1. What is the projected Compound Annual Growth Rate (CAGR) of the Extended Warranty?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Extended Warranty

Extended WarrantyExtended Warranty by Type (Standard Protection Plan, Accidental Protection Plan), by Application (Laptops and PCs, Mobile Devices, Wearables, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

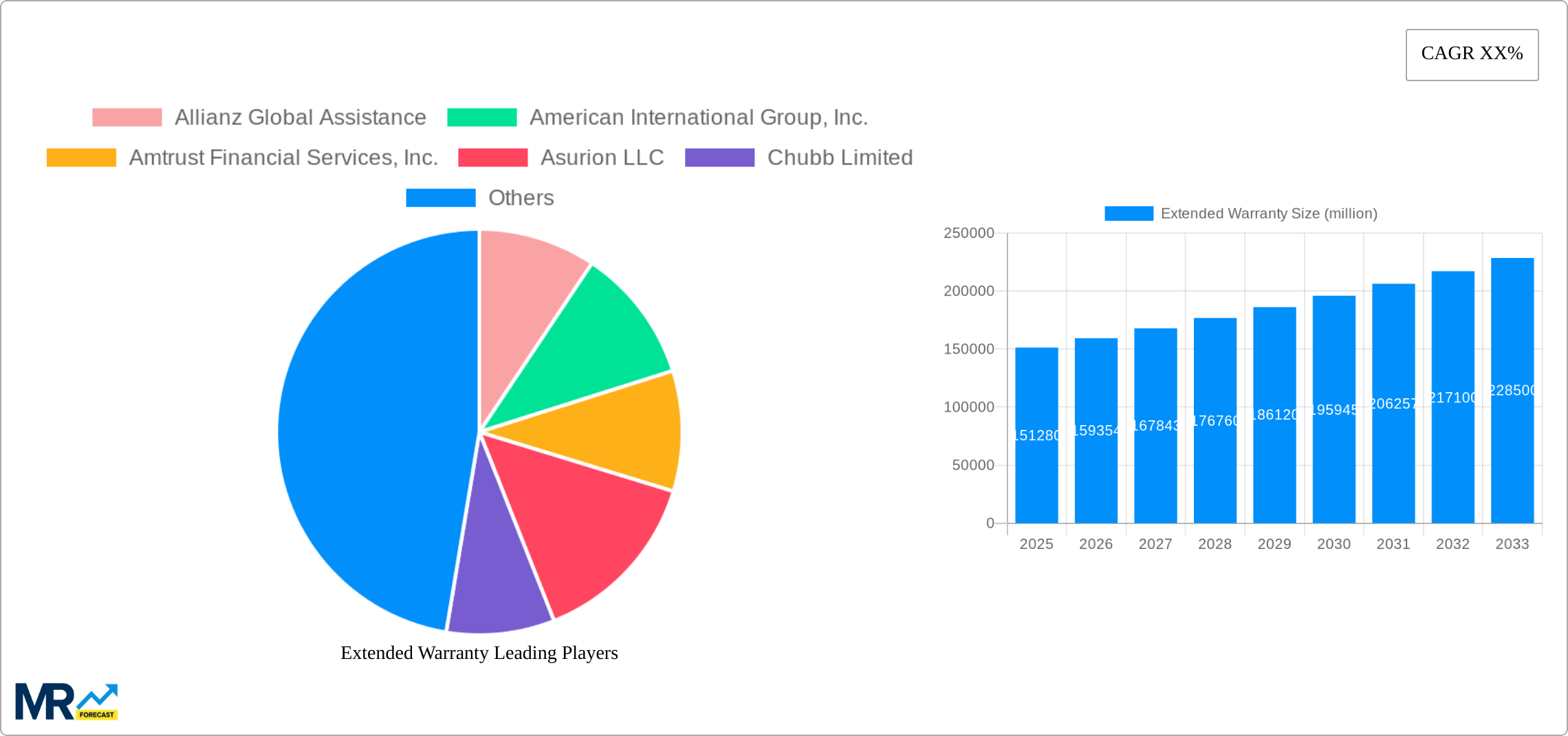

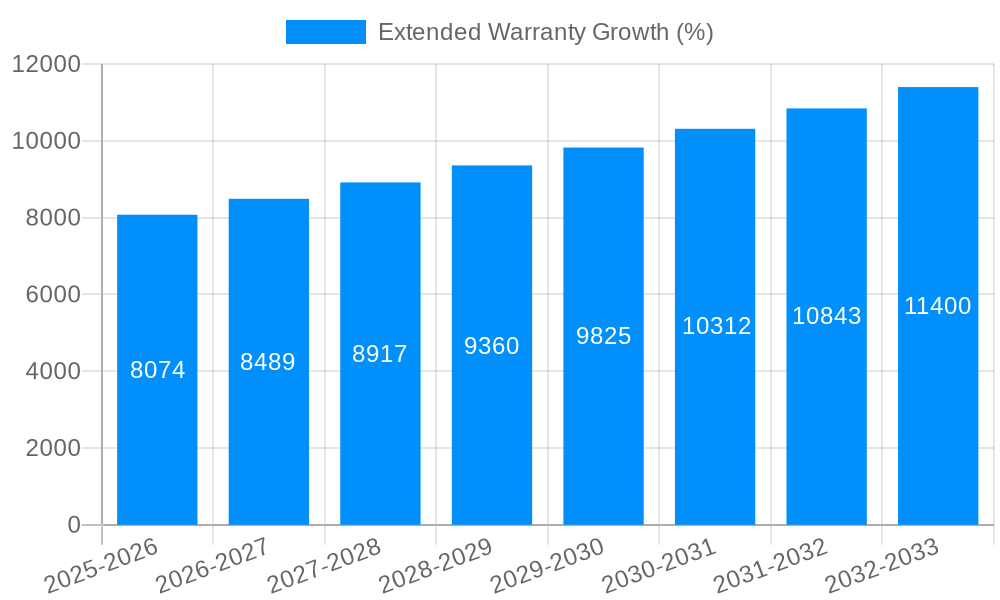

The global extended warranty market, currently valued at $151.28 billion (assuming "million" in the original text refers to billions), is poised for substantial growth over the next decade. Driven by increasing consumer electronics adoption, rising disposable incomes in developing economies, and a growing preference for product protection beyond standard manufacturer warranties, the market is expected to experience a healthy Compound Annual Growth Rate (CAGR). While a precise CAGR isn't provided, considering similar tech markets, a conservative estimate would place it between 5% and 8% annually. This growth is further fueled by evolving consumer behavior, with increased demand for extended warranties on high-value items like laptops, smartphones, and wearables. The market is segmented by warranty type (standard and accidental protection) and device application (laptops/PCs, mobile devices, wearables, and others), providing opportunities for specialized service providers to cater to niche needs. Key players like Allianz Global Assistance, Asurion, and Chubb Limited are shaping the competitive landscape through strategic partnerships, innovative product offerings, and global expansion.

