1. What is the projected Compound Annual Growth Rate (CAGR) of the Environmental Friendly Package?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Environmental Friendly Package

Environmental Friendly PackageEnvironmental Friendly Package by Application (Food & Beverages, Healthcare, Personal Care & Cosmetics, Others), by Type (Recycled Content Packaging, Re-Usable Packaging, Degradable Packaging), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

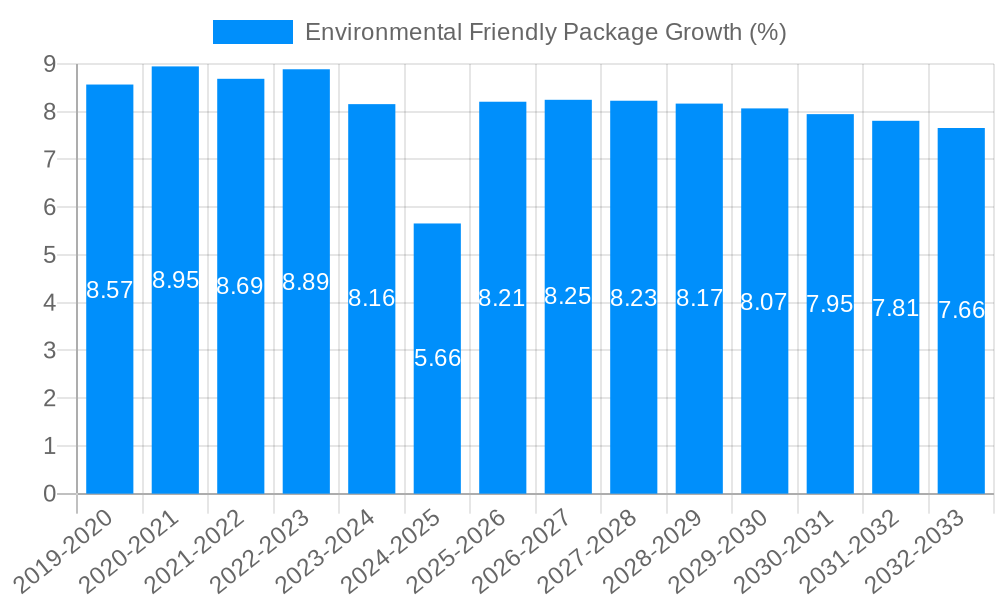

The global Environmental Friendly Packaging market is poised for substantial growth, projected to reach an estimated market size of $280 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 8.5% anticipated over the forecast period of 2025-2033. This expansion is primarily fueled by a growing consumer and regulatory demand for sustainable packaging solutions across a multitude of industries. Key drivers include increasing environmental consciousness, stringent government regulations promoting eco-friendly alternatives, and a corporate shift towards Corporate Social Responsibility (CSR) initiatives that prioritize sustainability. The market is segmented into Recycled Content Packaging, Re-Usable Packaging, and Degradable Packaging, each offering distinct benefits and catering to specific application needs.

