1. What is the projected Compound Annual Growth Rate (CAGR) of the Healthcare Data Collection and Labeling?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Healthcare Data Collection and Labeling

Healthcare Data Collection and LabelingHealthcare Data Collection and Labeling by Type (Audio, Image, World Healthcare Data Collection and Labeling Production ), by Application (Biotech, Dentistry, Diagnostic Centers, Others, World Healthcare Data Collection and Labeling Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

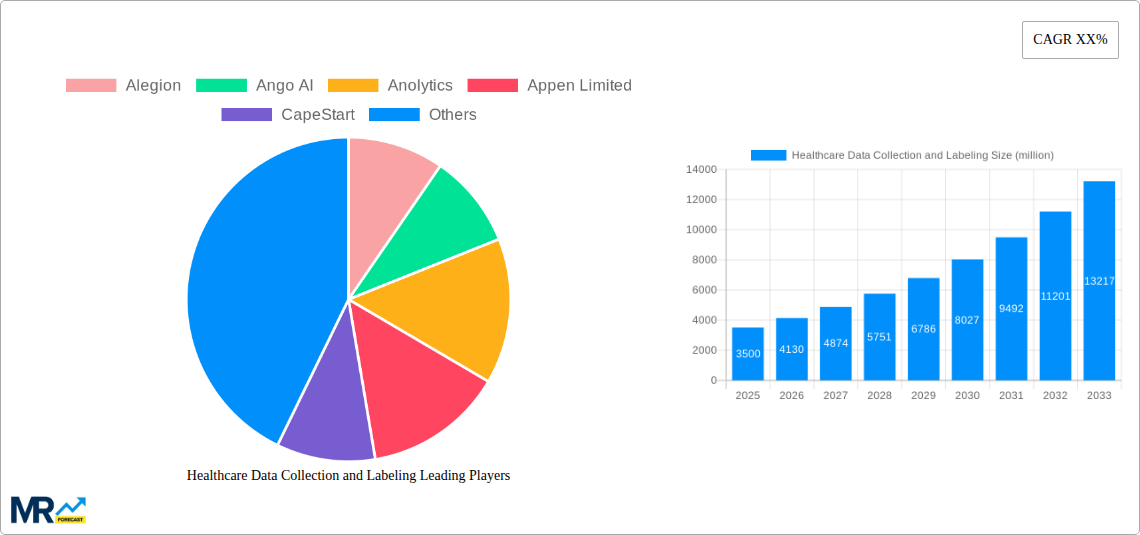

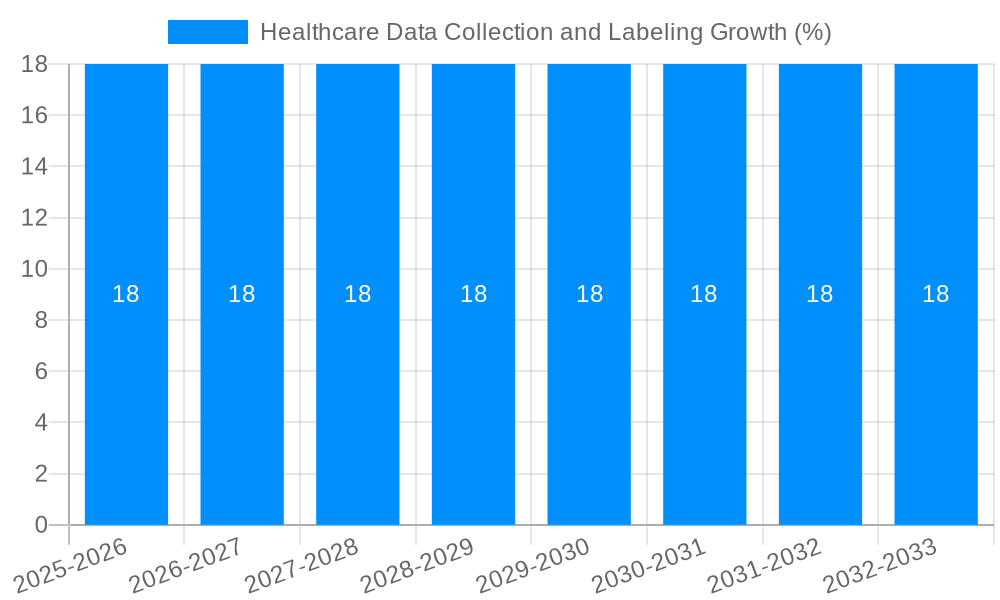

The global healthcare data collection and labeling market is experiencing robust expansion, driven by the escalating demand for high-quality, annotated data to fuel advancements in AI and machine learning within the healthcare sector. With an estimated market size of approximately USD 3,500 million in 2025, the sector is projected to witness a Compound Annual Growth Rate (CAGR) of around 18% through 2033. This impressive growth is intrinsically linked to the transformative potential of AI in areas such as drug discovery, personalized medicine, diagnostic imaging analysis, and clinical trial optimization. As healthcare organizations increasingly leverage data-driven insights to improve patient outcomes, reduce costs, and enhance operational efficiency, the need for accurate and comprehensive data annotation across diverse modalities like audio, image, and patient records becomes paramount. The burgeoning volume of healthcare data, coupled with the complexity and sensitivity of medical information, necessitates specialized expertise in data collection and labeling, thus underpinning the market's upward trajectory.

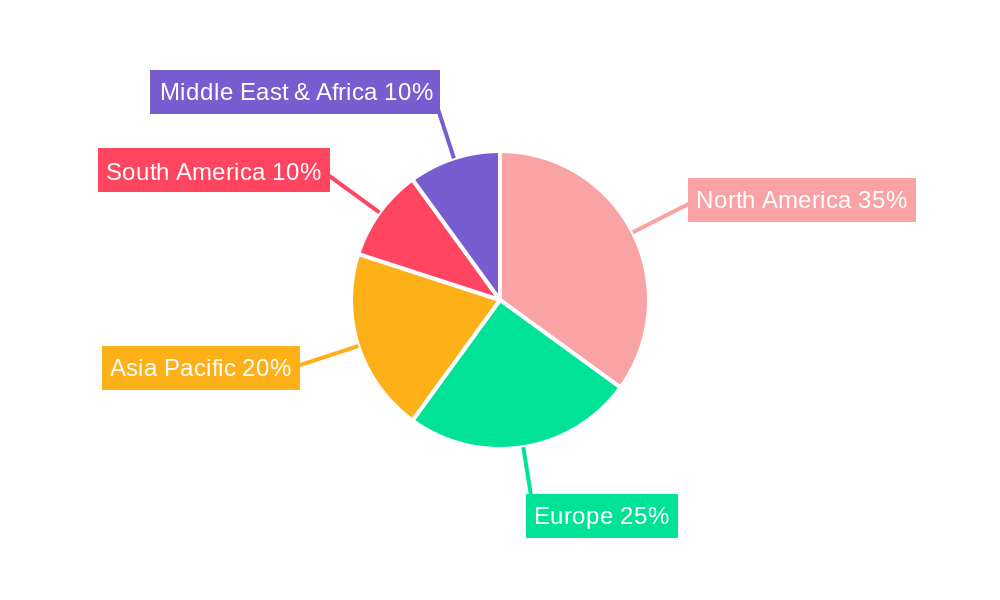

Key market drivers include the accelerating adoption of AI-powered diagnostic tools, the growing prevalence of chronic diseases requiring continuous patient monitoring and data analysis, and the increasing investments in digital health solutions. The market's segmentation by type reveals a strong demand for image labeling for radiology, pathology, and