1. What is the projected Compound Annual Growth Rate (CAGR) of the Epidural Anesthetic Drugs and Device?

The projected CAGR is approximately 7.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Epidural Anesthetic Drugs and Device

Epidural Anesthetic Drugs and DeviceEpidural Anesthetic Drugs and Device by Type (/> Epidural Anesthetic Drugs, Epidural Anesthetic Device), by Application (/> Abdomen Procedures, Pelvic Procedures, Lower Extremity Procedures, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

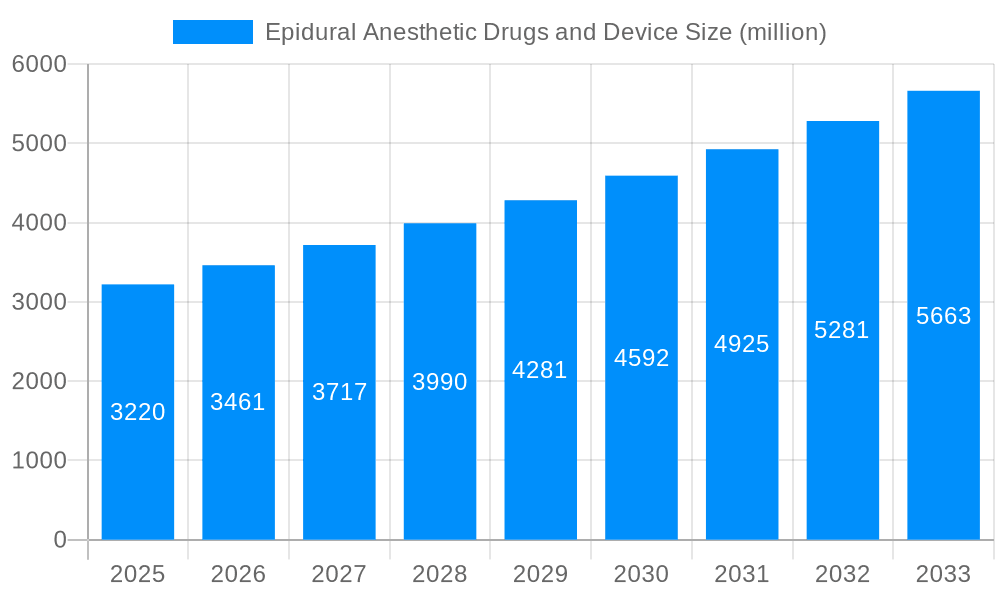

The global Epidural Anesthetic Drugs and Device market is poised for significant expansion, projected to reach an estimated USD 3.22 billion by the year 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 7.4%, indicating sustained momentum throughout the forecast period of 2025-2033. A primary driver for this upward trajectory is the increasing prevalence of surgical procedures, particularly those involving abdominal, pelvic, and lower extremity interventions, where epidural anesthesia offers a safe and effective pain management solution. Advances in drug formulations and the development of more sophisticated, user-friendly epidural devices are further fueling market adoption. The growing awareness among healthcare professionals and patients regarding the benefits of regional anesthesia, such as reduced opioid use and faster recovery times, also contributes to this positive outlook.

