1. What is the projected Compound Annual Growth Rate (CAGR) of the Electronic Lower Gastrointestinal Endoscopy?

The projected CAGR is approximately 7.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Electronic Lower Gastrointestinal Endoscopy

Electronic Lower Gastrointestinal EndoscopyElectronic Lower Gastrointestinal Endoscopy by Application (Hospital, Clinic, Others, World Electronic Lower Gastrointestinal Endoscopy Production ), by Type (Disposable, Reusable, World Electronic Lower Gastrointestinal Endoscopy Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

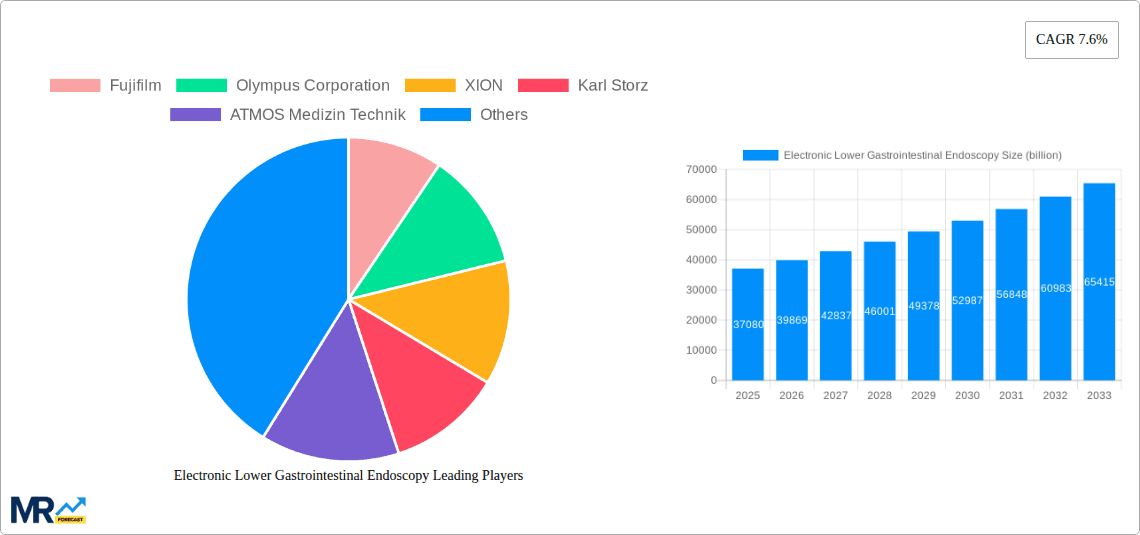

The global Electronic Lower Gastrointestinal Endoscopy market is poised for significant expansion, projected to reach approximately $37.08 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.6% expected throughout the forecast period of 2025-2033. This growth is primarily fueled by the increasing prevalence of gastrointestinal disorders such as colorectal cancer, inflammatory bowel disease, and irritable bowel syndrome, necessitating advanced diagnostic and therapeutic procedures. The aging global population also contributes to this upward trajectory, as older demographics are more susceptible to these conditions. Furthermore, technological advancements in endoscopy, including the development of high-definition imaging, capsule endoscopy, and AI-powered image analysis, are enhancing diagnostic accuracy and patient comfort, thereby driving market adoption. Increased healthcare expenditure and a growing emphasis on early disease detection and preventative care initiatives are also key drivers. The market is broadly segmented by application into hospitals, clinics, and other healthcare settings, with hospitals likely representing the largest segment due to their comprehensive diagnostic capabilities and patient volume.

The Electronic Lower Gastrointestinal Endoscopy market is characterized by a dynamic competitive landscape featuring prominent players like Fujifilm, Olympus Corporation, and Karl Storz, alongside emerging companies. These companies are actively engaged in research and development to introduce innovative solutions, including disposable endoscopes that offer improved hygiene and reduced cross-contamination risks, and reusable endoscopes that are continually being refined for enhanced durability and performance. The market also sees a growing trend towards minimally invasive procedures, which directly benefits endoscopy adoption. However, challenges such as the high cost of advanced endoscopic equipment and the need for specialized training for healthcare professionals may present some restraints. Geographically, the Asia Pacific region, particularly China and India, is expected to exhibit substantial growth owing to a burgeoning population, increasing healthcare infrastructure, and a rising awareness of gastrointestinal health. North America and Europe continue to be significant markets, driven by advanced healthcare systems and high adoption rates of new technologies.

