1. What is the projected Compound Annual Growth Rate (CAGR) of the Fully-automated Beer Dealcoholization System?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fully-automated Beer Dealcoholization System

Fully-automated Beer Dealcoholization SystemFully-automated Beer Dealcoholization System by Type (Maximum Processing Capacity: Less Than 500 Liters Per Hour, Maximum Processing Capacity: 500-1000 Liters Per Hour, Maximum Processing Capacity: 1000-2000 Liters Per Hour, Maximum Processing Capacity: Above 2000 Liters Per Hour, World Fully-automated Beer Dealcoholization System Production ), by Application (Regular Beer, Low Malt Beer, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

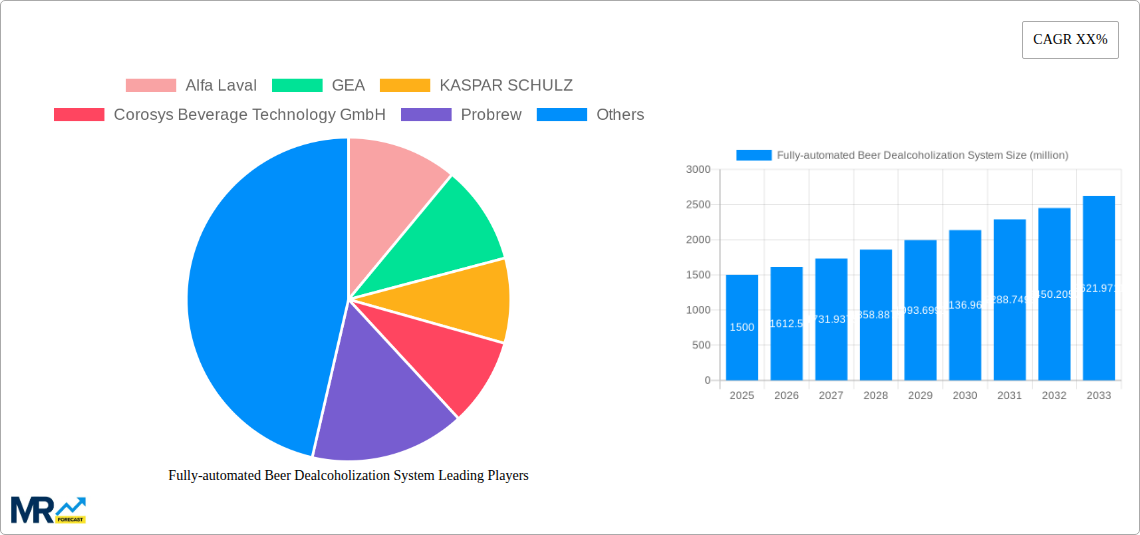

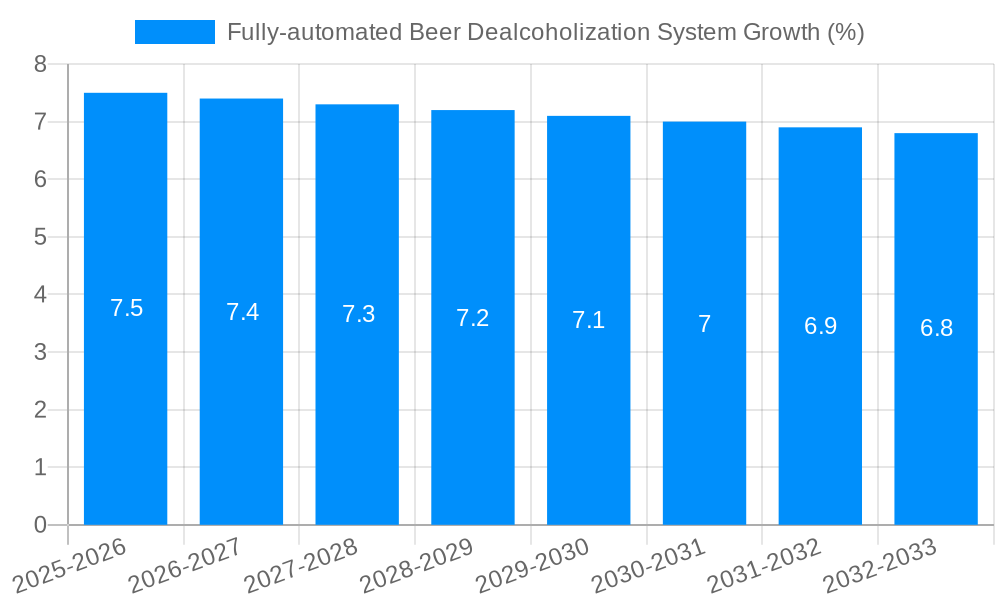

The global Fully-automated Beer Dealcoholization System market is experiencing robust growth, projected to reach an estimated market size of USD 1,500 million by 2025, with a significant Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025-2033. This upward trajectory is primarily fueled by the escalating consumer demand for low-alcohol and non-alcoholic beer options, driven by health-conscious lifestyles and evolving social preferences. Manufacturers are investing heavily in advanced dealcoholization technologies to meet this demand, ensuring product quality and flavor integrity are maintained. The market is segmented by processing capacity, with systems offering capacities of 500-1000 liters per hour and 