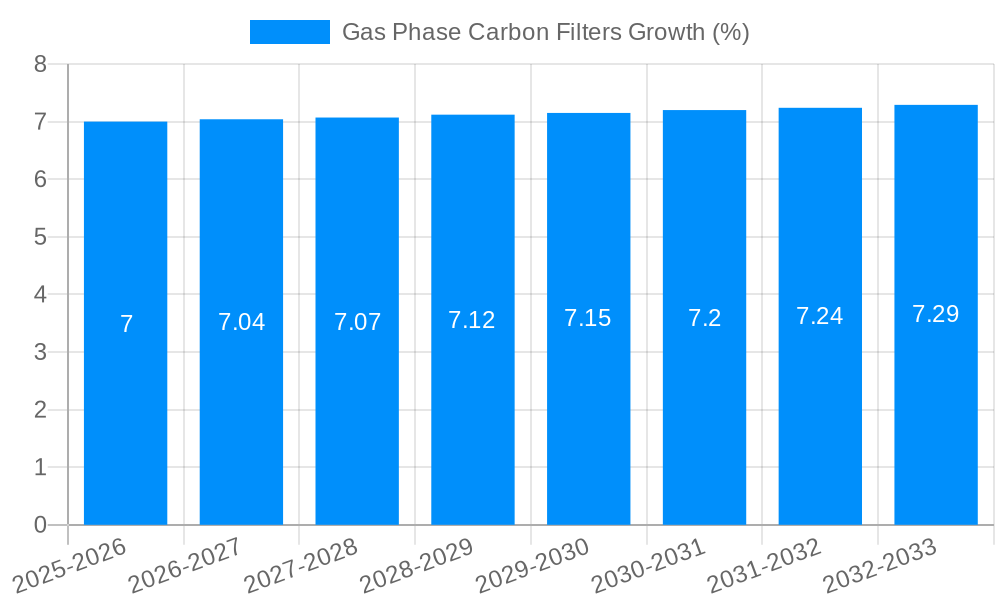

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gas Phase Carbon Filters?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Gas Phase Carbon Filters

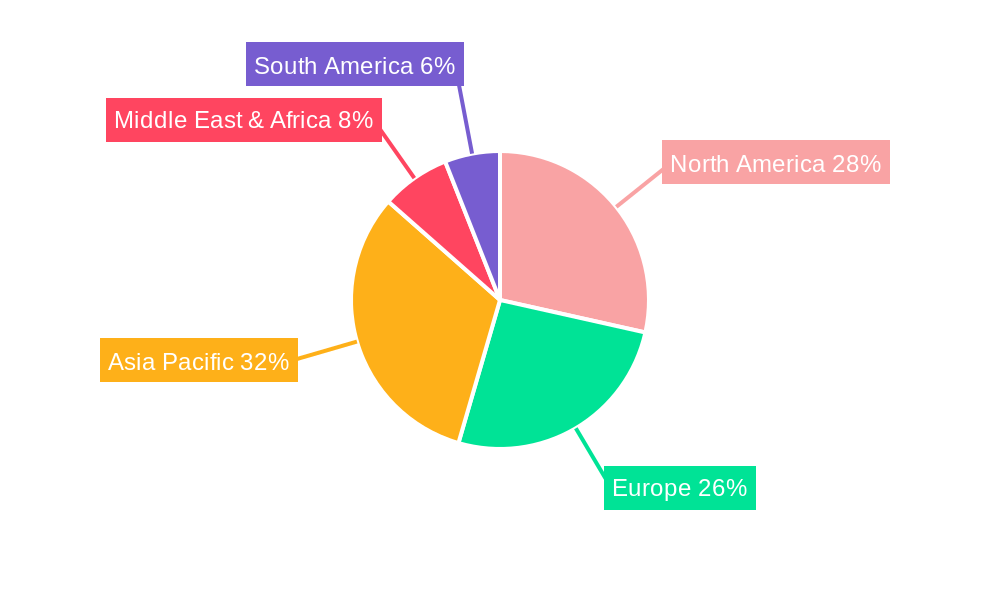

Gas Phase Carbon FiltersGas Phase Carbon Filters by Type (Granular Carbon Filters, Bonded Carbon Filters, Activated Carbon Filters), by Application (Museum, School, Hospital, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Gas Phase Carbon Filters market is poised for significant expansion, projected to reach an estimated market size of approximately USD 1,500 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of around 7.5% anticipated throughout the forecast period of 2025-2033. This growth is primarily propelled by the escalating demand for advanced air purification solutions across various critical sectors, including healthcare facilities and educational institutions, where maintaining high indoor air quality is paramount for occupant health and productivity. The increasing stringency of environmental regulations concerning air pollution and the growing awareness among consumers and industries about the detrimental effects of volatile organic compounds (VOCs) and other gaseous pollutants further underscore the market’s upward trajectory. Granular Carbon Filters and Activated Carbon Filters are expected to dominate the market share due to their superior adsorptive capabilities and cost-effectiveness in removing a wide spectrum of contaminants, making them indispensable for applications ranging from industrial emissions control to residential air purifiers.

