1. What is the projected Compound Annual Growth Rate (CAGR) of the Heavy lifting and Haulage?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Heavy lifting and Haulage

Heavy lifting and HaulageHeavy lifting and Haulage by Type (Mobile/Crawler/Lorry Cranes, Prime Movers, Multiple-axles Modular Trailer), by Application (Oil & Gas, Construction, General Industry, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

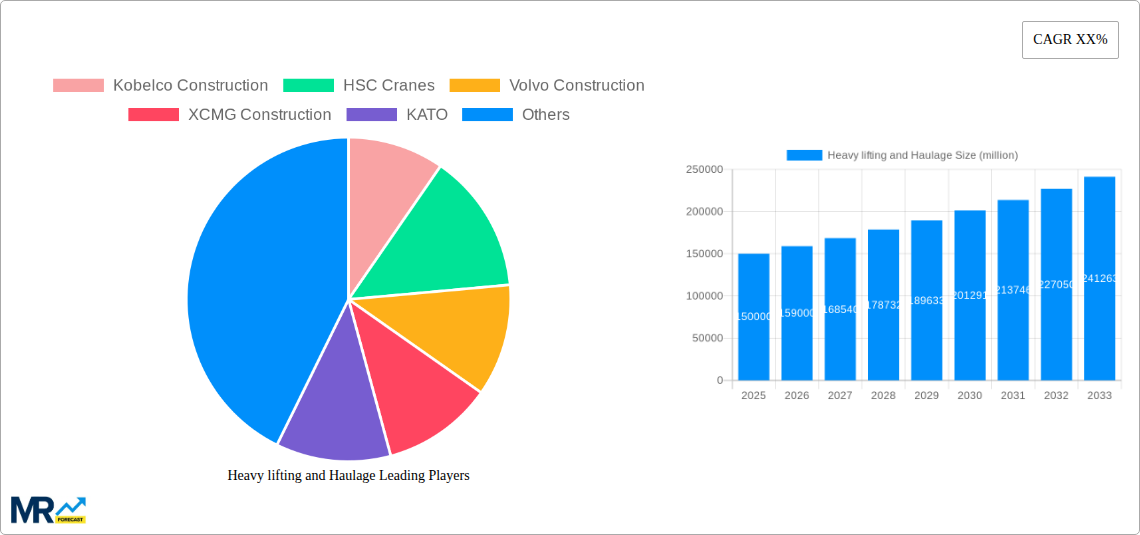

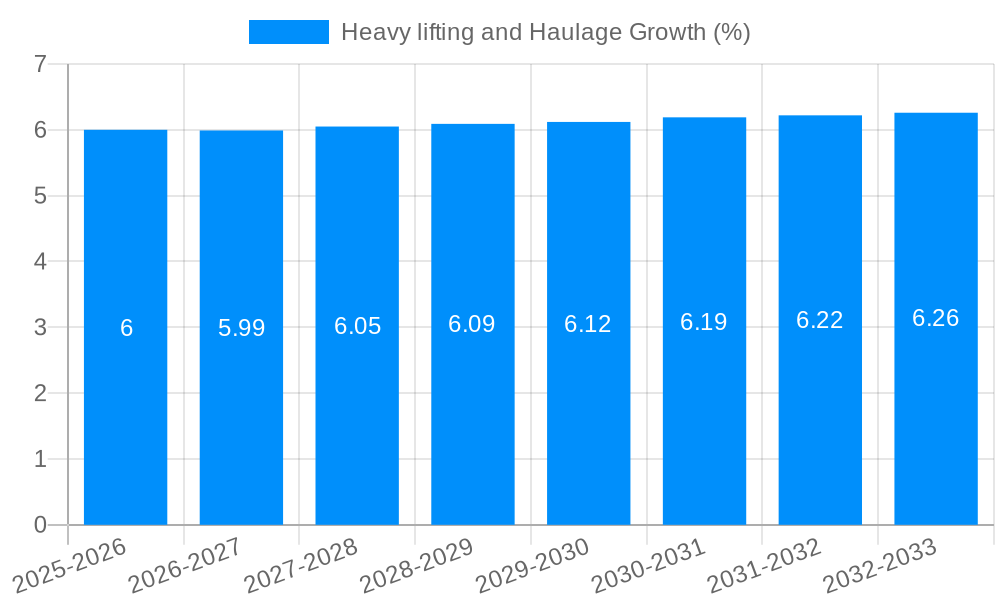

The global heavy lifting and haulage market is poised for significant expansion, projected to reach approximately $150 billion by 2025, driven by robust growth across key industries and strategic infrastructure development. This substantial market size underscores the critical role of specialized equipment and services in facilitating complex logistical operations. The market is expected to witness a Compound Annual Growth Rate (CAGR) of around 6%, signifying sustained upward momentum. This growth is primarily fueled by the burgeoning construction sector, particularly in emerging economies, and the ongoing expansion of the oil and gas industry which demands heavy-duty lifting and transportation for exploration, extraction, and refining activities. Furthermore, advancements in crane technology, including the development of more powerful, versatile, and environmentally friendly mobile and crawler cranes, are directly contributing to market expansion. The increasing adoption of sophisticated hauling solutions, such as multiple-axle modular trailers, enables the efficient and safe movement of oversized and overweight cargo, further bolstering market demand.

