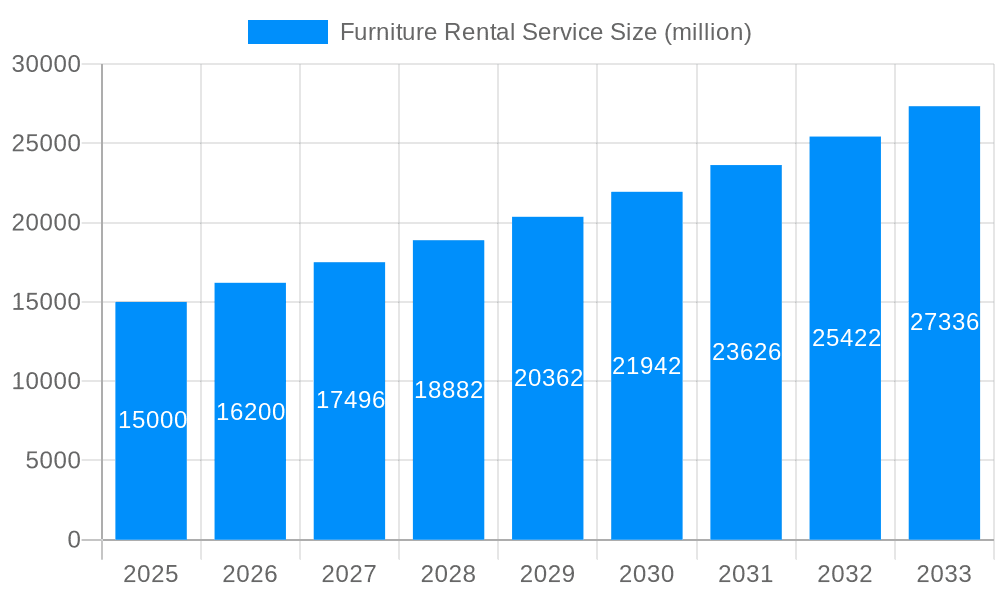

1. What is the projected Compound Annual Growth Rate (CAGR) of the Furniture Rental Service?

The projected CAGR is approximately 10.24%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Furniture Rental Service

Furniture Rental ServiceFurniture Rental Service by Type (Homewares, Small Electronics, Decoration, Others), by Application (Commercial, Residential), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

