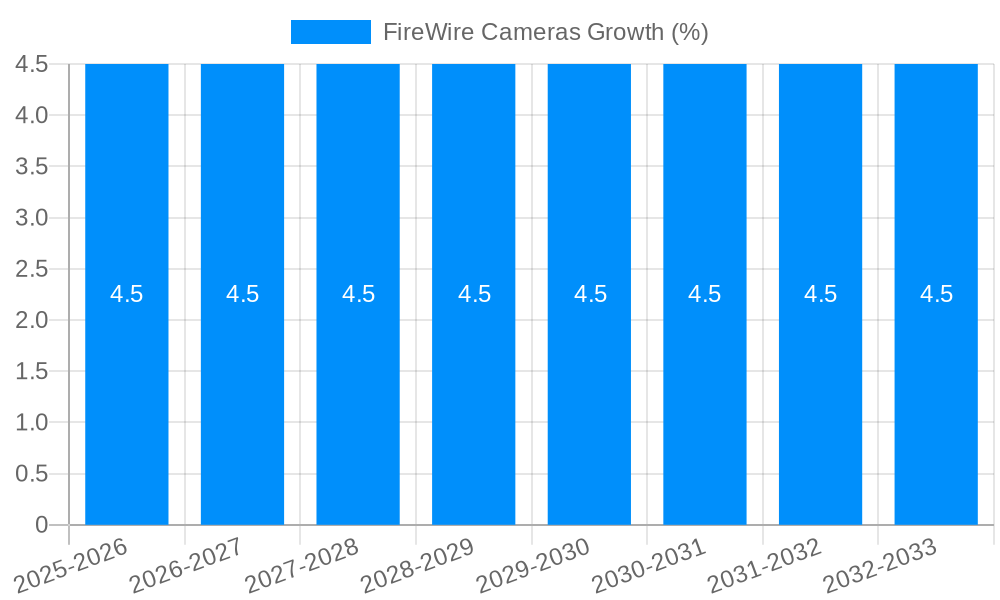

1. What is the projected Compound Annual Growth Rate (CAGR) of the FireWire Cameras?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

FireWire Cameras

FireWire CamerasFireWire Cameras by Type (GigE, FireWire.b, FireWire.a), by Application (Industrial, Medical and Life Sciences, Security and Surveillance, GIS, Intelligent Transportation System (ITS)), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