1000-2000 liters per hour currently holding significant market share due to their versatility and adoption by a wide range of breweries, from craft to large-scale operations. The "Regular Beer" and "Low Malt Beer" segments are the primary application drivers, reflecting the broad appeal of dealcoholized beverages across different beer styles.

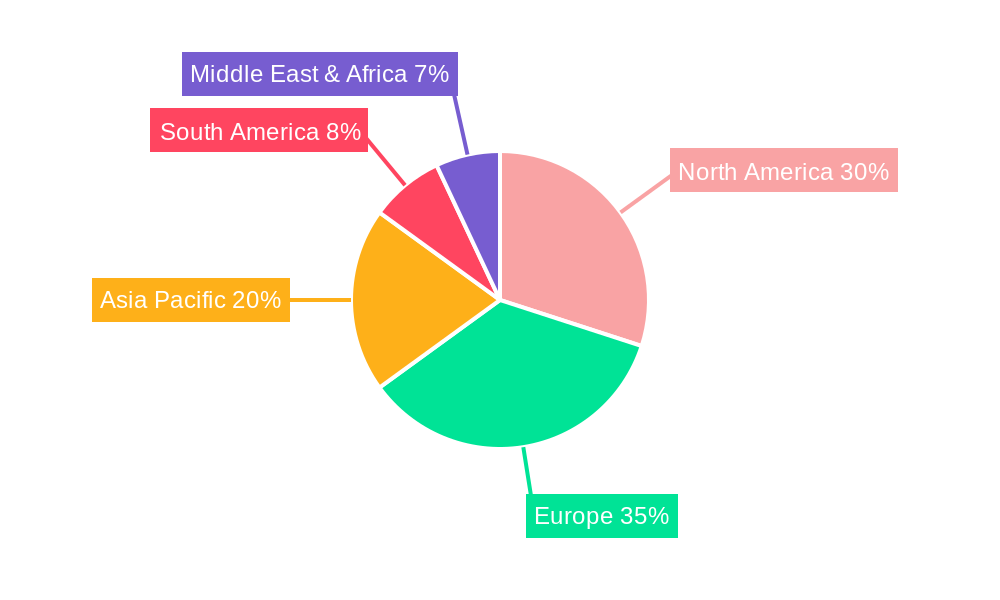

Further reinforcing market expansion are technological advancements in dealcoholization techniques, such as advanced membrane filtration and vacuum distillation, which offer higher efficiency and better preservation of beer's sensory attributes. Key market players like Alfa Laval, GEA, and Krones are at the forefront of innovation, continuously introducing sophisticated and cost-effective solutions. Geographically, North America and Europe are leading markets, owing to a mature beverage industry and strong consumer acceptance of low- and no-alcohol products. Asia Pacific is emerging as a high-growth region, with increasing disposable incomes and a rising awareness of health and wellness trends influencing beverage choices. While the market benefits from strong demand drivers, potential restraints include the initial capital investment required for automated systems and the ongoing challenge of replicating the authentic taste profile of full-strength beer in dealcoholized variants. Nevertheless, the market is poised for substantial expansion as technology matures and consumer preferences solidify.