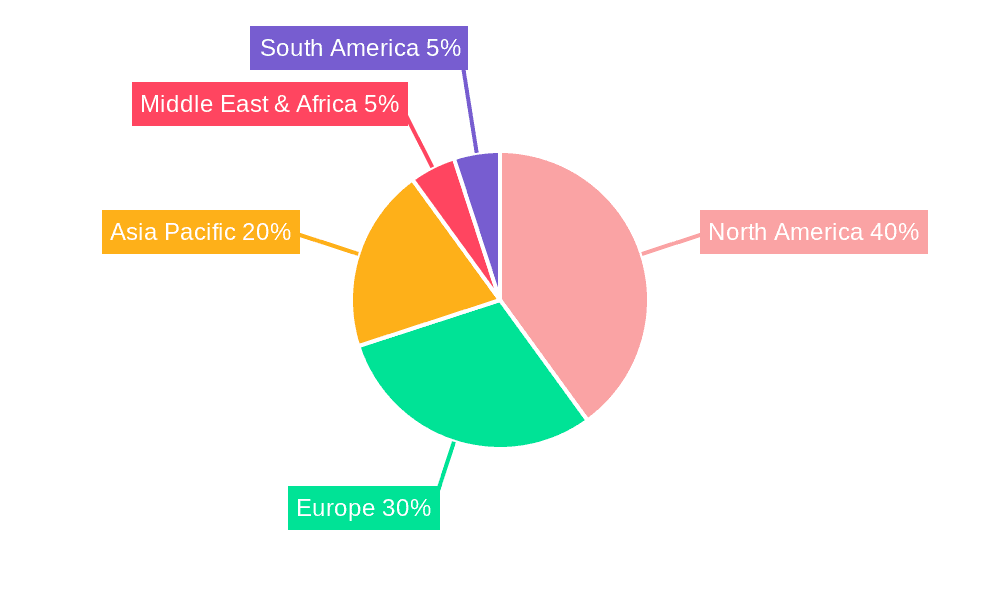

The global furniture rental market is poised for significant expansion, driven by escalating urbanization, the growing appeal of flexible living solutions, and evolving consumer preferences. The market, projected at $90.47 billion in the base year 2025, is anticipated to achieve a Compound Annual Growth Rate (CAGR) of 10.24% between 2025 and 2033, reaching an estimated $200 billion by 2033. This growth trajectory is underpinned by several critical drivers. First, the increasing adoption of subscription-based models offers unparalleled convenience, attracting a diverse demographic including young professionals, students, and transient populations. Second, the rising costs associated with homeownership and a greater desire for residential mobility are prompting consumers to favor furniture rental over outright purchase. Furthermore, businesses, particularly within the hospitality and commercial sectors, are increasingly recognizing the cost-effectiveness and adaptability of furniture rental solutions, especially in response to fluctuating occupancy rates and evolving interior design trends. Market segmentation highlights robust demand across both residential and commercial applications, with home furnishings and small electronics representing dominant product categories. While North America currently commands a substantial market share, the Asia-Pacific region is expected to experience pronounced growth due to rapid urbanization and rising disposable incomes. However, potential market restraints include economic volatility and fluctuations in rental pricing.

The competitive landscape is characterized by a dynamic interplay between established furniture rental providers and innovative, technology-forward startups. Strategic emphasis is placed on leveraging digital platforms, optimizing logistics for seamless delivery, and offering adaptable rental terms to cater to contemporary consumer demands. A notable trend is the heightened focus on personalized customer experiences and expanded product portfolios, including curated packages designed for diverse lifestyles and aesthetic preferences. Forward-thinking companies are integrating sustainability and eco-conscious practices into their operations, offering rental options that appeal to environmentally aware consumers. Geographic expansion continues to be a paramount strategy, with market participants targeting both mature and nascent markets to capitalize on the escalating global demand for furniture rental services. Sustained future growth will be contingent upon the industry's ability to adapt to shifting consumer expectations, integrate advanced technologies for enhanced customer journeys, and embrace sustainable operational frameworks.

The global furniture rental service market is experiencing significant growth, projected to reach multi-million unit volumes by 2033. Driven by evolving consumer preferences and technological advancements, this sector is transforming the way people furnish their homes and workplaces. The historical period (2019-2024) witnessed a steady increase in market adoption, particularly in urban areas with high population density and mobility. The base year (2025) serves as a crucial benchmark, highlighting the market's maturity and readiness for further expansion. The forecast period (2025-2033) anticipates continued growth fueled by several key factors explored later in this report. Key market insights reveal a shift away from traditional ownership models, with consumers increasingly opting for flexible rental options. This is particularly evident in the residential segment, where renters and young professionals are embracing furniture rental as a cost-effective and convenient alternative to purchasing. The rise of e-commerce platforms and subscription-based services has also streamlined the rental process, improving customer experience and driving market penetration. The market's expansion isn't limited to residential applications; commercial spaces, particularly co-working spaces and short-term rentals, are also adopting furniture rental to optimize their operations and reduce capital expenditure. Furthermore, the growing awareness of sustainable consumption patterns is contributing to the market’s appeal. Rental offers a circular economy approach, minimizing waste associated with furniture disposal and reducing the environmental impact. The increasing demand for flexibility and convenience is further pushing the growth of the industry. The market's evolution is intrinsically linked to broader societal shifts, reflecting a growing preference for experience over ownership, especially amongst millennials and Gen Z. The competitive landscape is dynamic, with both established players and innovative startups vying for market share through diverse service offerings and technological advancements, leading to a high level of innovation in the furniture rental market.

