1. What is the projected Compound Annual Growth Rate (CAGR) of the Experimental Animals?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Experimental Animals

Experimental AnimalsExperimental Animals by Type (Rodents, Non-rodent), by Application (Pharmaceutical Company, Hospital, Scientific Research, School, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

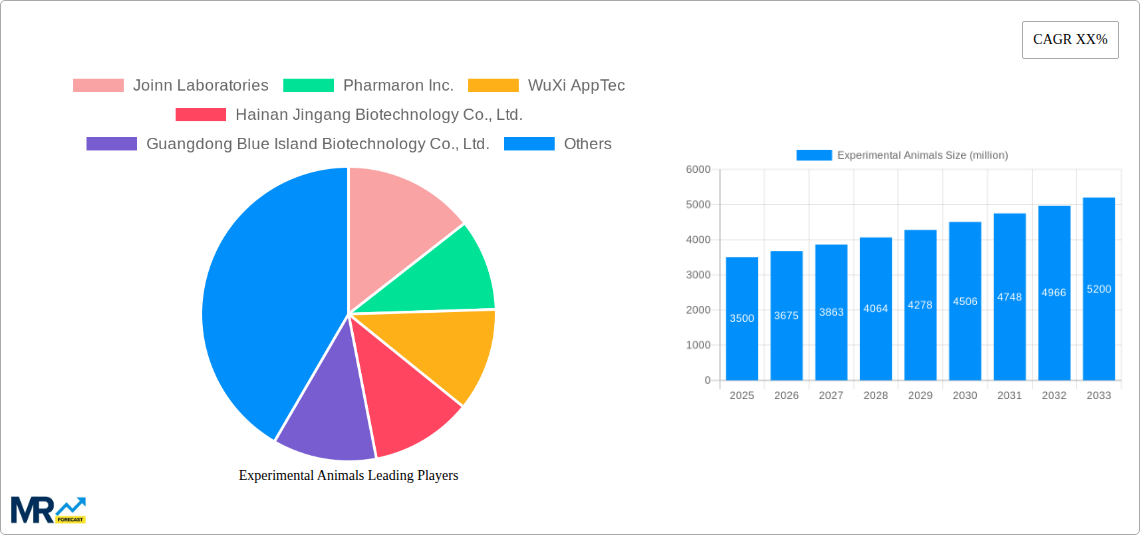

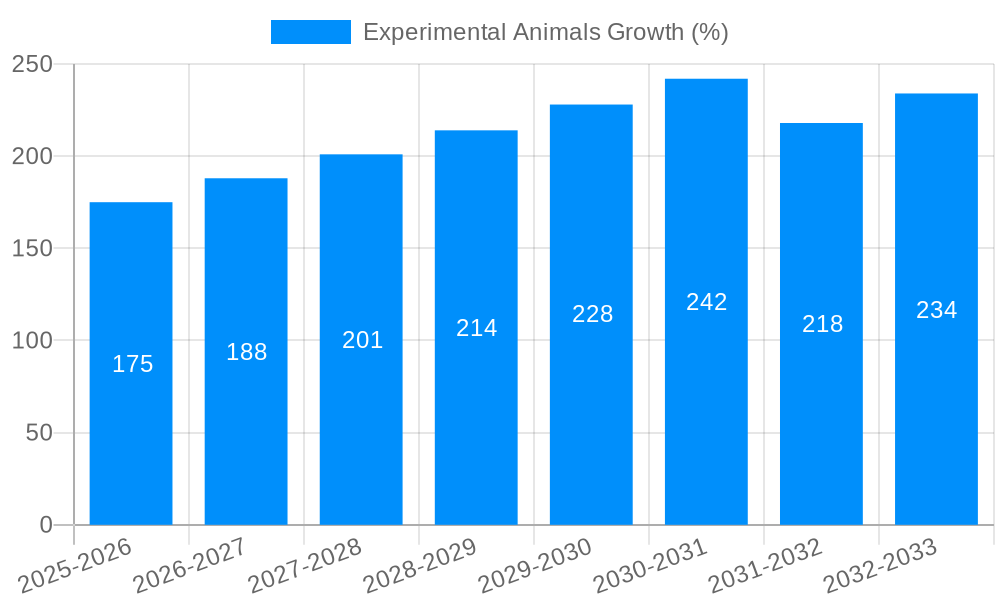

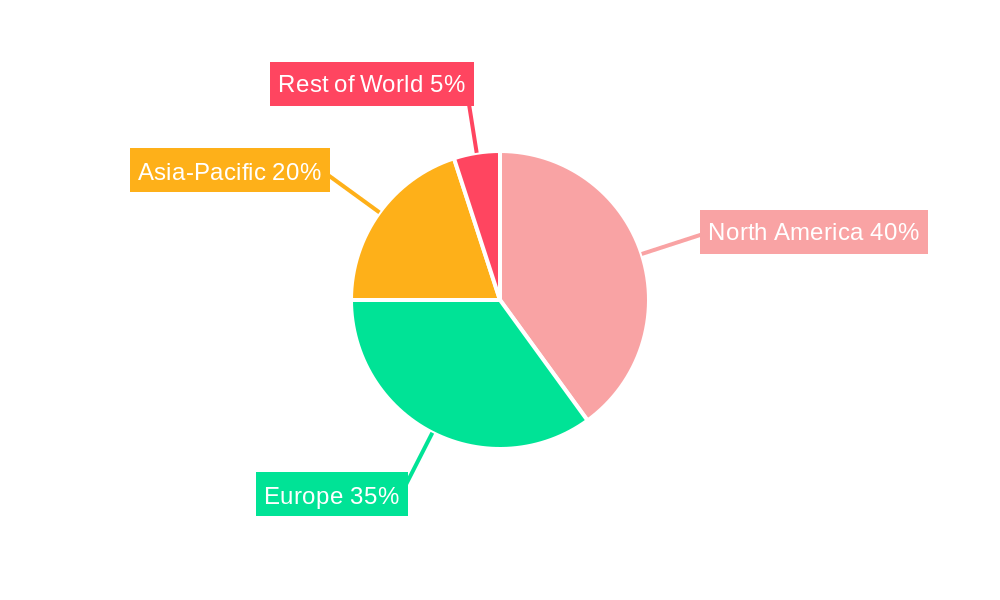

The global experimental animals market is a significant and expanding sector, driven by the increasing demand for preclinical research and drug development across the pharmaceutical and biotechnology industries. The market's growth is fueled by several factors, including the rising prevalence of chronic diseases necessitating extensive research, advancements in medical technology leading to more sophisticated animal models, and stringent regulatory requirements for drug approvals demanding robust preclinical data. While the precise market size for 2025 isn't provided, considering a hypothetical CAGR of 5% (a reasonable estimate given the consistent growth in related sectors), and assuming a 2019 market size of $5 billion (a plausible figure based on industry reports), the market value in 2025 could be estimated at approximately $6.2 billion. This substantial market is segmented by animal type (rodents accounting for a significant majority) and application (with pharmaceutical companies representing the largest consumer segment). The geographical distribution shows strong growth across North America and Europe, with Asia-Pacific emerging as a rapidly expanding region due to increasing investment in research and development infrastructure.

The market's growth trajectory is influenced by various trends, including the development of genetically engineered animal models allowing for more precise and targeted research. However, ethical concerns surrounding animal welfare and the rising costs associated with maintaining and experimenting with animals pose significant restraints to growth. Companies involved in the breeding, supply, and support services for experimental animals are actively seeking ways to balance research needs with ethical considerations, such