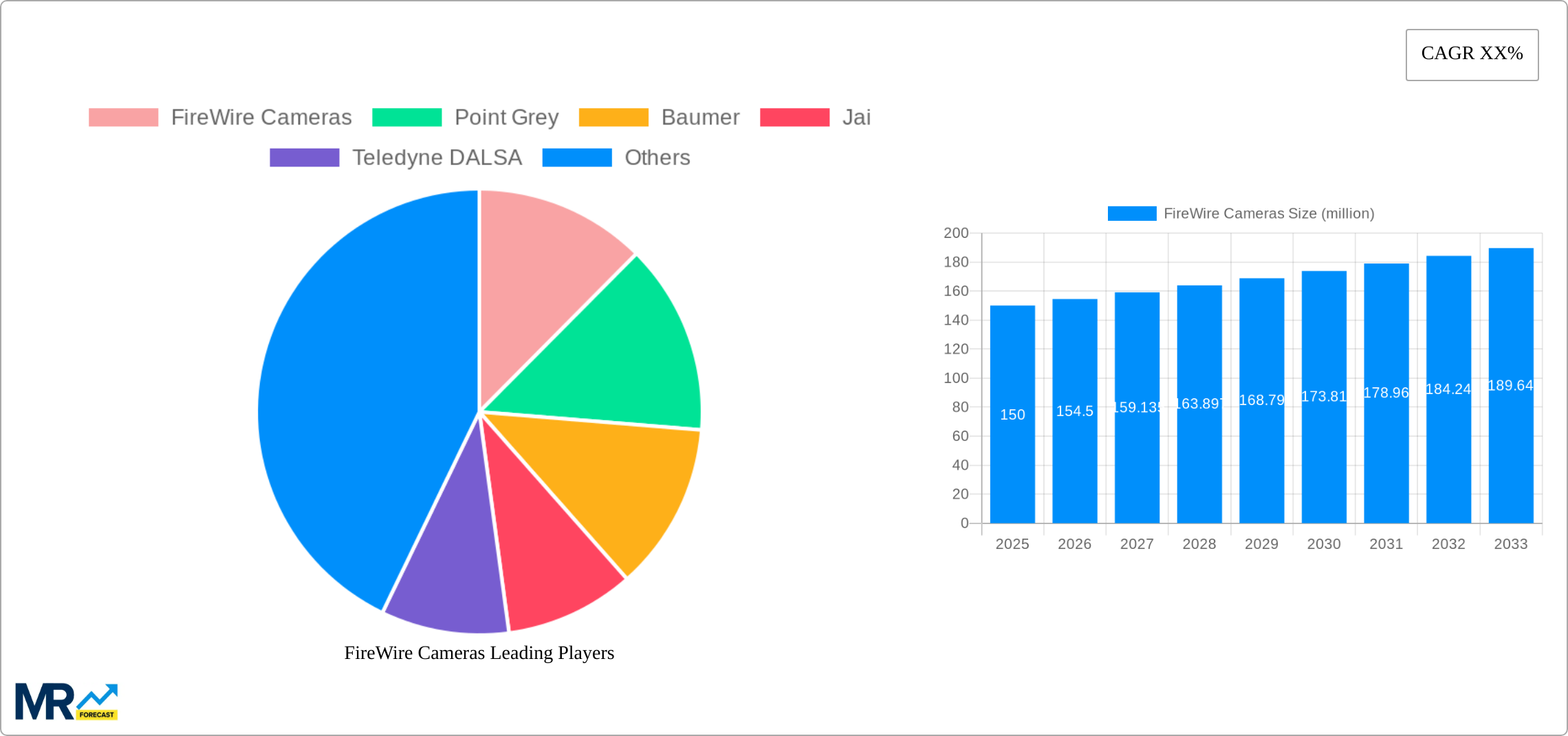

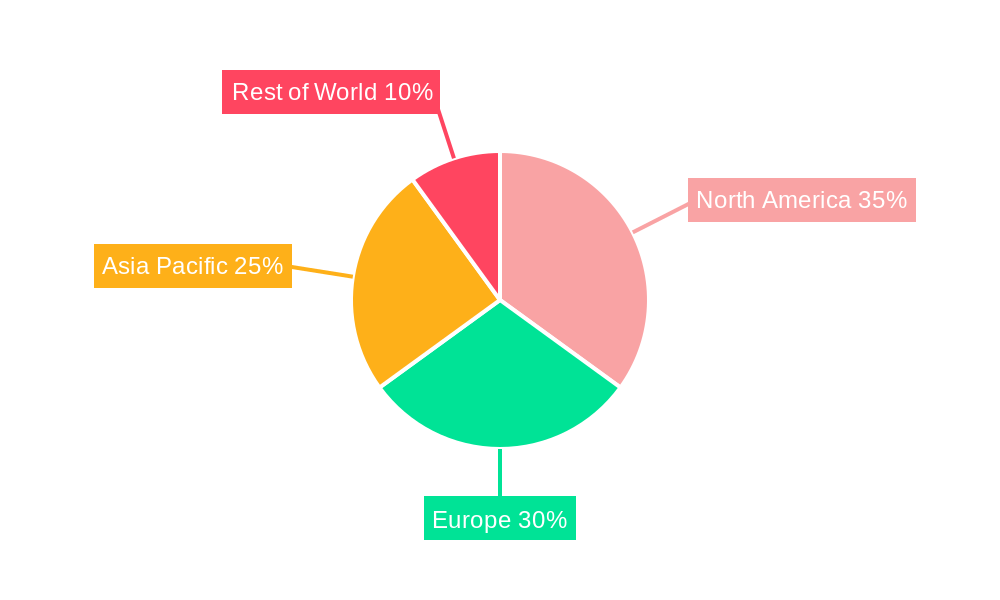

The FireWire camera market, while facing competition from newer technologies like GigE Vision, maintains a significant presence, particularly in niche applications demanding high data transfer rates and established infrastructure. The market's size in 2025 is estimated at $150 million, considering the prevalence of FireWire in legacy systems and its continued use in specific industrial and medical applications where reliability and established workflows are prioritized. A Compound Annual Growth Rate (CAGR) of 3% is projected for the forecast period (2025-2033), indicating a steady, albeit moderate, growth trajectory. This growth is driven primarily by continued demand within the medical and life sciences sectors, where FireWire cameras offer advantages in high-speed image acquisition for microscopy and surgical applications. The industrial automation sector also contributes to market demand, although less aggressively than in previous years. Restraints on market expansion include the emergence of GigE Vision as a superior alternative offering higher bandwidth and longer cable lengths, alongside the gradual phasing out of FireWire support in newer systems. Market segmentation reveals a significant share held by industrial applications, followed by medical and life sciences, with security and surveillance applications representing a smaller, yet consistent segment. Key players such as Allied Vision, Point Grey, and Teledyne DALSA continue to maintain a strong presence, leveraging their established expertise and existing customer base. Geographic distribution shows a relatively even spread across North America, Europe, and Asia-Pacific, reflecting the global nature of industrial and scientific applications.

The slower growth rate of the FireWire camera market reflects the technological shift towards GigE Vision and other advanced interfaces. However, the continued presence of legacy systems and the specific requirements of certain applications ensure a sustained demand for FireWire cameras in the foreseeable future. This necessitates a strategic approach from manufacturers, focusing on niche markets and specialized solutions to maintain market share and profitability. Future growth opportunities will depend on adapting