1. What is the projected Compound Annual Growth Rate (CAGR) of the Electrohydraulic Pump Motor?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Electrohydraulic Pump Motor

Electrohydraulic Pump MotorElectrohydraulic Pump Motor by Type (DC Motor, AC Motor, World Electrohydraulic Pump Motor Production ), by Application (Automotive Industry, Construction Industry, Mining, Industrial, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

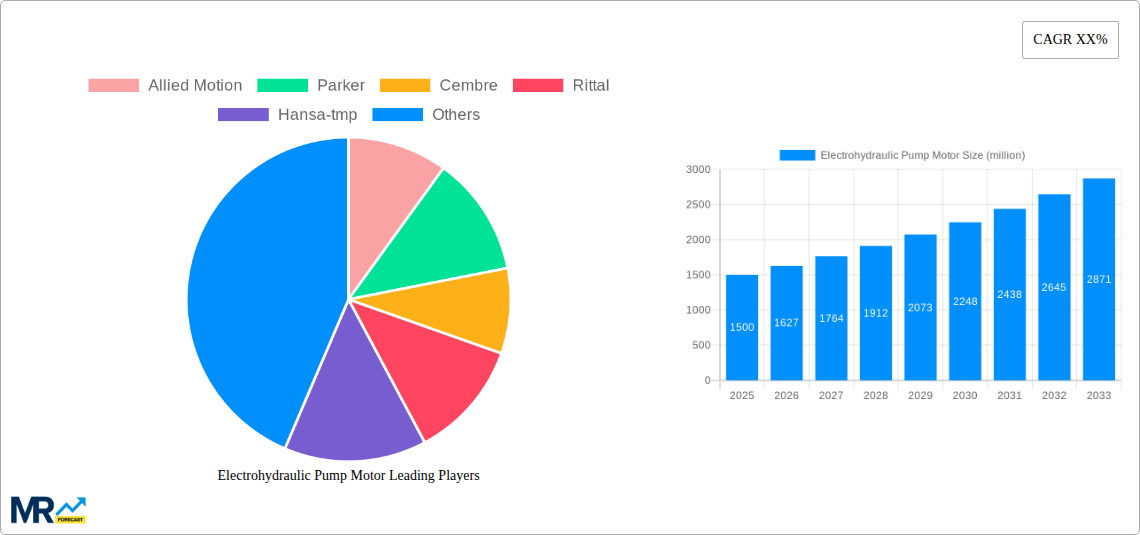

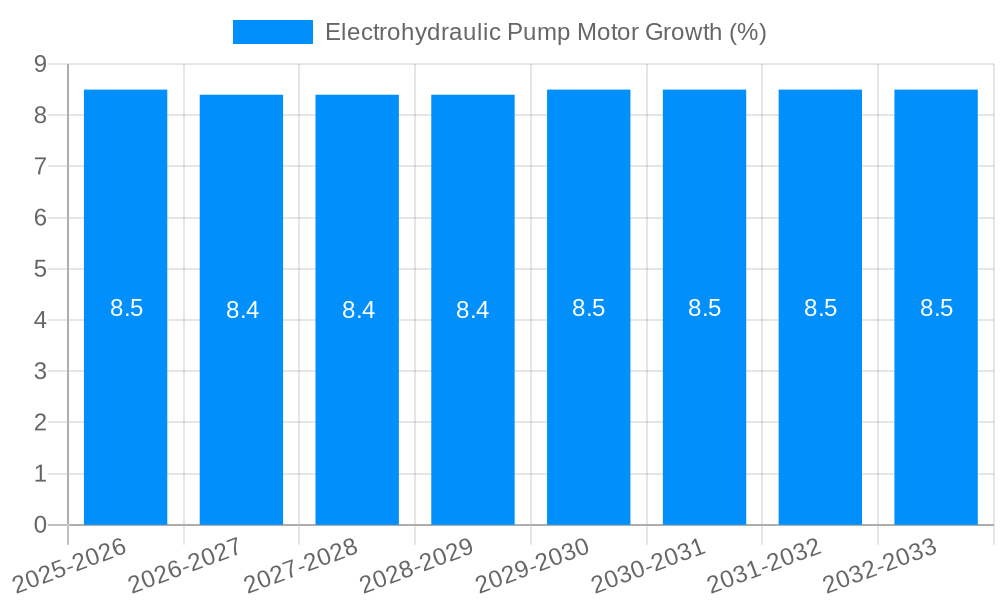

The global Electrohydraulic Pump Motor market is poised for significant expansion, projected to reach an estimated $1,500 million by 2025 and exhibit a robust Compound Annual Growth Rate (CAGR) of 8.5% over the forecast period. This impressive trajectory is propelled by a confluence of factors, including the increasing demand for energy-efficient and reliable hydraulic systems across diverse industrial sectors. Key drivers such as the rapid advancements in automation within manufacturing, the burgeoning construction industry's need for powerful and precise hydraulic solutions, and the continuous innovation in electric vehicle (EV) technology are fueling market growth. The versatility of electrohydraulic pump motors, offering superior control and performance compared to traditional hydraulic systems, is making them indispensable in applications demanding high-efficiency power transmission. Furthermore, the growing emphasis on reducing operational costs and enhancing productivity across industries is steering investments towards these advanced motor technologies.

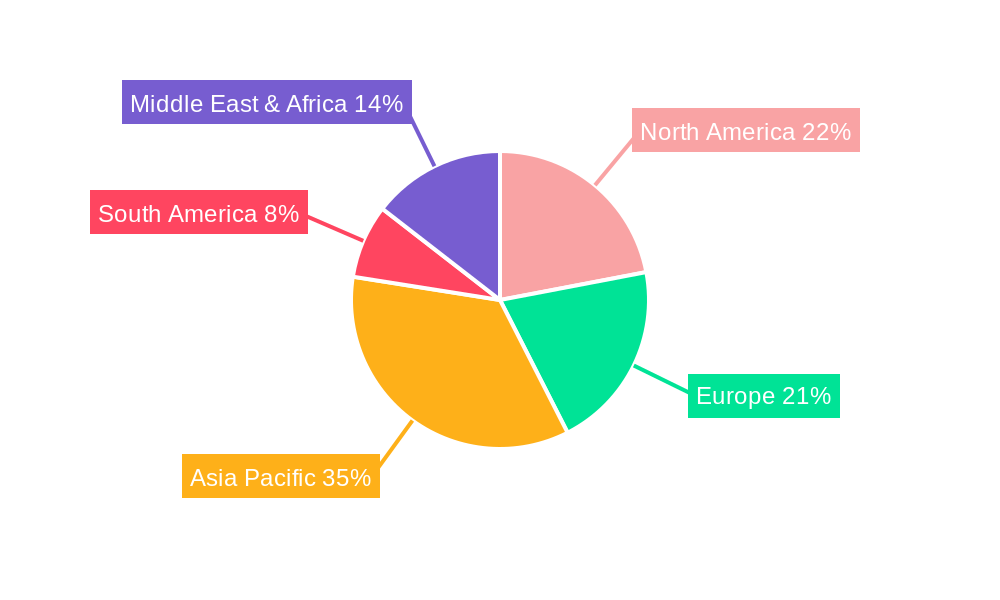

The market is segmented by motor type, with both DC and AC motors carving out significant market shares, each catering to specific performance and application requirements. In terms of application, the automotive industry, driven by the electrification trend and the need for sophisticated power steering and lift systems, stands out as a major growth area. The