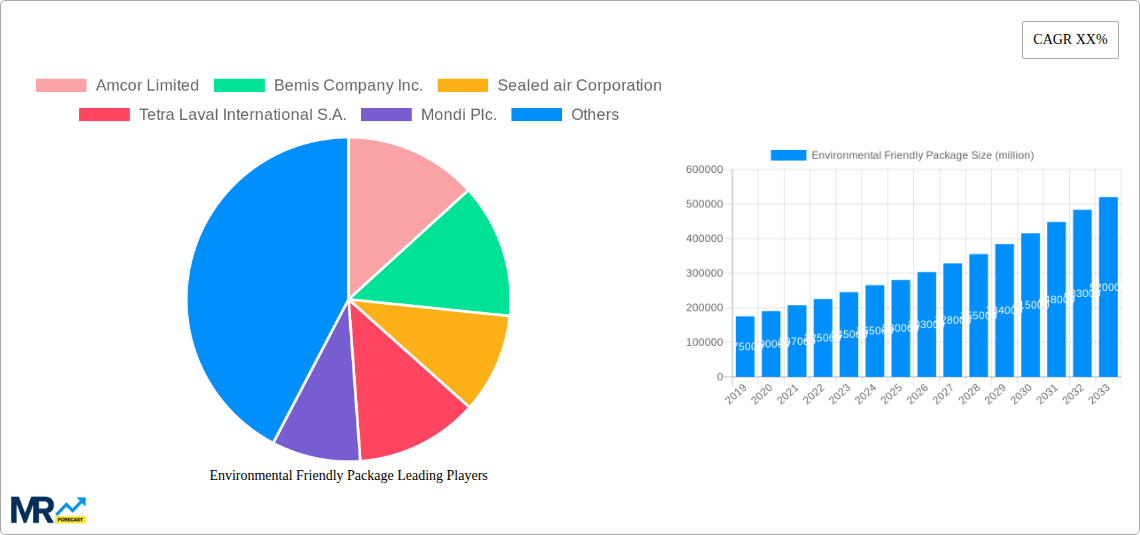

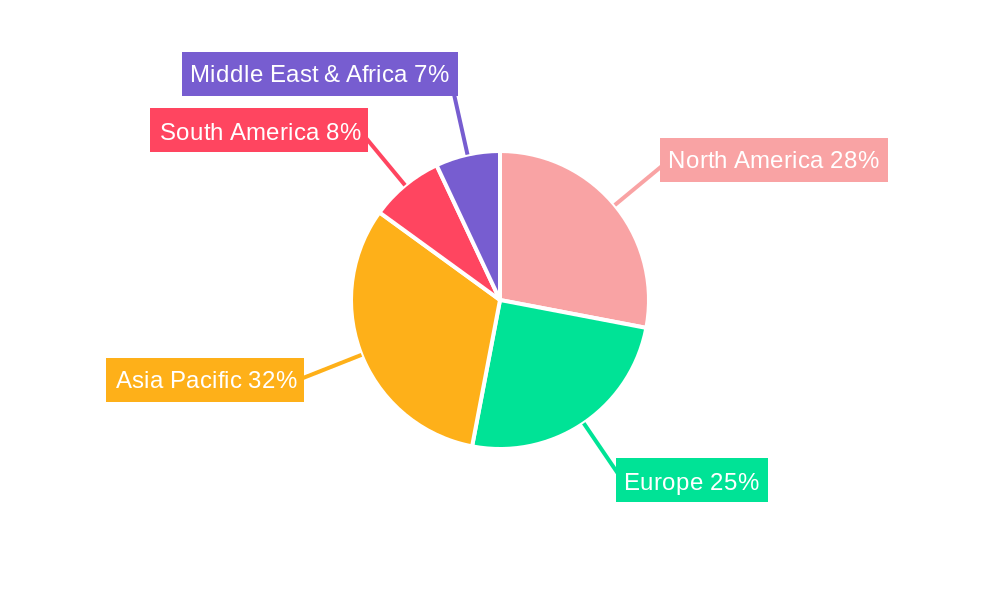

The food and beverages sector is a dominant application segment, driven by the sheer volume of packaging consumed and the increasing consumer preference for brands that demonstrate environmental stewardship. Healthcare and personal care & cosmetics sectors are also significant contributors, with a growing emphasis on premium and eco-conscious product offerings. While the market exhibits strong growth potential, certain restraints exist, such as the higher initial cost of some sustainable packaging materials compared to traditional options and the need for robust recycling and composting infrastructure to support widespread adoption of degradable and reusable formats. Leading companies like Amcor Limited, Bemis Company Inc., and Sealed Air Corporation are actively innovating and investing in sustainable packaging technologies to capture market share. Geographically, Asia Pacific, led by China and India, is emerging as a high-growth region due to rapid industrialization and increasing environmental awareness, while North America and Europe continue to be mature markets with strong regulatory frameworks driving demand.

Here is a unique report description on Environmental Friendly Packaging, incorporating the requested elements:

The global Environmental Friendly Package market is poised for remarkable expansion, projecting a valuation of over $750 million in the Base Year of 2025. This robust growth trajectory is set to continue through the Forecast Period of 2025-2033, with the market expected to surpass $1.2 billion by 2033. The Study Period, encompassing 2019-2033, highlights a significant shift in consumer and industry preferences towards sustainable solutions. The Historical Period (2019-2024) has laid the groundwork for this evolution, with increasing awareness surrounding plastic pollution and resource depletion driving initial adoption. Key market insights reveal a strong preference for Recycled Content Packaging, which is expected to capture a substantial market share, valued at over $400 million in 2025. This segment's dominance is fueled by its dual benefit of reducing landfill waste and conserving virgin resources. Re-Usable Packaging, though currently smaller in market size, is projected to witness an impressive compound annual growth rate (CAGR) of over 7% during the forecast period, indicating a growing trend towards circular economy models. The Degradable Packaging segment, while facing some technical and cost hurdles, is also anticipated to expand steadily, particularly in niche applications where single-use scenarios are unavoidable. The overarching trend is a move away from conventional, single-use plastics towards materials that minimize environmental impact across their lifecycle. Industry developments are continuously introducing innovative solutions, from biodegradable polymers to advanced recycling technologies, further shaping the market landscape. The Estimated Year of 2025 serves as a critical juncture, reflecting the current adoption rates and providing a baseline for future projections, demonstrating a market that is not only growing but also maturing with a clearer understanding of sustainable packaging's potential.