to evolving technological trends, including developing hybrid systems that integrate FireWire with newer technologies, focusing on providing robust and reliable solutions for demanding applications, and emphasizing after-sales support and service for existing installations. Specific advancements in FireWire technology, such as improved image processing capabilities within the cameras themselves, could also revitalize this segment.

The global FireWire camera market, valued at approximately $XXX million in 2025, is experiencing a period of transition. While the dominance of newer technologies like GigE Vision is undeniable, FireWire cameras continue to hold a significant niche, particularly in legacy systems and applications where cost-effectiveness and established integration are paramount. The historical period (2019-2024) witnessed a gradual decline in overall FireWire camera shipments, driven primarily by the adoption of higher-bandwidth, more feature-rich alternatives. However, the market hasn't completely plateaued. Steady demand persists in specific sectors such as medical imaging and certain industrial automation applications where FireWire's simplicity and established ecosystem provide a competitive advantage. This report analyzes the market dynamics, focusing on the forecast period (2025-2033), examining the factors influencing the continued presence, albeit reduced scale, of FireWire cameras in the broader machine vision landscape. The market segmentation by type (FireWire a, FireWire b, and GigE for comparison) and application (industrial, medical, security, etc.) offers granular insights into the specific niches where FireWire technology remains relevant and competitive. The analysis further considers geographical variations in adoption rates, highlighting regions where the legacy installed base of FireWire equipment continues to fuel demand for replacement and maintenance. The report also acknowledges the impact of technological advancements, such as the development of higher-performance FireWire chips and controllers, although their impact on market growth is expected to be limited. The study period (2019-2033) provides a comprehensive overview of both historical trends and future projections, allowing stakeholders to make informed decisions regarding investment and market positioning.

