1. What is the projected Compound Annual Growth Rate (CAGR) of the Green Hydrogen Powering Gas Turbines?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Green Hydrogen Powering Gas Turbines

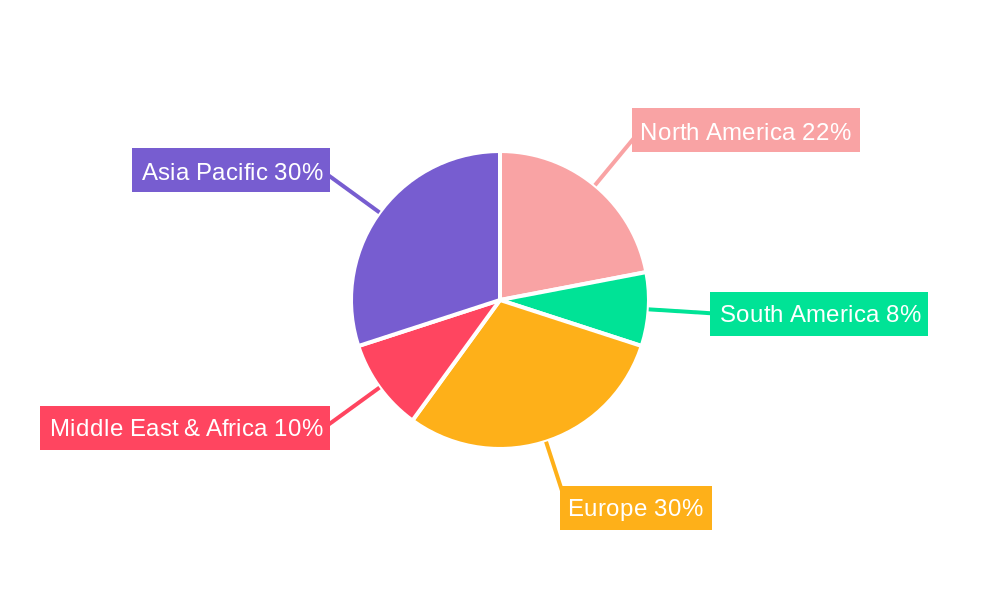

Green Hydrogen Powering Gas TurbinesGreen Hydrogen Powering Gas Turbines by Type (Small Type, Large Type), by Application (Oil & Gas, Industrial, Power Generation, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

