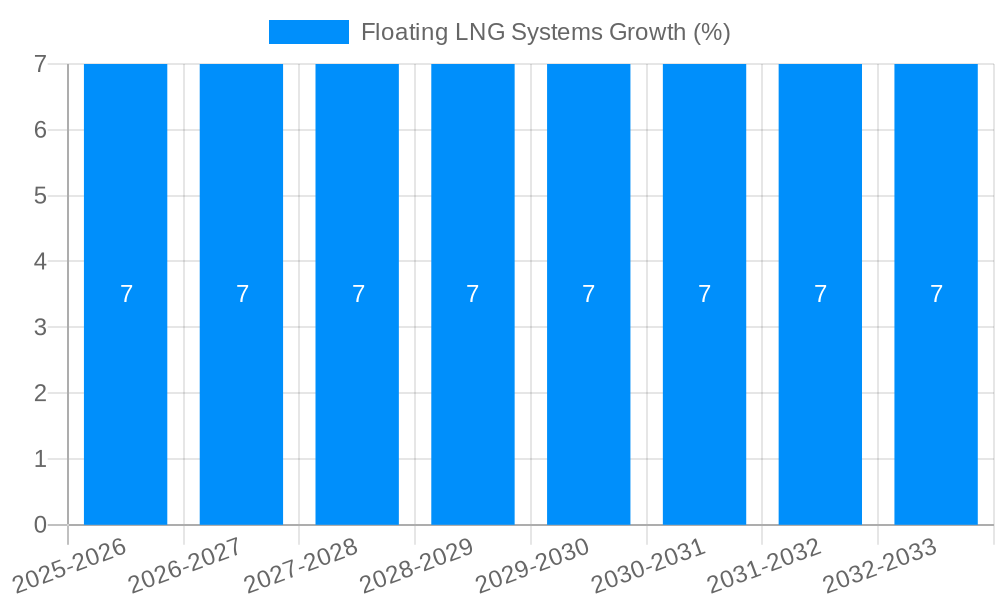

1. What is the projected Compound Annual Growth Rate (CAGR) of the Floating LNG Systems?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Floating LNG Systems

Floating LNG SystemsFloating LNG Systems by Type (Liquefied Natural Gas Floating Production Storage and Offloading Vessel), by Application (Deep Water Field, Marginal Field, Early Production(All Marine Field)), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Floating Liquefied Natural Gas (FLNG) systems market is experiencing robust growth, driven by the increasing demand for natural gas as a cleaner energy source and the exploration of challenging offshore environments. The market's expansion is fueled by several key factors. Firstly, the development of deepwater and marginal fields, previously uneconomical to exploit, is now feasible with FLNG technology. This allows for the exploitation of remote gas reserves, increasing global natural gas supply. Secondly, the flexibility offered by FLNG units, which can be deployed to various locations and adapted to different field sizes, provides significant advantages over onshore LNG plants, especially in regions with limited infrastructure. Furthermore, governments in many countries are actively promoting natural gas as a transition fuel, providing further impetus to the FLNG market. While regulatory hurdles and high initial investment costs pose some challenges, technological advancements are continuously mitigating these constraints, leading to improved efficiency and reduced operational expenses.