Here is a unique report description on Fully-automated Beer Dealcoholization Systems, incorporating the provided information and structure:

Report Title: Global Fully-automated Beer Dealcoholization System Market Analysis and Forecast (2019-2033)

This comprehensive report delves into the rapidly evolving global market for Fully-automated Beer Dealcoholization Systems, offering a meticulous analysis of trends, drivers, challenges, and growth opportunities from the historical period of 2019-2024 through to a projected forecast period extending to 2033. With a base year of 2025, the study provides invaluable insights into market dynamics, technological advancements, and competitive landscapes, crucial for stakeholders seeking to navigate this burgeoning sector. The market is projected to witness substantial growth, with estimated revenues reaching several hundred million dollars by the forecast period. This report equips industry players with the data and strategic foresight necessary to capitalize on emerging trends and secure a competitive edge in the coming decade.

The Fully-automated Beer Dealcoholization System market is experiencing a significant upswing, driven by a confluence of evolving consumer preferences and advancements in processing technologies. A key insight is the growing demand for low and no-alcohol (LNA) beer variants, a trend that has surged in popularity over the historical period (2019-2024) and is expected to accelerate through the forecast period (2025-2033). Consumers, increasingly health-conscious and seeking moderation without compromising on taste, are actively seeking alternatives to traditional alcoholic beverages. This shift in consumer behavior directly fuels the need for efficient and scalable dealcoholization solutions. Furthermore, the market is witnessing a trend towards higher processing capacities, with a notable inclination towards systems exceeding 1000-2000 liters per hour and even systems with capacities above 2000 liters per hour. This reflects the increasing scale of production required by major beverage manufacturers aiming to meet the burgeoning demand for LNA beers globally. The integration of advanced automation and intelligent control systems is also a paramount trend, enabling greater precision, consistency, and reduced operational costs. Companies are investing heavily in research and development to enhance the sensory profiles of dealcoholized beers, ensuring that the removal of alcohol does not significantly impact the inherent flavor and aroma characteristics. The adoption of technologies such as membrane filtration and spinning cone technology continues to be refined, offering more efficient and less impactful methods of alcohol extraction. The market is also observing a geographical shift, with Asia-Pacific emerging as a significant growth region, driven by an expanding middle class with increasing disposable incomes and a growing awareness of health and wellness trends. The report will dissect these trends, providing quantitative projections and qualitative analysis to illuminate the path forward for this dynamic market.

The rapid expansion of the Fully-automated Beer Dealcoholization System market is underpinned by several powerful driving forces. Foremost among these is the global health and wellness movement. As consumers worldwide become more health-conscious, the demand for lower-alcohol and alcohol-free beverages, including beer, has seen an unprecedented surge. This dietary shift is not a fleeting trend but a fundamental change in consumer lifestyle, directly translating into increased demand for dealcoholization technologies. Secondly, regulatory shifts and taxation policies in various regions, aimed at reducing alcohol consumption, indirectly favor the growth of LNA beer markets and, consequently, the dealcoholization systems. Producers are actively seeking to diversify their portfolios and cater to a broader consumer base, including those who abstain from alcohol or choose to moderate their intake. Moreover, technological advancements in dealcoholization processes have been instrumental. Innovations in membrane filtration, reverse osmosis, and vacuum distillation have significantly improved the efficiency, effectiveness, and cost-competitiveness of these systems. These advancements ensure that the dealcoholization process preserves the original flavor profile of the beer, a critical factor for consumer acceptance. The increasing ease of integration and automation offered by modern systems also reduces operational complexities for breweries, making dealcoholization a more accessible and attractive option.

Despite the robust growth trajectory, the Fully-automated Beer Dealcoholization System market is not without its hurdles. A primary challenge lies in preserving the sensory integrity of the beer. While technologies have advanced, achieving a perfect replication of the taste, mouthfeel, and aroma of alcoholic beer after alcohol removal remains a complex scientific and engineering feat. Off-flavors and a perceived watery texture can still be concerns for some consumers, leading to market resistance and limiting the appeal of certain dealcoholized products. Secondly, the initial capital investment for these sophisticated automated systems can be substantial, posing a significant barrier for smaller breweries or those in emerging economies. While the long-term operational cost savings are often compelling, the upfront expenditure can be prohibitive. Furthermore, consumer perception and education play a crucial role. The category of LNA beers is still relatively young, and educating consumers about the quality and variety available, as well as dispelling any lingering misconceptions, requires ongoing marketing efforts. Finally, regulatory complexities and differing labeling standards across various countries can create operational challenges for global beverage manufacturers seeking to produce and market dealcoholized beers internationally. Ensuring compliance with diverse food and beverage regulations adds another layer of complexity to market penetration.