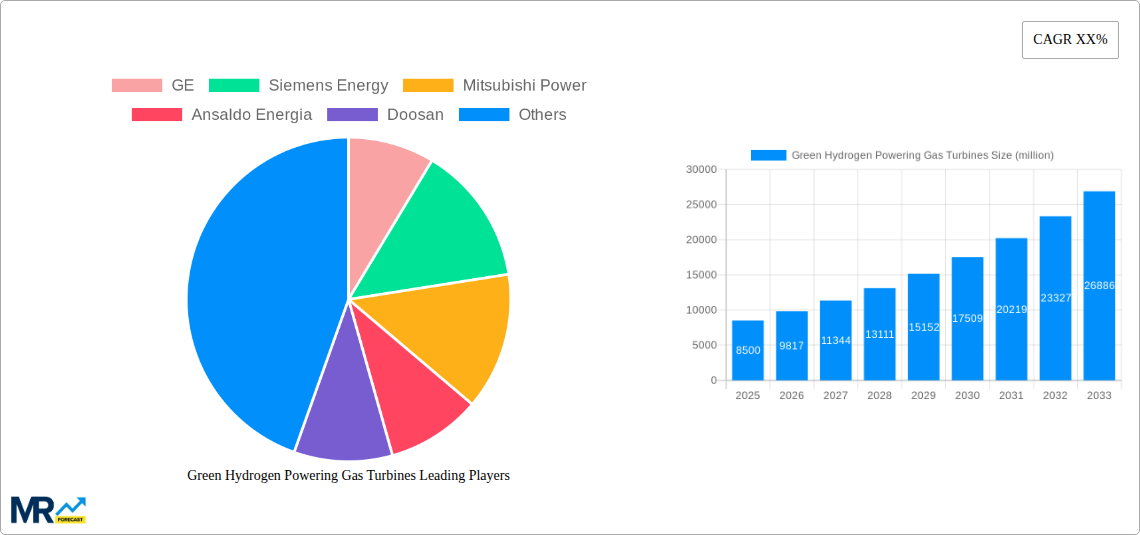

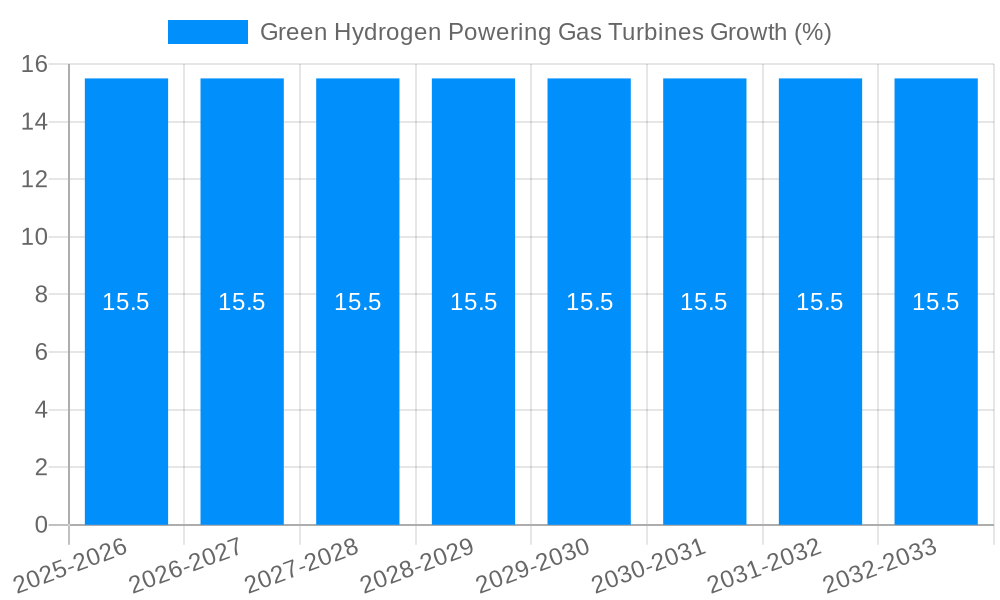

The global market for Green Hydrogen Powering Gas Turbines is experiencing a significant surge, projected to reach a market size of approximately $8,500 million in 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 15.5% through 2033, indicating a strong and sustained expansion. The primary drivers of this market include the escalating global demand for cleaner energy solutions, stringent environmental regulations pushing for decarbonization, and advancements in hydrogen production and storage technologies. The push towards net-zero emissions across various industries, particularly in the power generation and oil & gas sectors, is creating substantial opportunities for gas turbines capable of operating on green hydrogen. Furthermore, the increasing integration of renewable energy sources necessitates flexible and reliable power generation solutions, which gas turbines can provide when powered by green hydrogen, thereby supporting grid stability.

The market is characterized by key segments including small and large types of gas turbines, with major applications in Oil & Gas, Industrial, and Power Generation sectors. The Power Generation segment, in particular, is anticipated to witness the most significant adoption due to the critical need for decarbonizing electricity production. Key players such as GE, Siemens Energy, and Mitsubishi Power are actively investing in research and development to enhance the efficiency and compatibility of their gas turbines with hydrogen fuels. Emerging trends include the development of dual-fuel capabilities, allowing turbines to operate on both natural gas and hydrogen, and the exploration of pure hydrogen combustion. However, certain restraints, such as the high initial cost of hydrogen infrastructure and the current limitations in large-scale green hydrogen production capacity, need to be addressed for accelerated market penetration. Despite these challenges, the strategic importance of green hydrogen in achieving global climate goals positions this market for substantial and transformative growth.

This report provides a comprehensive analysis of the burgeoning market for green hydrogen as a fuel for gas turbines. Spanning from the historical period of 2019-2024, through the base year of 2025, and extending to a detailed forecast period of 2025-2033, this study offers critical insights into market trends, driving forces, challenges, and key growth opportunities. With an estimated market value of [Insert Million Unit Value Here, e.g., $500 million] in the Estimated Year of 2025, the report delves into the technological advancements and strategic initiatives shaping the future of decarbonized power generation.