Several factors are driving the expansion of the furniture rental service market. Firstly, the increasing urbanization and population density in major cities globally are creating a higher demand for flexible and convenient furniture solutions. Secondly, the rise of the sharing economy and subscription-based services has fostered a cultural shift towards rental models as opposed to outright ownership. This is particularly appealing to younger demographics who prioritize mobility and flexibility over long-term commitments. The increasing popularity of short-term rentals and co-working spaces fuels the demand for flexible, adaptable furniture solutions that can be easily adjusted as needed. Thirdly, the growing environmental awareness and concern for sustainability are pushing consumers to adopt rental models that promote a circular economy and minimize waste. Renting furniture reduces the environmental impact associated with manufacturing, transportation, and disposal of furniture. Finally, technological advancements, particularly in online platforms and mobile applications, have simplified the rental process, making it more accessible and user-friendly. These platforms often provide personalized recommendations, streamlined delivery, and hassle-free returns, enhancing the overall customer experience and further bolstering market growth. The cost-effectiveness of renting compared to buying, especially for frequently moved populations, is also a significant driver, helping customers to avoid large upfront costs and potential losses associated with moving or changing living situations.

Despite its significant growth potential, the furniture rental service market faces several challenges. Damage and wear and tear to rented furniture pose a considerable operational hurdle. Implementing effective damage assessment and repair protocols is crucial for maintaining profitability and satisfying customers. Maintaining inventory levels and managing logistics across multiple locations present complex supply chain challenges. Efficient inventory management systems and effective logistics networks are crucial to ensure timely delivery and pick-up of furniture, leading to customer satisfaction. Competition among numerous players and varying pricing strategies can create price volatility and impact profit margins. Differentiation through unique service offerings or targeted marketing is crucial to maintaining a competitive edge. Customer acquisition costs can be high, especially in saturated markets. Effective marketing strategies and customer loyalty programs are essential to attract and retain customers. Regulatory compliance, especially regarding contracts, consumer protection laws, and data privacy, can be complex and costly. Adherence to legal frameworks and effective risk management strategies are crucial for sustainable growth. Finally, potential issues with furniture quality and customer service can lead to negative reviews and reputational damage. Maintaining high-quality furniture and providing excellent customer service are crucial for building trust and long-term relationships.

The residential segment is expected to dominate the furniture rental market throughout the forecast period (2025-2033). This is driven by several factors including the growing number of renters, particularly millennials and Gen Z who prefer flexible living arrangements. The increasing popularity of short-term rentals (like Airbnb) also fuels the demand for rental furniture in this segment.

North America (specifically the US): The US market is mature and highly competitive, with established players and several successful startups. High disposable incomes, a significant renter population, and a robust e-commerce infrastructure contribute to its dominance.

Europe (primarily Western Europe): Western European countries are witnessing rising adoption rates of furniture rental services, driven by similar factors to North America, including urbanization and a preference for flexible lifestyles.

Asia-Pacific (particularly urban centers in China and India): Rapid urbanization and increasing disposable incomes in key Asian markets are creating significant growth opportunities. While still developing compared to North America and Europe, the potential for market expansion is vast.

The homewares segment also holds a significant share within the market, primarily driven by the need for furniture essentials such as sofas, beds, dining tables, and chairs. The demand for homewares is high and relatively consistent across demographics compared to more specialized items like electronics or specific decor items. This segment is less prone to rapid obsolescence, contributing to the viability of a rental model.

The furniture rental industry is experiencing rapid growth spurred by several key catalysts. The rising preference for flexible living arrangements, particularly among younger demographics, is a significant driver. The increasing popularity of subscription-based services and the convenience they offer further contributes to market expansion. Environmental concerns and a growing emphasis on sustainable consumption are also driving consumer interest in rental models, offering a more environmentally friendly alternative to traditional furniture ownership. Finally, technological advancements, enabling easier online browsing, booking, and delivery, are enhancing the customer experience and facilitating market growth.

This report provides a comprehensive overview of the furniture rental service market, covering key trends, driving forces, challenges, and growth opportunities. It analyzes the market's performance across key segments and regions, offering in-depth insights into the competitive landscape and providing forecasts for future growth. The report is invaluable for industry stakeholders, investors, and anyone seeking a comprehensive understanding of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.24% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.24%.

Key companies in the market include Homat, Aaron's, Rent-A-Center, Feather, Brook Furniture Rental, The Everset, Fernish, CORT Furniture Rental, Luxe modern Rentals, Rentomojo, Fashion Furniture Rentals, Oliver Space, Inhabitr, CasaOne, AFR Furniture Rental, .

The market segments include Type, Application.

The market size is estimated to be USD 90.47 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Furniture Rental Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Furniture Rental Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.