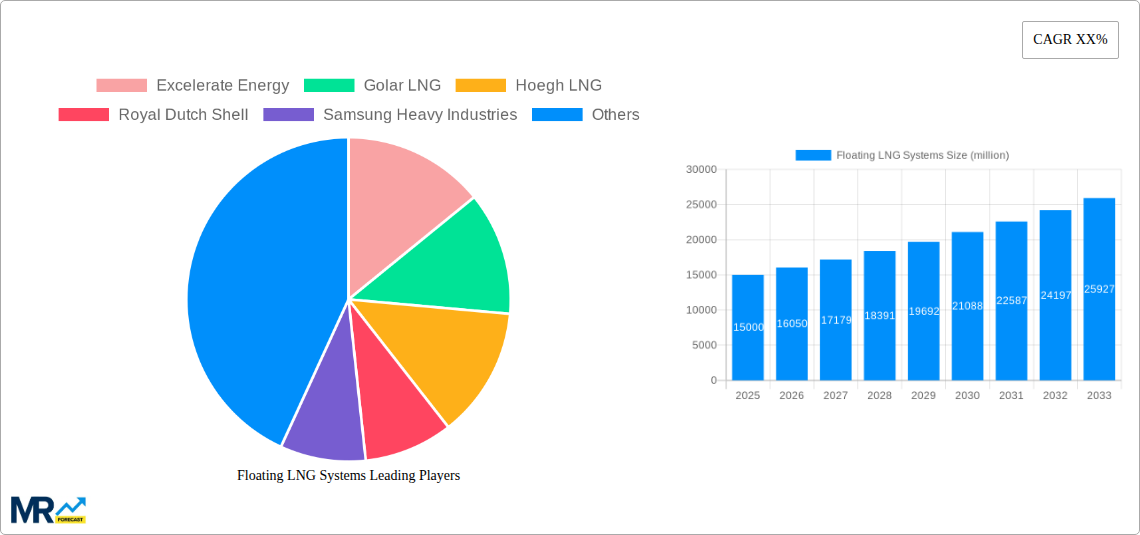

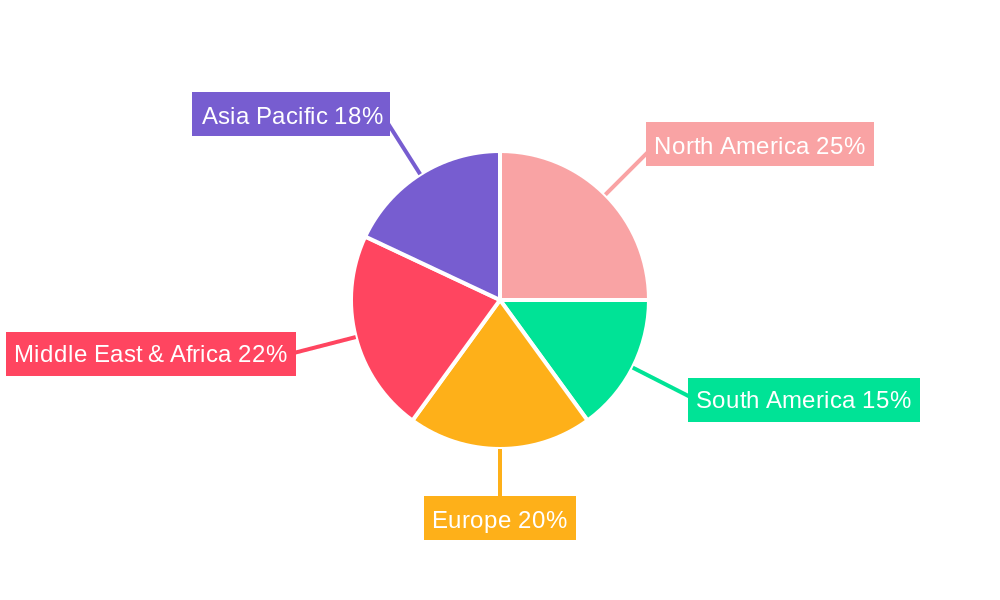

The market segmentation reveals strong growth in deepwater and marginal field applications. Liquefied Natural Gas Floating Production Storage and Offloading Vessels (LNG-FPSOs) are the dominant type, offering a comprehensive solution for gas production, liquefaction, storage, and offloading. Key players like Excelerate Energy, Golar LNG, and Hoegh LNG are leading the innovation and deployment of FLNG technologies, constantly enhancing unit designs and exploring new operational strategies. Regional analysis suggests a geographically diversified market, with North America, Europe, and Asia Pacific representing significant growth areas, though the exact regional market share varies based on exploration and production activities in each region. The forecast period (2025-2033) anticipates a continuation of the upward trend, driven by sustained global energy demand and the continuous advancement of FLNG technology, making it a more economically viable and environmentally conscious energy solution. We estimate a Compound Annual Growth Rate (CAGR) of approximately 12% for the forecast period, based on industry trends and the predicted increase in global gas demand.

The floating LNG (FLNG) systems market experienced significant growth between 2019 and 2024, driven by the increasing demand for natural gas globally and the exploration of challenging offshore resources. The market size, while not explicitly stated in the provided data, is estimated to be in the billions of dollars, reflecting substantial investments in FLNG infrastructure and technology. The historical period (2019-2024) showcased a steady upward trajectory, with key players like Excelerate Energy, Golar LNG, and Hoegh LNG securing numerous contracts and expanding their fleet of FLNG vessels. The base year of 2025 signifies a consolidation phase, with ongoing projects reaching completion and further investments in new technologies such as liquefied natural gas floating production storage and offloading (FPSO) vessels. The forecast period (2025-2033) projects continued expansion, propelled by the growing need to access remote and deepwater gas reserves. This expansion is further fueled by a broader adoption of FLNG as a cost-effective and flexible solution compared to traditional onshore LNG infrastructure. This trend is particularly notable in the development of marginal fields and early production projects, where the quick deployment and reduced capital expenditure of FLNG offer compelling advantages. The market is characterized by a high concentration of major players alongside a growing number of smaller, specialized companies entering the space, creating a dynamic competitive landscape. Advancements in FLNG technology, notably in areas such as liquefaction efficiency and environmental performance, contribute to the sustained momentum. The market's future growth will hinge on factors including regulatory support, technological innovation, and the overall stability of the global energy market. The substantial investments made during the study period (2019-2033) clearly indicate a long-term commitment to this technology as a key component of the global energy mix.

