1. What is the projected Compound Annual Growth Rate (CAGR) of the Hedge Funds?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Hedge Funds

Hedge FundsHedge Funds by Type (Equity Strategy, Macro Strategy, Multi-Strategy, Credit Strategy, Niche Strategy, Relative Value Strategy, Event Driven Strategy, Others), by Application (Institutional Investor, Individual Investor), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

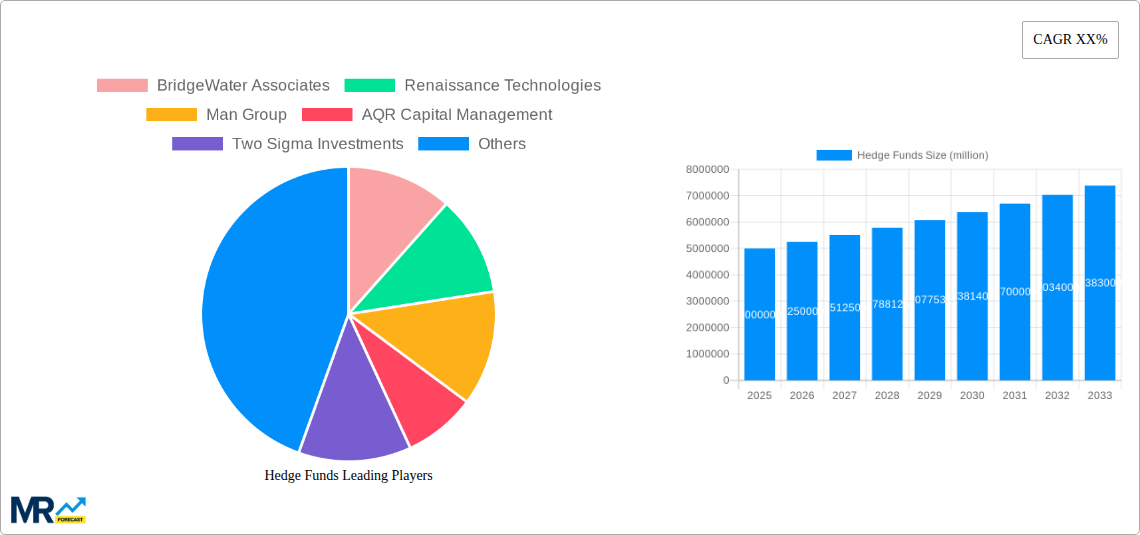

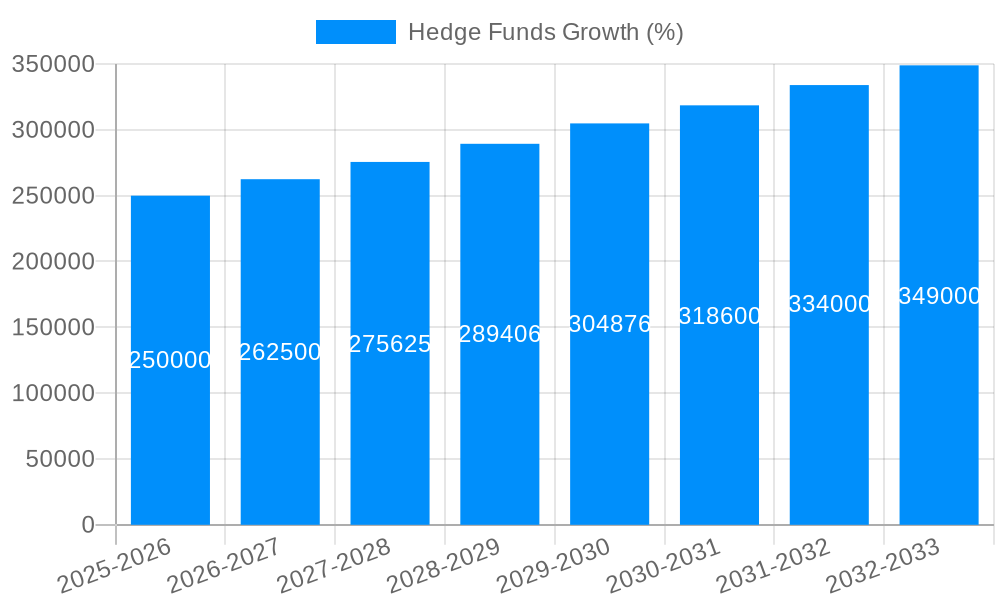

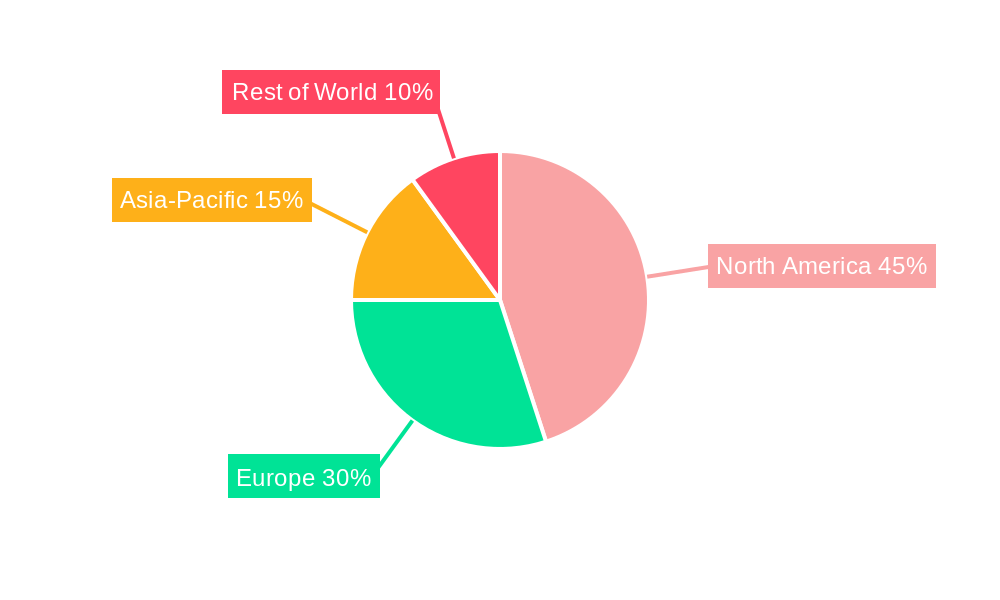

The global hedge fund market, a dynamic and complex investment landscape, is projected to experience substantial growth over the forecast period (2025-2033). While precise figures for market size and CAGR are unavailable, industry analysis suggests a robust expansion fueled by several key drivers. The increasing complexity of global financial markets necessitates sophisticated investment strategies offered by hedge funds, attracting both institutional and individual investors seeking higher returns. Technological advancements, particularly in areas like artificial intelligence and big data analytics, are significantly impacting hedge fund strategies and operational efficiency. Furthermore, the ongoing diversification of investment vehicles and the pursuit of alpha in various market conditions contribute to the sustained growth trajectory. However, regulatory scrutiny, persistent market volatility, and intense competition among established firms and new entrants pose significant challenges. The market is highly segmented, with various strategies (equity, macro, multi-strategy, credit, etc.) catering to distinct investor needs and risk profiles. North America, especially the United States, remains a dominant player, although other regions, like Asia Pacific, are experiencing accelerating growth driven by burgeoning economies and increasing investment sophistication.

Despite these challenges, the long-term outlook remains positive, driven by the continuous search for alternative investment options delivering higher risk-adjusted returns. The shift towards passive investing strategies is expected to continue, albeit not diminishing the demand for actively managed hedge funds, particularly those with demonstrated track records and specialized expertise. The institutional investor segment remains the largest contributor to the market, yet, the individual investor segment is witnessing notable growth as access to