1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Aluminum Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Food Aluminum Packaging

Food Aluminum PackagingFood Aluminum Packaging by Type (Aluminum Foil, Aluminum Can), by Application (Commercial, Civilian), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

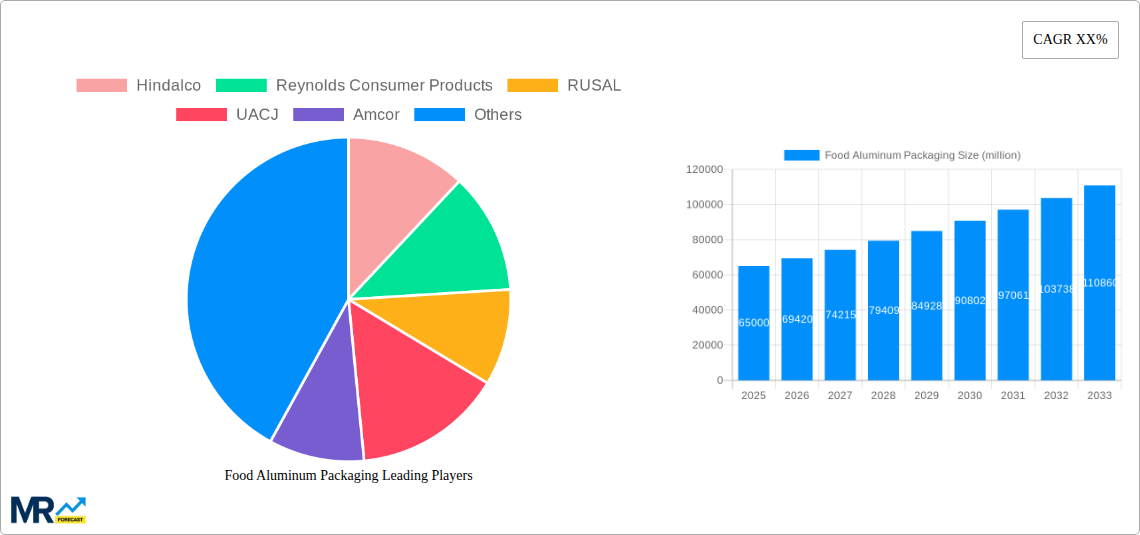

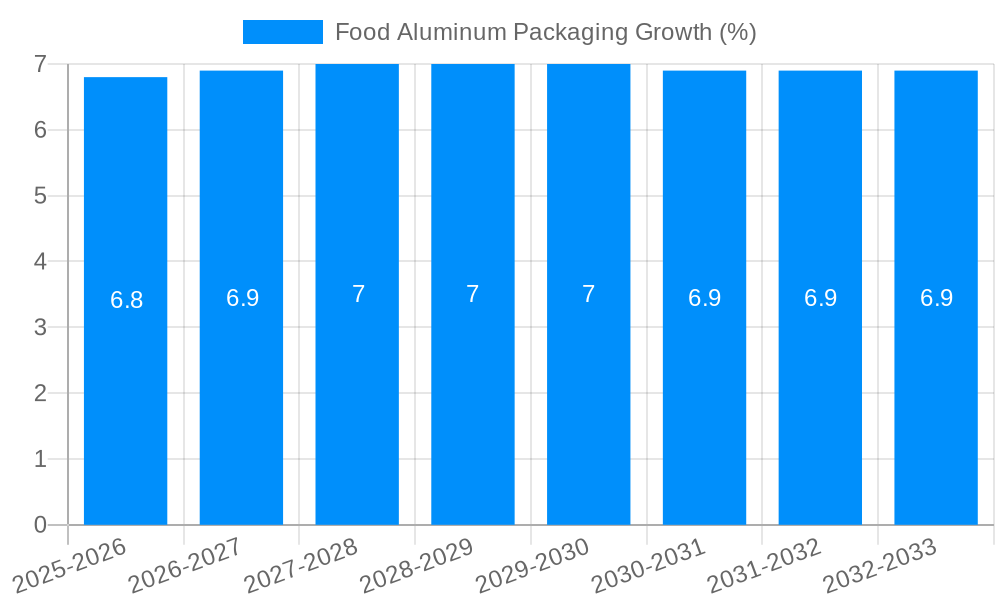

The global Food Aluminum Packaging market is poised for significant expansion, projected to reach a substantial market size of approximately $65 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 6.8% anticipated through 2033. This sustained growth is primarily fueled by the inherent advantages of aluminum in food preservation and presentation. Its excellent barrier properties against light, oxygen, and moisture ensure extended shelf life and maintain food quality, making it a preferred choice for a wide array of food products, from convenience meals and frozen foods to confectionery and beverages. The increasing consumer demand for convenient, portable, and sustainably packaged food items further propels market expansion. Furthermore, the recyclability of aluminum aligns with growing environmental consciousness and regulatory pushes towards a circular economy, positioning aluminum packaging as a sustainable solution.