Several powerful forces are collaboratively propelling the growth of the Environmental Friendly Package market. Foremost among these is the escalating global environmental consciousness. Consumers, increasingly aware of the detrimental effects of traditional packaging waste on ecosystems and climate change, are actively seeking out products with eco-friendly packaging. This demand acts as a significant pull factor for manufacturers and retailers to adopt sustainable alternatives. Regulatory frameworks are also playing a crucial role. Governments worldwide are implementing stricter policies, including bans on certain single-use plastics, extended producer responsibility (EPR) schemes, and incentives for sustainable material use. These regulations are creating a more favorable environment for the adoption of environmentally friendly packaging solutions and compelling businesses to innovate. Furthermore, corporate sustainability initiatives are a major catalyst. Many leading companies are setting ambitious environmental, social, and governance (ESG) targets, which often include a significant reduction in their packaging footprint. This commitment translates into substantial investments in research and development, as well as procurement of sustainable packaging materials, driving market demand and technological advancements. The convergence of these factors—consumer demand, regulatory pressure, and corporate responsibility—is creating a powerful impetus for the widespread adoption of environmentally friendly packaging across various industries.

Despite the promising growth, the Environmental Friendly Package market faces several significant challenges and restraints that impede its full potential. A primary concern remains the cost premium associated with many sustainable packaging solutions compared to conventional plastics. The initial investment in new manufacturing processes, the sourcing of sustainable raw materials, and specialized recycling infrastructure can lead to higher product prices, which can be a deterrent for price-sensitive consumers and businesses. Scalability and availability of certain eco-friendly materials also present hurdles. While some innovative materials are emerging, widespread adoption requires robust supply chains and large-scale production capabilities, which are still under development for many alternatives. Performance limitations can also be a restraint. Some biodegradable or compostable materials may not offer the same barrier properties, durability, or shelf-life protection as traditional plastics, particularly for sensitive products like certain foods or pharmaceuticals. Ensuring product integrity and safety while using eco-friendly packaging is paramount. Consumer confusion and lack of standardized labeling regarding recyclability, biodegradability, and compostability can lead to improper disposal, undermining the intended environmental benefits. Furthermore, the infrastructure for collection and processing of different types of eco-friendly packaging, especially those requiring industrial composting, is often underdeveloped in many regions, limiting their effective end-of-life management.

The Environmental Friendly Package market is characterized by strong regional variations and segment dominance, with specific areas exhibiting exceptional growth potential.

Key Regions and Countries:

Dominant Segments:

The Environmental Friendly Package industry is fueled by several key growth catalysts. A primary driver is the increasing consumer demand for sustainability. Consumers are actively seeking out products with eco-conscious packaging, influencing brand choices and pushing manufacturers towards greener alternatives. Secondly, supportive government regulations and policies, such as plastic bans, recycled content mandates, and tax incentives, are creating a more favorable market environment and encouraging investment in sustainable solutions. Technological advancements in material science and recycling processes are also crucial, leading to the development of innovative, high-performing, and cost-effective eco-friendly packaging options. Finally, corporate sustainability commitments by major brands, aiming to reduce their environmental impact, are a significant catalyst, driving large-scale adoption and R&D investments.

This comprehensive report delves into the intricate landscape of the Environmental Friendly Package market, providing an in-depth analysis of its current state and future prospects. It meticulously examines the market dynamics, forecasting its growth from a projected $750 million in 2025 to over $1.2 billion by 2033, with a detailed study period spanning 2019-2033. The report highlights key market insights, including the strong preference for Recycled Content Packaging, valued at over $400 million in 2025, and the promising growth of Re-Usable Packaging. It dissects the driving forces behind this expansion, such as escalating environmental consciousness, stringent regulations, and corporate sustainability initiatives. Conversely, it also addresses the inherent challenges, including cost premiums, scalability issues, and performance limitations. The report identifies key regions and segments poised for dominance, with North America and Europe leading in adoption, and the Food & Beverages application segment and Recycled Content Packaging type leading in market share. Furthermore, it outlines crucial growth catalysts and provides a comprehensive overview of the leading industry players and their significant developments. This report offers an indispensable resource for stakeholders seeking to navigate and capitalize on the burgeoning Environmental Friendly Package market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Amcor Limited, Bemis Company Inc., Sealed air Corporation, Tetra Laval International S.A., Mondi Plc., Sonoco Products Company, Cargill Incorporation, Graham Packaging Company Incorporation, Huhtamaki OYJ, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Environmental Friendly Package," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Environmental Friendly Package, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.