1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Packages?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Food Packages

Food PackagesFood Packages by Type (/> Foam, Metal composite, Plastic, Paper, Glass, Other), by Application (/> Additives, Supplements, Ready To Eat Foods, Processed Foods, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

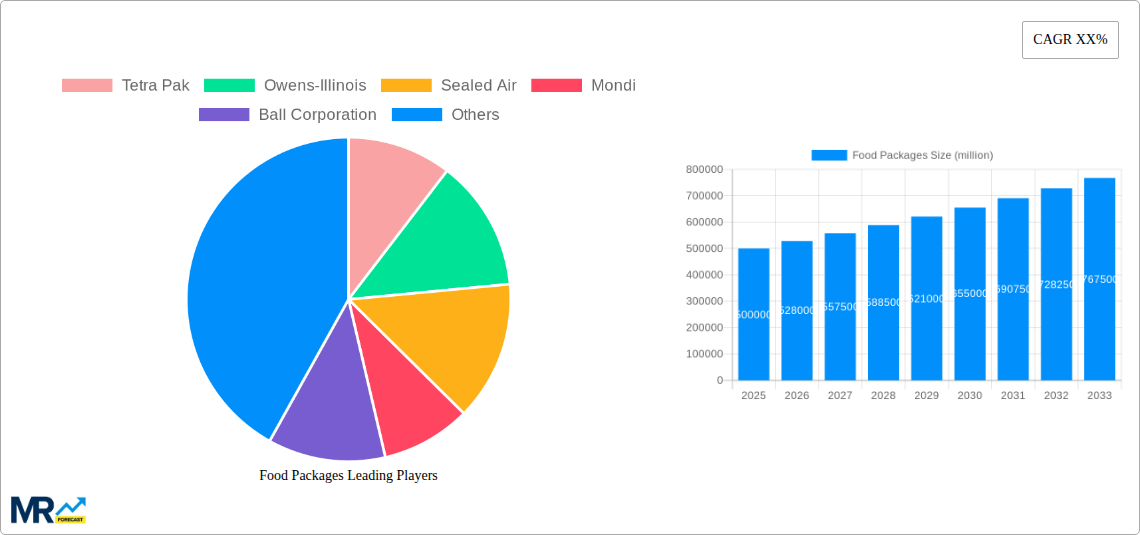

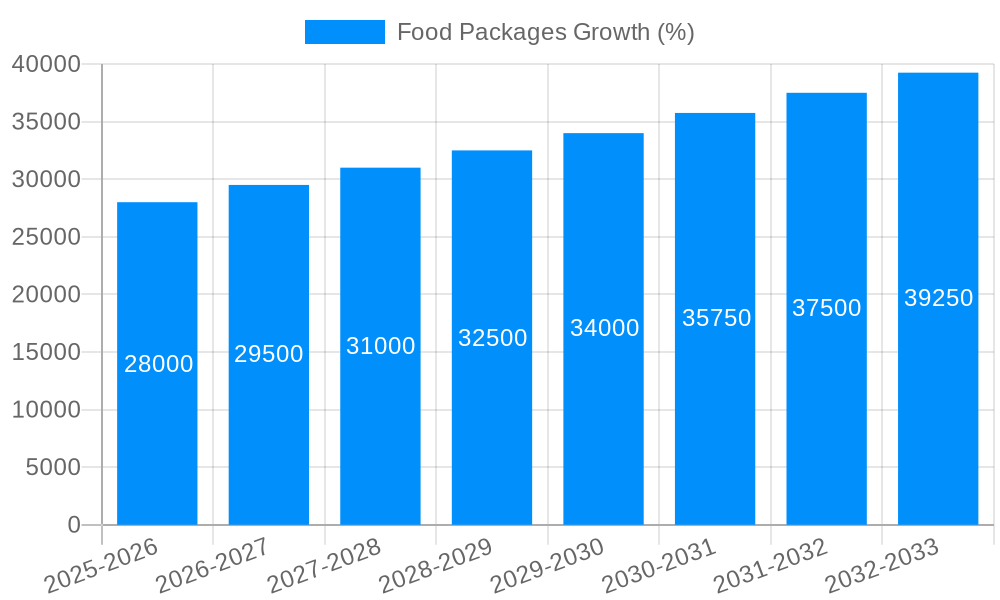

The global food packaging market is poised for significant expansion, projected to reach a substantial Market Size of approximately USD 500 billion by 2025, driven by an estimated Compound Annual Growth Rate (CAGR) of around 5.5% during the forecast period of 2025-2033. This robust growth is underpinned by escalating global food demand, the increasing popularity of convenience and ready-to-eat foods, and the continuous innovation in packaging materials and technologies. The Value Unit of this market is expected to be in the millions of USD, reflecting the sheer volume and value of transactions within this sector. Key drivers include a growing middle class, particularly in emerging economies, which translates to increased disposable income and a higher consumption of packaged food products. Furthermore, the rising awareness and demand for sustainable and eco-friendly packaging solutions are also acting as powerful catalysts, pushing manufacturers to invest in recyclable, biodegradable, and compostable materials. Technological advancements in food preservation, shelf-life extension, and smart packaging are further contributing to market expansion by enhancing product safety and consumer appeal.