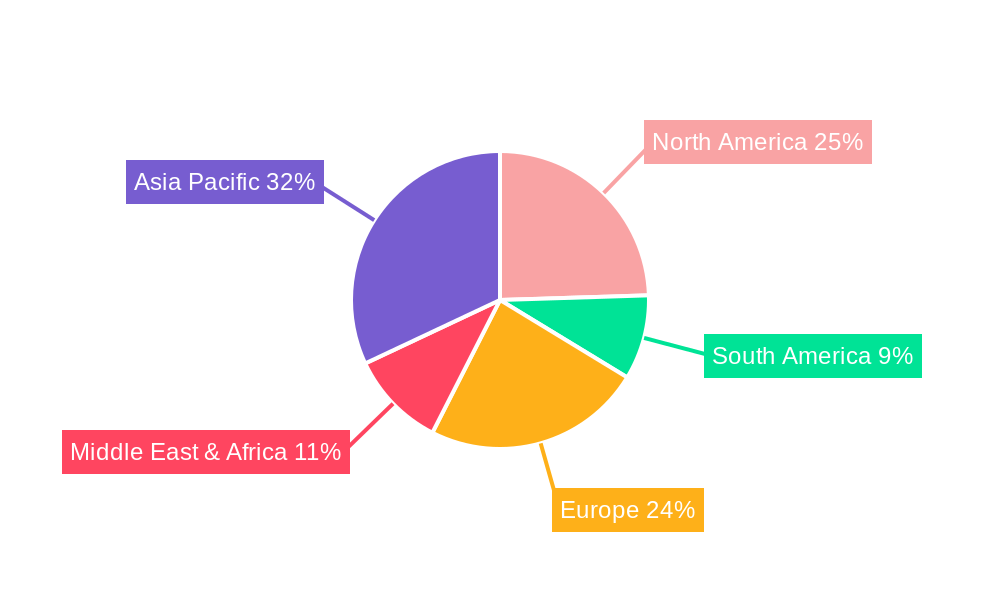

The competitive landscape is characterized by the presence of a few dominant global players and a multitude of regional specialists, each vying for market share through innovation, strategic partnerships, and a focus on operational efficiency. Key market restraints include stringent environmental regulations and the high capital investment required for acquiring and maintaining heavy lifting and haulage equipment. However, the persistent need for large-scale infrastructure projects, including renewable energy installations, transportation networks, and industrial facilities, coupled with the growing demand for specialized services in sectors like mining and logistics, is expected to outweigh these challenges. Regional dynamics reveal Asia Pacific as a major growth engine due to rapid industrialization and infrastructure investment, while North America and Europe remain mature yet crucial markets, characterized by technological adoption and complex project demands. The Middle East & Africa region presents significant untapped potential, particularly within the oil and gas and construction sectors.

Here's a unique report description on Heavy Lifting and Haulage, incorporating your specific requirements:

The global heavy lifting and haulage market is poised for significant expansion, driven by a confluence of infrastructural development, industrial growth, and technological advancements. Our comprehensive analysis, spanning the Study Period of 2019-2033, with a Base Year of 2025 and Estimated Year of 2025, forecasts a robust trajectory for this critical sector. The Historical Period (2019-2024) has witnessed a steady rise, fueled by increasing investments in energy projects, particularly in the Oil & Gas segment, and a resurgence in construction activities worldwide. The Forecast Period (2025-2033) is expected to see this momentum accelerate. The market's value is projected to reach millions of dollars by the end of the forecast period, underscoring its substantial economic importance. Key trends indicate a growing demand for high-capacity cranes, particularly mobile and crawler variants, capable of handling increasingly complex and heavy loads. The integration of advanced telematics and automation in haulage solutions is also a defining characteristic, enhancing efficiency, safety, and precision. Furthermore, the shift towards renewable energy infrastructure, such as wind farms, is opening up new avenues for specialized heavy lifting and haulage services, requiring innovative equipment and logistical strategies. The evolving regulatory landscape and a heightened focus on environmental sustainability are also shaping market dynamics, pushing for more fuel-efficient machinery and eco-friendly operational practices. The increasing adoption of sophisticated project management software and digital twins for planning and execution further optimizes complex lifting and hauling operations.

