1. What is the projected Compound Annual Growth Rate (CAGR) of the Extended Warranty?

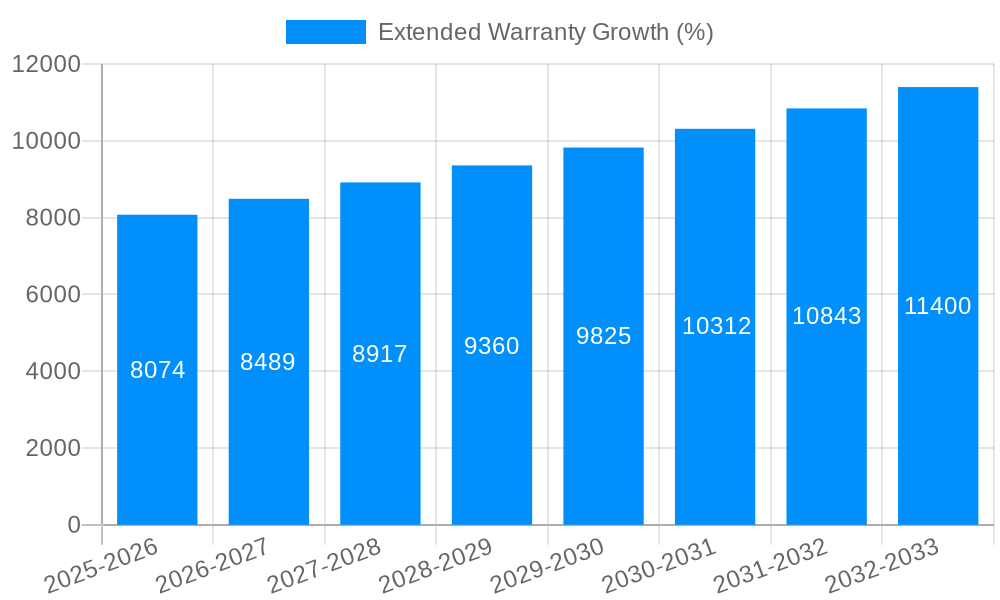

The projected CAGR is approximately 5.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Extended Warranty

Extended WarrantyExtended Warranty by Type (Standard Protection Plan, Accidental Protection Plan), by Application (Laptops and PCs, Mobile Devices, Wearables, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