Despite the promising growth, the market faces certain restraints, such as the relatively high initial investment costs associated with sophisticated filtration systems and the ongoing need for regular maintenance and replacement of filter media, which can impact adoption rates in price-sensitive markets. However, technological advancements are continuously addressing these challenges by developing more efficient and longer-lasting filter materials and integrated systems. The market is also witnessing a notable trend towards the development of smart filters with embedded sensors for real-time performance monitoring and predictive maintenance, enhancing operational efficiency for end-users. Leading companies such as Camfil, AAF Flanders, and Donaldson Company are actively investing in research and development to introduce innovative products and expand their global footprint. Geographically, the Asia Pacific region, particularly China and India, is emerging as a high-growth market driven by rapid industrialization and increasing disposable incomes, while North America and Europe continue to represent significant markets due to established regulatory frameworks and a mature consumer base for air quality solutions.

The global Gas Phase Carbon Filters market is poised for robust expansion, projecting a Compound Annual Growth Rate (CAGR) of XXX% during the forecast period of 2025-2033. This growth is underpinned by a confluence of escalating concerns surrounding air quality, increasingly stringent environmental regulations, and a heightened awareness of the health implications of airborne pollutants. The study period, spanning from 2019 to 2033, with a base year and estimated year of 2025, allows for a comprehensive analysis of historical trends and future trajectories. During the historical period (2019-2024), the market witnessed steady adoption driven by industrial applications seeking to mitigate VOC emissions and odorous compounds. As we move into the forecast period, the market's dynamism will be further fueled by advancements in filtration technology, leading to more efficient and specialized carbon filter solutions.

The increasing prevalence of indoor air quality (IAQ) concerns across commercial and residential sectors is a significant tailwind. In particular, the healthcare and museum segments are expected to exhibit substantial demand due to the critical need for air purity and the preservation of sensitive artifacts, respectively. Granular carbon filters, known for their high adsorption capacity and cost-effectiveness, are anticipated to maintain a dominant position, especially in large-scale industrial applications. However, bonded carbon filters are gaining traction due to their superior structural integrity and ability to offer a more uniform filtration media, particularly in applications demanding precise air purification. The market is also observing a shift towards more sustainable and regenerable carbon filter solutions, driven by environmental initiatives and cost-saving objectives. Emerging applications in sectors like pharmaceuticals and food processing, where even trace contaminants can have significant consequences, will further diversify the market landscape. The study will delve into the intricate interplay of these factors, providing actionable insights for stakeholders.

Several powerful forces are driving the substantial growth anticipated in the Gas Phase Carbon Filters market. Foremost among these is the escalating global emphasis on environmental protection and the subsequent enactment of stricter air quality standards by governmental bodies worldwide. These regulations compel industries to invest in effective emission control technologies, with gas phase carbon filters emerging as a crucial solution for capturing volatile organic compounds (VOCs), hazardous air pollutants (HAPs), and offensive odors. Concurrently, a burgeoning awareness among the general populace regarding the detrimental health effects of poor indoor air quality (IAQ) is significantly boosting demand. This awareness is particularly pronounced in densely populated urban areas and workplaces, where pollutants can accumulate and pose serious risks. The healthcare sector, in its unwavering commitment to patient well-being, is a prime example, requiring ultra-pure air environments to prevent cross-contamination and hospital-acquired infections.

Furthermore, the rapid industrialization and urbanization across emerging economies are creating new avenues for market expansion. As these regions develop, the need for industrial air pollution control intensifies, driving the adoption of gas phase carbon filters. Technological advancements play a pivotal role as well. Innovations in activated carbon impregnation and manufacturing processes are leading to the development of more efficient, selective, and longer-lasting filter media. These improvements not only enhance performance but also contribute to cost-effectiveness in the long run, making gas phase carbon filters a more attractive investment for a broader range of applications. The increasing complexity of industrial processes and the introduction of new chemical compounds also necessitate sophisticated filtration solutions, further solidifying the market's upward trajectory.

Despite the promising growth trajectory, the Gas Phase Carbon Filters market is not without its hurdles. A significant challenge lies in the operational costs associated with gas phase carbon filters. The initial investment in filter units can be substantial, and the ongoing need for periodic replacement or regeneration of the activated carbon media can represent a recurring expense. This can be a deterrent for smaller enterprises or those operating with tighter budgetary constraints, particularly in price-sensitive markets. Moreover, the effectiveness of carbon filters is directly linked to the saturation point of the activated carbon. Once saturated, the filter loses its adsorptive capacity, necessitating timely replacement. Improper maintenance or failure to adhere to replacement schedules can lead to the release of previously captured pollutants back into the environment, negating the filter's purpose and potentially leading to compliance issues.