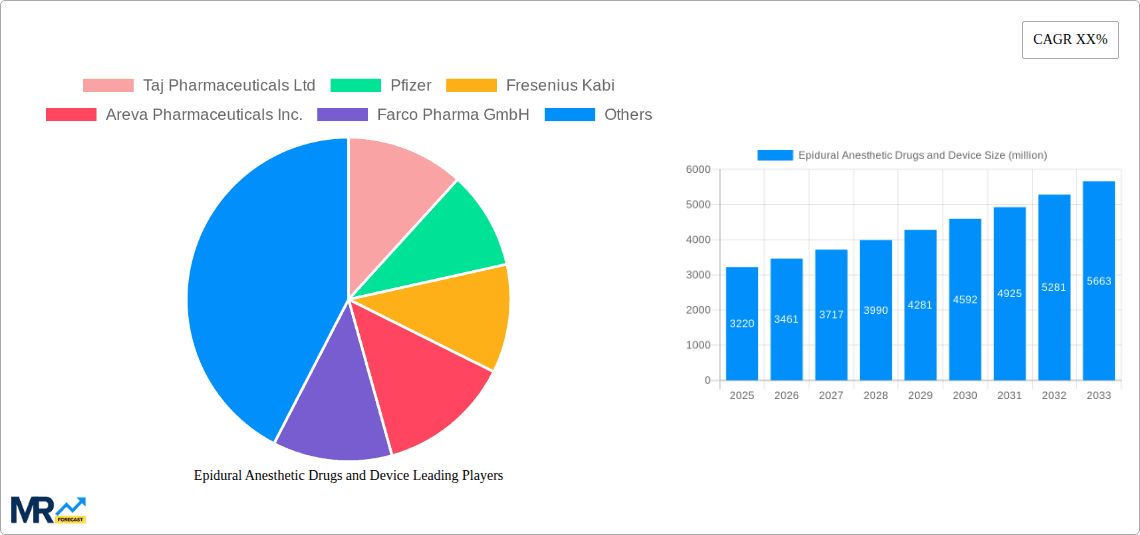

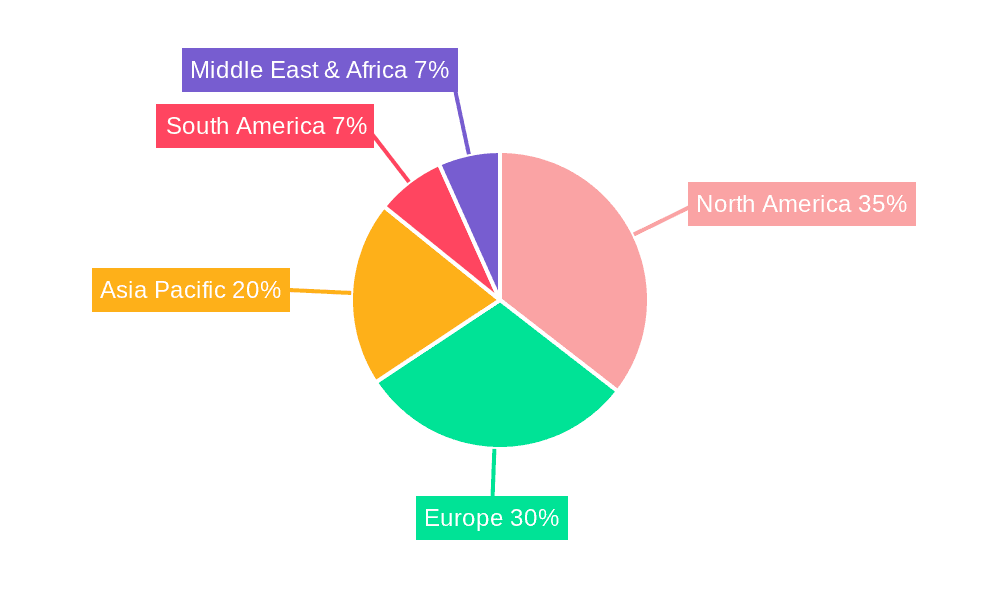

The market's expansion is further supported by key trends including the integration of advanced technologies in drug delivery systems for enhanced precision and patient comfort, and a growing demand for minimally invasive surgical techniques that often utilize epidural anesthesia. Companies like Pfizer, Fresenius Kabi, and B.Braun are at the forefront, innovating and expanding their product portfolios to cater to diverse medical needs. Geographically, North America and Europe are expected to remain dominant markets due to advanced healthcare infrastructure and high surgical volumes. However, the Asia Pacific region presents substantial growth opportunities, driven by a burgeoning patient pool and improving healthcare access. While the market is generally robust, potential restraints could include stringent regulatory approvals for new drug formulations and devices, and the availability of alternative anesthesia methods. Nevertheless, the overall outlook remains highly optimistic for the epidural anesthetic drugs and device market.

Here's a report description on Epidural Anesthetic Drugs and Devices, incorporating the requested elements:

The global Epidural Anesthetic Drugs and Device market is poised for significant expansion, exhibiting a compound annual growth rate (CAGR) of approximately 5.8% during the forecast period of 2025-2033. Building upon a robust historical trajectory from 2019-2024, the market is anticipated to reach an estimated valuation of $8.2 billion in the base year of 2025. This growth is underpinned by a confluence of factors, including an aging global population susceptible to various surgical interventions, a rising prevalence of chronic pain conditions requiring interventional pain management, and advancements in anesthetic formulations and delivery systems. The increasing adoption of minimally invasive surgical techniques, where epidural anesthesia offers distinct advantages in terms of patient recovery and reduced opioid reliance, further bolsters market sentiment. From a segmentation perspective, the Epidural Anesthetic Drugs segment is expected to hold a dominant share, driven by continuous research and development into novel drug formulations offering improved efficacy and reduced side effects. Concurrently, the Epidural Anesthetic Device segment is witnessing innovation in the form of advanced catheter designs, smart pumps, and integrated monitoring systems, enhancing precision and patient safety. The Abdomen Procedures application segment is projected to lead due to the high volume of gastrointestinal, gynecological, and urological surgeries performed globally. Emerging economies, with their expanding healthcare infrastructure and increasing disposable incomes, are becoming crucial growth engines, presenting lucrative opportunities for established and new market entrants alike. The period between 2019 and 2033 signifies a dynamic evolution for this market, characterized by strategic collaborations, product launches, and a growing emphasis on patient-centric pain management solutions.

