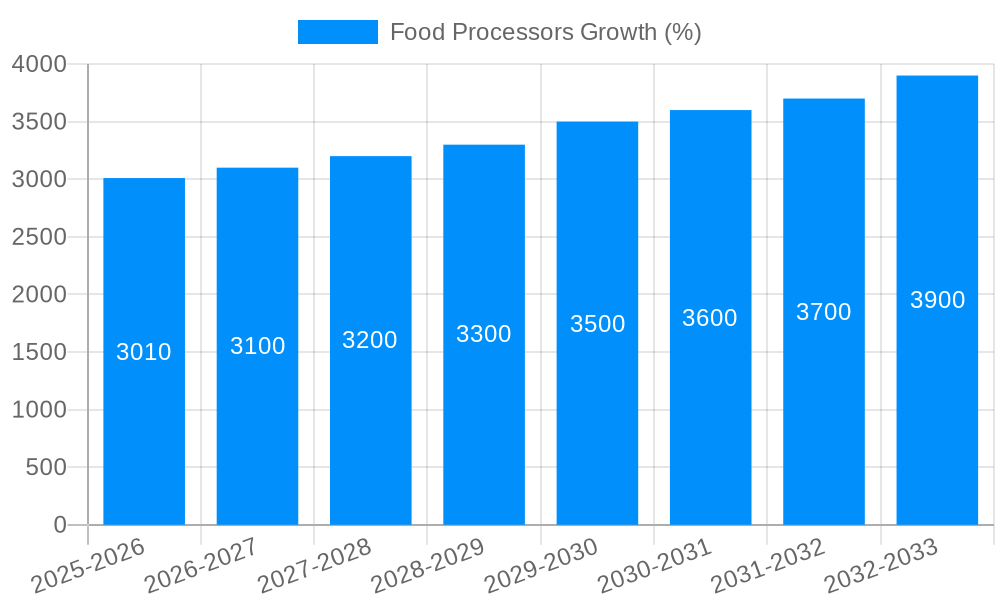

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Processors?

The projected CAGR is approximately 5.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Food Processors

Food ProcessorsFood Processors by Type (4 Cup Capacity, 8 Cup Capacity, 12 Cup Capacity, Over 12 Cup Capacity), by Application (Residential Use, Commercial Use), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

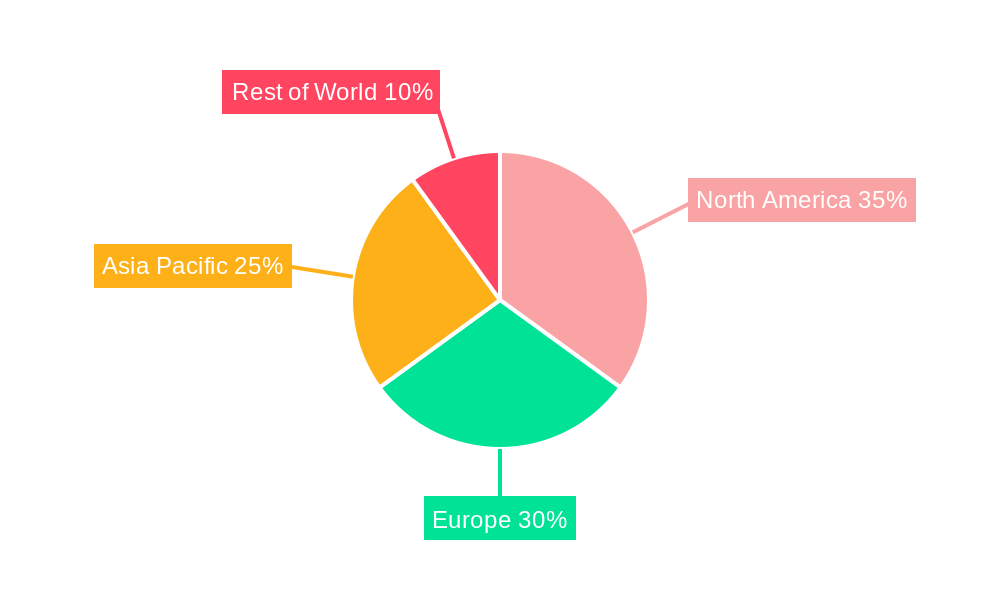

The global food processor market, valued at $58.99 billion in 2025, is projected to experience robust growth, driven by increasing consumer demand for convenient and healthy meal preparation. A Compound Annual Growth Rate (CAGR) of 5.0% is anticipated from 2025 to 2033, indicating a significant expansion of this market. Key drivers include rising disposable incomes, particularly in developing economies, leading to increased adoption of time-saving kitchen appliances. The growing popularity of healthy eating habits and the need for quick and efficient food preparation further fuel market growth. Furthermore, the rising number of dual-income households and busy lifestyles are contributing factors. Market segmentation reveals strong demand across various capacities, ranging from compact 4-cup models ideal for individuals or small families to larger, 12-cup+ models suitable for commercial use or large households. Residential use currently dominates, but the commercial segment is experiencing accelerated growth due to increased adoption in restaurants, cafes, and catering services. Leading brands like DeLonghi, Cuisinart, KitchenAid, and Hamilton Beach hold significant market share, leveraging their strong brand recognition and established distribution networks. However, emerging brands are challenging the established players through innovation and competitive pricing strategies, particularly in the online sales channel. Geographic segmentation indicates that North America and Europe currently hold the largest market share, but significant growth potential exists in Asia-Pacific and other developing regions as consumer preferences evolve and economic conditions improve. The market is expected to witness continuous innovation in terms of functionality, design, and energy efficiency, leading to the launch of premium and advanced models that offer smart features and enhanced performance.

