .

The market segments include Type, Application.

The market size is estimated to be USD 1311.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "High Performance Fuel Injector," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High Performance Fuel Injector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.