1. What is the projected Compound Annual Growth Rate (CAGR) of the Fretting Wear Tester?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fretting Wear Tester

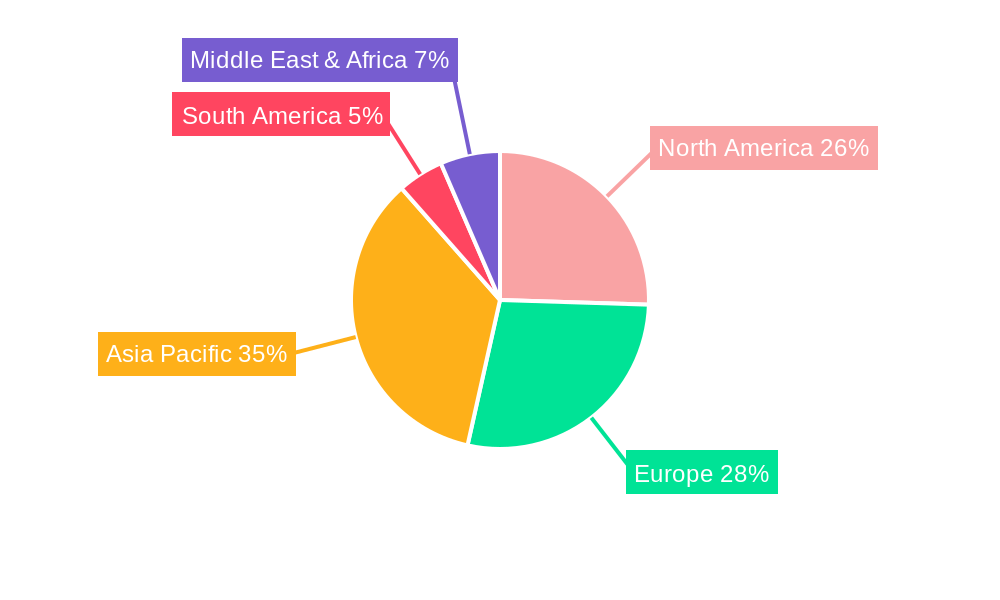

Fretting Wear TesterFretting Wear Tester by Type (Manual, Automatic, World Fretting Wear Tester Production ), by Application (Industrial, Scientific Research, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