as adopting the 3Rs principle (Replacement, Reduction, Refinement) and promoting the development of alternative methods. The competitive landscape is moderately concentrated, with several major international players and a number of regional suppliers vying for market share. Future growth will likely depend on factors such as technological advancements, regulatory changes, and the continued development of humane and ethical research practices.

The global experimental animals market, valued at several billion USD in 2024, is poised for substantial growth throughout the forecast period (2025-2033). Driven by escalating demand from the pharmaceutical and biotechnology sectors, the market exhibits a robust expansion trajectory. The increasing prevalence of chronic diseases necessitates extensive pre-clinical research, fueling the demand for experimental animals in drug discovery and development. Furthermore, advancements in biomedical research, particularly in areas like genomics and personalized medicine, are contributing significantly to market growth. The historical period (2019-2024) witnessed a steady increase in consumption, primarily driven by rodents due to their cost-effectiveness and suitability for various research applications. However, the rising demand for non-rodent models, owing to their physiological similarities with humans, is expected to create a significant segment within the market during the forecast period. The geographical distribution of market share indicates a concentration in North America and Europe, attributed to the presence of well-established research institutions and pharmaceutical companies. However, emerging economies in Asia, particularly China and India, are witnessing rapid expansion, driven by rising investments in research infrastructure and increasing awareness of animal welfare regulations. The market is characterized by a complex interplay of factors, including technological innovations in animal breeding and housing, evolving regulatory landscapes, and ethical considerations surrounding animal experimentation. In the next decade, we expect to see continued diversification in animal models, improved welfare standards, and a growing emphasis on the 3Rs (Replacement, Reduction, Refinement) principles.