The competitive landscape is characterized by intense rivalry among both established players and new entrants. Successful companies are investing heavily in research and development, focusing on improving product quality, performance, and safety features. Marketing strategies are shifting towards online channels to reach a wider consumer base, utilizing targeted digital advertising and influencer marketing to boost brand awareness and sales. Future growth prospects are largely dependent on several factors, including technological advancements, evolving consumer trends, fluctuations in raw material prices, and economic stability across different regions. Successful players are adapting to these challenges through diversification, strategic partnerships, and continuous product improvement. Overall, the global food processor market demonstrates considerable potential for long-term growth, driven by evolving consumer lifestyles and technological innovations.

The global food processor market, valued at approximately $XX billion in 2024, is projected to experience robust growth, reaching an estimated $YY billion by 2033. This signifies a Compound Annual Growth Rate (CAGR) of X%. Several key trends are shaping this growth. Firstly, the rising popularity of healthy eating and home cooking is a significant driver. Consumers are increasingly seeking convenient ways to prepare nutritious meals, leading to higher demand for food processors that offer diverse functionalities, from chopping and slicing to pureeing and kneading. Secondly, the market is witnessing a shift towards multifunctional appliances that offer versatility and space-saving solutions. Consumers are less inclined to purchase individual appliances for specific tasks, opting instead for multi-purpose kitchen tools like food processors. Thirdly, technological advancements are driving innovation within the industry. Smart food processors with integrated features like recipe apps, automated settings, and improved safety features are gaining traction. Finally, the increasing focus on sustainability is influencing design and manufacturing processes. Consumers are increasingly conscious of environmentally friendly materials and energy-efficient appliances, which is pushing manufacturers to adopt sustainable practices. The market's competitive landscape is marked by the presence of both established players and emerging brands, constantly striving for innovation to cater to evolving consumer preferences and demand.

Several factors are fueling the expansion of the food processor market. The burgeoning popularity of meal prepping is a key driver. Consumers are increasingly adopting meal prepping as a way to manage their time efficiently and ensure healthier eating habits. Food processors significantly streamline this process, making it easier to prepare large quantities of ingredients in advance. Furthermore, the growing number of working professionals and dual-income households has increased the demand for convenient kitchen appliances that can save time and effort. Food processors fit this need perfectly by offering efficient solutions for various culinary tasks. The rising disposable income in emerging economies is also contributing to market growth. As living standards improve, consumers in these regions are increasingly investing in premium kitchen appliances, including advanced food processors. Finally, the constant introduction of innovative features and technological enhancements in food processors, such as improved blade designs, enhanced safety mechanisms, and smart connectivity, keeps the market dynamic and attractive to consumers.

Despite the promising growth trajectory, the food processor market faces several challenges. The high initial cost of premium food processors can be a deterrent for budget-conscious consumers, especially in developing economies. This often leads to a preference for more affordable alternatives or hand-held tools. The market is also characterized by intense competition, with numerous established brands and new entrants vying for market share. This competition forces companies to constantly innovate and offer competitive pricing, impacting profit margins. Another significant challenge is the increasing prevalence of counterfeit products, which can undermine consumer trust and damage brand reputation. Finally, fluctuating raw material prices and supply chain disruptions can negatively impact manufacturing costs and product availability, potentially affecting overall market growth and profitability.

The residential use segment is projected to dominate the food processor market throughout the forecast period (2025-2033). This dominance is driven by several factors:

The 8-cup capacity segment is also expected to hold a significant market share, representing a balance between capacity and affordability for the average household. North America and Europe are expected to remain key regional markets due to high consumer spending power and well-established kitchen appliance markets. However, the Asia-Pacific region is poised for significant growth, fueled by rising disposable incomes and increasing urbanization.

Within specific countries, the United States is likely to retain its position as a leading market, followed by countries like Germany, France, and Japan. The growth in emerging markets, like China and India, presents significant opportunities for manufacturers focusing on affordable yet high-quality products.

The food processor industry is being propelled by several key growth catalysts. These include rising consumer demand for convenient and time-saving kitchen appliances, growing awareness of healthy eating and the benefits of home-cooked meals, and the introduction of innovative features and functionalities in food processors, such as smart connectivity and automated settings. Further, the increasing adoption of meal prepping and the expansion of online retail channels are all contributing to the market's expansion.

This report provides a comprehensive analysis of the global food processor market, offering detailed insights into market trends, driving forces, challenges, key players, and future growth projections. It's an essential resource for businesses involved in the manufacturing, distribution, and retail of food processors, providing valuable market intelligence to inform strategic decision-making. The report covers the historical period (2019-2024), base year (2025), estimated year (2025), and forecast period (2025-2033), offering a holistic view of the market's past performance, current status, and future potential. This analysis includes detailed segmentation by type (4-cup, 8-cup, 12-cup, and over 12-cup capacity) and application (residential and commercial use). Furthermore, the report highlights key regional and country-level market dynamics, allowing for a nuanced understanding of the market's global landscape.

Note: The "XX billion" and "YY billion" values, as well as the CAGR, need to be replaced with actual market data. Similarly, specific details about market developments should be added based on your research. I have provided a template; you will need to fill in the specific data.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.0%.

Key companies in the market include Delonghi Group, Conair Corporation (Cuisinart), Whirlpool (KitchenAid), Hamilton Beach Brands, BSH Home Appliances, Breville, TAURUS Group, Magimix, Spectrum Brands (Black+ Decker), Newell Brands (Oster), Philips, Panasonic, .

The market segments include Type, Application.

The market size is estimated to be USD 58990 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Food Processors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Food Processors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.