Key market drivers include the escalating demand for ready-to-eat meals, the expanding processed food industry, and the growing popularity of energy drinks and specialty beverages, all of which heavily rely on aluminum packaging for their integrity and appeal. The diverse applications, ranging from aluminum foil for wrapping and sealing to rigid aluminum cans for beverages and prepared foods, cater to both commercial and civilian needs. Emerging trends such as the development of thinner, lighter gauge aluminum packaging, innovative coatings for enhanced functionality, and a focus on premiumization in packaging design are shaping the market landscape. While the market demonstrates strong growth potential, potential restraints include fluctuations in raw material prices, particularly aluminum, and the availability of alternative packaging materials. Nonetheless, the enduring benefits of aluminum in terms of safety, durability, and recyclability are expected to outweigh these challenges, securing its dominant position in the food packaging sector.

This report provides an in-depth analysis of the global Food Aluminum Packaging market, spanning the historical period of 2019-2024 and projecting future trends through 2033, with a base and estimated year of 2025. The study delves into the intricate dynamics shaping this vital industry, offering insights into market drivers, challenges, regional dominance, growth catalysts, leading players, and significant developments.

XXX The global food aluminum packaging market is poised for robust growth, driven by an escalating demand for sustainable and high-performance packaging solutions. In the Base Year of 2025, the market is estimated to be valued at over $65,000 million, showcasing its significant economic footprint. This growth is propelled by a confluence of factors, including the increasing consumption of processed and convenience foods worldwide, a rising awareness among consumers regarding the benefits of aluminum packaging such as its recyclability and barrier properties, and the continuous innovation in packaging designs and functionalities. The Study Period of 2019-2033 illustrates a sustained upward trajectory, with projections indicating a substantial increase in market value. A key trend observed during the Historical Period of 2019-2024 was the growing adoption of aluminum cans for beverages, a segment that is expected to continue its expansion due to the inherent advantages of aluminum in preserving product quality and extending shelf life. Furthermore, the application of aluminum foil in household and commercial food wrapping continues to be a dominant segment, driven by its versatility and cost-effectiveness. The Forecast Period of 2025-2033 is anticipated to witness intensified competition and a greater emphasis on eco-friendly manufacturing processes. Companies are increasingly investing in research and development to enhance the sustainability profile of their aluminum packaging, including the use of recycled aluminum content and the optimization of production processes to reduce energy consumption and carbon emissions. The market is also seeing a rise in specialized aluminum packaging solutions tailored for specific food categories, such as retort pouches and rigid containers, catering to niche demands for extended shelf life and enhanced product presentation. The overall outlook suggests a dynamic market characterized by innovation, sustainability, and a steadfast demand from the global food industry.

The food aluminum packaging market is experiencing a significant upswing, driven by a powerful combination of consumer preferences, industry advancements, and inherent product advantages. Foremost among these drivers is the escalating global demand for convenient and ready-to-eat food products. As urbanization accelerates and lifestyles become more demanding, consumers are increasingly seeking packaging solutions that offer ease of use, extended shelf life, and portability. Aluminum packaging excels in all these aspects, providing an excellent barrier against light, oxygen, and moisture, thereby preserving the freshness and quality of food items for longer durations. This intrinsic protective capability directly translates into reduced food waste, a factor of growing importance for both consumers and regulatory bodies. Furthermore, the inherent sustainability of aluminum is a monumental driving force. Aluminum is one of the most recycled materials globally, and its closed-loop recycling process allows for near-infinite reuse without degradation of quality. This significantly lower environmental footprint compared to many other packaging materials aligns perfectly with the increasing consumer and corporate focus on sustainability and environmental responsibility. The cost-effectiveness and durability of aluminum also play a crucial role. Despite fluctuations in raw material prices, aluminum packaging often presents a competitive cost-benefit ratio over its lifecycle, especially when factoring in its protective qualities and recyclability. Its robust nature ensures product integrity during transit and handling, minimizing spoilage and damage, which ultimately contributes to overall cost savings for the food industry.

