1. What is the projected Compound Annual Growth Rate (CAGR) of the Hedge Funds?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Hedge Funds

Hedge FundsHedge Funds by Type (/> Equity Strategy, Macro Strategy, Multi-Strategy, Credit Strategy, Niche Strategy, Relative Value Strategy, Event Driven Strategy, Others), by Application (/> Institutional Investor, Individual Investor), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

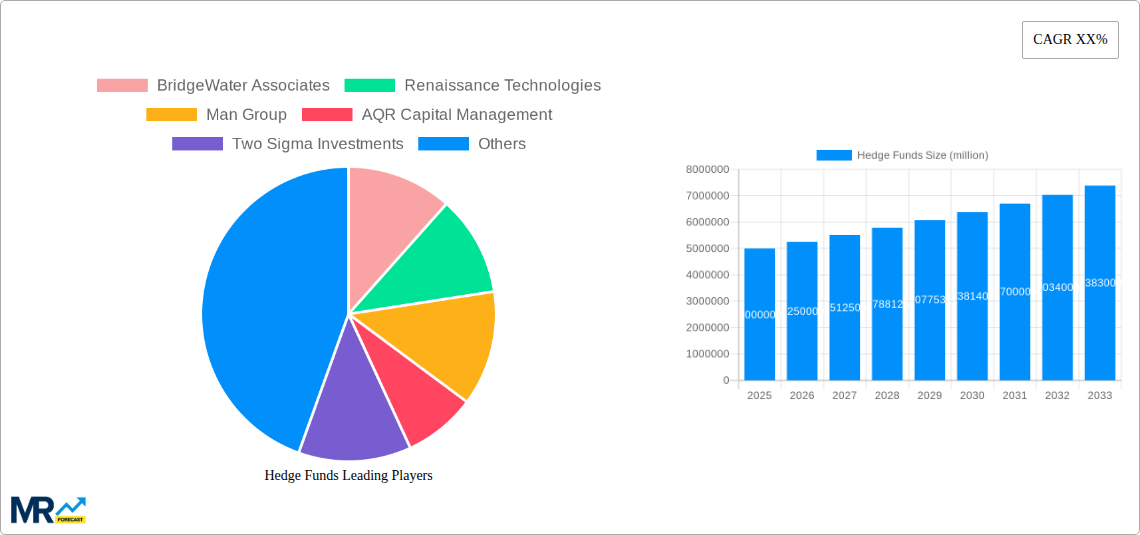

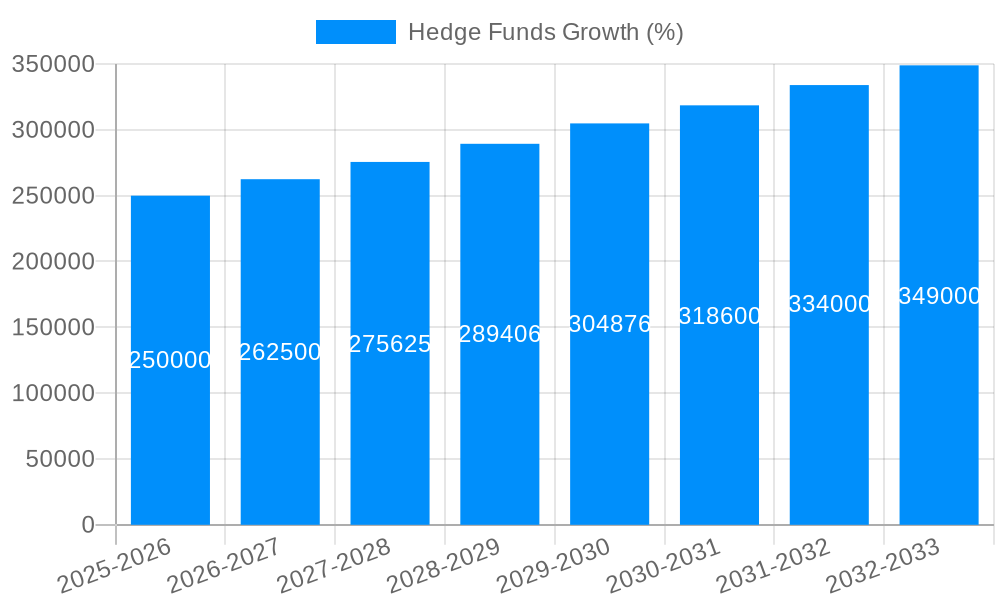

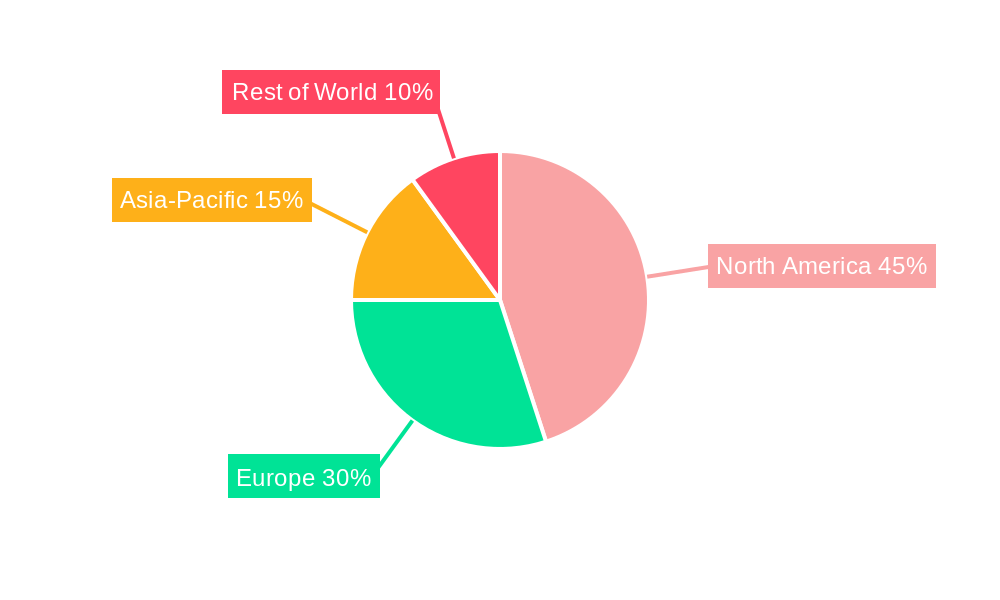

The global hedge fund industry, populated by giants like Bridgewater Associates, Renaissance Technologies, and BlackRock, is a dynamic and lucrative sector characterized by significant growth potential. While precise figures for market size and CAGR are unavailable, industry reports suggest a substantial market value, potentially exceeding several trillion dollars in 2025, with a compound annual growth rate (CAGR) likely in the low-to-mid single digits over the forecast period (2025-2033). This growth is driven by several factors, including increasing institutional investor participation seeking alpha in diverse market conditions, the ongoing development of sophisticated quantitative trading strategies, and the expansion of alternative investment strategies into emerging markets. Trends point towards increased adoption of technology, including AI and machine learning, for portfolio management and risk assessment, as well as a shift towards more sustainable and ESG-conscious investment approaches. However, regulatory scrutiny, heightened competition, and periodic market downturns present significant challenges that could restrain future growth. The industry is segmented by strategy (e.g., long-short equity, global macro, distressed debt), investor type (institutional, high-net-worth individuals), and geographic region, with North America and Europe currently dominating the market share.

The forecast period (2025-2033) presents both opportunities and risks. While the industry's overall growth is projected to continue, the rate of expansion will likely fluctuate based on macroeconomic conditions and investor sentiment. Successful hedge funds will need to adapt to changing market dynamics, embracing technological innovation, maintaining strong risk management practices, and consistently delivering alpha to attract and retain investors. Competition among established players and the emergence of new entrants will further intensify the pressure on profitability and performance. The continued evolution of regulatory frameworks across global jurisdictions will also play a crucial role in shaping the industry's landscape in the years to come.