alternative investment strategies becomes more streamlined. Key players like Bridgewater Associates, Renaissance Technologies, and BlackRock are likely to maintain significant market share, while smaller, niche players will continue to specialize in specific strategies and segments to carve their own niche within the competitive landscape. The future success of hedge funds hinges on adapting to evolving market conditions, embracing technological innovation, and effectively managing risk amidst regulatory changes.

The global hedge fund industry, boasting assets under management (AUM) exceeding $4 trillion in 2024, is poised for continued evolution over the forecast period (2025-2033). The historical period (2019-2024) witnessed significant shifts, with a noticeable increase in the adoption of alternative investment strategies like quantitative trading and a growing focus on Environmental, Social, and Governance (ESG) factors. While the traditional equity long/short strategy remains prominent, the multi-strategy approach, incorporating elements of macro, credit, and relative value strategies, has experienced substantial growth, driven by its inherent diversification benefits. The increased complexity of global financial markets has fueled demand for sophisticated risk management tools and strategies, benefiting firms with advanced technological capabilities and data analytics expertise. Furthermore, the regulatory landscape continues to evolve, with increased scrutiny on transparency and fees, forcing hedge fund managers to adapt and demonstrate strong performance justification. The rise of fintech and the increasing accessibility of sophisticated trading technology have also fostered the emergence of smaller, more nimble hedge funds, challenging the dominance of established giants. Competition is fierce, with firms vying for limited talent and seeking to differentiate themselves through specialized expertise and unique investment approaches. The estimated AUM for 2025 sits around $4.5 trillion, indicating a robust and dynamic market primed for further expansion and innovation. The forecast period will likely see a continuation of these trends, with further diversification of strategies and increasing specialization within niche areas. The integration of artificial intelligence and machine learning into investment strategies is expected to become increasingly prominent, transforming the industry's operational efficiency and investment decision-making processes.

