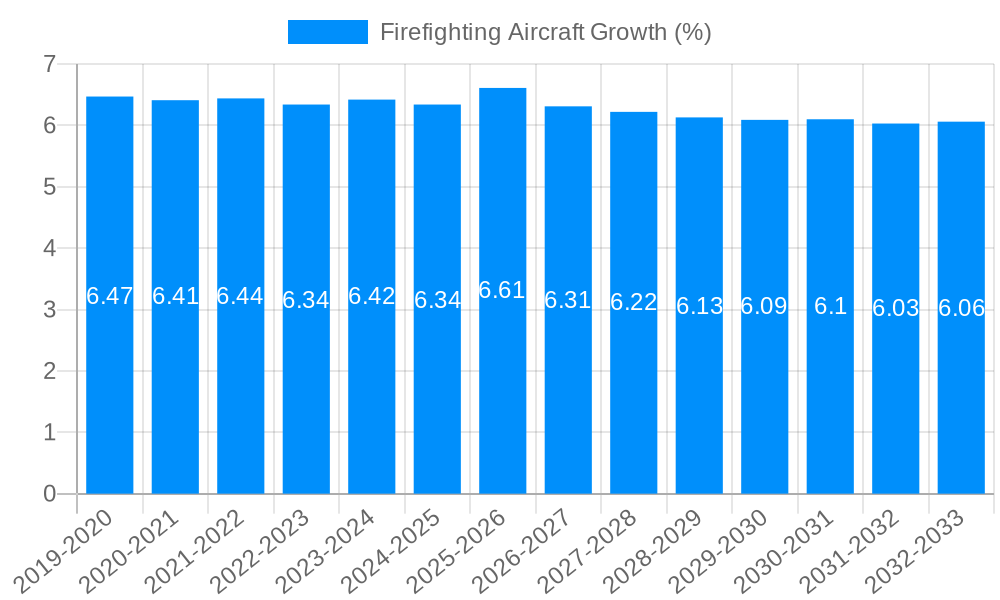

1. What is the projected Compound Annual Growth Rate (CAGR) of the Firefighting Aircraft?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Firefighting Aircraft

Firefighting AircraftFirefighting Aircraft by Type (Aircraft, Large Tanker, Helicopter, World Firefighting Aircraft Production ), by Application (Firefighting Organizations, Military, Others, World Firefighting Aircraft Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

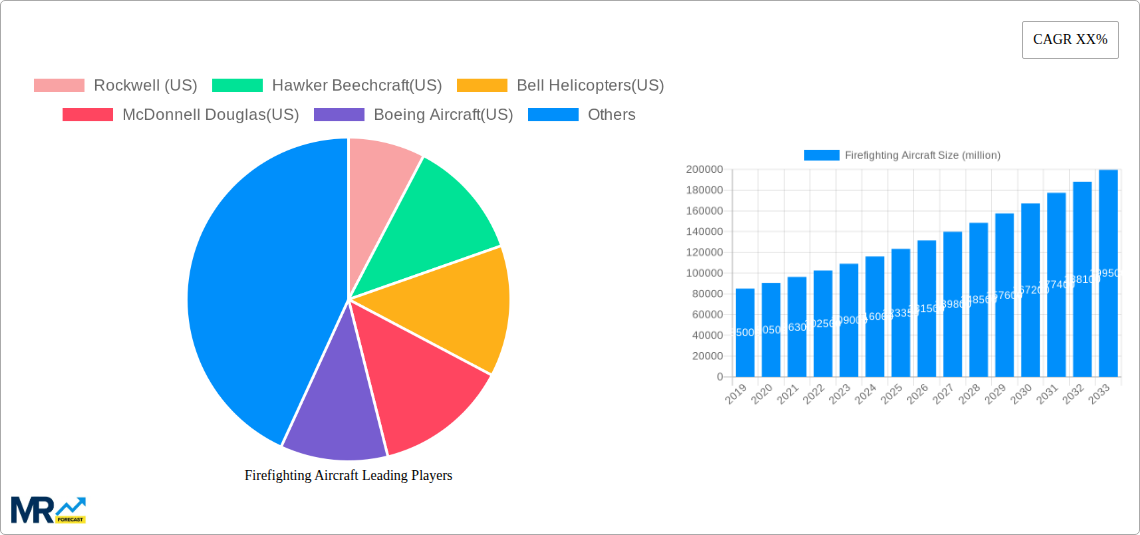

The global firefighting aircraft market, valued at $123.35 million in 2025, is projected to experience significant growth over the forecast period (2025-2033). While a precise CAGR is unavailable, considering the increasing frequency and intensity of wildfires globally coupled with advancements in aerial firefighting technology, a conservative estimate would place the annual growth rate between 5% and 7%. This growth is driven by several factors. Rising global temperatures and changing weather patterns contribute to more frequent and severe wildfires, increasing demand for effective firefighting solutions. Simultaneously, technological advancements, such as the development of more efficient water-dropping systems, improved aircraft design for maneuverability and payload capacity, and the integration of advanced sensors and communication systems, are enhancing the effectiveness and safety of aerial firefighting operations. Government initiatives and increased funding for wildfire prevention and suppression programs also play a crucial role in boosting market growth. However, high initial investment costs associated with acquiring and maintaining firefighting aircraft, along with the potential for operational risks and limitations depending on terrain and weather conditions, can act as restraints.