The global hedge fund industry, a cornerstone of alternative investments, navigated a period of significant transformation between 2019 and 2024. The historical period (2019-2024) witnessed fluctuating performance across various strategies, with some experiencing substantial growth while others struggled to maintain profitability. Macroeconomic factors, including interest rate hikes and geopolitical uncertainty, heavily influenced investment decisions and returns. The base year, 2025, presents a relatively stable, albeit cautious, outlook. Assets under management (AUM) experienced moderate growth, driven primarily by increased investor interest in diversifying portfolios amidst market volatility. Several leading firms like Bridgewater Associates and Renaissance Technologies continued to dominate the market, leveraging their established track records and sophisticated quantitative strategies. However, increased regulatory scrutiny and the rise of alternative investment vehicles, such as private equity and venture capital, presented new challenges. The forecast period (2025-2033) anticipates continued growth, albeit at a potentially slower pace than previously observed. Technological advancements, including artificial intelligence and machine learning, are expected to play a progressively larger role in investment strategies, further shaping the competitive landscape. The industry is predicted to witness further consolidation, with larger firms acquiring smaller ones to achieve economies of scale and expand their service offerings. Increased competition is expected from both established players and new entrants, particularly those offering specialized strategies and niche market expertise. Furthermore, the industry's sustainability initiatives, driven by growing environmental, social, and governance (ESG) concerns, will continue influencing investment decisions and regulatory requirements. The overall trend suggests a maturing industry, adapting to evolving market conditions and investor preferences, with technology and regulatory factors playing increasingly crucial roles. AUM is projected to reach $X trillion by 2033, representing a CAGR of Y%.

