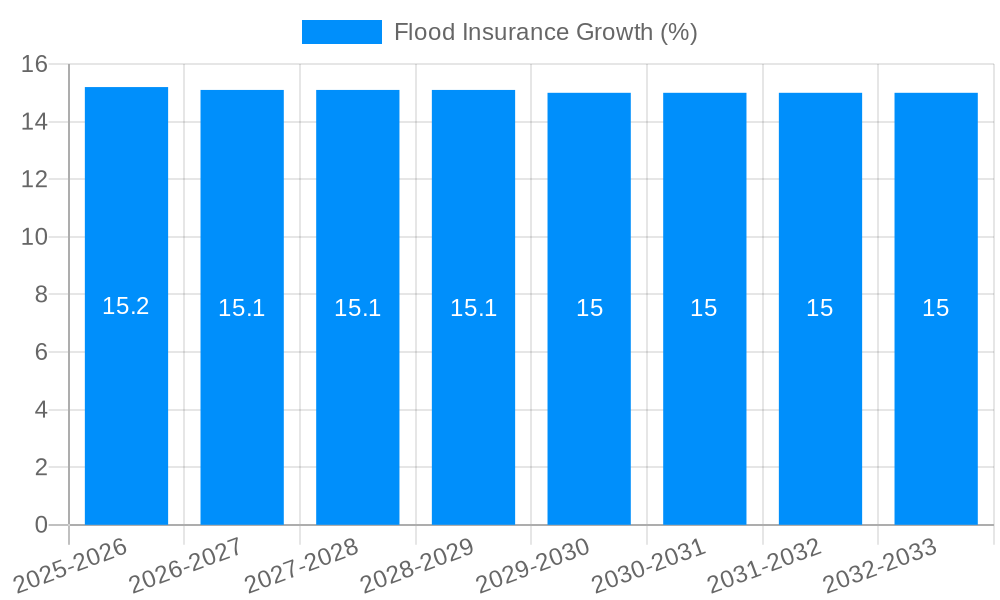

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flood Insurance?

The projected CAGR is approximately 15.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Flood Insurance

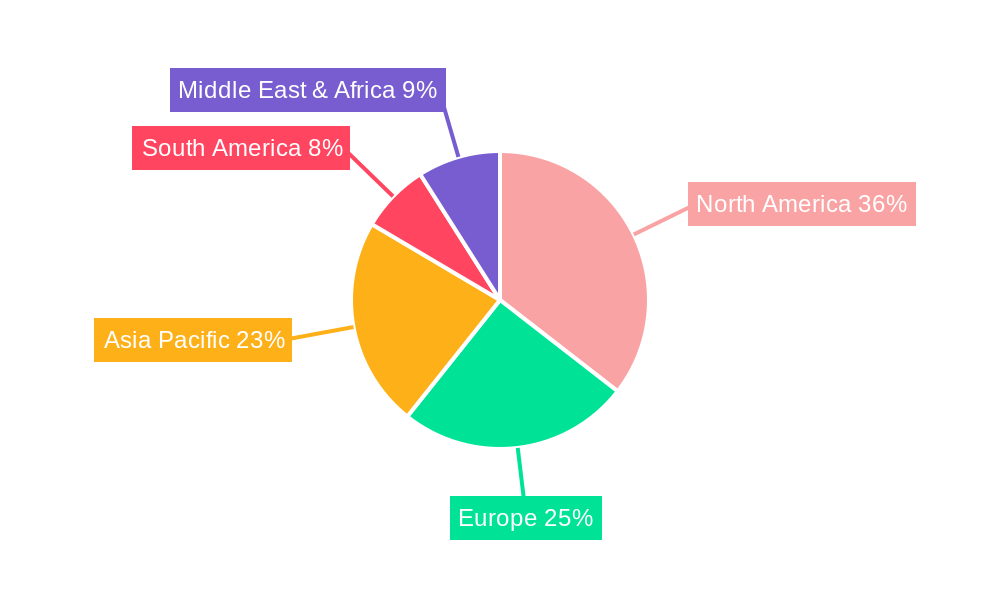

Flood InsuranceFlood Insurance by Type (Life Insurance, Non-Life Insurance), by Application (Commercial, Residential, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