Market segmentation, while not provided, is likely to include various aircraft types (e.g., fixed-wing, helicopters), payload capacities, and technological features. Key players such as Rockwell, Boeing, and Sikorsky are expected to maintain significant market share, while emerging companies with innovative solutions may also emerge as strong competitors. Regional market analysis would likely show North America and Australia as significant markets due to prevalent wildfire risks, followed by regions like Europe and parts of Asia and South America experiencing increased wildfire activity. The continued development of sustainable aviation fuels and environmentally friendly firefighting technologies will further shape the future trajectory of this vital market. The focus will increasingly shift towards integrating predictive analytics, improved coordination among firefighting agencies, and the strategic use of aerial resources to maximize the effectiveness of wildfire response and prevention.

The global firefighting aircraft market, valued at $XXX million in 2025, is projected to experience substantial growth during the forecast period (2025-2033). This expansion is fueled by several interconnected factors, including the increasing frequency and intensity of wildfires globally, driven by climate change and human activity. The historical period (2019-2024) already showcased a noticeable upswing in demand, with governments and private organizations increasingly recognizing the critical role air support plays in rapid response and effective wildfire suppression. This trend is expected to continue, with a significant surge in investment in both the acquisition of new aircraft and the upgrading of existing fleets. The market is characterized by a diverse range of aircraft types, from smaller, single-engine air tankers to large, multi-engine airtankers capable of carrying thousands of gallons of retardant. Technological advancements, such as improved aerial firefighting systems and enhanced navigation capabilities, are further driving market expansion. However, challenges remain, including high initial investment costs, operational complexities, and the need for skilled pilots and maintenance crews. The competitive landscape is dynamic, featuring both established aerospace giants and specialized firefighting aircraft manufacturers. The market's future growth trajectory will hinge on factors like government policies promoting wildfire prevention and response, advancements in aircraft technology, and the overall economic climate impacting public and private investment in this critical sector. The report provides a detailed analysis of these trends, offering crucial insights for stakeholders seeking to understand the market's potential and challenges.

The escalating global wildfire crisis is the primary catalyst driving the firefighting aircraft market. Climate change is exacerbating the frequency, intensity, and geographical spread of wildfires, creating an urgent need for more effective and rapid response mechanisms. Longer, hotter, and drier seasons are creating ideal conditions for fire outbreaks, overwhelming traditional ground-based firefighting efforts. The devastating consequences of large-scale wildfires, including property damage, loss of life, and environmental devastation, are compelling governments and organizations to invest heavily in aerial firefighting capabilities. This investment translates into increased demand for both new and upgraded firefighting aircraft. Furthermore, technological advancements in aircraft design, fire retardant technology, and aerial firefighting systems are making these operations more efficient and effective. Improved navigation systems, thermal imaging capabilities, and enhanced precision dropping mechanisms are improving the accuracy and efficacy of aerial firefighting efforts. These improvements are attracting further investment and driving the market forward. Finally, growing awareness among the public and policymakers about the importance of wildfire prevention and suppression is fostering a more favorable regulatory environment for the industry.

Despite the strong growth drivers, several challenges hinder the growth of the firefighting aircraft market. The high initial cost of acquiring and maintaining these specialized aircraft represents a significant barrier to entry for many organizations, particularly smaller ones. Operational complexities, requiring specialized training for pilots and maintenance personnel, add to the overall cost. Furthermore, the geographic limitations of certain aircraft types and the need for suitable landing and refuelling infrastructure pose operational challenges, particularly in remote or rugged terrains. Regulatory compliance and safety standards are also stringent, necessitating significant investment in safety measures and training. The market is also susceptible to economic fluctuations, as budgetary constraints can impact government investment in aerial firefighting capabilities. Moreover, dependence on favorable weather conditions and the inherent risks involved in aerial firefighting operations represent ongoing challenges to be addressed. Competition from alternative wildfire suppression methods, such as ground-based efforts and the use of drones, further adds to the complexities of this market.