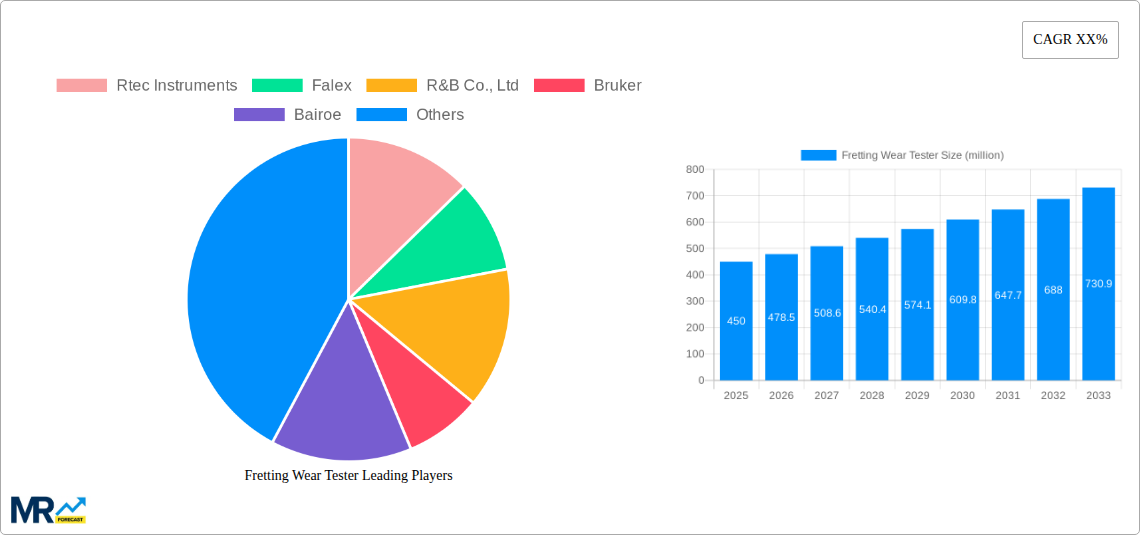

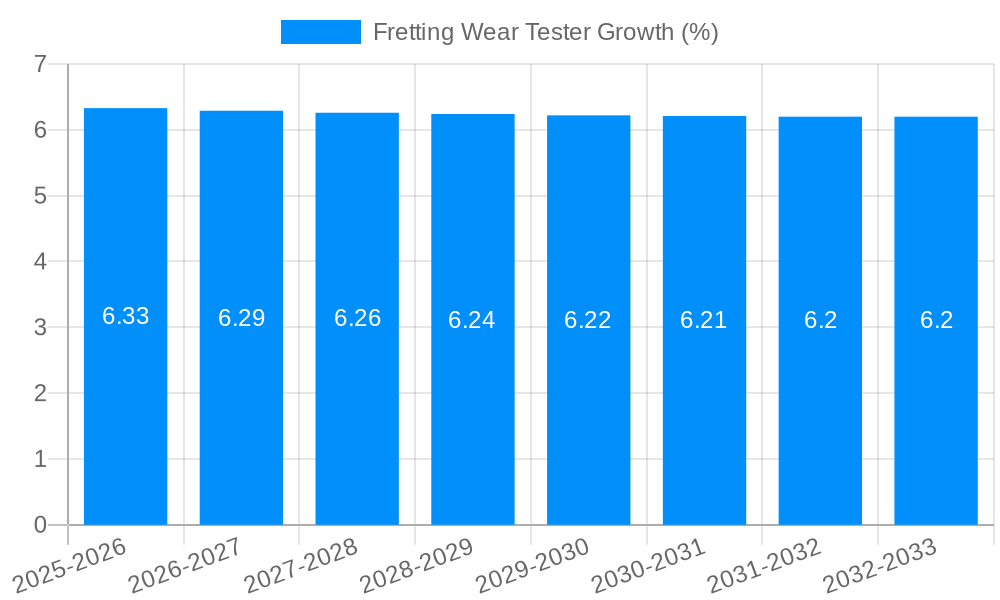

The global Fretting Wear Tester market is poised for substantial growth, projected to reach approximately $450 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This expansion is primarily fueled by the increasing demand for advanced material testing in critical sectors such as automotive, aerospace, and industrial machinery, where understanding component durability under fretting conditions is paramount. The market is witnessing a strong push towards sophisticated automatic testers that offer higher precision, repeatability, and efficiency compared to their manual counterparts. This trend is particularly evident in industrial applications, where continuous operation and stringent quality control necessitate automated solutions for wear analysis. Furthermore, the growing emphasis on product longevity, reduced maintenance costs, and enhanced safety standards across various industries is a significant driver for the adoption of fretting wear testing. Scientific research institutions are also contributing to market demand, utilizing these testers to develop new materials and validate advanced tribological models.

The market, however, faces certain restraints, including the high initial cost of advanced fretting wear testing equipment and the need for skilled personnel to operate and interpret results, which can be a barrier for smaller enterprises. Geographically, Asia Pacific, particularly China and India, is emerging as a key growth region, driven by the rapid industrialization, burgeoning manufacturing sector, and increasing investments in research and development. North America and Europe remain mature yet significant markets, characterized by a strong presence of established players and a continuous demand for high-performance testing solutions. The competitive landscape is dynamic, with key companies like Rtec Instruments, Falex, and Bruker focusing on product innovation, strategic collaborations, and expanding their global reach to cater to the evolving needs of diverse end-use industries. The shift towards intelligent testing systems with data analytics capabilities is a prominent trend shaping the future of this market.

This comprehensive report delves into the intricate dynamics of the global Fretting Wear Tester market, offering an in-depth analysis of trends, drivers, challenges, and future projections. Spanning the Study Period of 2019-2033, with a Base Year and Estimated Year of 2025, and a detailed Forecast Period of 2025-2033, this research provides actionable insights for stakeholders. The Historical Period of 2019-2024 lays the groundwork for understanding past market evolution and identifying emerging patterns.

The Fretting Wear Tester market, valued in the millions of units, is poised for significant growth and technological advancement. The report meticulously examines various facets, including Type (Manual, Automatic, World Fretting Wear Tester Production), Application (Industrial, Scientific Research, Other), and Industry Developments.

The Fretting Wear Tester market is experiencing a period of robust evolution, driven by a confluence of technological advancements and escalating demands across diverse industrial sectors. In the Historical Period of 2019-2024, we observed a steady upward trajectory, with market expansion fueled by increasing awareness of material degradation in critical applications. The Estimated Year of 2025 signifies a pivotal point, where the market is projected to command a valuation in the hundreds of millions of units globally. Looking ahead, the Forecast Period of 2025-2033 anticipates sustained and accelerated growth. A key trend is the burgeoning demand for automated fretting wear testers, reflecting the industry's push towards higher throughput, improved precision, and reduced human error in testing protocols. This shift is particularly evident in sectors like aerospace, automotive, and medical devices, where component reliability is paramount. Furthermore, the integration of advanced data analytics and artificial intelligence into fretting wear testing platforms is emerging as a significant development. These intelligent systems offer real-time monitoring, predictive failure analysis, and optimization of material selection and design. The increasing complexity of modern machinery and the relentless pursuit of enhanced performance and longevity are directly translating into a greater need for sophisticated fretting wear testing solutions. The report will highlight how research and development activities are increasingly focused on creating testers capable of simulating a wider range of real-world operating conditions, including varying loads, frequencies, and environmental factors, thereby providing more accurate and representative wear data. The global fretting wear tester production landscape is also evolving, with a notable trend towards miniaturization and portable testing solutions, catering to on-site testing requirements and expanding the reach of fretting wear analysis beyond traditional laboratory settings. This dynamic market is not merely about the number of units produced but also about the sophistication and versatility of the testing methodologies employed.