The green hydrogen powering gas turbines market is experiencing a transformative phase, driven by an urgent global imperative to decarbonize the energy sector and achieve ambitious climate goals. As industries and governments worldwide seek to transition away from fossil fuels, hydrogen, particularly when produced through renewable energy sources (green hydrogen), has emerged as a compelling and versatile solution for powering existing and next-generation gas turbines. A significant trend observed is the increasing investment in research and development by leading Original Equipment Manufacturers (OEMs) like GE, Siemens Energy, Mitsubishi Power, Ansaldo Energia, Doosan, MAPNA Group, Solar Turbines, MAN Energy Solutions, and Kawasaki Heavy Industries to adapt their gas turbine technology for higher hydrogen blends and eventually pure hydrogen combustion. This adaptation is not just about retrofitting existing fleets but also designing new turbine architectures optimized for hydrogen's unique combustion characteristics.

Another prominent trend is the growing focus on the "Large Type" segment of gas turbines, which are critical for large-scale power generation and industrial applications. The capacity to achieve significant emissions reductions in these high-demand sectors makes the integration of green hydrogen particularly attractive. Concurrently, the "Power Generation" application segment is witnessing the most substantial uptake, as utilities and power producers explore hydrogen's potential to provide dispatchable, low-carbon electricity. The "Oil & Gas" and "Industrial" sectors are also showing increasing interest, driven by the need to reduce their operational carbon footprint and meet stricter environmental regulations. Furthermore, policy support, including tax incentives, subsidies, and the establishment of hydrogen infrastructure hubs, is playing a pivotal role in accelerating market adoption. The development of robust supply chains for green hydrogen production and transportation remains a key area of focus and a significant trend shaping the market's trajectory. The interplay between technological readiness, economic viability, and supportive regulatory frameworks will define the pace and scale of green hydrogen adoption in gas turbines over the forecast period, with an anticipated market value of [Insert Projected Million Unit Value for 2033 Here, e.g., $2,500 million] by 2033. The transition is not merely about fuel substitution but a fundamental shift towards a more sustainable and resilient energy system.

The meteoric rise of green hydrogen as a fuel for gas turbines is propelled by a confluence of powerful drivers, with the overriding force being the global commitment to climate change mitigation and decarbonization. Governments worldwide are implementing stringent emissions regulations and setting ambitious net-zero targets, creating a palpable demand for low-carbon energy solutions. Green hydrogen, produced via electrolysis powered by renewable energy sources, offers a pathway to near-zero or zero-carbon emissions when combusted in gas turbines, making it an attractive alternative to traditional fossil fuels. The existing infrastructure of gas turbines, with a significant installed base globally, presents an opportunity for a relatively swift transition compared to developing entirely new generation technologies. Adapting these turbines to run on hydrogen, either as a blend or in pure form, represents a cost-effective and efficient way to decarbonize power generation and industrial processes without necessitating complete asset replacement.

Furthermore, advancements in electrolysis technology are steadily reducing the cost of green hydrogen production, making it increasingly competitive with conventional fuels. The declining costs of renewable energy, such as solar and wind power, which are essential for producing green hydrogen, also contribute significantly to its economic viability. The increasing focus on energy security and diversification by many nations is another key driver. By developing domestic green hydrogen production capabilities, countries can reduce their reliance on imported fossil fuels, enhancing their energy independence and resilience. The growing awareness among businesses and consumers about environmental sustainability is also creating market pull for green hydrogen-powered solutions, influencing investment decisions and driving innovation across the value chain. The potential for utilizing existing gas infrastructure for hydrogen transportation, with certain modifications, further bolsters its appeal as a scalable and implementable decarbonization strategy for the power generation and industrial sectors.