dermatology applications, alongside audio labeling for telehealth consultations and voice-activated medical devices. Furthermore, the application landscape highlights significant growth in the biotech sector for R&D, dentistry for image analysis, and diagnostic centers for improved diagnostic accuracy. Geographically, North America, led by the United States, is expected to dominate the market due to its advanced healthcare infrastructure, substantial AI research, and significant R&D expenditure. Asia Pacific, particularly China and India, is emerging as a high-growth region, fueled by a large patient population, increasing healthcare digitization, and a growing pool of skilled data annotators. Despite the immense potential, challenges such as data privacy regulations (e.g., HIPAA, GDPR), the need for domain-specific expertise, and the potential for bias in labeled data present areas that require careful navigation by market participants.

This comprehensive report, Healthcare Data Collection and Labeling: A Deep Dive into the $150 Million Market (2019-2033), provides an in-depth analysis of the burgeoning global market for healthcare data collection and labeling. With a current estimated market size of $25.5 million in 2025, projected to reach a substantial $150.7 million by 2033, this study meticulously examines the pivotal role of accurate and expertly labeled data in powering advancements across the healthcare spectrum. The report covers a critical study period from 2019 to 2033, with a base year of 2025 and a detailed forecast period from 2025-2033, building upon a robust historical period of 2019-2024.

The report delves into the multifaceted landscape of healthcare data, encompassing various data types, applications, and industry-wide developments. We explore the critical contributions of leading companies, analyze the driving forces and inherent challenges, and identify key regional and segment dominance. This research is indispensable for stakeholders seeking to navigate the complexities and capitalize on the immense opportunities within this rapidly evolving sector.