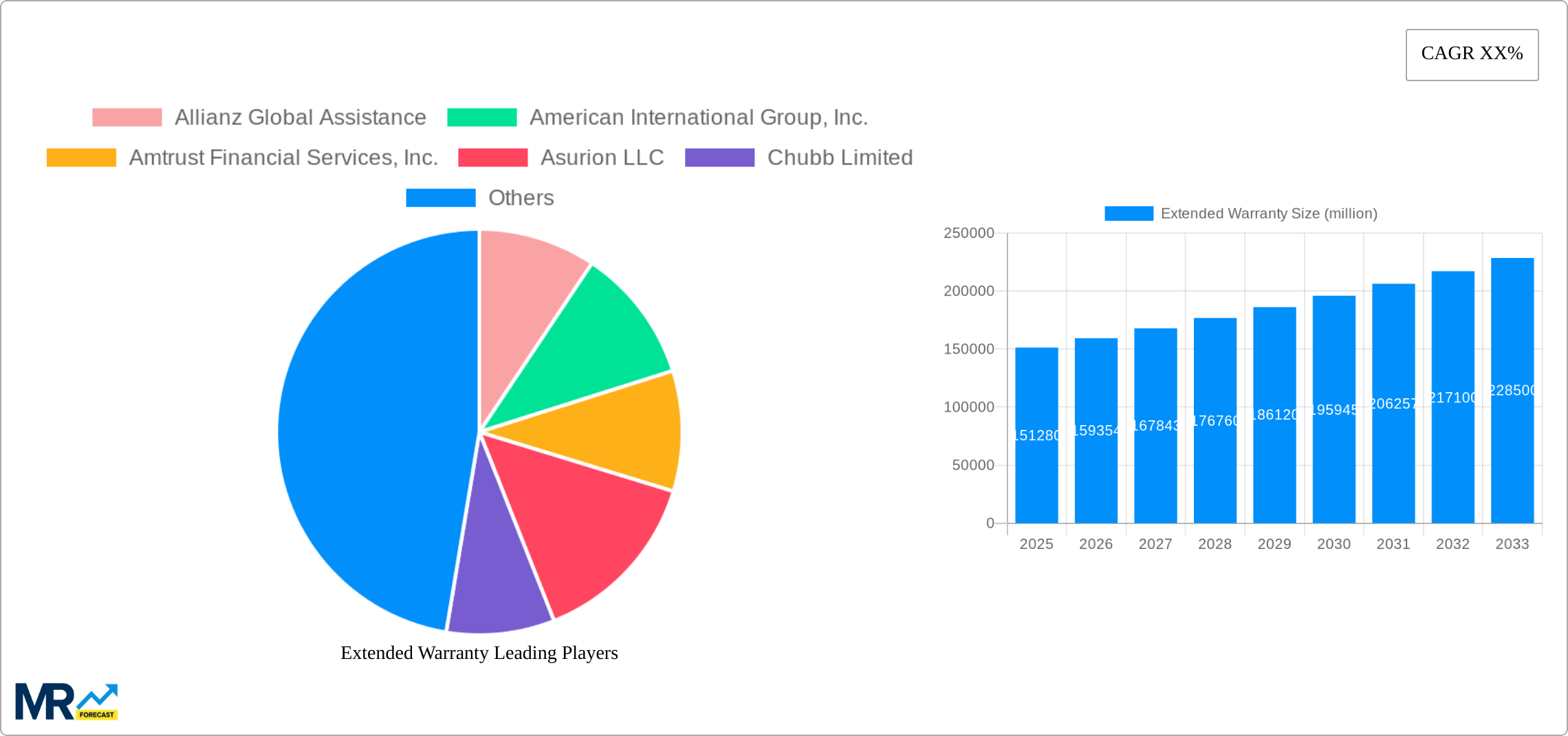

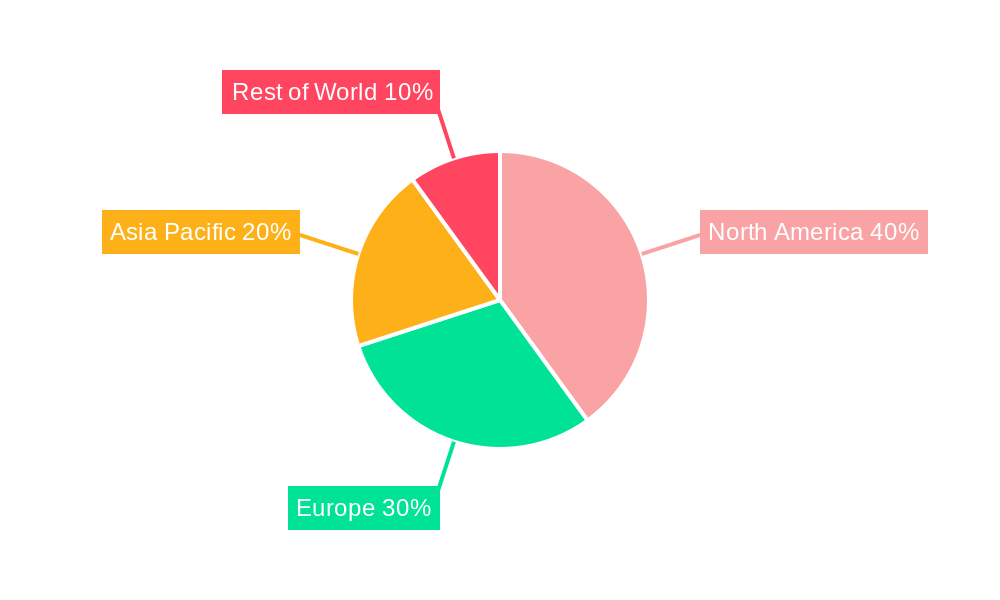

The extended warranty market, valued at $103,120 million in 2025, is projected to experience robust growth, driven by increasing consumer electronics adoption, the rising prevalence of sophisticated devices requiring specialized repair, and a growing preference for guaranteed product longevity and peace of mind. The market's Compound Annual Growth Rate (CAGR) of 5.6% from 2025 to 2033 indicates a substantial expansion over the forecast period. Key drivers include the escalating cost of repairs and replacements, coupled with consumers' growing awareness of the financial benefits of extended warranties, especially for high-value items like laptops, smartphones, and wearables. Market segmentation reveals significant demand across various application categories, with laptops and PCs holding a substantial share, followed by mobile devices and wearables. The competitive landscape comprises a mix of established players like Allianz Global Assistance, Asurion, and Chubb, along with specialized warranty providers, indicating a healthy level of competition fostering innovation and service improvements. Geographical analysis indicates that North America and Europe currently dominate the market, although Asia-Pacific is poised for significant growth, reflecting the region's rapidly expanding electronics market and increasing consumer spending power.