Despite its numerous advantages, the food aluminum packaging market faces several challenges and restraints that influence its growth trajectory. A primary concern revolves around fluctuations in raw material prices, particularly the price of aluminum. Global economic conditions, geopolitical events, and supply chain disruptions can lead to significant volatility in the cost of bauxite and alumina, the primary components for aluminum production. This price instability can impact the profitability of packaging manufacturers and potentially affect the affordability of aluminum packaging for food producers. Another significant challenge is the increasing competition from alternative packaging materials. While aluminum offers distinct advantages, other materials like plastics, glass, and paper-based packaging are continuously evolving with improved functionalities and often at a lower initial cost. Flexible packaging solutions, in particular, are gaining traction in certain food segments due to their lightweight nature and customizability. Furthermore, regulatory landscapes and environmental concerns, while often favoring aluminum's recyclability, can also present hurdles. Stricter regulations regarding the use of certain coatings or additives in food contact materials, or increased scrutiny on the energy-intensive nature of primary aluminum production, can necessitate significant investment in compliance and process upgrades. Lastly, consumer perception and misinformation regarding the safety and environmental impact of aluminum packaging can also act as a restraint. While scientifically proven to be safe for food contact and highly recyclable, lingering doubts or negative perceptions can influence purchasing decisions and brand loyalty. Addressing these challenges requires continuous innovation, strategic partnerships, and proactive communication to highlight the unique benefits and sustainable attributes of aluminum packaging.

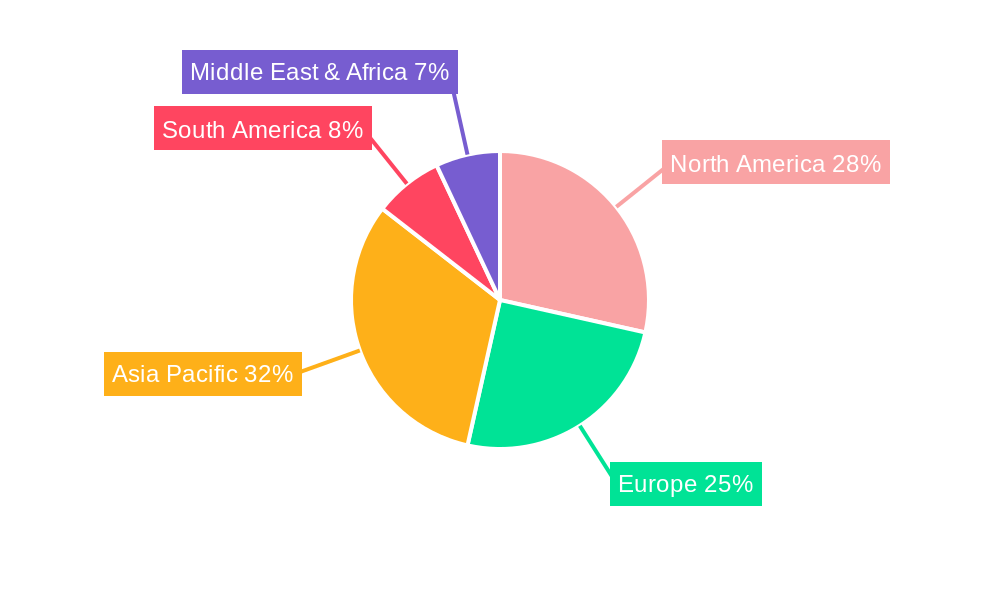

The global food aluminum packaging market is characterized by regional dominance and segment leadership, with specific areas and product categories exhibiting significant growth potential.

Dominating Segments:

Aluminum Cans: This segment is a powerhouse in the food aluminum packaging market, driven by the beverage industry's extensive reliance on cans for soft drinks, beer, and energy drinks. The Base Year of 2025 sees the aluminum can segment alone accounting for a substantial portion of the overall market value, estimated to be in the range of $30,000 million to $35,000 million. The Forecast Period of 2025-2033 is expected to witness continued growth in this segment, fueled by the increasing popularity of single-serving beverage formats and the growing preference for canned beverages in emerging markets. The inherent advantages of aluminum cans, such as their light weight, durability, and excellent barrier properties, make them an ideal choice for preserving beverage quality and extending shelf life. Innovations in can design, including thinner walls and enhanced recyclability features, further bolster their market position. The Historical Period of 2019-2024 has already demonstrated the resilience and steady growth of this segment, with companies like Reynolds Consumer Products, CCL Container, and Amcor heavily investing in expanding their can manufacturing capacities.