The disposal of spent activated carbon also presents an environmental challenge. While efforts are being made to develop regeneration processes, a considerable amount of spent carbon still requires proper disposal, which can be costly and environmentally regulated. The variety of contaminants that gas phase carbon filters can effectively address is also a factor; while highly effective against a wide range of organic compounds and odors, they are generally not suitable for removing inorganic gases or particulate matter, requiring a multi-stage filtration approach in many applications. Furthermore, the energy consumption associated with some advanced filtration systems utilizing carbon filters can be a concern, especially in industries focused on energy efficiency. Educating end-users about the nuances of carbon filter selection, maintenance, and disposal remains a continuous challenge for manufacturers and suppliers.

Segment Dominance: Activated Carbon Filters & Hospital Application

The Gas Phase Carbon Filters market is poised for significant expansion driven by the dominance of specific segments. Among the Type of filters, Activated Carbon Filters are expected to lead the market share, accounting for a substantial portion of global demand during the forecast period. This dominance stems from the inherent versatility and high adsorption capacity of activated carbon, making it the go-to solution for a broad spectrum of contaminants. Activated carbon's porous structure and vast surface area enable it to effectively capture a wide array of volatile organic compounds (VOCs), acidic gases, and odoriferous molecules, which are prevalent in industrial emissions and indoor air environments. The manufacturing processes for activated carbon are relatively mature, ensuring a consistent supply and a competitive price point for various applications.

Within the Application spectrum, the Hospital segment is projected to be a key growth driver and a dominating force in terms of market value. The stringent requirements for sterile and high-purity air within healthcare facilities are paramount. Hospitals necessitate advanced air filtration systems to prevent the spread of airborne pathogens, reduce the risk of hospital-acquired infections (HAIs), and create a safe environment for patients, staff, and visitors. Gas phase carbon filters play a critical role in removing odors emanating from various hospital processes, controlling airborne contaminants generated by medical equipment, and ensuring that exhaust air from sensitive areas, such as operating rooms and isolation wards, is adequately purified before being released. The increasing focus on infection control protocols and the growing number of healthcare facilities globally, especially in developing economies, will further bolster the demand for activated carbon filters within hospitals. The need to filter out specific medical gases or off-gases from certain procedures will also contribute to this dominance.

The synergy between activated carbon filters and the hospital application creates a powerful market dynamic. The efficacy of activated carbon in addressing the diverse and often critical air purification needs of hospitals, coupled with the increasing global investment in healthcare infrastructure and stringent air quality mandates within these institutions, solidifies its leading position. While Granular Carbon Filters will continue to be relevant for bulk odor control and cost-effective solutions in certain industrial settings, and Bonded Carbon Filters may find niche applications where structural integrity is paramount, Activated Carbon Filters, especially in the demanding Hospital sector, will define the market's apex. The forecast period of 2025-2033 is expected to witness an intensified adoption of advanced activated carbon-based solutions within hospitals, potentially reaching a market value in the hundreds of millions globally, underscoring its critical role in public health and safety.

The Gas Phase Carbon Filters industry is experiencing several key growth catalysts. The rising global awareness of indoor air quality (IAQ) and its impact on health and productivity is a significant driver, pushing demand in residential, commercial, and institutional settings. Increasingly stringent environmental regulations worldwide, particularly concerning industrial emissions of VOCs and hazardous air pollutants, necessitate the adoption of effective capture technologies like gas phase carbon filters. Furthermore, advancements in activated carbon impregnation and manufacturing techniques are leading to the development of more efficient, specialized, and longer-lasting filter media, enhancing performance and cost-effectiveness.

This comprehensive report offers an in-depth analysis of the Gas Phase Carbon Filters market, providing invaluable insights for stakeholders. The report meticulously examines market trends, driving forces, and challenges, alongside identifying key regions and segments poised for dominance, particularly highlighting the ascendancy of Activated Carbon Filters within the Hospital application. It delves into specific growth catalysts, offering a clear picture of the industry's forward momentum. Furthermore, the report presents a detailed overview of leading players and their contributions, along with a timeline of significant industry developments. The estimated market size is projected to reach millions by 2033, reflecting a substantial growth trajectory. This report will equip businesses with the strategic intelligence needed to navigate the evolving market, capitalize on emerging opportunities, and mitigate potential risks.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Camfil, AAF Flanders, Donaldson Company, Parker Hannifin, Filtration Group, MANN+HUMMEL GROUP, Koch Filter, NAFCO, Cosmos Air Purification, Troy Filters, Pure Air Filtration, AirClean Systems, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Gas Phase Carbon Filters," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Gas Phase Carbon Filters, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.