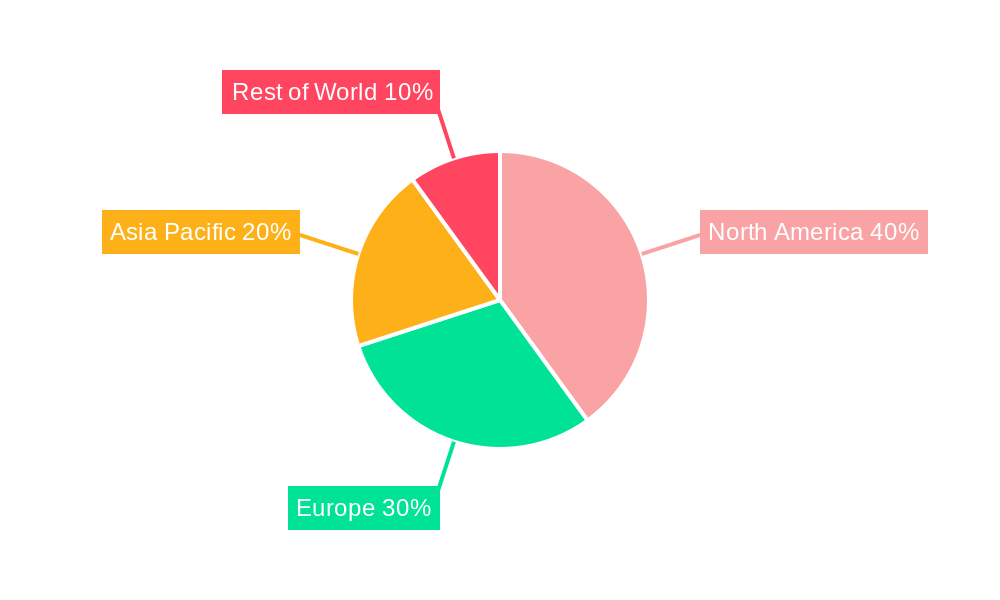

Geographic segmentation reveals strong market presence across North America, Europe, and Asia Pacific, with significant growth potential in emerging markets within Asia and Africa. The North American market, characterized by high consumer electronics penetration and a strong awareness of extended warranty benefits, is expected to remain a dominant force. However, rapid technological advancements and increased smartphone/laptop ownership in developing Asian and African countries will drive significant future growth in those regions. While factors like economic downturns could potentially restrain market growth, the overall outlook remains positive, driven by the increasing value of personal electronics and the growing need for financial protection against unexpected repair costs. The focus on digital distribution channels and personalized warranty offerings will continue to shape market evolution in the coming years.

The global extended warranty market exhibited robust growth during the historical period (2019-2024), exceeding several billion units sold. This upward trajectory is projected to continue throughout the forecast period (2025-2033), with estimations reaching tens of billions of units by 2033. Several key market insights underscore this expansion. Firstly, increasing consumer electronics ownership, particularly in developing economies, fuels demand for protection against unexpected repairs and replacements. The rising cost of repairs for sophisticated devices like smartphones and laptops further incentivizes consumers to opt for extended warranties. Secondly, the proliferation of e-commerce and online marketplaces has simplified the purchase process of extended warranties, making them readily accessible. Furthermore, aggressive marketing strategies employed by warranty providers, emphasizing the value proposition of cost savings in the long run, have successfully influenced consumer purchasing decisions. The market is also witnessing a shift towards bundled warranties offered with initial device purchases, providing seamless integration and increased convenience. Finally, the introduction of innovative warranty options, like accidental damage coverage and extended service plans, catering to evolving consumer needs, further contributes to market expansion. This growth is not uniform across all segments; we see particular strength in the mobile device and laptop/PC sectors, though wearables are showing promising growth potential. The competitive landscape, while featuring established players, is also attracting new entrants, leading to innovative product offerings and pricing strategies. The overall trend strongly indicates a sustained and substantial growth of the extended warranty market in the coming years.

Several factors contribute to the impressive growth of the extended warranty market. The escalating cost of repairs for complex electronic devices is a significant driver. Smartphones, laptops, and other technologically advanced products often require specialized parts and expertise for repairs, leading to high repair bills that can catch consumers off guard. Extended warranties offer a buffer against these unexpected expenses, providing peace of mind and financial protection. Another key driver is the increasing consumer awareness of the benefits of extended warranties. Marketing efforts by warranty providers have effectively highlighted the long-term cost savings associated with these plans, particularly when compared to the potential cost of out-of-warranty repairs. The rising adoption of e-commerce also contributes, with many online retailers seamlessly integrating extended warranty options into the checkout process. Furthermore, the introduction of innovative warranty plans, such as those covering accidental damage or extended service periods, has broadened the appeal and value proposition of extended warranties, making them a more attractive purchase for a wider range of consumers. The growing adoption of smart devices in emerging economies also presents a substantial opportunity for expansion.