The Fully-automated Beer Dealcoholization System market is poised for significant growth across various regions and segments, with particular dominance anticipated in specific areas.

Dominant Segment by Processing Capacity: Above 2000 Liters Per Hour

The "Above 2000 Liters Per Hour" segment is expected to be a primary driver of market value and volume. This is directly correlated with the production demands of major global beverage manufacturers who are increasingly focusing on large-scale production of low and no-alcohol beer. As these companies expand their LNA portfolios to meet escalating consumer demand, they require highly efficient, high-capacity systems to maintain cost-effectiveness and meet market supply. Investments in this segment are substantial, often running into tens of millions of dollars per installation, reflecting the scale of operations. The ability of these systems to process vast quantities of beer ensures that the economies of scale are leveraged, making LNA beer production more competitive against traditional alcoholic counterparts. This segment is characterized by significant technological integration, including advanced automation, precise control mechanisms, and optimized energy consumption to handle such high throughputs. Companies like Alfa Laval and GEA are at the forefront of developing and supplying these large-scale solutions, often tailoring them to the specific needs of multinational brewing corporations.

Dominant Application: Regular Beer

While "Low Malt Beer" and "Other" applications will see growth, the "Regular Beer" segment is anticipated to remain the largest and most impactful. This is because the primary application of dealcoholization systems is to remove alcohol from conventionally brewed beers to create LNA versions, thereby expanding the market for existing beer brands. Many established breweries are leveraging their core beer recipes and adapting them for the LNA market through dealcoholization. This allows them to tap into the growing consumer demand for healthier options without fundamentally altering their brewing heritage or brand identity. The sheer volume of regular beer production globally ensures that this segment will continue to be the largest market for dealcoholization technologies. The market value associated with the dealcoholization of regular beer can easily reach hundreds of millions of dollars annually as major players invest in adapting their flagship products.

Dominant Region: Europe

Europe is projected to continue its dominance in the Fully-automated Beer Dealcoholization System market. This is attributed to several factors:

The Fully-automated Beer Dealcoholization System industry is experiencing robust growth, primarily fueled by the accelerating global demand for low and no-alcohol (LNA) beverages. This consumer-led shift towards healthier lifestyle choices is a significant catalyst, prompting breweries worldwide to expand their LNA product portfolios. Furthermore, continuous technological advancements in dealcoholization processes, such as improved membrane filtration and spinning cone technologies, are making these systems more efficient, cost-effective, and capable of preserving the beer's original sensory qualities. This technological evolution is reducing operational complexities and enhancing the appeal of dealcoholized beers to a wider consumer base. The increasing investment in research and development by leading manufacturers, aiming to optimize flavor profiles and reduce processing impact, also acts as a key growth catalyst, driving innovation and market expansion.

This report provides an unparalleled and comprehensive examination of the Fully-automated Beer Dealcoholization System market. It meticulously analyzes market size and forecasts, offering detailed projections for the period between 2019 and 2033, with a crucial base year of 2025. The report delves into the intricate technological landscape, detailing advancements in systems for various processing capacities, from Less Than 500 Liters Per Hour to Above 2000 Liters Per Hour, and exploring applications such as Regular Beer, Low Malt Beer, and Other. Beyond quantitative data, it offers in-depth qualitative insights into industry developments, key regional dominance, and the strategic imperatives for leading players. This all-encompassing analysis equips stakeholders with the critical intelligence needed to navigate this dynamic market, make informed investment decisions, and capitalize on emerging opportunities, ultimately contributing to the sustained growth of the global dealcoholized beverage sector, estimated to reach hundreds of millions of dollars in market value.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Alfa Laval, GEA, KASPAR SCHULZ, Corosys Beverage Technology GmbH, Probrew, Koch Glitsch, Centec GmbH, ATEC GmbH, API Heat Transfer, Krones.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Fully-automated Beer Dealcoholization System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fully-automated Beer Dealcoholization System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.