Aluminum Foil: Another exceptionally dominant segment is aluminum foil. In 2025, the market value for aluminum foil in food packaging applications is projected to be upwards of $25,000 million to $30,000 million. Aluminum foil's versatility is its key strength, finding application in a wide array of uses, from household food wrapping and baking to commercial food preparation and packaging for sensitive food items like dairy, confectionery, and pharmaceuticals. Its ability to act as a complete barrier against light, moisture, and oxygen is paramount for maintaining the freshness and extending the shelf life of a broad spectrum of food products. The Study Period of 2019-2033 will likely see sustained demand for aluminum foil, especially from the Civilian application segment, where home cooks and food service providers rely on its ease of use and effectiveness. The Commercial application of aluminum foil in industrial food processing, catering, and takeaway services also represents a significant and growing market. Companies like Hindalco, UACJ, and Lotte Aluminium are key players in this segment, continuously innovating with different thicknesses, coatings, and embossing patterns to meet evolving industry needs. The Estimated Year of 2025 reflects a mature yet growing market for aluminum foil, with its environmental credentials and proven performance ensuring its continued relevance.

Dominating Regions/Countries:

North America: This region, encompassing the United States and Canada, has historically been and is projected to remain a dominant force in the food aluminum packaging market. In 2025, North America's market share is estimated to be between 30% to 35% of the global market value, translating to an estimated market value exceeding $20,000 million. This dominance is attributed to a combination of factors: a mature food processing industry, high consumer demand for convenience and processed foods, stringent quality and safety standards that favor aluminum's protective properties, and a strong emphasis on recycling and sustainability initiatives. The presence of major global packaging manufacturers like Reynolds Consumer Products, Amcor, and Handi-Foil Corporation further solidifies North America's leading position. The Forecast Period of 2025-2033 is expected to see continued steady growth, driven by innovation in packaging design and a persistent consumer preference for reliable and sustainable packaging solutions.

Europe: Europe represents another critical and highly influential region in the food aluminum packaging market. By 2025, its market share is anticipated to be around 25% to 30%, with an estimated market value of approximately $16,000 million to $19,000 million. The region's leadership is propelled by its advanced food and beverage industries, a strong consumer base with a high disposable income, and a robust regulatory framework that often champions environmental sustainability and circular economy principles. The emphasis on recyclability and the growing demand for premium food products that require high-quality packaging contribute significantly to aluminum's appeal in Europe. Leading European players such as Alibérico Packaging, Carcano Antonio S.p.A., and Constellium are at the forefront of innovation, focusing on sustainable production methods and advanced packaging solutions. The Study Period of 2019-2033 will likely see Europe continue to drive demand for high-value, specialized aluminum packaging.

The dominance of these segments and regions is a testament to the inherent advantages of aluminum packaging, its adaptability to diverse food types and consumer needs, and the continuous efforts by industry players to innovate and align with global sustainability goals.

The food aluminum packaging industry is experiencing a robust growth trajectory fueled by several key catalysts. The increasing global demand for convenient and ready-to-eat food products is a primary driver, as consumers seek packaging that offers ease of use and extended shelf life. Furthermore, the growing consumer awareness and preference for sustainable packaging solutions strongly favor aluminum due to its high recyclability rate and lower environmental impact compared to many alternatives. Advancements in manufacturing technologies, leading to lighter, stronger, and more cost-effective aluminum packaging, also contribute significantly to market expansion. The expanding middle class in emerging economies is creating new avenues for growth, with a rising demand for packaged food items that require reliable and protective packaging.

This report offers an exhaustive exploration of the food aluminum packaging market, providing comprehensive coverage of key trends, market dynamics, and future projections. It delves into the intricate factors propelling the industry forward, such as the escalating demand for convenient food products and the undeniable rise in consumer preference for sustainable packaging. Simultaneously, the report critically examines the challenges and restraints that shape the market landscape, including raw material price volatility and the competitive pressures from alternative materials. With detailed regional and segment analysis, the report identifies key growth areas and dominant players, offering invaluable insights for strategic decision-making. The comprehensive understanding provided will empower stakeholders to navigate this dynamic sector effectively and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Hindalco, Reynolds Consumer Products, RUSAL, UACJ, Amcor, Handi-Foil Corporation, Lotte Aluminium, Symetal, Alibérico Packaging, Carcano Antonio S.p.A., Novelis, Formacia, Alfipa, Constellium, i2r, CCL Container, Raviraj Ltd, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Food Aluminum Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Food Aluminum Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.