Several factors are propelling the growth of the floating LNG systems market. The increasing global demand for natural gas as a cleaner-burning fossil fuel compared to coal is a significant driver. This demand is particularly strong in Asia and Europe, where nations are actively seeking to diversify their energy sources and reduce reliance on coal-fired power plants. Furthermore, the exploration and development of offshore gas resources, particularly in deepwater and marginal fields, has become increasingly important. Traditional onshore LNG infrastructure is often unsuitable for these locations due to high costs and logistical challenges. FLNG systems provide a highly cost-effective and flexible solution to tap into these previously inaccessible resources. This is further bolstered by technological advancements, including improvements in liquefaction process efficiency and the development of more resilient and cost-effective floating platforms. Finally, the relatively shorter construction and deployment timelines for FLNG projects compared to onshore facilities are attractive to energy companies seeking faster returns on investment. This speed to market makes FLNG a particularly desirable option for early production projects, further driving market growth. Governments also play a role through supportive regulatory frameworks and incentives that encourage the development of FLNG infrastructure.

Despite the significant growth potential, the FLNG sector faces several challenges. The high initial capital investment required for the design, construction, and deployment of FLNG facilities represents a significant barrier to entry. This cost factor can make it challenging for smaller companies to participate in the market, thus contributing to a relatively concentrated industry structure. The complex technical challenges involved in operating these systems in often harsh offshore environments, particularly in deep water, require specialized expertise and advanced technology. This necessitates significant investment in research and development to improve the reliability and efficiency of FLNG technologies. Moreover, regulatory and permitting processes for FLNG projects can be lengthy and complex, potentially delaying project timelines and increasing costs. These bureaucratic hurdles, which vary across different jurisdictions, can impact the overall attractiveness of FLNG investments. Finally, fluctuating natural gas prices and the global energy market volatility introduce risk to FLNG projects, making long-term investment planning more challenging. Addressing these factors is crucial for ensuring the continued growth and sustainable development of the FLNG sector.

The global distribution of FLNG projects suggests a complex interplay of geographical factors and project type that contributes to market dominance. While no single region or country completely dominates, several key areas and segments show significant potential.

Deepwater Fields: This segment is expected to witness substantial growth due to the inherent limitations of conventional onshore LNG plants in accessing these challenging locations. The technological advancements enabling efficient and safe deepwater operations are making previously uneconomical reserves commercially viable, thereby fueling the growth of this market segment. The high capital expenditure is balanced by the potential for large-scale gas production.

Asia: Countries within Asia, driven by a high demand for natural gas, are likely to continue leading in FLNG deployment. Their investment in offshore energy infrastructure and their proximity to major gas producing areas in Southeast Asia and Australia will drive continuous growth. The growing energy consumption, coupled with government-led initiatives to diversify energy sources, will ensure continued strong demand for FLNG projects.

Africa: The continent holds significant, largely untapped reserves. With an increasing focus on domestic energy security and the exploration of offshore gas, Africa is poised for significant FLNG growth. This is particularly important for marginal fields, where FLNG becomes the most attractive option for profitable exploitation of the existing gas fields.

Liquefied Natural Gas Floating Production Storage and Offloading (FPSO) Vessels: This sub-segment of FLNG systems is anticipated to show high growth given its adaptability and efficiency in various offshore environments. The integration of production, storage, and offloading capabilities into a single floating platform enhances operational efficiency and cost-effectiveness, making it an attractive solution for many projects.

In summary, while the Asia-Pacific region showcases high demand, the deepwater field segment represents the most technologically driven growth area. The expansion of FLNG into Africa's extensive offshore reserves will be a major force shaping the market's future. The convergence of these geographical and technological factors will determine the dominant regions and market segments within the coming decade.

Several factors act as catalysts for growth in the FLNG industry. The increasing global demand for natural gas, coupled with the need to exploit remote and deepwater gas reserves, makes FLNG a vital solution. Technological advancements leading to improved liquefaction efficiency and platform stability further enhance the attractiveness of FLNG solutions. Supportive government policies and incentives focused on boosting domestic energy production and diversifying energy sources are also crucial, streamlining the regulatory approval process for FLNG projects.

This report provides a comprehensive overview of the floating LNG systems market, including analysis of market trends, driving forces, challenges, key players, and significant developments. It covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering valuable insights into the market's past performance and future growth trajectory. The analysis includes detailed information on key market segments, including different vessel types and applications, enabling a thorough understanding of the industry landscape. The report also identifies key growth catalysts and potential challenges, providing valuable information for stakeholders, investors, and industry professionals operating within the FLNG sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Excelerate Energy, Golar LNG, Hoegh LNG, Royal Dutch Shell, Samsung Heavy Industries, PETRONAS, Daewoo Shipbuilding and Marine Engineering, Hyundai Heavy Industries.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Floating LNG Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Floating LNG Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.