The continued growth of the extended warranty market is expected to be fueled by several factors including technological advancements leading to more complex devices prone to malfunction, the rise of e-commerce and online warranty purchasing, and the increasing adoption of subscription-based models that often integrate extended warranty options. However, potential restraints include the perception of warranties as an added unnecessary expense, the increasing lifespan of electronic devices, and competition from manufacturers offering extended warranty packages directly. Market players are likely to focus on innovative offerings like enhanced service packages, customizable warranty options, and streamlined claims processes to maintain a competitive edge. The focus on customer experience and proactive maintenance services will become increasingly important as the market continues its trajectory of steady growth.

The global extended warranty market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. The historical period (2019-2024) witnessed a steady increase in demand, driven by factors such as rising consumer electronics ownership, increasing product complexity, and a growing preference for longer-term device protection. The base year (2025) serves as a crucial benchmark, highlighting the market's maturation and its readiness for substantial expansion during the forecast period (2025-2033). This growth is not uniformly distributed across all product categories. While laptops and PCs remain a significant segment, the rapid proliferation of mobile devices and wearables, combined with their comparatively higher price points and susceptibility to damage, has fueled exceptionally strong growth in these sectors. Furthermore, the shift towards subscription-based models, bundled warranty offerings, and the increased availability of online purchase options have significantly impacted market dynamics. Consumers are increasingly seeking comprehensive coverage options beyond the standard manufacturer warranty, leading to a noticeable shift towards accidental protection plans. The market is also witnessing the emergence of innovative warranty solutions tailored to specific demographics and product lifecycles. Competitive pricing strategies and strategic partnerships between warranty providers and retailers are further stimulating market expansion. The market's evolution demonstrates a clear trend toward a more consumer-centric approach, focusing on customized warranty solutions that prioritize customer satisfaction and long-term value. This focus on value propositions, combined with technological advancements that enable more sophisticated claims processes and fraud detection, will continue to drive future growth. The involvement of major players like Allianz Global Assistance and Asurion LLC signifies the market’s maturity and its capacity for continued expansion in the coming years. The overall trend points towards a continuously evolving landscape characterized by technological innovation, consumer preference shifts, and fierce competition amongst providers.

Several factors are propelling the growth of the extended warranty market. Firstly, the increasing complexity and technological advancement of consumer electronics leads to higher repair costs. Consumers are understandably hesitant to bear these costs, making extended warranties an attractive option for mitigating financial risk. Secondly, the rising prevalence of smartphones, laptops, and other electronic devices has created a massive potential customer base. The higher initial cost of these devices further incentivizes consumers to invest in extended warranties, particularly given the potential for accidental damage or malfunctions. Thirdly, the increasing popularity of online shopping has made it easier for consumers to purchase extended warranties alongside their primary purchases. This streamlined integration removes friction from the purchasing process, encouraging higher adoption rates. Furthermore, the introduction of innovative warranty products such as accidental damage protection plans caters to specific consumer needs and preferences, boosting market growth. Aggressive marketing strategies by warranty providers, highlighting the value proposition of extended warranties in terms of peace of mind and financial security, also contribute significantly to market expansion. Finally, evolving consumer behavior, including a greater willingness to pay for convenience and protection, creates a favorable environment for the extended warranty market's continued success. These factors collectively drive significant growth, with millions of consumers actively seeking protection beyond standard manufacturer warranties.