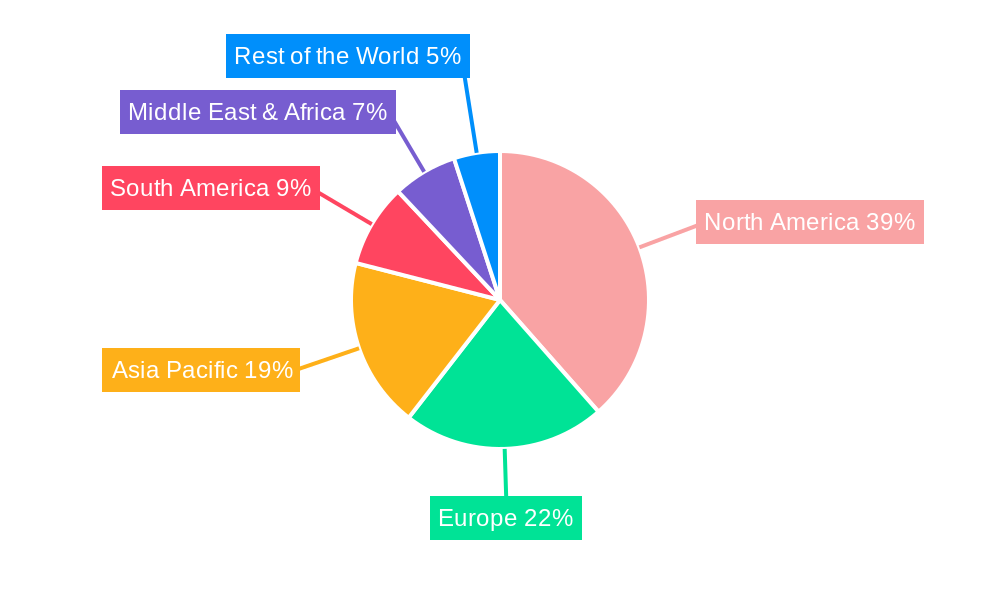

North America: The region is expected to dominate the market due to the high incidence of wildfires, particularly in the western United States and Canada, coupled with significant government investment in wildfire suppression. The presence of major aircraft manufacturers in the US further fuels the market's growth.

Australia: Experiencing increasingly severe and frequent wildfires, Australia is another key market with a high demand for firefighting aircraft. The unique geographical characteristics and challenges associated with firefighting in this region drive demand for specialized aircraft and technologies.

Europe: While wildfire incidences in Europe are lower compared to North America and Australia, rising temperatures and changing weather patterns are leading to an increase in wildfire events and subsequently, the demand for firefighting aircraft in several southern European countries.

Air Tankers (Fixed-Wing): This segment is expected to maintain its dominant position due to their ability to carry large payloads of retardant over longer distances. Their efficiency in covering vast areas makes them crucial for large-scale wildfire suppression. Technological advancements in air tankers, including improved precision dropping systems, are further enhancing their effectiveness and market appeal.

Helicopters: The helicopter segment will witness substantial growth, especially in regions with challenging terrain or where more agile and precise firefighting is required. Their ability to operate in confined spaces and deploy water or retardant quickly makes them vital components of modern wildfire response strategies. The use of helicopters for initial attack and supporting ground teams is also driving this segment's expansion.

The substantial investment in firefighting capabilities by government agencies in North America and Australia, driven by their increased vulnerability to severe wildfires, is a major factor contributing to the growth within these key regions. The dominance of air tankers and the steady growth in the helicopter segment reflect the market's need for both high-capacity, long-range fire suppression and agile, localized response capabilities. The forecast suggests that continued technological advancement, rising wildfire occurrences, and proactive governmental strategies will fuel the continued market leadership of North America and Australia, alongside the continued importance of both air tankers and helicopters in the overall firefighting aircraft ecosystem.

The firefighting aircraft industry is experiencing significant growth propelled by the escalating global wildfire crisis and related factors. Increased government funding for wildfire prevention and control programs, particularly in regions prone to extreme weather events, is a key catalyst. Technological advancements in aircraft design, fire retardant technologies, and aerial firefighting systems enhance operational efficiency, leading to increased demand. The growing awareness of the devastating consequences of wildfires and the need for proactive measures, coupled with improved public-private partnerships, further accelerate market expansion.

This report provides a comprehensive overview of the global firefighting aircraft market, encompassing historical data, current market trends, and future growth projections. It analyzes key market drivers, challenges, and opportunities, while also providing a detailed competitive landscape analysis. The report offers valuable insights for investors, industry professionals, and policymakers involved in the wildfire suppression sector. The detailed segmentation by aircraft type and geography offers granular market understanding, allowing readers to effectively strategize and adapt to the evolving market dynamics.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Rockwell (US), Hawker Beechcraft(US), Bell Helicopters(US), McDonnell Douglas(US), Boeing Aircraft(US), Glenn L. Martin Company, Lockheed Corporation, Douglas Aircraft Company, Canadair(Cananda), Grumman Aerospace(US), Sikorsky Aircraft Corp(US), Aerospatiale, .

The market segments include Type, Application.

The market size is estimated to be USD 123350 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Firefighting Aircraft," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Firefighting Aircraft, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.