1. What is the projected Compound Annual Growth Rate (CAGR) of the Fixed-route Autonomous Vehicle?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fixed-route Autonomous Vehicle

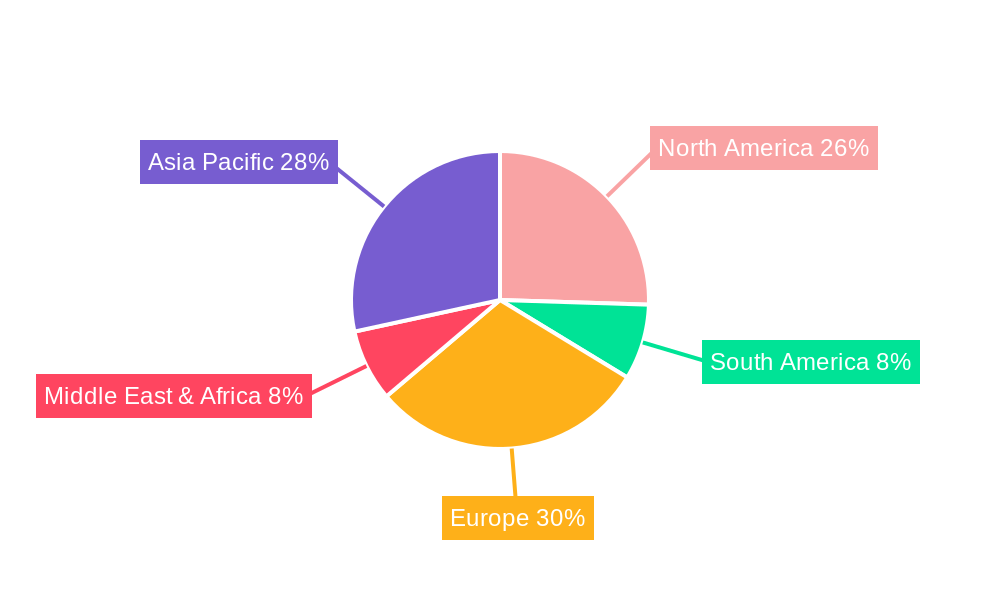

Fixed-route Autonomous VehicleFixed-route Autonomous Vehicle by Type (Fixed-point Vehicles, Scenic-spot Vehicles), by Application (Transportation, Tourism, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Fixed-route Autonomous Vehicle market is experiencing significant growth, projected to reach a substantial market size by 2033. This expansion is fueled by the inherent efficiency and safety advantages offered by autonomous technology in controlled environments. Fixed-route applications, such as shuttles within corporate campuses, university grounds, and public transportation hubs, are prime beneficiaries. The increasing need for cost-effective and reliable transportation solutions, coupled with a growing awareness of the potential to reduce traffic congestion and carbon emissions, acts as a major catalyst. Furthermore, advancements in sensor technology, artificial intelligence, and vehicle-to-everything (V2X) communication are continuously enhancing the capabilities and safety of these vehicles, paving the way for wider adoption. The market is also being shaped by supportive government initiatives and pilot programs aimed at accelerating the development and deployment of autonomous mobility solutions, particularly in urban and semi-urban settings.

The market's trajectory is further propelled by the distinct advantages fixed-route autonomy provides over its free-roaming counterparts. With predictable paths, lower speeds, and clearly defined operating zones, fixed-route systems present fewer complex challenges for autonomous navigation, leading to faster deployment timelines and more immediate returns on investment. Key segments like scenic-spot vehicles are capitalizing on the novelty and enhanced visitor experience that autonomous shuttles can offer, while transportation applications are focusing on optimizing last-mile connectivity and improving the overall efficiency of public transport networks. Despite the promising outlook, challenges such as regulatory hurdles, public acceptance, and the initial high cost of technology could temper the growth rate in certain regions. However, the overwhelming long-term benefits in terms of operational efficiency, enhanced safety, and sustainability are expected to outweigh these restraints, positioning the fixed-route autonomous vehicle market for robust and sustained expansion over the forecast period.