The global healthcare data collection and labeling market is witnessing a transformative surge, driven by the exponential growth of artificial intelligence (AI) and machine learning (ML) applications within the medical domain. From 2019 to 2024, the market has experienced a steady ascent, laying the groundwork for the projected significant expansion. The base year of 2025 marks a pivotal point, with an estimated market valuation of $25.5 million, poised for accelerated growth in the subsequent forecast period of 2025-2033. This trend is underpinned by an increasing demand for high-quality, annotated data essential for training sophisticated AI algorithms that power diagnostic tools, drug discovery platforms, personalized medicine initiatives, and robotic surgery. The sheer volume of healthcare data generated daily, from electronic health records (EHRs) and medical images to genomic sequences and wearable device outputs, presents both an opportunity and a significant challenge. Organizations are increasingly recognizing that the value of this data is unlocked only through meticulous collection and precise labeling.

Key market insights reveal a growing preference for specialized labeling services that cater to the unique nuances of medical data. This includes the precise annotation of medical images (X-rays, CT scans, MRIs), the transcription and semantic labeling of clinical audio recordings, and the structured labeling of patient-reported outcomes. The complexity of medical terminology, the need for domain expertise, and stringent regulatory compliance (like HIPAA and GDPR) necessitate highly skilled annotators and robust quality control mechanisms. Consequently, there's a notable trend towards outsourcing these critical tasks to specialized data labeling companies. These companies are investing heavily in AI-powered annotation tools, advanced workflows, and dedicated quality assurance teams to ensure the accuracy and consistency required by the healthcare industry. The market is also seeing a rise in the adoption of federated learning and privacy-preserving techniques, enabling data annotation without compromising patient confidentiality, thus further expanding the potential for data utilization. The market's trajectory indicates a clear shift towards sophisticated data annotation solutions that can handle diverse data types and complex labeling requirements, making it an indispensable component of modern healthcare innovation.

The healthcare data collection and labeling market is experiencing robust growth, propelled by a confluence of powerful driving forces. Foremost among these is the escalating adoption of Artificial Intelligence (AI) and Machine Learning (ML) across various healthcare applications. The ability of AI algorithms to analyze vast datasets and identify subtle patterns is revolutionizing diagnostics, leading to earlier disease detection and more accurate prognoses. This, in turn, necessitates an immense supply of precisely labeled data to train these sophisticated algorithms effectively. The estimated market size of $25.5 million in 2025 is a testament to this foundational need.

Furthermore, the relentless pursuit of personalized medicine is a significant catalyst. By analyzing individual patient data, including genetic information, lifestyle factors, and treatment responses, healthcare providers can tailor treatments for optimal outcomes. The collection and meticulous labeling of this highly granular data are crucial for building these personalized models. The burgeoning field of medical imaging analysis, from identifying anomalies in X-rays to segmenting tumors in MRIs, relies heavily on accurately annotated images. This demand for visual data labeling is a substantial contributor to market expansion. Additionally, the increasing focus on preventative care and remote patient monitoring, facilitated by wearable devices and IoT sensors, generates a continuous stream of real-time data that requires careful collection and interpretation, further fueling the need for labeling services. The drive towards improving operational efficiency within healthcare institutions also plays a role, as labeled data can be used to optimize resource allocation, streamline administrative processes, and predict patient flow.

Despite the significant growth trajectory, the healthcare data collection and labeling market faces several formidable challenges and restraints that temper its expansion. The paramount concern revolves around data privacy and security. Healthcare data is highly sensitive, and strict regulations such as HIPAA in the United States and GDPR in Europe impose stringent requirements on its collection, storage, and labeling. Ensuring compliance while enabling access for AI model training is a complex and costly endeavor, often necessitating sophisticated anonymization and de-identification techniques. The threat of data breaches and the potential for misuse of sensitive patient information create a significant barrier, requiring substantial investment in cybersecurity infrastructure and robust data governance policies.

Another considerable challenge lies in the sheer complexity and heterogeneity of healthcare data. Data originates from diverse sources, including electronic health records, medical imaging equipment, laboratory systems, and wearable devices, often in varying formats and with inconsistent quality. Standardizing and accurately labeling this disparate data requires specialized domain expertise and advanced technological solutions. The lack of a universally adopted data standardization framework further exacerbates this issue. Moreover, the scarcity of skilled data annotators with deep medical knowledge is a persistent restraint. Training and retaining such professionals are challenging due to the specialized nature of the work and the high demand for their expertise, leading to potential bottlenecks in project timelines and increased operational costs. The cost of high-quality data labeling, especially for intricate tasks requiring medical professionals, can also be substantial, impacting the overall return on investment for AI-driven healthcare initiatives.