Despite the significant promise, the widespread adoption of green hydrogen in gas turbines faces several formidable challenges and restraints. A primary obstacle is the cost of green hydrogen production. While costs are declining, they remain higher than fossil fuels, particularly natural gas. The significant upfront investment required for large-scale electrolysis plants powered by dedicated renewable energy sources, coupled with the cost of water, is a major barrier. Infrastructure development for hydrogen storage, transportation, and distribution is another critical restraint. The existing pipeline infrastructure is largely designed for natural gas and requires substantial modifications or entirely new infrastructure to safely and efficiently transport hydrogen, which has different physical and chemical properties. This necessitates significant capital investment and time.

The technical readiness and compatibility of gas turbines with higher hydrogen concentrations also pose challenges. While many turbines can be adapted for hydrogen blends, achieving full conversion to pure hydrogen combustion requires significant technological advancements and modifications to combustion systems, materials, and control systems to manage issues like flame instability, increased NOx emissions at higher temperatures, and material embrittlement. The availability and supply chain of green hydrogen remain nascent. Scaling up production to meet the demand of the global gas turbine fleet requires substantial investment in electrolyzer manufacturing, renewable energy capacity, and a robust global supply chain. Regulatory uncertainties and lack of standardized policies across different regions can hinder investment and project development. Clear guidelines on hydrogen quality, safety standards, and carbon accounting are crucial. Finally, the perceived safety risks associated with hydrogen, although manageable with proper engineering and protocols, can also be a psychological barrier to widespread adoption.

The Large Type segment of gas turbines, particularly within the Power Generation application, is poised to dominate the green hydrogen powering gas turbines market. This dominance is driven by several interconnected factors, with the Power Generation application serving as the primary engine of growth. The sheer scale of electricity demand globally necessitates large-capacity power plants, making the decarbonization of these facilities a high priority for governments and utility companies striving to meet their climate commitments. Large Type gas turbines, often operating at high capacity factors, offer the greatest potential for significant emissions reductions when fueled by green hydrogen. Companies like GE, Siemens Energy, and Mitsubishi Power are actively investing in developing and commercializing large-scale turbines capable of operating on hydrogen.

Key Regions/Countries Driving Dominance:

Dominance of the "Large Type" Segment:

The synergy between the strategic importance of Power Generation, the economic advantages of the Large Type segment, and the targeted investments by key regions and leading companies firmly establishes this segment and its primary application as the dominant force in the green hydrogen powering gas turbines market during the forecast period.

Several key growth catalysts are accelerating the adoption of green hydrogen in gas turbines. Foremost is the increasing global momentum towards achieving Net-Zero emissions targets, which compels industries to seek viable low-carbon solutions. Supportive government policies, including subsidies, tax credits for hydrogen production and utilization, and the establishment of carbon pricing mechanisms, are significantly improving the economic attractiveness of green hydrogen. Technological advancements in electrolyzer efficiency and declining renewable energy costs are making green hydrogen production more cost-competitive, narrowing the price gap with fossil fuels. Furthermore, the development of robust hydrogen infrastructure, including pipelines and storage facilities, supported by strategic investments, is crucial for enabling large-scale deployment. Pilot projects and successful demonstrations of hydrogen-fueled gas turbines by major OEMs are building confidence and de-risking investments for end-users.

This comprehensive report provides an in-depth examination of the green hydrogen powering gas turbines market, offering invaluable insights for stakeholders seeking to navigate this evolving landscape. It meticulously analyzes market size, growth projections, and segmentation across various dimensions including turbine type (Small Type, Large Type), application (Oil & Gas, Industrial, Power Generation, Others), and key industry developments. The report also delves into the technological advancements, regulatory frameworks, and economic factors influencing market dynamics. By offering detailed market shares, competitive intelligence, and future outlooks, this report serves as an indispensable resource for strategic decision-making, investment planning, and understanding the transformative potential of green hydrogen in decarbonizing the power generation and industrial sectors. The study meticulously details the projected market value in the millions of units, offering a clear financial perspective on the sector's growth trajectory from 2019-2033.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include GE, Siemens Energy, Mitsubishi Power, Ansaldo Energia, Doosan, MAPNA Group, Solar Turbines, MAN Energy Solutions, Kawasaki Heavy Industries, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Green Hydrogen Powering Gas Turbines," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Green Hydrogen Powering Gas Turbines, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.