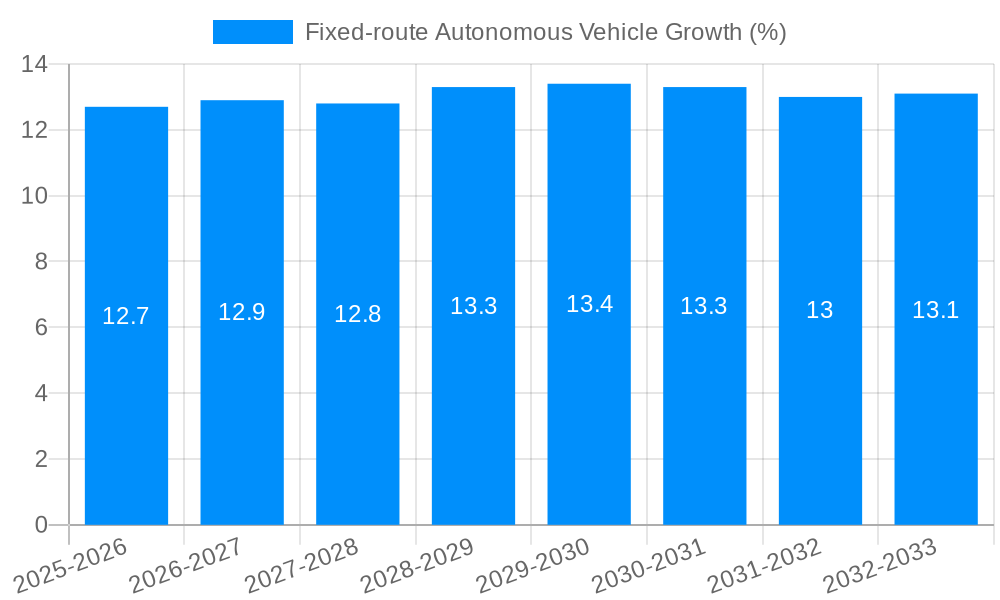

This report delves into the burgeoning market for fixed-route autonomous vehicles (AVs), a segment poised for significant expansion and transformation within the mobility landscape. The study, spanning the historical period of 2019-2024 and projecting through 2033, with a focus on the base and estimated year of 2025, offers a comprehensive analysis of market dynamics, key players, and future trajectories. The global market for fixed-route AVs is projected to witness a substantial Compound Annual Growth Rate (CAGR) from an estimated value of $120 million in 2025, escalating to over $750 million by 2033. This growth is underpinned by a confluence of technological advancements, increasing urbanization, and a growing demand for efficient, sustainable, and safe transportation solutions.

The core of this market lies in the deployment of AVs operating on pre-defined, predictable paths, making them ideal for applications such as shuttle services within campuses, airports, and business parks, as well as for tourism-oriented routes in scenic locations. The report meticulously dissects the market by vehicle type, categorizing them into Fixed-point Vehicles and Scenic-spot Vehicles, and by application, including Transportation and Tourism. It also acknowledges the 'Others' segment, which encompasses niche applications and emerging uses. The industry developments section will highlight the latest technological breakthroughs and regulatory shifts that are shaping the deployment and adoption of these vehicles. Understanding the intricate interplay of these factors is crucial for stakeholders seeking to capitalize on the immense opportunities within this evolving sector.

