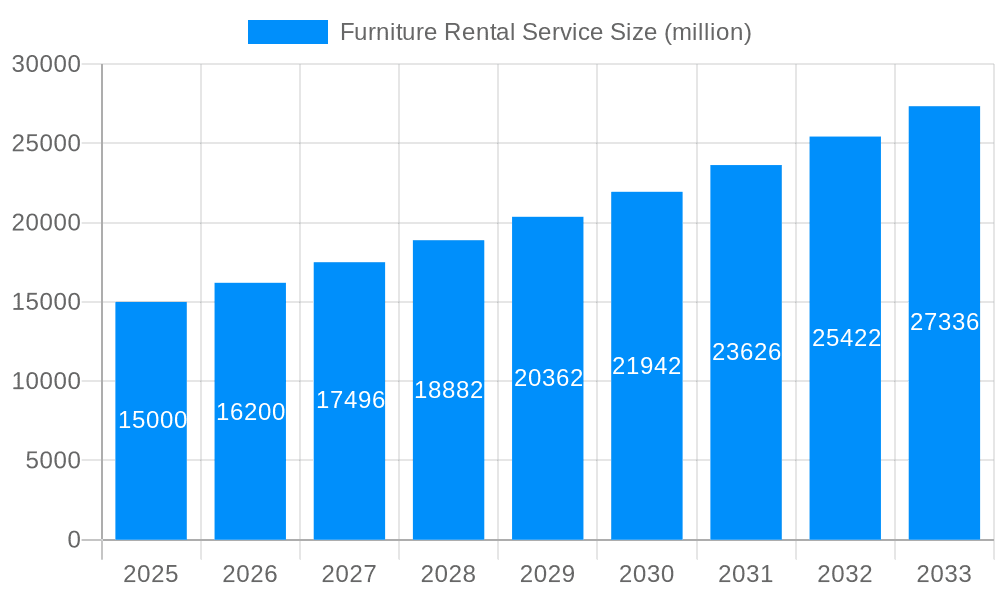

1. What is the projected Compound Annual Growth Rate (CAGR) of the Furniture Rental Service?

The projected CAGR is approximately 10.24%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Furniture Rental Service

Furniture Rental ServiceFurniture Rental Service by Type (Homewares, Small Electronics, Decoration, Others), by Application (Commercial, Residential), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global furniture rental market is poised for substantial expansion, driven by evolving consumer lifestyles and a growing preference for flexible solutions. The market, valued at $90.47 billion in the 2025 base year, is forecast to achieve a Compound Annual Growth Rate (CAGR) of 10.24%, reaching an estimated significant valuation by 2033. This growth trajectory is underpinned by several key dynamics. Firstly, the increasing appeal of subscription models, offering unparalleled convenience, resonates strongly with younger demographics and urban populations prioritizing mobility and adaptability over long-term ownership. Secondly, the demand for contemporary, stylish furniture, especially in urban environments with limited storage, is propelling rental services that provide access to high-quality pieces without the commitment of purchase. Furthermore, the commercial sector is increasingly adopting furniture rental for temporary office spaces, projects, and events. The residential segment remains the primary market driver. Leading regions, including North America and Europe, are at the forefront due to high disposable incomes and well-established rental ecosystems. While challenges such as furniture damage and competition from traditional retail persist, innovative business models emphasizing sustainability and enhanced customer experiences are effectively addressing these concerns and fostering market advancement.

Analysis of market segments indicates that Homewares and Small Electronics currently dominate, driven by the demand for readily replaceable items and the increasing integration of smart home technology. However, the Decoration segment is projected for rapid growth, fueled by dynamic interior design trends and consumer desire for easily adaptable living spaces. Technological advancements, including enhanced online platforms, virtual reality visualization tools, and optimized logistics, will further support this growth. Leading market participants, such as Homat, Aaron's, and Rent-A-Center, are strategically investing in technology and expanding their product portfolios to maintain competitive advantages and meet diverse customer requirements. This competitive environment stimulates innovation and elevates the overall customer experience, thereby driving sustained market growth.

