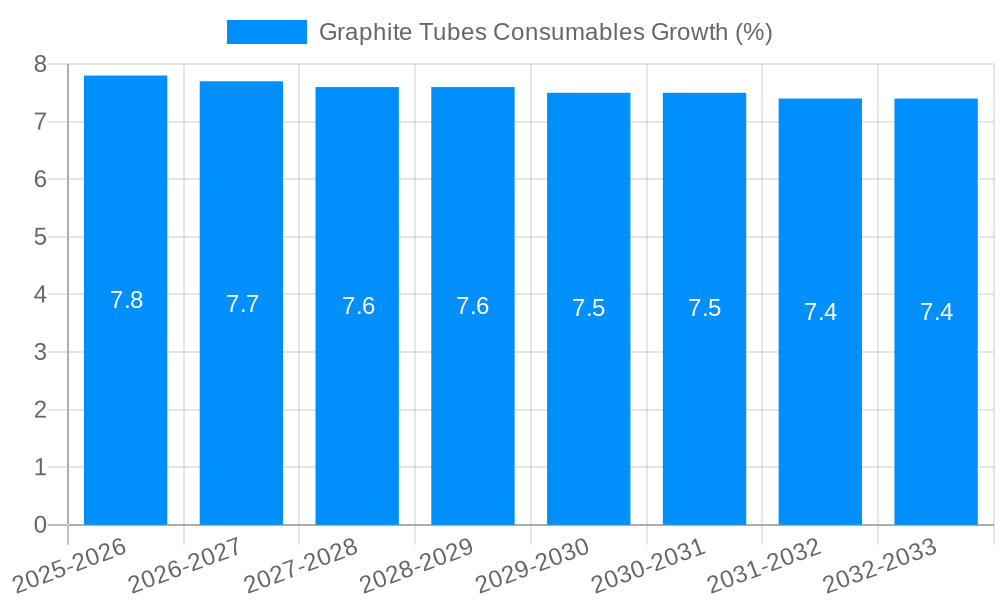

1. What is the projected Compound Annual Growth Rate (CAGR) of the Graphite Tubes Consumables?

The projected CAGR is approximately 7.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Graphite Tubes Consumables

Graphite Tubes ConsumablesGraphite Tubes Consumables by Type (/> TGHA Graphite Tubes, HGA Graphite Tubes), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Graphite Tubes Consumables market is poised for robust growth, projected to reach a significant valuation. This expansion is driven by the increasing adoption of graphite tubes in atomic absorption spectroscopy (AAS) and other analytical techniques across various industries, including environmental monitoring, food safety, and pharmaceuticals. The expanding research and development activities in these sectors, coupled with a growing demand for accurate and reliable elemental analysis, are key catalysts for market penetration. Furthermore, the continuous innovation in graphite tube technology, leading to enhanced performance, durability, and sensitivity, is expected to fuel further market expansion. As analytical instrumentation becomes more sophisticated and accessible, the demand for high-quality consumables like graphite tubes will naturally escalate.