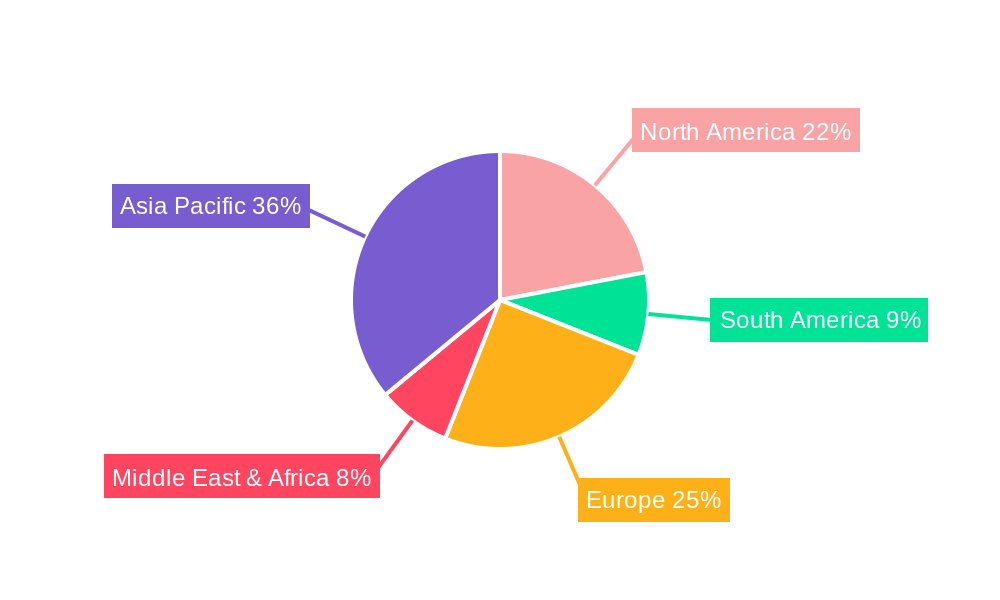

The market is characterized by a diverse range of segments, with the Type segment showing significant traction across various materials like Foam, Metal composite, Plastic, Paper, and Glass. Each type offers unique benefits in terms of protection, cost, and sustainability, catering to specific food product needs. The Application segment is equally dynamic, with Additives, Supplements, Ready To Eat Foods, and Processed Foods being major beneficiaries of advanced packaging solutions. The demand for packaging for Ready To Eat Foods, in particular, is booming due to busy lifestyles and the convenience they offer. Geographically, Asia Pacific is anticipated to emerge as a dominant region, fueled by rapid industrialization, a burgeoning population, and significant investments in the food processing industry. While the market presents immense opportunities, certain restrains such as fluctuating raw material prices, stringent regulatory frameworks regarding food safety, and the environmental impact of certain traditional packaging materials could pose challenges. However, the ongoing Trends towards e-commerce, personalized nutrition, and the integration of smart technologies within packaging are expected to offset these challenges and continue to shape the trajectory of the food packaging industry.

Here is a comprehensive report description on Food Packages, incorporating your specified elements:

The global food packaging market is poised for substantial growth, with projections indicating a valuation that will reach $550,000 million by 2033. This remarkable expansion is a direct reflection of evolving consumer preferences, technological advancements in packaging materials, and an increasing demand for convenience and shelf-life extension. During the historical period of 2019-2024, the market demonstrated consistent upward momentum, laying a strong foundation for the forecast period of 2025-2033. The base year of 2025 itself is anticipated to witness a market size of $480,000 million, underscoring the significant scale of this industry. Key market insights reveal a pronounced shift towards sustainable and eco-friendly packaging solutions. Consumers are becoming more aware of the environmental impact of their choices, driving demand for recyclable, biodegradable, and compostable materials. This trend is not only influencing material innovation but also the design and functionality of food packaging. For instance, the rise of the ready-to-eat food segment, fueled by busy lifestyles and a growing urban population, necessitates packaging that offers convenience, portion control, and extended shelf life. Innovations in plastic packaging are focused on reducing plastic usage while enhancing barrier properties, such as advanced films and coatings. Paper-based packaging is also experiencing a resurgence, with companies investing in high-barrier coatings and innovative structural designs to compete with traditional plastic and metal options. Metal packaging, particularly aluminum, continues to be a strong contender due to its recyclability and barrier properties, especially for beverages and certain processed foods. The composite materials segment, leveraging the strengths of different materials, is also gaining traction for specialized applications. Overall, the market is characterized by a dynamic interplay between sustainability imperatives, technological innovation, and the ever-present need to ensure food safety and quality, all contributing to its robust growth trajectory.