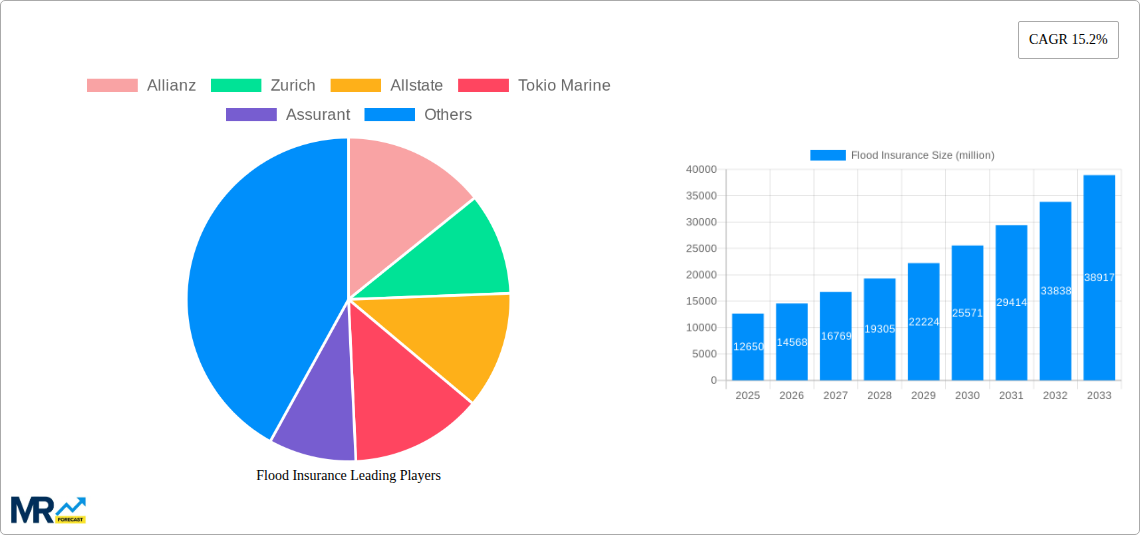

The global flood insurance market is poised for significant expansion, projected to reach a substantial market size of $12,650 million by 2025, fueled by a robust Compound Annual Growth Rate (CAGR) of 15.2%. This impressive growth trajectory indicates a heightened awareness of flood risks and an increasing demand for protective financial solutions. The market's expansion is primarily driven by escalating climate change impacts, leading to more frequent and severe flooding events across various regions. Urbanization and the development of infrastructure in flood-prone areas further contribute to this upward trend, necessitating comprehensive flood coverage. The rising cost of flood damage, coupled with increasing regulatory mandates and governmental initiatives promoting flood insurance adoption, also plays a crucial role in market acceleration. Key segments include life insurance and non-life insurance, with non-life insurance, particularly property and casualty coverage, dominating the market due to its direct applicability to flood damage. Applications are broadly categorized into commercial, residential, and others, with both residential and commercial sectors showing strong uptake, reflecting the widespread vulnerability to flood events.

The competitive landscape features a blend of global insurance giants and specialized providers, including Allianz, Zurich, Allstate, Tokio Marine, Assurant, Chubb, and numerous others, all vying for market share by offering innovative products and enhanced customer service. Emerging trends indicate a growing demand for parametric flood insurance, which offers faster payouts based on pre-defined triggers like rainfall levels or water depth, bypassing traditional claims assessment processes. Digitalization and the use of advanced analytics for risk assessment and pricing are also transforming the market, allowing for more accurate and personalized insurance solutions. However, challenges persist, such as the high cost of premiums in high-risk areas, limited availability of coverage in some severely affected regions, and insufficient awareness among certain demographics. Addressing these restraints through innovative product design, public-private partnerships, and targeted awareness campaigns will be critical for unlocking the full potential of the global flood insurance market in the coming years.

This comprehensive report offers an in-depth analysis of the global flood insurance market, meticulously examining its trajectory from the Historical Period (2019-2024) through the Study Period (2019-2033), with a specific focus on the Base Year (2025) and the Forecast Period (2025-2033). We present a detailed market valuation, estimating the market size to reach a significant XX million USD by the end of the forecast period, reflecting the growing awareness and necessity of flood protection. The report delves into the intricate dynamics of this vital insurance segment, offering actionable insights for insurers, reinsurers, policymakers, and stakeholders.

The global flood insurance market is experiencing a profound and dynamic evolution, driven by a confluence of escalating climate risks and increasing urbanization in vulnerable areas. XXX The heightened frequency and intensity of extreme weather events, directly linked to climate change, have significantly amplified the demand for robust flood insurance solutions. Historical data from the Historical Period (2019-2024) reveals a steady increase in flood-related claims, prompting a recalibration of risk assessment models and pricing strategies by major insurance providers. As we move into the Base Year (2025), the market is characterized by a growing emphasis on sophisticated data analytics and technological integration to better predict and price flood risks. Insurers are leveraging AI and machine learning to analyze vast datasets, including historical flood patterns, topographical information, and future climate projections, to offer more accurate and personalized policies. Furthermore, the Study Period (2019-2033) anticipates a considerable expansion in market penetration, particularly in regions historically underserved by flood insurance. This growth is fueled by a combination of regulatory impetus, public awareness campaigns, and the development of innovative products that cater to a wider range of risks and property types. The market is also witnessing a surge in the adoption of parametric insurance solutions, which trigger payouts based on predefined event parameters (e.g., rainfall levels or water depth) rather than actual loss assessment, thereby accelerating claims processing and providing immediate liquidity to policyholders. Emerging markets, especially those in Southeast Asia and coastal regions of developing nations, represent significant untapped potential, as they are increasingly exposed to flood risks due to rapid infrastructure development and environmental degradation. The interplay between evolving regulatory landscapes, advancements in geospatial technology, and the persistent threat of climate change is set to define the future contours of the flood insurance sector, pushing the market towards greater resilience and inclusivity.