The electronic lower gastrointestinal endoscopy market is poised for robust expansion, with an estimated market size projected to reach several billion dollars by 2033. The XXX value, representing a significant CAGR of over 8% during the Study Period: 2019-2033, underscores the accelerating adoption of advanced endoscopic technologies. This growth is fueled by a confluence of factors, including the increasing prevalence of gastrointestinal disorders such as colorectal cancer, inflammatory bowel disease (IBD), and irritable bowel syndrome (IBS), necessitating more frequent and sophisticated diagnostic and therapeutic procedures. The shift towards minimally invasive procedures continues to drive demand for electronic endoscopes due to their enhanced visualization, maneuverability, and patient comfort compared to traditional methods. Furthermore, advancements in imaging technology, such as high-definition (HD) and ultra-HD resolutions, coupled with the integration of artificial intelligence (AI) for polyp detection and characterization, are revolutionizing diagnostic accuracy and treatment efficacy. The growing emphasis on preventative healthcare and early disease detection further contributes to the expanding use of lower gastrointestinal endoscopy, particularly in screening programs for colorectal cancer. The market is also witnessing a surge in the development and adoption of disposable endoscopes, driven by concerns surrounding infection control and the rising costs associated with reprocessing reusable devices. This trend, however, is balanced by the continued demand for reusable endoscopes, especially in high-volume healthcare settings where cost-effectiveness and durability are paramount. The competitive landscape is characterized by continuous innovation, with established players and emerging companies vying for market share through product differentiation and strategic collaborations. As healthcare systems worldwide increasingly prioritize patient outcomes and procedural efficiency, the role of electronic lower gastrointestinal endoscopy is set to become even more critical. The global production volume is anticipated to cross the [Insert Billion Value Here] mark by Estimated Year: 2025, indicating substantial manufacturing capabilities and supply chain robustness to meet the escalating demand. This detailed report delves into the intricate dynamics of this vital medical technology sector, offering in-depth insights into market trends, driving forces, challenges, regional dominance, key players, and future developments from Historical Period: 2019-2024 through Forecast Period: 2025-2033.

The escalating global burden of gastrointestinal diseases stands as a primary driver for the electronic lower gastrointestinal endoscopy market. Conditions such as colorectal cancer, IBD, and IBS, marked by increasing incidence and prevalence, necessitate accurate and timely diagnosis, which electronic endoscopy facilitates with unparalleled precision. The inherent benefits of minimally invasive procedures, including reduced patient discomfort, shorter recovery times, and a lower risk of complications, are further propelling the adoption of these advanced endoscopic tools. As healthcare providers and patients alike increasingly favor less invasive interventions, the demand for electronic endoscopes is surging. Moreover, significant technological advancements are continuously reshaping the landscape. The integration of high-resolution imaging, including 4K and even 8K capabilities, provides clinicians with exceptionally clear and detailed views of the gastrointestinal tract, crucial for identifying subtle pathological changes. The burgeoning field of AI in endoscopy, with algorithms capable of assisting in polyp detection, characterization, and even predicting malignancy, is revolutionizing diagnostic accuracy and workflow efficiency. This technological evolution enhances diagnostic confidence and improves patient outcomes, thereby driving market growth. The growing awareness and proactive approach towards cancer screening, especially for colorectal cancer, is another powerful propellant. Public health initiatives and governmental policies promoting early detection are directly translating into higher demand for endoscopic procedures.