The global Healthcare Data Collection and Labeling market is characterized by significant regional variations and segment-specific dominance. North America, particularly the United States, stands out as a key region poised to dominate the market due to several compelling factors. The region boasts a highly advanced healthcare infrastructure, significant investment in AI and healthcare technology research and development, and a robust ecosystem of pharmaceutical companies, biotech firms, and diagnostic centers actively leveraging data-driven solutions. The presence of leading academic institutions and research hospitals fosters innovation, creating a fertile ground for the demand for high-quality, labeled healthcare data. Furthermore, the established regulatory frameworks, while stringent, have also led to the development of sophisticated data governance practices and a growing acceptance of data-driven approaches, making it a mature market for data labeling services. The estimated market size in North America is projected to see substantial growth, contributing a significant portion to the global $150.7 million by 2033.

Within this dynamic market, the Image segment is expected to be a primary driver of dominance, especially within the healthcare context. The ever-increasing volume and complexity of medical imaging data – encompassing X-rays, CT scans, MRIs, ultrasounds, and pathology slides – necessitate highly accurate and detailed labeling for AI-powered diagnostic and predictive applications. The ability of AI to identify subtle anomalies in these images, often undetectable by the human eye, is revolutionizing radiology, oncology, and ophthalmology, among other fields. Companies are investing heavily in sophisticated annotation tools and expert annotators capable of performing tasks such as lesion segmentation, tumor identification, and organ delineation.

Beyond imaging, the Application segment of Diagnostic Centers is also a significant contributor to market dominance. Diagnostic centers are at the forefront of utilizing AI for a wide range of medical tests, from pathology and radiology to genetic analysis. The accurate labeling of data from these centers is crucial for developing AI models that can improve diagnostic accuracy, reduce turnaround times, and enhance the efficiency of diagnostic workflows. The growing emphasis on early disease detection and preventative care further amplifies the demand for labeled data from diagnostic settings. The "Others" application segment, which broadly encompasses areas like drug discovery and development, clinical trial optimization, and personalized treatment planning, also holds substantial potential for growth and market impact. The intricate nature of drug discovery, for instance, requires the labeling of vast chemical and biological datasets, while personalized medicine relies on annotating genomic and patient-specific data to tailor therapies. The collaborative efforts between technology providers and healthcare organizations are fostering innovative approaches to data collection and labeling across these diverse applications, solidifying the dominance of these key segments and regions.

The healthcare data collection and labeling industry is experiencing significant growth catalysts that are accelerating its evolution. A primary catalyst is the increasing demand for AI-driven solutions in medical diagnostics, drug discovery, and personalized medicine. As AI models become more sophisticated, the need for vast quantities of accurately labeled data to train them intensifies, directly benefiting the data labeling sector. Advancements in AI and ML technologies themselves, leading to more efficient and accurate labeling tools, also act as a powerful growth driver. Furthermore, the growing awareness of the potential of predictive analytics in healthcare, from forecasting disease outbreaks to identifying at-risk patient populations, fuels the demand for robustly labeled datasets. The push for value-based healthcare and the emphasis on improving patient outcomes are also indirectly encouraging the adoption of data-intensive technologies, thereby stimulating the need for data collection and labeling.

This report offers a comprehensive and in-depth analysis of the global healthcare data collection and labeling market, providing invaluable insights for stakeholders. It delves into the market's intricate dynamics, meticulously detailing market size, historical trends, and future projections from 2019 to 2033, with a specific focus on the base year of 2025 and the forecast period of 2025-2033. The study examines the critical trends shaping the industry, explores the key driving forces behind its growth, and critically assesses the challenges and restraints that influence its trajectory. Furthermore, it identifies and analyzes the dominant regions and segments within the market, offering a granular understanding of where growth is most pronounced. The report also highlights the significant catalysts fueling further expansion and provides a detailed overview of the leading players and their contributions, alongside a timeline of significant sector developments. This all-encompassing approach ensures that readers are equipped with the knowledge necessary to navigate and capitalize on the opportunities within this vital and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Alegion, Ango AI, Anolytics, Appen Limited, CapeStart, Centaur Labs, Cogito Tech, DataLabeler, iMerit, Infolks Private Limited, Innodata, Keymakr, Snorkel AI, Summa Linguae Technologies.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Healthcare Data Collection and Labeling," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Healthcare Data Collection and Labeling, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.