Several key factors are fueling the growth of the hedge fund industry. Firstly, persistently low interest rates in many developed economies continue to push investors towards higher-yielding alternatives. Hedge funds, with their potential for superior risk-adjusted returns, are a natural destination for this capital. Secondly, the increasing complexity and volatility of global markets are driving demand for sophisticated investment management expertise. Hedge funds, with their flexible investment mandates and access to diverse strategies, are well-positioned to navigate these turbulent waters. Thirdly, the growing pool of high-net-worth individuals and institutional investors seeking alpha generation (above-market returns) is significantly boosting the industry's AUM. Fourthly, technological advancements, particularly in areas like artificial intelligence and big data analytics, are enhancing the efficiency and effectiveness of hedge fund operations, leading to improved performance and cost reductions. Finally, the ongoing evolution of regulatory frameworks, while presenting challenges, is also fostering greater transparency and investor confidence, attracting more capital into the sector. The interplay of these factors creates a potent engine driving the sustained growth trajectory of the global hedge fund industry.

Despite the promising outlook, the hedge fund industry faces significant headwinds. High fees remain a persistent point of contention for investors, putting pressure on fund managers to justify their performance relative to alternative investments. The regulatory environment continues to tighten, increasing compliance costs and potentially limiting investment strategies. Furthermore, the industry faces intense competition, both from established players and emerging competitors employing innovative technologies and strategies. The persistent search for alpha in increasingly efficient markets is challenging, requiring managers to consistently adapt and innovate to maintain a competitive edge. Attracting and retaining top talent is crucial but also expensive, impacting profitability. Geopolitical uncertainties and macroeconomic volatility contribute to market unpredictability, making consistent performance difficult to guarantee. Finally, periodic market downturns can significantly impact investor sentiment and AUM, putting pressure on even the most successful firms. Effectively managing these challenges is crucial for the long-term sustainability and growth of the hedge fund industry.

North America (United States): The US remains the dominant force in the hedge fund industry, accounting for a significant majority of global AUM. This is driven by a confluence of factors including a large pool of high-net-worth individuals, sophisticated institutional investors, and a well-established regulatory framework, albeit complex. New York and Connecticut remain key hubs.

Europe: While lagging behind North America, Europe holds a significant share of the global market, with London and other major financial centers serving as important hubs. Regulatory changes (like Brexit) impact the industry's composition, but substantial AUM remains.

Asia: Asia's hedge fund industry is growing rapidly, driven by the increasing wealth in countries like China and Hong Kong. However, regulatory hurdles and infrastructure development still represent some limitations.

Dominant Segment: Multi-Strategy: Multi-strategy hedge funds represent a compelling investment vehicle, offering diversification across various market conditions. Their ability to adapt to changing market dynamics and allocate capital across various asset classes, including equities, fixed income, and derivatives, makes them attractive to investors seeking reduced risk and higher potential returns. This segment's dominance reflects the industry's increasing sophistication and its embrace of dynamic, flexible strategies. The growth of this segment can be partly attributed to the increased adoption of quantitative strategies and algorithmic trading, allowing for more efficient portfolio construction and risk management.

Dominant Application: Institutional Investors: Institutional investors, including pension funds, endowments, and insurance companies, constitute the primary client base for hedge funds. These entities often possess significant capital and a long-term investment horizon, making them ideal partners for sophisticated investment strategies. Their investment mandates and risk tolerances align closely with the offerings of hedge funds, ensuring a strong symbiotic relationship.

The hedge fund industry's continued growth is fueled by several factors. Increased demand from sophisticated investors seeking alternative investments to traditional assets, combined with the potential for higher risk-adjusted returns, underpins this trajectory. The rise of sophisticated investment strategies and the increased utilization of technology and data analytics drive efficiency and improved performance, adding further momentum. Ultimately, successful adaptation to evolving market conditions and proactive risk management strategies are crucial for sustaining growth in this dynamic landscape.

This report provides a detailed analysis of the hedge fund industry, covering historical performance, current trends, and future projections. It examines key drivers of growth, emerging challenges, and the leading players shaping the sector. The study period from 2019 to 2033 provides a comprehensive overview, with a focus on the forecast period from 2025 to 2033. Market segmentation by strategy and investor type offers a granular understanding of the market dynamics. The report's insights are vital for investors, fund managers, and industry stakeholders seeking to navigate the complexities and opportunities of the global hedge fund market. The base year is 2025, and the estimated year is 2025. The report provides valuable data points in millions of units to showcase the scale of AUM and other industry metrics.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BridgeWater Associates, Renaissance Technologies, Man Group, AQR Capital Management, Two Sigma Investments, Millennium Management, Elliot Management, BlackRock, Citadel, Davidson Kempner Capital, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Hedge Funds," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Hedge Funds, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.