The Fretting Wear Tester market is propelled by a powerful combination of factors that underscore the critical importance of understanding and mitigating wear phenomena. The escalating demand for enhanced product reliability and longevity across industries stands as a primary driver. As manufacturing processes become more sophisticated and product lifecycles extend, ensuring the resistance of components to fretting wear – a form of wear occurring between contacting surfaces under oscillating relative motion of small amplitude – becomes paramount. This is particularly true in high-stakes sectors such as aerospace, where component failure can have catastrophic consequences, and in the automotive industry, where vehicle durability and safety are core selling points. The constant drive for innovation and the development of new materials with superior wear resistance also fuels the market. Researchers and manufacturers rely on advanced fretting wear testers to evaluate and validate the performance of these novel materials before their integration into commercial products. Furthermore, stringent regulatory standards and quality control mandates imposed by governing bodies in various industries necessitate comprehensive material testing, including fretting wear analysis. This regulatory push compels companies to invest in reliable testing equipment to ensure their products meet the required performance benchmarks. The increasing complexity of modern machinery and the miniaturization of components in fields like electronics and medical devices also contribute significantly. These smaller, more intricate parts are often subjected to challenging operating conditions, making fretting wear a critical failure mode that requires precise testing.

Despite the robust growth trajectory, the Fretting Wear Tester market encounters several challenges and restraints that temper its full potential. A significant hurdle is the high initial cost associated with acquiring advanced, automated fretting wear testing systems. The sophisticated technology and precision engineering required for these machines translate into substantial capital expenditure, which can be prohibitive for smaller research institutions or companies with limited budgets. This cost factor often leads to a preference for manual testers, especially in less demanding applications, thereby limiting the adoption of more advanced solutions. Another challenge lies in the complexity of interpreting fretting wear data. Accurately correlating laboratory test results with real-world performance can be difficult due to the myriad of variables involved in actual operating environments. This necessitates extensive expertise and sophisticated analytical tools, adding to the overall cost and time investment in testing. Standardization across different testing methodologies and equipment can also be an issue. The lack of universally accepted protocols for fretting wear testing can lead to inconsistencies in results obtained from different laboratories or using different instruments, hindering direct comparisons and cross-validation. Furthermore, the specialized nature of fretting wear testing requires highly skilled personnel to operate the equipment, conduct the tests, and interpret the results. A shortage of qualified technicians and researchers can impede the efficient utilization of existing testing infrastructure and slow down the adoption of new technologies. Finally, the continuous need for recalibration and maintenance of these precision instruments represents an ongoing operational expense that can be a deterrent for some market participants.

The global Fretting Wear Tester market is characterized by distinct regional dynamics and segment dominance, with certain areas and applications showcasing particularly strong performance.

Dominant Segments:

Dominant Regions/Countries:

The interplay of these segments and regions, driven by the overarching need for material characterization and performance validation, shapes the global Fretting Wear Tester market landscape.

The Fretting Wear Tester industry is experiencing several key growth catalysts that are fueling its expansion. The continuous innovation in material science, leading to the development of new alloys, composites, and coatings with enhanced wear resistance, necessitates advanced testing methods to validate their performance. Furthermore, the increasing complexity and miniaturization of components in critical industries like aerospace, automotive, and medical devices amplify the importance of precise fretting wear characterization to ensure reliability and safety. The growing emphasis on product lifecycle management and the demand for longer-lasting, more durable products also directly translate into a higher demand for fretting wear testing solutions.

The global Fretting Wear Tester market is characterized by the presence of several key players driving innovation and catering to diverse industry needs. These companies are instrumental in the research, development, and manufacturing of advanced fretting wear testing equipment.

The Fretting Wear Tester sector has witnessed several pivotal developments, reflecting a continuous drive towards enhanced capabilities and broader applicability.

This report provides a holistic understanding of the Fretting Wear Tester market, extending beyond mere statistical data. It delves into the underlying technological advancements, market trends, and strategic imperatives shaping the industry's future. The comprehensive analysis covers the entire value chain, from raw material sourcing and manufacturing to end-user applications and after-sales services. It aims to equip stakeholders with the knowledge necessary to navigate market complexities, identify emerging opportunities, and mitigate potential risks. The report's robust methodology ensures that the presented data and projections are reliable and insightful, providing a solid foundation for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Rtec Instruments, Falex, R&B Co., Ltd, Bruker, Bairoe, Jinan Huaxing, Jinan Yihua Tribology Testing Technology, Shandong Zhongyi Instrument, Wanjia, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Fretting Wear Tester," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fretting Wear Tester, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.