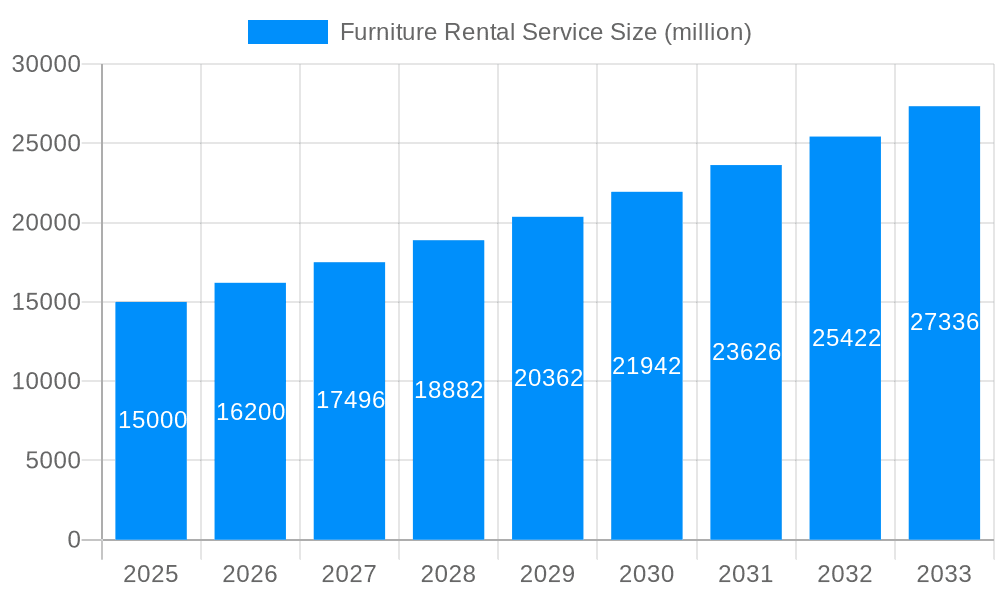

1. What is the projected Compound Annual Growth Rate (CAGR) of the Furniture Rental Service?

The projected CAGR is approximately 10.24%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Furniture Rental Service

Furniture Rental ServiceFurniture Rental Service by Type (Homewares, Small Electronics, Decoration, Others), by Application (Commercial, Residential), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global furniture rental market is poised for significant expansion, driven by evolving consumer lifestyles, rapid urbanization, and the proliferation of subscription models. Projections indicate a market size of $90.47 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 10.24% between 2025 and 2033. Key growth catalysts include the increasing preference for flexible living arrangements, particularly among younger demographics, and the inherent cost-effectiveness and convenience of renting over purchasing for transient populations. The digital transformation of the sector, marked by robust e-commerce integration and innovative service offerings, is further accelerating market penetration. Additionally, growing demand from the commercial sector for temporary office solutions and corporate housing solutions contributes to this upward trend.

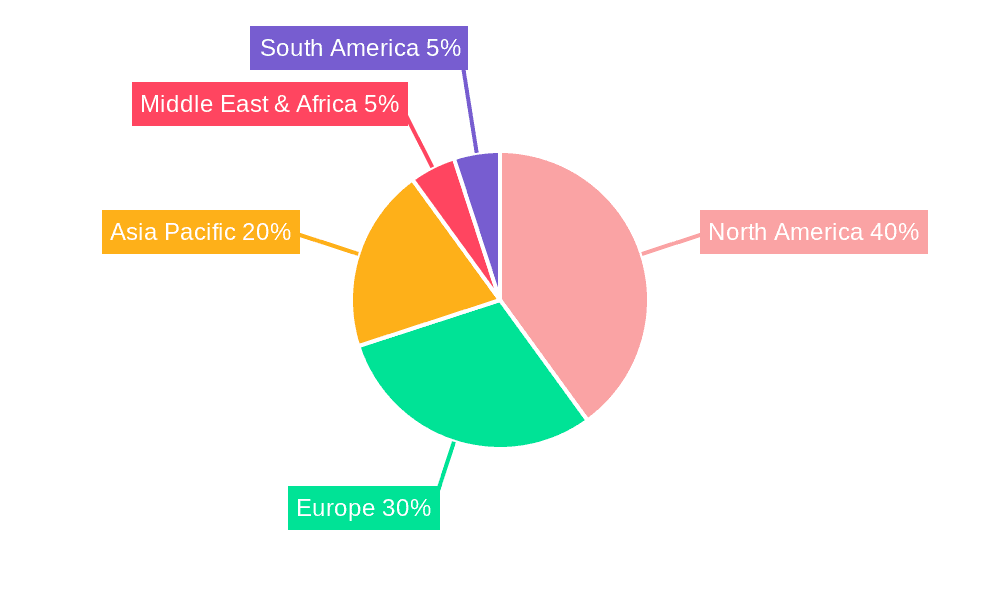

Market analysis highlights robust demand across diverse furniture categories, with home furnishings, small appliances, and decorative items at the forefront. While the residential segment remains dominant, commercial applications, including short-term accommodations and co-working environments, are experiencing accelerated growth. Industry leaders such as CORT Furniture Rental, Aaron's, and Rent-A-Center leverage their established brand equity and extensive operational infrastructures. Conversely, agile, technology-driven entrants like Fernish and CasaOne are disrupting the landscape with enhanced digital customer experiences and optimized logistics. Geographically, North America and Europe are expected to maintain substantial market shares, while the Asia-Pacific region presents considerable growth potential, fueled by rising disposable incomes and urbanization. Potential market constraints include the risk of product damage, inventory management complexities, and competitive pressures from traditional furniture retailers.