Despite its robust growth, the extended warranty market faces several challenges. One significant obstacle is the complexity of warranty terms and conditions. Many consumers find the fine print of these agreements difficult to understand, leading to confusion and dissatisfaction. This lack of clarity can erode consumer trust and deter purchases. Another challenge is the prevalence of fraudulent or misleading warranty offerings, which damage consumer confidence in the overall market. The high upfront cost of extended warranties can also deter some consumers, particularly those with tight budgets. This is exacerbated by the fact that many consumers may never need to utilize their warranty, leading to a perception of wasted expenditure. Competition amongst providers is fierce, creating downward pressure on pricing, which can reduce profit margins for warranty providers. Finally, the increasing longevity and reliability of electronic devices may indirectly impact demand, as consumers anticipate fewer potential repair needs. Addressing these challenges, through greater transparency, consumer education, and rigorous regulatory oversight, is crucial for sustained market growth.

The extended warranty market shows significant regional variations, with developed economies leading in adoption due to higher disposable incomes and greater tech ownership. However, developing economies are witnessing rapid growth potential fueled by rising smartphone penetration and expanding middle classes. Within segments, the mobile device sector dominates due to the high cost of repairs and frequent accidental damage to these devices.

Mobile Devices: This segment consistently displays the highest demand for extended warranties, due to the high repair costs of modern smartphones and the prevalent risk of accidental damage such as screen cracks or water damage. Millions of units of mobile device extended warranties are sold annually, driving significant market revenue. The continued growth of the smartphone market, particularly in developing regions, ensures sustained growth for this segment.

Laptops and PCs: This segment also shows substantial demand, though possibly slightly lower than mobile devices. The cost of repairing laptops and PCs, especially those with advanced components, can be substantial. Extended warranties provide a safety net against unexpected malfunctions and costly repairs. Growth in this segment is tied to the overall PC and laptop market trends, which generally show stable demand.

Regional Dominance: North America and Western Europe currently hold the largest market shares due to high tech penetration and consumer awareness. However, Asia-Pacific, particularly India and China, are experiencing rapid growth, driven by increasing smartphone ownership and rising consumer spending. This shift in regional dominance is expected to continue in the forecast period.

The Standard Protection Plan remains the most popular type of warranty due to its broad coverage of manufacturer defects and malfunctions. However, the Accidental Protection Plan is gaining traction, demonstrating the growing consumer need for coverage beyond standard manufacturing defects. The combination of strong demand for mobile device warranties and rapid growth in Asia-Pacific makes these the key drivers for the extended warranty market's continued expansion.

The extended warranty industry is fueled by several key catalysts. The rising cost of repairs for high-value electronics continues to drive consumer adoption. Increased awareness among consumers of the financial protection offered by extended warranties is another significant factor. The development of innovative warranty plans with broader coverage, such as accidental damage protection, further increases their appeal. The ongoing expansion of e-commerce and seamless integration of warranty options at the point of purchase also contributes to higher sales. These factors, combined with rising disposable incomes in many regions, ensure a positive outlook for the industry’s growth.

The extended warranty market is poised for robust growth, driven by increasing consumer electronics adoption, rising repair costs, and innovative product offerings. The market's expansion is significantly influenced by technological advancements, changing consumer behavior, and evolving regional dynamics. A comprehensive report provides valuable insights into market trends, key players, and growth opportunities, enabling businesses to make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Allianz Global Assistance, American International Group, Inc., Amtrust Financial Services, Inc., Asurion LLC, Chubb Limited, Assurant, Inc., SquareTrade, Inc., The Warranty Group, Inc., Advanced American Auto Warranty Services LLC, Corporate Warranties India Pvt. Ltd, .

The market segments include Type, Application.

The market size is estimated to be USD 151280 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Extended Warranty," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Extended Warranty, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.