Several key factors fuel the continued growth and evolution of the hedge fund industry. Firstly, the persistent demand for alpha generation in an increasingly volatile and complex global financial environment propels investors towards hedge funds' potential for superior risk-adjusted returns. Sophisticated quantitative strategies, leveraging advanced data analytics and artificial intelligence, provide a competitive edge, allowing for identifying and exploiting market inefficiencies with greater precision. Secondly, the increasing complexity of global markets, including the emergence of new asset classes and trading instruments, necessitates specialized expertise, a strength of the hedge fund industry. This specialization allows funds to focus on specific niches, providing investors with tailored exposure to various market segments and strategies. Thirdly, the rise of institutional investors, such as pension funds and sovereign wealth funds, significantly increases the industry's AUM. These large-scale investors seek diversification and enhanced risk management capabilities, both of which are readily offered by hedge funds. Lastly, ongoing technological advancements and their integration into trading strategies and portfolio management provide hedge funds with a considerable advantage, leading to efficiency improvements and enhanced investment performance. These advancements, encompassing machine learning and high-frequency trading algorithms, continuously redefine the industry's capabilities, bolstering its attractiveness to investors seeking optimized returns.

Despite the growth potential, the hedge fund industry faces substantial challenges. Regulatory scrutiny has intensified in recent years, with increased pressure to enhance transparency and improve risk management practices. Compliance costs have risen significantly, impacting profitability, especially for smaller firms. Furthermore, the high fees charged by many hedge funds are a persistent concern for investors. The ongoing debate regarding value versus performance pressures firms to continuously demonstrate superior returns to justify their costs. In addition, intense competition exists within the industry, particularly among larger firms with established track records and extensive resources. This competition drives down fees, squeezing profit margins, and necessitates constant innovation to remain competitive. Attracting and retaining top talent remains a crucial challenge, as skilled portfolio managers and quantitative analysts are in high demand across various financial institutions. Finally, market volatility and macroeconomic uncertainty represent ongoing risks, impacting investment performance and investor sentiment. The industry's dependence on market conditions necessitates adaptability and robust risk management capabilities to navigate these challenges successfully.

North America (United States): Remains the dominant region, accounting for the largest share of global hedge fund AUM, primarily due to the presence of significant investment capital and a well-developed financial infrastructure. The sophisticated regulatory environment, while demanding, fosters trust and transparency, attracting both domestic and international investors. Many of the leading hedge fund firms are headquartered in the US, including Bridgewater Associates, Renaissance Technologies, and Citadel, further solidifying its position as the leading hub. This is further supported by a robust ecosystem of service providers, such as legal, accounting, and technology firms, all of which contribute to the smooth functioning of the industry.

Europe (UK & Western Europe): Europe, particularly the UK and Western European nations, maintains a strong presence, drawing on a rich history of financial innovation and attracting significant foreign investments. However, Brexit and regulatory changes have presented some challenges in recent years, influencing AUM growth in the region. London continues to be a significant hub, but other European financial centers are emerging as alternative locations, presenting both opportunities and competition.

Asia (Hong Kong & Singapore): Asia's growing economic influence and increasing high-net-worth individuals are fostering the growth of hedge funds, particularly in key financial hubs like Hong Kong and Singapore. The region’s strategic location and growing domestic markets create an attractive environment for both local and international hedge fund managers. While this region presents significant growth opportunities, regulatory frameworks and market access can be more complex compared to North America.

Long/Short Equity: This remains a dominant investment strategy, offering both upside potential and downside protection. Its versatility and adaptability to various market conditions continue to attract considerable investor interest.

Quantitative/Systematic Strategies: Increasing reliance on data analysis and algorithmic trading is creating demand for specialized quantitative strategies. These strategies aim to identify and exploit market inefficiencies, often using advanced mathematical models and machine learning techniques. The industry’s rapid technological development will likely bolster the growth of such strategies.

Multi-Strategy Funds: These funds allocate capital across multiple investment strategies, offering investors diversification and exposure to a broader range of opportunities. Their flexibility allows them to adapt to shifting market conditions, benefiting from the strengths of various underlying strategies.

Several factors are driving growth in the hedge fund industry. The increasing complexity of global markets and the search for alpha are key drivers, making the specialized expertise of hedge funds increasingly attractive. Technological advancements, such as artificial intelligence and machine learning, are enhancing investment strategies, improving efficiency and boosting returns. Furthermore, the growing pool of institutional investors seeking diversification and enhanced risk management further fuels the industry's expansion.

This report provides a comprehensive overview of the global hedge fund industry, encompassing historical performance, current market trends, and future growth prospects. Analysis includes leading players, key strategies, challenges, and future catalysts that will reshape the industry over the forecast period (2025-2033). The report is essential for investors, industry professionals, and researchers seeking a detailed understanding of this complex and dynamic sector. The projections are based on rigorous market research and include analysis of macroeconomic factors, regulatory developments, and technological advancements influencing the hedge fund landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BridgeWater Associates, Renaissance Technologies, Man Group, AQR Capital Management, Two Sigma Investments, Millennium Management, Elliot Management, BlackRock, Citadel, Davidson Kempner Capital.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Hedge Funds," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Hedge Funds, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.