The furniture rental service market, valued at USD 10 billion in 2025, is experiencing significant growth, projected to reach USD 25 billion by 2033. This surge is fueled by evolving consumer preferences, particularly among millennials and Gen Z, who prioritize flexibility, affordability, and sustainability. The traditional model of purchasing furniture is being challenged by the convenience and cost-effectiveness of renting. This trend is particularly pronounced in urban areas with high population density and mobility, where renting offers a practical solution to furnishing needs without the long-term commitment of ownership. The market is witnessing the emergence of innovative business models, including subscription-based services offering curated collections and flexible rental terms. Technological advancements, such as online platforms and mobile applications, have simplified the rental process, boosting accessibility and expanding the market reach. This digital transformation enables companies to target a wider audience and manage inventory efficiently. The increasing awareness of environmental sustainability further supports the growth of the rental market, as it reduces waste associated with furniture disposal and encourages a circular economy. This report analyzes the market dynamics during the study period (2019-2033), focusing on the estimated year (2025) and forecasting the period from 2025 to 2033, based on data from the historical period (2019-2024). Key players are constantly innovating to enhance customer experience and expand their service offerings, introducing features like white-glove delivery, assembly, and flexible upgrade options. This competitive landscape fosters innovation and contributes to the market's overall expansion. Furthermore, the expansion into commercial and corporate rentals represents another significant growth driver.

Several factors are propelling the growth of the furniture rental service market. Firstly, the rising popularity of flexible living arrangements is a key driver. Individuals, particularly younger demographics, are increasingly opting for shorter-term leases and more frequent relocations, making furniture rental a more attractive proposition than outright purchase. Secondly, the escalating costs of homeownership and furnishing are pushing consumers towards more budget-friendly alternatives like rental services. This is especially true in expensive metropolitan areas where furniture purchases can represent a substantial financial burden. Thirdly, the growing environmental consciousness is promoting the adoption of sustainable consumption patterns. Renting furniture minimizes waste associated with discarding unwanted items, aligning with the increasing demand for eco-friendly options. The shift towards experience-driven consumption also contributes to this trend. Consumers are increasingly prioritizing experiences over material possessions, and furniture rental fits seamlessly into this lifestyle choice. This is further reinforced by the convenience and ease of access provided by online platforms, which enable customers to browse, select, and manage their rentals from the comfort of their homes, eliminating the hassle of traditional brick-and-mortar stores. Finally, the increasing adoption of flexible work arrangements, with more individuals working remotely, is driving demand for quality home office furniture, further boosting the rental market.

Despite its significant growth potential, the furniture rental service market faces certain challenges. One major restraint is the potential for damage and wear and tear to rented furniture. Managing damage claims and ensuring timely repairs or replacements can be complex and costly for rental companies. Logistics and transportation costs also play a role. Efficiently delivering and picking up furniture across various locations requires significant investment in infrastructure and logistics, particularly in urban areas. Competition from established furniture retailers and online marketplaces is another major challenge. These established players often offer competitive pricing and financing options, posing a threat to rental companies. Maintaining inventory levels to meet fluctuating demand is another hurdle; overstocking can lead to storage costs and potential losses, while understocking results in lost sales opportunities. Furthermore, managing customer expectations regarding delivery timelines, furniture quality, and overall service experience is crucial for maintaining customer satisfaction and loyalty. Regulatory compliance related to contracts, insurance, and data privacy also presents an ongoing challenge for businesses operating in this sector. Finally, the perception of rented furniture being of lower quality compared to owned furniture remains a barrier that some rental companies need to overcome through improved quality control and brand building.

The Residential segment is poised to dominate the furniture rental market in the forecast period. This is primarily due to the increasing urban population, high mobility, and a preference for flexible living arrangements among younger demographics in major cities globally. Within this segment, the Homewares category is expected to lead the charge.