The fixed-route autonomous vehicle market is characterized by a clear upward trajectory, driven by increasing investments in autonomous technology and a growing recognition of its potential to address urban mobility challenges. The market's expansion is fueled by pilot programs and early deployments in controlled environments, such as university campuses, business parks, and retirement communities, demonstrating the viability and benefits of these solutions. The estimated market value of $120 million in 2025 is expected to surge, indicating a strong investor confidence and a robust pipeline of development and deployment initiatives. A significant trend is the increasing sophistication of sensor technology and artificial intelligence, enabling these vehicles to navigate complex environments with enhanced safety and reliability. Furthermore, the focus on sustainability is pushing the adoption of electric-powered fixed-route AVs, aligning with global efforts to reduce carbon emissions and promote eco-friendly transportation. The integration of these vehicles into broader smart city initiatives is also a key trend, with governments and private entities collaborating to create seamless, interconnected mobility networks. The development of specialized applications, such as last-mile connectivity and on-demand shuttle services, is further diversifying the market and creating new revenue streams. The report anticipates a continued surge in demand for these vehicles, particularly in densely populated urban areas and tourist destinations, as they offer a cost-effective and efficient alternative to traditional transportation modes. The increasing regulatory support and standardization efforts across various regions are also playing a pivotal role in accelerating market penetration. The transition from pilot projects to commercial-scale operations is a crucial milestone, with numerous companies actively engaged in scaling their deployments and expanding their service offerings. The market is also witnessing innovative business models, including subscription-based services and public-private partnerships, which are crucial for widespread adoption. The integration of advanced communication technologies, such as 5G, is enabling real-time data exchange and enhancing the operational efficiency of fixed-route AVs. This interconnectedness fosters improved traffic management and passenger experience, further solidifying their position in the future of urban mobility.

The fixed-route autonomous vehicle market is experiencing a powerful surge propelled by a multitude of converging forces. Foremost among these is the pressing need for enhanced urban mobility solutions. As cities continue to grow and population density increases, traditional transportation systems are often strained, leading to congestion and inefficiencies. Fixed-route AVs offer a predictable, efficient, and often more sustainable alternative for moving people within specific zones. Coupled with this is the relentless advancement in autonomous driving technology. Sophisticated sensors, powerful AI algorithms, and improved mapping capabilities have reached a maturity that allows for safe and reliable operation in defined environments. This technological progress directly translates into increased confidence for both operators and passengers. Furthermore, a significant driver is the growing emphasis on sustainability and environmental consciousness. Many fixed-route AVs are electric, producing zero tailpipe emissions, making them an attractive option for municipalities and organizations aiming to reduce their carbon footprint and comply with stricter environmental regulations. The economic benefits are also undeniable; reduced labor costs, optimized energy consumption, and increased operational efficiency contribute to a compelling return on investment, particularly for recurring transportation needs on fixed routes. Finally, the evolving regulatory landscape, with governments increasingly open to piloting and implementing autonomous vehicle technologies, provides a crucial supportive environment for market growth.

Despite the promising outlook, the fixed-route autonomous vehicle sector faces several significant hurdles that could temper its growth trajectory. A primary challenge remains public perception and acceptance. While technological advancements are considerable, widespread trust in fully autonomous systems, especially concerning safety in diverse weather conditions or unexpected pedestrian interactions, is still developing. Extensive public education and successful, incident-free deployments are crucial to overcoming this. Regulatory ambiguity and fragmentation also pose a substantial restraint. While some regions are actively developing frameworks for AVs, a lack of standardized regulations across different jurisdictions can complicate deployment and scaling efforts for companies operating on a wider basis. The initial capital investment for acquiring and deploying fleets of autonomous vehicles can be substantial, representing a significant financial barrier for smaller organizations or those with limited budgets, impacting the market’s rapid adoption. Cybersecurity threats are another growing concern; ensuring the integrity of vehicle software and communication networks against malicious attacks is paramount to maintaining operational safety and public trust. The integration of these new systems into existing transportation infrastructure, which may not be designed for autonomous operation, can also present logistical and technical challenges, requiring significant upgrades and coordination. Lastly, the reliability and maintenance of complex autonomous systems, especially in varied environmental conditions, will require robust support networks and ongoing investment.

The fixed-route autonomous vehicle market is poised for significant regional and segmental dominance, with a clear indication of which areas will lead the charge in adoption and innovation.