Despite its promising growth trajectory, the extended warranty market faces several challenges. One key challenge is the prevalence of fraud and abuse. This includes customers filing false claims or intentionally damaging products to claim warranty benefits, leading to increased costs for providers and potentially inflated prices for consumers. Secondly, the market is highly competitive, with numerous players vying for market share, leading to pressure on pricing and profit margins. Differentiating offerings and providing exceptional customer service are crucial for success in this competitive environment. Additionally, managing operational efficiency, particularly claims processing and customer support, is essential for ensuring profitability and maintaining customer satisfaction. Economic downturns can also negatively impact the market as consumers may prioritize essential expenditures over optional purchases like extended warranties. Finally, the complexity of product repair and the need for specialized skills and parts can add to the operational overhead of warranty providers, impacting their overall profitability and potentially influencing pricing structures. These challenges necessitate a strategic approach from warranty providers, focused on efficient operations, robust fraud detection mechanisms, and customer-centric services.

The extended warranty market is geographically diverse, with significant growth anticipated across multiple regions. However, North America and Europe are currently leading the market, driven by high consumer electronics adoption rates and a greater awareness of the benefits of extended warranties. Within these regions, the United States and countries like Germany and the United Kingdom demonstrate particularly strong demand. Asia-Pacific is also poised for significant growth, fueled by the expanding middle class and rising disposable incomes. Within market segments, the Mobile Devices segment is projected to dominate.

Mobile Devices: The high cost of smartphones and tablets, combined with their susceptibility to damage, makes extended warranties highly appealing to consumers. The prevalence of accidental damage (screen cracks, water damage) drives substantial demand for accidental protection plans, specifically. This segment's rapid technological advancements also contribute to higher repair costs, further increasing the value proposition of extended warranties. The segment is also characterized by a high replacement rate for devices, leading to a continuous demand for warranties on new purchases.

Laptops and PCs: While a significant segment, the pace of growth in this segment is slightly slower compared to Mobile Devices. The increasing affordability of laptops and PCs, coupled with longer product lifecycles in some cases, means that extended warranties are not always perceived as essential. However, for professional users and those reliant on their devices for work, extended warranties remain a valuable option, ensuring business continuity and mitigating financial risks associated with repairs or replacements.

Wearables: This is a rapidly growing segment, fueled by the popularity of smartwatches, fitness trackers, and other wearable devices. Although smaller in overall value compared to mobile devices, this segment demonstrates a high growth rate. The compact size of wearable devices increases the risk of loss or damage, pushing consumers towards extended warranties for protection. The premium price point of many wearables further adds to the desirability of warranty coverage.

Accidental Protection Plans: Across all device categories, the demand for accidental protection plans is showing considerable strength. Consumers are increasingly aware of the potential for unforeseen damage and are willing to pay extra for the peace of mind that comes with this additional coverage. This segment's growth is intricately linked to the popularity of mobile devices and wearable technology, where accidental damage is a frequent occurrence. The higher cost of repairs in these categories makes accidental protection a critical element of the extended warranty market.

The combination of high consumer electronics adoption, increasing awareness of warranty benefits, and the vulnerability of mobile devices and wearables to damage collectively position the Mobile Devices segment, with a strong emphasis on Accidental Protection Plans, as the dominant force in the extended warranty market throughout the forecast period.

The extended warranty industry's growth is fueled by a confluence of factors. Rising consumer electronics ownership, particularly smartphones and wearables, creates a vast customer base. Simultaneously, the increasing complexity and cost of repairs make extended warranties a cost-effective way to mitigate financial risk. Moreover, innovative warranty models, such as subscription-based plans and bundled offerings, enhance convenience and appeal to a broader consumer segment. These factors, combined with effective marketing strategies and partnerships with retailers, create a powerful catalyst for sustained market expansion.

This report provides a comprehensive overview of the extended warranty market, examining historical trends, current market dynamics, and future projections. It delves into key growth drivers, challenges, and regional variations, offering valuable insights into the competitive landscape. The report highlights leading players and significant developments, providing a valuable resource for businesses and investors in the extended warranty sector. It also meticulously analyzes market segmentation, focusing on key product applications and warranty types, providing actionable data to understand market trends and potential opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.6%.

Key companies in the market include Allianz Global Assistance, American International Group, Inc., Amtrust Financial Services, Inc., Asurion LLC, Chubb Limited, Assurant, Inc., SquareTrade, Inc., The Warranty Group, Inc., Advanced American Auto Warranty Services LLC, Corporate Warranties India Pvt. Ltd, .

The market segments include Type, Application.

The market size is estimated to be USD 103120 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Extended Warranty," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Extended Warranty, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.