The food packaging market's robust growth is propelled by a confluence of powerful forces that are reshaping consumer behavior and industry practices. Foremost among these is the escalating global population, which directly translates into a heightened demand for food products and, consequently, their packaging. As urbanization accelerates, particularly in developing economies, the need for packaged foods that are convenient, safe, and readily available becomes paramount. This demographic shift creates a consistently expanding consumer base for packaged food items. Furthermore, the evolving lifestyles of consumers worldwide, characterized by busier schedules and a greater emphasis on convenience, are fueling the demand for ready-to-eat meals, single-serving portions, and grab-and-go options. Food packaging plays a critical role in delivering these convenience-oriented food products, ensuring their freshness and appeal. The increasing awareness among consumers regarding food safety and the desire for products with extended shelf life are also significant drivers. Advanced packaging technologies that prevent spoilage, contamination, and physical damage are highly valued, leading to greater adoption of innovative materials and designs. The food industry's continuous innovation in product development, including the introduction of new food formulations and specialized dietary options, also necessitates the development of tailored packaging solutions. These factors collectively create a fertile ground for growth within the food packaging sector.

Despite the promising growth trajectory, the food packaging market faces several significant challenges and restraints that can impact its expansion. Foremost among these is the growing global concern over plastic waste and its environmental impact. Increasing regulatory pressure, consumer activism, and the push towards a circular economy are leading to bans and restrictions on single-use plastics, forcing manufacturers to seek alternative materials or invest heavily in recycling infrastructure. This transition can be costly and complex. The cost of raw materials is another significant restraint. Fluctuations in the prices of petroleum-based plastics, aluminum, paper pulp, and glass can directly impact the profitability of packaging manufacturers and influence the final price of packaged food products. Supply chain disruptions, exacerbated by geopolitical events, natural disasters, and pandemics, can also lead to material shortages and increased lead times, hindering production and delivery schedules. Furthermore, the complexity of food safety regulations across different regions and the need for stringent compliance can pose significant hurdles for packaging companies, requiring continuous investment in quality control and specialized certifications. The development and implementation of innovative, sustainable packaging solutions often require substantial research and development investment, which may not be feasible for all players in the market. Finally, consumer perception and acceptance of alternative packaging materials can be a restraint; for instance, some consumers may still perceive paper or compostable packaging as less durable or effective than traditional options.

The global food packaging market is characterized by significant regional dominance and segment leadership, driven by distinct economic, demographic, and regulatory factors.

Dominant Regions/Countries:

Dominant Segments:

Several key growth catalysts are propelling the food packaging industry forward. The continuous rise in global population and the subsequent increase in food consumption directly translate to a higher demand for packaging. Furthermore, the accelerating trend of urbanization and the adoption of modern lifestyles are fueling the demand for convenient, ready-to-eat, and processed food options, all of which heavily rely on effective packaging solutions. Consumers' growing awareness and demand for healthier food options and specialized dietary products also necessitate innovative packaging that maintains product integrity and freshness.

This comprehensive report provides an in-depth analysis of the global food packaging market, covering the period from 2019 to 2033, with a base year of 2025. It meticulously details market trends, drivers, challenges, and key regional and segmental dominance. The report offers granular insights into the value of the market, estimated to reach $550,000 million by 2033, with the base year of 2025 valued at $480,000 million. It explores the impact of industry developments and identifies the leading players and their significant contributions. The report is designed for stakeholders seeking a thorough understanding of the market dynamics, growth catalysts, and future outlook.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Tetra Pak, Owens-Illinois, Sealed Air, Mondi, Ball Corporation, Crown Holdings, Smurfit Kappa, Amcor, Stora Enso, WestRock, International Paper, TricorBraun, SternMaid America LLC, Victory Packaging, The Plastek Group, TransPak, AFP Inc., Marathon Cheese Corporation, Illing Company, Inc., Flexaco, Inc, Sambrailo Packaging.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Food Packages," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Food Packages, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.