Dominant Segments:

Type: Fixed-point Vehicles: This category is expected to be a primary driver of market growth. Fixed-point vehicles are designed for repetitive, predictable routes within defined operational design domains (ODDs) such as:

Application: Transportation: Within the broader application landscape, the use of fixed-route AVs for general transportation purposes, beyond specific tourist attractions, will likely dominate. This encompasses:

Dominant Regions:

North America (Specifically the United States): This region is expected to lead due to several factors:

Europe: Europe presents a strong case for dominance, particularly in specific countries:

The synergy between the dominance of fixed-point vehicles and their application in general transportation, coupled with the proactive environments in North America and key European nations, will shape the early stages of significant market expansion and the establishment of operational precedents. The ability to demonstrate safety, reliability, and cost-effectiveness in these controlled yet functional environments will pave the way for broader adoption across other segments and regions.

Several key factors are poised to accelerate the growth of the fixed-route autonomous vehicle industry. The continuous advancements in Artificial Intelligence and sensor technology are making these vehicles more capable and safer, directly addressing a core adoption barrier. The increasing global focus on sustainability and the push towards electrification are driving demand for eco-friendly transportation solutions, a niche where electric AVs excel. Furthermore, supportive government initiatives, including pilot programs, regulatory frameworks, and urban mobility investments, are creating a conducive environment for deployment. The economic benefits, such as reduced operational costs and increased efficiency, are also becoming more evident, making them an attractive proposition for businesses and municipalities.

This report provides an exhaustive exploration of the fixed-route autonomous vehicle market, delving into its current landscape and future potential. It meticulously analyzes market trends, identifying key growth drivers and potential inhibitors. The study offers detailed insights into the market segmentation by vehicle type (Fixed-point Vehicles, Scenic-spot Vehicles) and application (Transportation, Tourism, Others), providing a granular understanding of where the demand is strongest. Furthermore, it highlights significant industry developments and outlines the strategies of leading companies, painting a comprehensive picture for investors, policymakers, and industry stakeholders. The projected market growth, from an estimated $120 million in 2025 to over $750 million by 2033, underscores the significant opportunities within this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

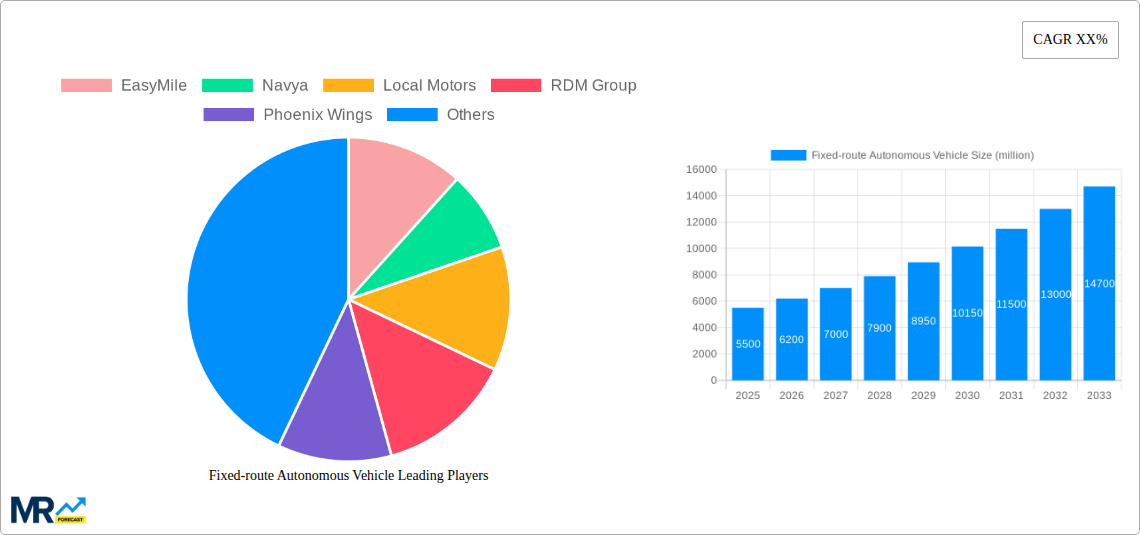

Key companies in the market include EasyMile, Navya, Local Motors, RDM Group, Phoenix Wings, DFKI Robotics Innovation Center, Yutong, Mercedes Benz, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Fixed-route Autonomous Vehicle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fixed-route Autonomous Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.