The furniture rental service market is experiencing a period of significant transformation, driven by evolving consumer preferences and technological advancements. Over the historical period (2019-2024), the market witnessed substantial growth, exceeding several million units annually. This upward trajectory is projected to continue throughout the forecast period (2025-2033), with estimations indicating a compound annual growth rate (CAGR) in the millions of units. Key market insights reveal a shift away from traditional ownership models towards flexible, subscription-based services. This trend is particularly pronounced among younger demographics and urban dwellers who value mobility and convenience. The rise of e-commerce platforms and mobile applications has streamlined the rental process, making furniture rental accessible to a wider consumer base. Furthermore, the increasing awareness of sustainability and the desire to minimize waste are contributing factors to the market's growth. Consumers are increasingly opting to rent furniture, rather than purchase it, as this allows them to easily update their decor without the burden of ownership and disposal. The market is also witnessing the emergence of innovative business models, such as curated furniture rental services offering designer pieces and flexible lease terms. These factors collectively paint a picture of a dynamic and rapidly expanding furniture rental market. The estimated market size in 2025 is projected to be in the hundreds of millions of units, showcasing the massive potential for growth in this sector. The base year for our analysis is 2025, providing a comprehensive understanding of the present state and future prospects of the industry.

Several factors are driving the exponential growth of the furniture rental service market. Firstly, the increasing urbanization and mobility of populations, especially among millennials and Gen Z, fuels the demand for flexible living solutions. Renting furniture offers convenience and avoids the commitment of long-term ownership, aligning perfectly with their lifestyle preferences. Secondly, the rise of the sharing economy and subscription models has created a favorable environment for furniture rental services. Consumers are increasingly embracing on-demand services, preferring convenience and accessibility over traditional ownership. Thirdly, economic factors play a crucial role. Furniture rental offers a more affordable alternative to purchasing, particularly for budget-conscious consumers or those facing temporary financial constraints. The ability to easily upgrade or downsize furniture based on changing needs further contributes to its appeal. Lastly, growing environmental awareness is pushing consumers towards more sustainable consumption patterns. Renting furniture reduces waste associated with manufacturing and disposal, appealing to environmentally conscious individuals. The combination of these factors creates a powerful synergy that is propelling the rapid expansion of the furniture rental service market, making it a compelling investment opportunity in the coming years.

Despite its significant growth potential, the furniture rental service market faces several challenges and restraints. One primary concern is the potential for damage and wear and tear to rented furniture. Managing and mitigating these risks requires robust inventory management systems, thorough inspection protocols, and potentially higher rental fees to account for potential losses. Competition within the market is also intensifying, with established players and new entrants vying for market share. Maintaining a competitive edge necessitates innovation in service offerings, pricing strategies, and customer experience. Furthermore, logistical complexities associated with delivery, setup, and retrieval of furniture can pose operational challenges, particularly in densely populated urban areas. Efficient and cost-effective logistics are crucial for profitability. Finally, consumer perceptions and trust remain a factor. Overcoming potential skepticism about the quality of rented furniture and ensuring customer satisfaction are essential for sustained growth. Addressing these challenges effectively will be crucial for the long-term success of companies operating in this market.

The residential segment is expected to dominate the furniture rental market throughout the forecast period (2025-2033), driven by the increasing popularity of flexible living arrangements and the growing preference for subscription-based services amongst urban dwellers. Specific regions such as North America and Western Europe are projected to exhibit strong growth, fueled by higher disposable incomes and a preference for convenience-driven services. Within the residential segment, the homewares category will likely represent a significant portion of the market, given the widespread need for furniture in households.

Residential Segment Dominance: The residential segment's growth is primarily driven by the shifting consumer preferences toward flexible living and the increasing acceptance of rental models, particularly among younger demographics. The ease of upgrading or changing furniture as lifestyle or needs change, coupled with cost savings, makes residential rental attractive.

North America & Western Europe: These regions possess a significant proportion of affluent consumers with a willingness to adopt subscription models. Higher disposable incomes, coupled with a robust e-commerce infrastructure, facilitate seamless online ordering and delivery of rental furniture.

Homewares Category: This category is essential for the setup of a home, influencing a strong demand for rental furniture. Items like sofas, beds, dining tables, chairs, and storage units make up a significant portion of the total volume of furniture rentals.

The dominance of these segments and regions is not just a current trend but is projected to continue into the future, given sustained underlying economic and societal factors. Other segments like commercial rental are expected to grow, though at a slower pace than residential.

The furniture rental service industry is experiencing robust growth due to several key factors. The increasing urbanization and mobility of populations are creating a demand for flexible furniture solutions. Simultaneously, the rise of the sharing economy and subscription models is changing consumer behavior, emphasizing convenience and affordability. Moreover, eco-conscious consumers are drawn to the sustainable nature of renting, reducing waste associated with manufacturing and disposal. These combined factors are generating a significant surge in market demand, reinforcing the industry's positive growth trajectory.

This report provides a comprehensive analysis of the furniture rental service market, covering market trends, driving forces, challenges, key regions and segments, growth catalysts, leading players, and significant developments. The detailed analysis spans the study period from 2019 to 2033, offering invaluable insights for businesses and investors seeking to understand and navigate this dynamic market. The projections, based on meticulous research and market data, provide a clear picture of the market’s potential and growth prospects in the coming years.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.24% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.24%.

Key companies in the market include Homat, Aaron's, Rent-A-Center, Feather, Brook Furniture Rental, The Everset, Fernish, CORT Furniture Rental, Luxe modern Rentals, Rentomojo, Fashion Furniture Rentals, Oliver Space, Inhabitr, CasaOne, AFR Furniture Rental, .

The market segments include Type, Application.

The market size is estimated to be USD 90.47 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Furniture Rental Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Furniture Rental Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.