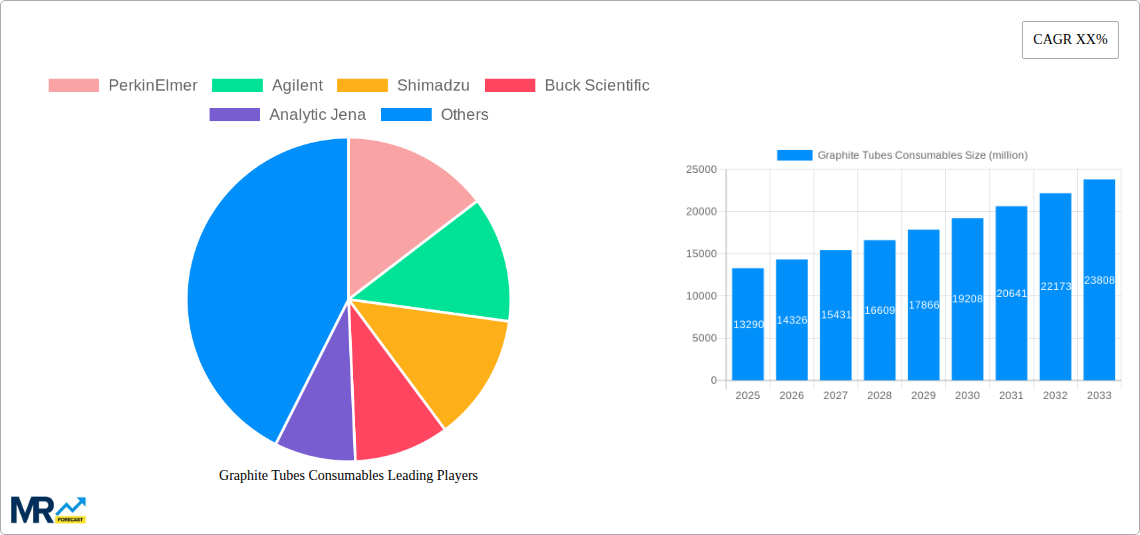

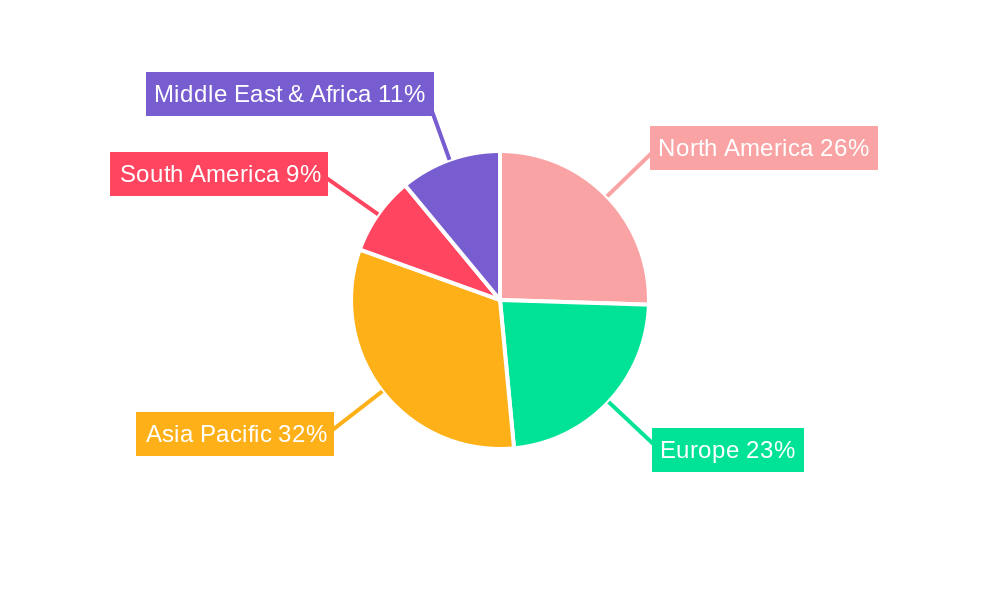

The market is segmented into two primary types: TGHA (Treated Graphite High Atomization) Graphite Tubes and HGA (High-Temperature Graphite Atomizer) Graphite Tubes, each catering to specific analytical requirements and applications. TGHA tubes, known for their superior sensitivity and reduced background absorption, are gaining traction in demanding trace element analysis. Conversely, HGA tubes continue to be a popular choice for a wide range of general-purpose elemental analysis due to their cost-effectiveness and reliability. Major market players like PerkinElmer, Agilent, and Shimadzu are actively investing in product development and expanding their geographical presence to capitalize on the burgeoning demand. The Asia Pacific region, particularly China and India, is anticipated to exhibit the highest growth rate owing to rapid industrialization, increasing R&D investments, and a growing installed base of analytical instruments.

This comprehensive report delves into the global Graphite Tubes Consumables market, a critical component within the analytical instrumentation sector. With a projected market size expected to reach tens of billions of US dollars by the end of the study period, this analysis provides in-depth insights into market dynamics, growth trajectories, and key strategic considerations. The study encompasses a thorough examination of the market from the Historical Period of 2019-2024, with a Base Year of 2025 serving as the pivotal point for analysis and projections. The Study Period extends to 2033, offering a forward-looking perspective on market evolution.

The global market for graphite tubes consumables is experiencing a robust and steady growth trajectory, underpinned by increasing demand for sophisticated analytical techniques across diverse industries. The market, valued in the billions of US dollars, is being shaped by a confluence of factors including technological advancements, growing regulatory compliance requirements, and a burgeoning scientific research landscape. A significant trend observed is the increasing preference for high-performance graphite tubes that offer enhanced sensitivity, improved precision, and extended lifespan. This demand is particularly pronounced in applications requiring trace element analysis, such as environmental monitoring, food safety testing, and pharmaceutical quality control. Furthermore, the development of specialized coatings and advanced manufacturing techniques for graphite tubes is enabling them to withstand higher temperatures and harsher chemical environments, thereby expanding their applicability. The report highlights a notable shift towards more sustainable and environmentally friendly manufacturing processes for these consumables, driven by global sustainability initiatives and a growing corporate responsibility focus. Innovation in tube design, focusing on reducing sample contamination and optimizing atomization efficiency, is another key trend that continues to drive market growth. The increasing adoption of automated sample introduction systems also necessitates the use of highly reliable and consistent graphite tubes, further fueling demand. The overall market sentiment is optimistic, with continuous innovation and expanding application areas promising sustained growth throughout the forecast period. The interplay between instrument manufacturers and consumable providers is becoming increasingly collaborative, leading to the development of integrated solutions that enhance analytical performance.