The robust growth of the flood insurance market is predominantly propelled by an intensifying awareness of climate change's tangible impacts. The increasing frequency and severity of catastrophic flood events worldwide, as evidenced in the Historical Period (2019-2024), have undeniably heightened consumer and corporate concern for flood-related risks. This escalating threat landscape is acting as a powerful catalyst, compelling individuals and businesses to seek financial protection against devastating losses. Coupled with this, rapid urbanization, particularly in low-lying coastal areas and riverine regions, has significantly increased the number of properties and infrastructure vulnerable to inundation. Government initiatives and evolving regulatory frameworks in many countries are also playing a crucial role by mandating or incentivizing flood insurance, thereby expanding the customer base. Furthermore, the availability of sophisticated risk modeling tools and enhanced data analytics allows insurers to better understand, price, and offer more competitive flood insurance products, making coverage more accessible and attractive to a broader market.

Despite the considerable growth drivers, the flood insurance market is not without its significant hurdles. A primary challenge remains the issue of affordability, particularly in high-risk areas where premiums can become prohibitively expensive for many individuals and small businesses. This can lead to underinsurance or a complete lack of coverage, leaving communities vulnerable. The inherent unpredictability of flood events, despite advancements in modeling, also poses a significant challenge for actuaries in accurately assessing long-term risk and setting sustainable premiums. Furthermore, the capital intensive nature of flood insurance, requiring substantial reserves to cover potential large-scale losses, can act as a restraint for smaller insurance entities. In some regions, the lack of adequate flood mapping and risk data can hinder the development and uptake of suitable insurance products. Public perception and understanding of flood risk, and the value proposition of flood insurance, can also vary significantly, requiring continuous educational efforts by the industry.

The Non-Life Insurance segment, particularly within the Residential application, is poised to dominate the global flood insurance market throughout the Study Period (2019-2033). This dominance is driven by several interconnected factors that highlight the pervasive need for flood protection for individual homes and the associated property values.

Residential Application: The sheer volume of residential properties globally, combined with their direct exposure to flood risks from various sources like riverine floods, coastal surges, and pluvial (surface water) flooding, makes this segment the largest consumer of flood insurance. As urbanization continues to expand, more homes are being built in flood-prone areas, increasing the insured value at risk. The Base Year (2025) estimates indicate a substantial portion of the total market value will be attributed to residential policies, a trend projected to intensify. The increasing awareness of the devastating financial impact of floods on individual households, coupled with post-disaster recovery experiences from events within the Historical Period (2019-2024), has significantly boosted demand for homeowner's flood insurance. Policyholders are increasingly recognizing that standard homeowner's insurance often excludes flood damage, necessitating separate coverage.

Non-Life Insurance Type: Flood insurance intrinsically falls under the umbrella of Non-Life Insurance, which covers damages to property and assets. Unlike Life Insurance, which deals with human mortality, Non-Life insurance policies are designed to provide financial compensation for losses incurred due to unforeseen events like floods. The nature of flood damage – encompassing structural damage, property loss, and business interruption – necessitates the indemnification capabilities offered by Non-Life insurers. The Forecast Period (2025-2033) expects continued innovation within this segment, with insurers developing more specialized Non-Life products for flood protection.

Key Regions & Countries: Several regions and countries are expected to be significant contributors to market dominance due to their geographical vulnerability and robust insurance markets.

The interplay of these factors – the widespread need for residential protection, the inherent nature of flood coverage within Non-Life Insurance, and the geographical concentration of high-risk populations in key regions – collectively points towards the continued dominance of the Residential application within the Non-Life Insurance segment in the global flood insurance market.

Several factors are acting as significant catalysts for growth in the flood insurance industry. Escalating climate change impacts, leading to more frequent and severe flood events, are a primary driver of increased awareness and demand. Growing urbanization in vulnerable areas further amplifies the risk exposure. Government initiatives, including regulatory mandates and incentivized coverage, are expanding market reach. Technological advancements in risk modeling and data analytics are enabling more accurate pricing and product development, making insurance more accessible and attractive to a wider audience.

This report provides a holistic view of the flood insurance landscape, encompassing market trends, growth drivers, and challenges. It offers actionable insights into the dominant segments and regions, identifying key players and their strategies. The analysis extends to significant industry developments and their projected impact, ultimately equipping stakeholders with the knowledge to navigate this evolving market and capitalize on emerging opportunities. The report's comprehensive nature ensures a deep understanding of the factors shaping the future of flood insurance, from technological innovations to the persistent realities of climate change.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.2%.

Key companies in the market include Allianz, Zurich, Allstate, Tokio Marine, Assurant, Chubb, PICC, Sompo Japan Nipponkoa, CPIC, PingAn, Sunshine, Berkshire Hathaway, Suncorp, Progressive, American Strategic, .

The market segments include Type, Application.

The market size is estimated to be USD 12650 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Flood Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Flood Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.