The ascendance of the Epidural Anesthetic Drugs and Device market is primarily propelled by an escalating global demand for effective pain management solutions across a spectrum of medical interventions. The increasing incidence of age-related diseases and the subsequent rise in surgical procedures, particularly in specialties like orthopedics, obstetrics, and general surgery, directly fuels the need for reliable anesthetic options. Epidural anesthesia, with its targeted pain relief and potential for reduced systemic side effects compared to general anesthesia, is increasingly favored by both clinicians and patients. Furthermore, the growing recognition of chronic pain as a significant public health concern has spurred the development and adoption of interventional pain management techniques, of which epidural injections are a cornerstone. Technological advancements in both drug delivery and device design are also significant drivers. Innovations in anesthetic formulations are focusing on longer-acting agents, reduced neurotoxicity, and improved pharmacokinetic profiles. Similarly, the evolution of epidural devices, including enhanced catheter materials, improved needle designs for easier insertion, and sophisticated infusion pumps for precise titration, contributes to improved procedural success rates and patient outcomes. The push towards enhanced patient recovery protocols and the desire to minimize opioid dependence post-surgery further position epidural anesthesia as a preferred choice, thereby driving market growth.

Despite its promising growth trajectory, the Epidural Anesthetic Drugs and Device market faces several challenges and restraints that could temper its expansion. A primary concern revolves around the inherent risks and potential complications associated with epidural procedures, such as nerve damage, infection, and post-dural puncture headache. While these risks are generally low, their existence necessitates rigorous training for healthcare professionals and careful patient selection, which can limit broader adoption in certain settings. The availability of alternative pain management strategies, including regional blocks, general anesthesia, and advanced multimodal analgesia, also presents a competitive challenge. Furthermore, the cost of sophisticated epidural devices and some newer anesthetic agents can be a significant barrier, particularly in resource-limited healthcare systems and emerging economies. Regulatory hurdles and stringent approval processes for new anesthetic drugs and devices can also slow down market penetration and innovation. Additionally, a lack of adequate awareness or insufficient training among some healthcare providers regarding the optimal use of epidural techniques may hinder their widespread implementation. The perception of epidural anesthesia as a complex procedure requiring specialized expertise can also contribute to its underutilization in some clinical scenarios.

The global Epidural Anesthetic Drugs and Device market is projected to witness significant regional dominance, with North America expected to lead the charge, closely followed by Europe. This leadership is attributed to several interconnected factors:

North America:

Europe:

Segment Dominance:

Within the market segments, the Epidural Anesthetic Drugs segment is poised for continued dominance. This is driven by:

However, the Epidural Anesthetic Device segment is also experiencing substantial growth and is crucial for the effective delivery of these drugs. Advancements in:

The Abdomen Procedures application segment is expected to be the largest contributor to the market revenue due to the sheer volume of surgeries performed in areas like general surgery (hernia repair, appendectomy), gynecology (hysterectomy, C-sections), and urology (prostatectomy). The suitability of epidural anesthesia for these procedures, offering excellent pain control and facilitating early ambulation, makes it a preferred choice.

The Epidural Anesthetic Drugs and Device industry is fueled by several key growth catalysts. The increasing global prevalence of chronic pain conditions, coupled with an aging population and a subsequent rise in surgical interventions, creates a sustained demand for effective pain management solutions. Technological advancements in both anesthetic formulations, leading to improved efficacy and reduced side effects, and in device design, such as enhanced catheters and intelligent infusion pumps, are significantly enhancing procedural outcomes and patient safety. The growing emphasis on enhanced recovery after surgery (ERAS) protocols, which aim to accelerate patient recuperation and reduce hospital stays, strongly favors epidural anesthesia due to its capacity for targeted pain relief and reduced opioid dependency. Furthermore, the expanding healthcare infrastructure in emerging economies is opening new avenues for market penetration.

This comprehensive report delves into the intricate dynamics of the Epidural Anesthetic Drugs and Device market, providing an in-depth analysis of its evolution from 2019 to 2033. The study encompasses a detailed examination of market trends, segmentation by drug type and device, and application-specific demand across various procedures. It meticulously analyzes the driving forces, challenges, and restraints shaping market growth, alongside identifying key regional players and their strategic initiatives. Furthermore, the report highlights significant industry developments, including product launches and regulatory updates, offering valuable insights into the competitive landscape. With a robust CAGR projection and a detailed market forecast, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this vital sector of healthcare.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.4%.

Key companies in the market include Taj Pharmaceuticals Ltd, Pfizer, Fresenius Kabi, Areva Pharmaceuticals Inc., Farco Pharma GmbH, Mahendra Chemicals, Aurobindo Pharma Ltd, Amphastar Pharmaceuticals, Inc., B.Braun, BD, Meditech Devices, Smith Medical, Teleflex.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Epidural Anesthetic Drugs and Device," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Epidural Anesthetic Drugs and Device, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.