Several factors continue to sustain demand for FireWire cameras, despite the rise of competing technologies. Cost-effectiveness remains a key driver, especially for low-bandwidth applications where the performance difference between FireWire and more modern interfaces is negligible. The extensive existing infrastructure in certain industrial settings and legacy systems presents a strong barrier to immediate adoption of new technologies. Migrating an entire system to a new interface is expensive and time-consuming. Further, many businesses maintain a significant stock of FireWire-compatible equipment, reducing the immediate need for upgrades. A skilled workforce accustomed to working with FireWire also contributes to its continued use; retraining personnel to operate newer systems represents a substantial added cost. Finally, in certain niche applications where real-time processing is crucial but high bandwidth is not, FireWire's latency advantages over some newer technologies make it a practical choice. These factors combine to create a persistent, if slowly shrinking, market for FireWire cameras in specific sectors.

The primary challenge faced by FireWire cameras is the relentless advance of newer technologies. GigE Vision, USB3 Vision, and other high-speed interfaces offer substantially higher bandwidth, significantly improved data transfer rates, and advanced features like Power over Ethernet (PoE). This makes them attractive alternatives for most new projects. The lack of significant technological improvements in FireWire itself exacerbates this challenge; the technology has essentially plateaued, while competitors are constantly evolving. Furthermore, the decreasing availability of FireWire components and expertise makes maintenance and support increasingly difficult, leading to higher costs and potential system downtime. The limited availability of new FireWire camera models further restricts market expansion. This makes the future prospects for the technology uncertain as component manufacturers phase out production. The transition to newer standards is inevitable, thus making it harder for FireWire camera manufacturers to compete in the long term.

The Industrial segment is projected to dominate the FireWire camera market throughout the forecast period (2025-2033). This is primarily due to the large installed base of legacy systems in manufacturing, automation, and quality control processes. While newer installations are increasingly using GigE Vision and other interfaces, the cost and disruption of a complete system overhaul incentivizes businesses to continue using existing FireWire cameras.

Industrial Segment: High demand for maintenance and replacement within existing industrial automation infrastructure is a key driver. The cost-effectiveness of FireWire for certain applications within this segment also contributes to its continued relevance. The market concentration in regions with established industrial bases, particularly in North America, Europe, and parts of Asia, further strengthens this segment's dominance.

Medical and Life Sciences: Though smaller than the industrial sector, the medical segment shows significant continued application of FireWire, driven by the need for stable, reliable, and relatively inexpensive image capture in various medical imaging applications. However, the progressive adoption of high-resolution, high-speed imaging modalities represents a significant headwind.

Geographic Dominance: North America and Europe are likely to retain a larger market share due to a high concentration of established industries utilizing FireWire technology. However, the growth in other regions, particularly in Asia, driven by increasing industrialization, is expected, although at a much slower pace than newer technologies.

In summary: While the overall FireWire camera market is projected to decline slowly, the industrial sector will continue to be the main driver of demand, with established markets in North America and Europe providing relative stability.

Despite the challenges, a few factors could contribute to limited continued growth in specific niche applications: cost-effective solutions for simple machine vision tasks, the availability of refurbished and used FireWire cameras, and continued support from specialized manufacturers catering to the legacy market. These factors will only sustain very low growth and not reverse existing decline trends.

This report provides a comprehensive analysis of the FireWire camera market, offering detailed insights into market trends, driving forces, challenges, key players, and future growth prospects. The segmentation by type and application allows for a granular understanding of market dynamics and enables strategic decision-making for stakeholders. The inclusion of historical data and future projections provides a holistic perspective on the market's evolution. The report serves as a valuable resource for industry professionals seeking to understand and navigate the evolving landscape of machine vision technology.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include FireWire Cameras, Point Grey, Baumer, Jai, Teledyne DALSA, Sony, Allied Vision, IDS, The Imaging Source, Toshiba Teli, PixeLINK, Microscan, IMPERX, Leutron Vision, Sentech, Matrox, GEViCAM, Fairsion, Daheng Image, Vezu Tech, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "FireWire Cameras," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the FireWire Cameras, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.