Despite the promising growth trajectory, the electronic lower gastrointestinal endoscopy market is not without its challenges. A significant restraint lies in the substantial initial investment required for acquiring advanced endoscopic systems and associated equipment. The high cost of these sophisticated devices can be a barrier for smaller healthcare facilities and those in resource-limited regions, impacting widespread adoption. Furthermore, the ongoing need for continuous technological upgrades to keep pace with innovations presents a recurring capital expenditure, which can strain healthcare budgets. Another considerable challenge is the risk of healthcare-associated infections, necessitating stringent protocols for cleaning, disinfection, and sterilization, particularly for reusable endoscopes. While disposable endoscopes offer a solution, their associated costs can be prohibitive for routine use in some settings. The complexity of some advanced endoscopic procedures also demands highly trained and skilled personnel, leading to a potential shortage of qualified endoscopists in certain areas. Reimbursement policies can also play a crucial role; insufficient coverage or complex billing procedures for endoscopic services can discourage their utilization. Finally, the stringent regulatory environment governing medical devices, requiring extensive testing and approval processes, can lead to delays in product launches and increased development costs for manufacturers.

The Hospital segment, within the Application category, is projected to be a dominant force in the global electronic lower gastrointestinal endoscopy market during the Forecast Period: 2025-2033. Hospitals, as central hubs for complex medical procedures, advanced diagnostics, and inpatient care, naturally represent the largest consumers of sophisticated endoscopic equipment. Their capacity to handle a high volume of procedures, coupled with the presence of specialized gastroenterology departments and the financial resources to invest in cutting-edge technology, positions them as key market drivers. The increasing prevalence of gastrointestinal disorders, coupled with the growing trend towards early cancer detection and preventative screenings, directly translates into a higher demand for lower gastrointestinal endoscopies within hospital settings. Furthermore, hospitals are at the forefront of adopting new technologies, including AI-assisted diagnostics and advanced imaging modalities, which are integral to the electronic lower gastrointestinal endoscopy landscape. The continuous advancements in therapeutic endoscopy, such as endoscopic submucosal dissection (ESD) and endoscopic retrograde cholangiopancreatography (ERCP), which are often performed in hospital environments, further bolster the dominance of this segment. The robust infrastructure, availability of trained medical professionals, and the ability to manage complex cases make hospitals the primary venue for these procedures.

Within the broader market context, North America and Europe are expected to lead in terms of market value and adoption rates. This leadership is attributed to several factors:

While Asia-Pacific is expected to witness the fastest growth due to expanding healthcare access and rising awareness, North America and Europe will likely maintain their dominance in terms of overall market size and technological sophistication in the near to medium term. The Type: Reusable segment, while facing competition from disposables, will continue to hold a significant share due to its cost-effectiveness in high-volume settings and established infrastructure for reprocessing. However, the growing concern for infection control is a catalyst for the increasing adoption of Type: Disposable endoscopes, particularly in specific applications and healthcare environments.

The electronic lower gastrointestinal endoscopy industry is propelled by several key growth catalysts. The burgeoning global demand for minimally invasive procedures, driven by enhanced patient comfort and faster recovery, is a primary driver. Technological advancements, particularly in imaging resolution and the integration of artificial intelligence for improved diagnostic accuracy, are revolutionizing the field. Furthermore, the escalating incidence of gastrointestinal disorders, including colorectal cancer, fuels the need for early detection and effective treatment, directly boosting the demand for endoscopic interventions.

This comprehensive report provides an in-depth analysis of the electronic lower gastrointestinal endoscopy market, meticulously covering market size, segmentation, and future projections. It delves into the intricate dynamics of key regions and countries, highlighting dominant segments like Hospitals within the Application category. The report further examines the competitive landscape, profiling leading players and their strategic initiatives. With a detailed exploration of market trends, driving forces, challenges, and industry developments, this report offers invaluable insights for stakeholders seeking to understand and capitalize on the evolving electronic lower gastrointestinal endoscopy sector. The XXX value, coupled with a CAGR of over 8% during the Study Period: 2019-2033, signifies a robust growth trajectory and immense opportunities within this vital medical technology domain.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.6%.

Key companies in the market include Fujifilm, Olympus Corporation, XION, Karl Storz, ATMOS Medizin Technik, Pentax, Sono Scape, Toooge, Chongqing Jinshan Science & Technology (Group), Opto Medic, Aohua, Vision Medical, MDH, .

The market segments include Application, Type.

The market size is estimated to be USD 37.08 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Electronic Lower Gastrointestinal Endoscopy," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Electronic Lower Gastrointestinal Endoscopy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.