The heavy lifting and haulage industry is experiencing a powerful surge, propelled by several interconnected factors. The most significant driver is the global commitment to massive infrastructural projects. Governments worldwide are injecting substantial capital into upgrading existing infrastructure and building new transportation networks, including roads, bridges, and railways. This necessitates the movement of extraordinarily heavy components and materials, directly benefiting the heavy lifting and haulage sector. Accompanying this is the ongoing expansion and modernization of the Oil & Gas industry, particularly in emerging economies. The exploration and extraction of resources, along with the construction of refineries and pipelines, demand specialized heavy-duty equipment capable of operating in challenging environments. The burgeoning renewable energy sector is another key propellant. The installation of wind turbines, solar farms, and hydroelectric power plants involves lifting and transporting components that are often oversized and exceptionally heavy. This trend is creating a strong demand for specialized lifting solutions and expert haulage services. Finally, rapid urbanization and industrialization, especially in Asia-Pacific, are creating a sustained need for construction of commercial buildings, manufacturing facilities, and logistics hubs, all of which rely heavily on proficient heavy lifting and haulage operations for material handling and equipment deployment.

Despite the robust growth prospects, the heavy lifting and haulage market is not without its hurdles. A primary challenge is the significant capital investment required for acquiring and maintaining advanced heavy lifting equipment and specialized haulage vehicles. The sheer cost of these assets, coupled with their complex maintenance needs, can be a barrier for smaller companies and can impact profitability. Moreover, the availability of skilled labor is a growing concern. Operating sophisticated cranes and managing complex haulage logistics requires highly trained and experienced professionals. A shortage of such talent can lead to project delays and increased operational costs. Regulatory complexities also pose a significant restraint. Navigating diverse and often stringent regulations related to transportation permits, load limits, road safety, and environmental compliance across different regions can be time-consuming and resource-intensive. Furthermore, the susceptibility of the industry to economic downturns and geopolitical instability cannot be overlooked. Fluctuations in global commodity prices, project funding disruptions, and unforeseen political events can significantly impact demand for heavy lifting and haulage services. Finally, the inherent risks associated with handling extremely heavy loads, including the potential for accidents, necessitates stringent safety protocols and can lead to increased insurance premiums, adding to operational expenses.

The global heavy lifting and haulage market is characterized by distinct regional dominance and segment leadership, with the Construction segment emerging as a pivotal force, particularly within the Asia-Pacific region.

The Asia-Pacific region is poised to lead the market due to a dynamic combination of rapid economic growth, extensive urbanization, and ambitious governmental investments in infrastructure development. Countries like China, India, and Southeast Asian nations are witnessing unprecedented construction activities, ranging from the development of smart cities and high-speed rail networks to the expansion of airports and ports. These projects invariably require the lifting and transportation of massive structural components, pre-fabricated units, and heavy machinery, creating a sustained and substantial demand for heavy lifting and haulage services. The sheer scale of ongoing and planned infrastructure projects, coupled with a burgeoning manufacturing sector, solidifies Asia-Pacific's position as the dominant market.

Within this expansive regional landscape, the Construction segment is unequivocally the primary driver of market growth. This segment encompasses a wide array of applications, including:

The synergy between the massive infrastructural push in Asia-Pacific and the inherent demands of the construction sector creates a self-reinforcing growth cycle. Companies operating in this region benefit from large-scale projects that offer significant revenue potential, while the availability of advanced lifting and haulage solutions enables the execution of these complex endeavors. The increasing adoption of advanced construction techniques and technologies, such as modular construction and pre-fabrication, further amplifies the demand for specialized heavy haulage and precision lifting services within the construction segment. The presence of major players like XCMG Construction, Sany, and Zoomlion, all headquartered in China, further underscores the dominance of this region and segment. The continuous influx of investment into infrastructure and construction, projected to continue through the Forecast Period (2025-2033), ensures that this dominance will persist.

Several key factors are acting as significant growth catalysts for the heavy lifting and haulage industry. The unrelenting global demand for enhanced infrastructure, driven by urbanization and economic development, provides a foundational catalyst. Additionally, the ongoing energy transition, with its focus on renewable energy projects like wind and solar farms, creates a new and expanding market for specialized heavy lifting solutions. The increasing adoption of advanced technologies, such as AI-powered route optimization, autonomous haulage systems, and sophisticated crane management software, is enhancing efficiency and safety, thereby driving demand for modern equipment and services. Finally, government incentives and supportive policies aimed at boosting infrastructure development and industrial growth in key emerging economies are further fueling market expansion.

This report offers an in-depth and all-encompassing analysis of the global heavy lifting and haulage market. It delves into the intricate market dynamics, providing detailed insights into current trends, historical performance, and future projections. The report meticulously examines the driving forces that are propelling the industry forward, alongside the challenges and restraints that market participants must navigate. Furthermore, it identifies key regions and segments poised for significant growth, offering strategic perspectives on market dominance. Crucially, the report includes a comprehensive overview of leading players and their contributions, as well as a timeline of significant industry developments. This detailed coverage ensures stakeholders have a holistic understanding of the market landscape, enabling informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Kobelco Construction, HSC Cranes, Volvo Construction, XCMG Construction, KATO, Terex Corporation, Volkswagen Truck & Bus, Zoomlion, Sany, Tadano Ltd, Liebherr, Cargotec, MANITOWOC, FUWA, Konecranes, CHINA HEAVY LIFT, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Heavy lifting and Haulage," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Heavy lifting and Haulage, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.