The burgeoning global experimental animals market is propelled by several key factors. Firstly, the relentless pursuit of novel therapeutics for a growing number of complex diseases, including cancer, Alzheimer's, and infectious diseases, necessitates extensive pre-clinical testing using animal models. Pharmaceutical and biotechnology companies rely heavily on these models to evaluate drug efficacy, safety, and toxicity before human clinical trials. Secondly, the advancements in biotechnology and genetic engineering have led to the development of sophisticated animal models that accurately mimic human diseases, thereby improving the reliability and translational value of research findings. This increased precision in modeling human diseases translates into more effective drug development and reduces the risk of clinical trial failures. Thirdly, the expanding scope of scientific research across diverse fields, including toxicology, immunology, and neuroscience, further contributes to the high demand for experimental animals. Academic institutions, government research agencies, and contract research organizations (CROs) are significant consumers of these animals. Finally, the increasing adoption of advanced imaging techniques and data analysis methods allows researchers to extract more valuable information from animal studies, enhancing the overall efficiency and effectiveness of pre-clinical research.

Despite the substantial growth potential, the experimental animals market faces certain challenges. Stringent regulatory frameworks governing animal welfare and experimentation are becoming increasingly common globally, leading to higher compliance costs and potentially limiting research activities. The ethical concerns surrounding the use of animals in research continue to generate public debate and activism, potentially affecting research funding and public perception of the industry. Fluctuations in global economic conditions can also impact the market, as research budgets are often susceptible to economic downturns. Furthermore, the high cost associated with maintaining animal colonies, including breeding, housing, and veterinary care, can pose a significant barrier to entry for smaller research institutions or companies. Finally, the availability of alternative research methods, such as in vitro studies and computational modeling, although still limited in certain applications, presents a potential long-term challenge to the market's growth. The need to balance scientific advancement with ethical considerations and economic realities necessitates a carefully considered approach by all stakeholders.

The Rodent segment dominates the experimental animals market, accounting for the largest share of global consumption. Rodents, particularly mice and rats, are favored due to their relatively low cost, ease of handling, short lifespans, and well-established genetic backgrounds. Their physiological similarity to humans in certain aspects makes them suitable for numerous research applications.

North America and Europe currently hold significant market shares, primarily due to the established presence of major pharmaceutical companies, research institutions, and robust regulatory frameworks. These regions are characterized by substantial investments in biomedical research and a high concentration of CROs (Contract Research Organizations).

However, Asia, particularly China, is emerging as a key growth driver. China's expanding pharmaceutical industry, coupled with increasing government investments in scientific research and infrastructure, is fueling a substantial rise in the demand for experimental animals. The increasing number of CROs and research institutions in China is further boosting market expansion.

The Pharmaceutical Company segment is the largest consumer of experimental animals. Pharmaceutical companies utilize these animals extensively in pre-clinical drug development, safety testing, and toxicology studies. This segment is expected to continue its dominance driven by a steady pipeline of new drug candidates and the growing global need for innovative therapies.

In summary: While North America and Europe maintain a strong hold on the market currently, the rapid expansion of the pharmaceutical and research sectors in China, coupled with the dominant role of rodents as the preferred model, presents a dynamic and rapidly evolving landscape for the experimental animals market.

The experimental animals industry is experiencing significant growth due to the convergence of factors including the increasing prevalence of chronic diseases demanding novel therapeutics, the rise of personalized medicine requiring specific animal models, and substantial investment in research and development across both public and private sectors. Technological advancements, such as improved animal breeding techniques and sophisticated disease models, are also contributing significantly to market expansion.

This report provides a comprehensive analysis of the global experimental animals market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It delves into key market trends, growth drivers, challenges, and opportunities, providing granular insights into market segmentation by animal type (rodents, non-rodents) and application (pharmaceutical companies, hospitals, scientific research, etc.). The report also profiles leading players in the industry, highlighting their market share, strategies, and recent developments. This in-depth analysis will enable stakeholders to make informed decisions and capitalize on the growth potential of this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Joinn Laboratories (China)Pharmaron Inc., Pharmaron Inc., Shanghai Model Organisms, Sichuan Hengshu Bio-Technology Co.,Ltd., China Environmental Technology and Bioenergy Holdings Limited, GemPharmatech Co., Ltd., Vital River, Biocytogen Pharmaceuticals (Beijing) Co., Ltd., Jackson Laboratory, Hainan JINGANG BIOTECH Co., Ltd., Guangdong Landau Biotechnology Co. Ltd., Hubei Topgene Biotechnology Co., Ltd., Envigo, Shanghai Slack Experimental Animal Co., Ltd., Janvier Labs, Taconic Biosciences, Charles River Laboratories, Institute Of Beijing Xieerxin Biology Resource Co.ltd,, Changzhou Cavens Laboratory Animals Co., Ltd., Beijing HFK Bioscience Co., Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Experimental Animals," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Experimental Animals, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.