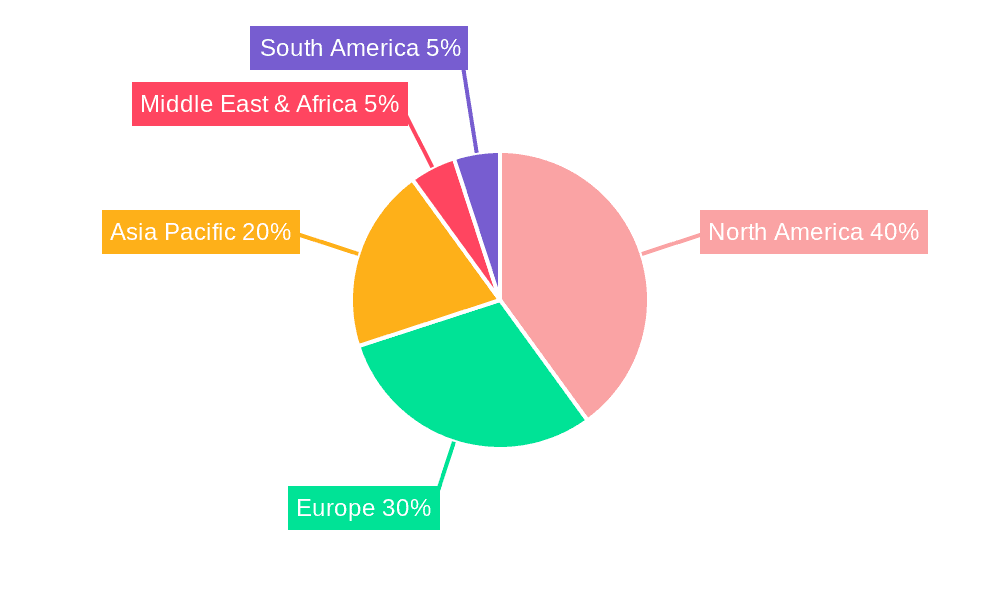

North America (United States and Canada): This region is anticipated to hold the largest market share, driven by high disposable income, a preference for convenience, and the significant adoption of online furniture rental services. The high population density in urban centers like New York, Los Angeles, and Toronto fuels the demand for flexible furnishing solutions.

Europe (Western Europe and Northern Europe): This region shows promising growth prospects due to increasing consumer awareness of sustainability and the preference for short-term rentals. Cities like London, Paris, and Amsterdam represent key markets.

Asia-Pacific (China and India): This region is experiencing rapid growth, driven by increasing urbanization and rising disposable incomes, particularly within the middle-class population. However, challenges related to logistics and infrastructure need to be addressed for further market expansion.

The dominance of the residential segment and the homewares category is supported by the convenience and affordability they provide. Renting furniture offers flexibility, allowing users to easily change their décor as their needs or preferences evolve. This resonates particularly well with young professionals and families who are likely to relocate frequently or change their lifestyles quickly. The ease of access through online platforms further enhances the appeal, leading to a higher adoption rate in this sector. The other segments, though smaller, are also showing growth; specifically the commercial segment is picking up pace as more businesses choose flexible furniture solutions for their workplaces.

The furniture rental industry's growth is accelerated by several key catalysts. The rising adoption of subscription-based models enhances customer convenience and affordability. The expanding reach of e-commerce platforms makes rental options easily accessible. A growing awareness of sustainability further boosts the market, as renting reduces waste and aligns with eco-conscious consumer choices. Finally, the increasing demand for flexible living spaces and the mobility of the workforce drives the need for temporary yet quality furniture solutions.

This report provides a comprehensive overview of the furniture rental service market, encompassing key trends, drivers, challenges, and growth projections. The analysis covers major regional markets and key segments, highlighting significant developments and the competitive landscape within the industry. The data-driven insights presented are valuable for industry stakeholders, investors, and anyone seeking a comprehensive understanding of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.24% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.24%.

Key companies in the market include Homat, Aaron's, Rent-A-Center, Feather, Brook Furniture Rental, The Everset, Fernish, CORT Furniture Rental, Luxe modern Rentals, Rentomojo, Fashion Furniture Rentals, Oliver Space, Inhabitr, CasaOne, AFR Furniture Rental, .

The market segments include Type, Application.

The market size is estimated to be USD 90.47 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Furniture Rental Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Furniture Rental Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.