Several powerful forces are propelling the graphite tubes consumables market towards significant expansion. The ever-increasing stringency of environmental regulations globally is a primary driver, necessitating more accurate and sensitive elemental analysis for monitoring pollutants in air, water, and soil. This directly translates to a higher demand for high-quality graphite tubes used in techniques like Atomic Absorption Spectrometry (AAS). Similarly, the burgeoning food safety sector, driven by consumer demand for healthier and safer products, requires rigorous testing for contaminants and essential nutrients, further boosting the market. In the pharmaceutical industry, stringent quality control measures and the development of new drug formulations demand precise elemental analysis at every stage, from raw material sourcing to finished product testing. The continuous advancements in analytical instrumentation, particularly in AAS and inductively coupled plasma mass spectrometry (ICP-MS), are creating new opportunities for graphite tube consumables. These instruments are becoming more sensitive, requiring specialized consumables that can keep pace with their capabilities. The growing emphasis on research and development across various scientific disciplines, including materials science, geochemistry, and clinical diagnostics, also contributes significantly to market growth. Researchers rely heavily on elemental analysis to understand material properties, geological compositions, and biological processes, thereby driving the consumption of graphite tubes.

Despite the robust growth prospects, the graphite tubes consumables market faces several challenges and restraints that could temper its expansion. One significant challenge is the inherent cost sensitivity associated with these consumables. While performance is paramount, budget constraints in research institutions and smaller laboratories can limit the adoption of premium, high-cost graphite tubes, even if they offer superior performance. This often leads to a preference for more economical options, potentially compromising analytical accuracy in certain scenarios. Another restraint stems from the technological maturity and incremental innovation cycle within the graphite tube manufacturing sector. While advancements are occurring, the core technology has been established for some time, and revolutionary breakthroughs are infrequent, which can lead to slower overall market evolution compared to more dynamic technology sectors. Supply chain disruptions, a global phenomenon, can also impact the availability and pricing of raw materials, particularly high-purity graphite, which is essential for producing quality tubes. Geopolitical instability or trade restrictions can further exacerbate these issues. Furthermore, the availability of alternative analytical techniques, such as ICP-OES and ICP-MS, which may not always require graphite tubes as consumables, poses a potential threat, especially for applications where sample throughput and sensitivity requirements can be met by these alternatives. Finally, the disposal of used graphite tubes, which can be considered hazardous waste in certain applications due to sample residues, presents environmental and regulatory challenges, requiring specific handling and disposal protocols, adding to the overall operational costs for end-users.

The global graphite tubes consumables market is poised for significant dominance by North America, particularly the United States, and the Asia Pacific region, with China at the forefront. These regions are expected to collectively account for a substantial portion of the market value, reaching billions of US dollars in the forecast period.

North America (United States):

Asia Pacific (China):

Dominant Segment: HGA Graphite Tubes

Within the type segment, HGA (Heated Graphite Atomizer) Graphite Tubes are anticipated to dominate the market.

Several key factors are acting as significant growth catalysts for the graphite tubes consumables industry. The relentless pursuit of higher sensitivity and precision in elemental analysis across diverse sectors like environmental monitoring, food safety, and pharmaceuticals is a primary driver. Advancements in analytical instrumentation, particularly in AAS, are creating a demand for more robust and high-performance consumables. Furthermore, increasing global regulatory requirements for quality control and safety assurance are compelling industries to invest in sophisticated analytical techniques, directly boosting the consumption of graphite tubes. The expanding research and development activities in emerging fields such as nanotechnology and advanced materials also contribute to this growth.

This report provides a comprehensive and holistic view of the global graphite tubes consumables market, offering unparalleled depth and breadth of analysis. It meticulously examines market dynamics, trends, drivers, and challenges, providing a clear roadmap for stakeholders. The report includes detailed segmentation by type, including TGHA Graphite Tubes and HGA Graphite Tubes, allowing for granular understanding of specific product category performance. It also forecasts market size in billions of US dollars, with projections extending to 2033, based on a robust methodology anchored by the Base Year of 2025. The analysis of key regions and countries, alongside the identification of leading players and significant historical and future developments, ensures a well-rounded perspective. This report serves as an indispensable tool for market participants seeking to understand the competitive landscape, identify growth opportunities, and make informed strategic decisions within this vital consumables sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.8%.

Key companies in the market include PerkinElmer, Agilent, Shimadzu, Buck Scientific, Analytic Jena, GBC Scientific, Hitachi, Aurora, Thermo, .

The market segments include Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Graphite Tubes Consumables," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Graphite Tubes Consumables, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.