construction industry, with its extensive use of excavators, cranes, and other heavy machinery, continues to be a cornerstone of demand. Mining operations, requiring robust and high-performance hydraulic components, also represent a substantial market. Emerging trends include the integration of smart technologies and IoT capabilities into electrohydraulic pump motors for predictive maintenance and enhanced operational oversight. However, challenges such as the initial cost of advanced electrohydraulic systems and the availability of skilled technicians for installation and maintenance could pose moderate restraints to the market's otherwise stellar growth. Geographically, Asia Pacific, led by China and India, is expected to dominate the market due to rapid industrialization and infrastructure development, followed closely by North America and Europe, which are witnessing a surge in adoption driven by technological innovation and stringent efficiency regulations.

Here is a comprehensive report description for Electrohydraulic Pump Motors, incorporating your specified details:

This comprehensive report offers an in-depth analysis of the global Electrohydraulic Pump Motor market, examining its trajectory from the historical period of 2019-2024 through to a detailed forecast for 2025-2033. The base year for extensive analysis is 2025, providing a crucial benchmark for understanding current market dynamics and future potential. The report utilizes a robust methodology to project market growth, with specific attention paid to the projected World Electrohydraulic Pump Motor Production reaching substantial figures in the million unit range during the study period. This intricate market is characterized by its vital role in a multitude of industrial applications, driven by evolving technological advancements and increasing demand for efficient and reliable fluid power systems. We will explore the nuances of both DC and AC motor types within this sector, assessing their respective market shares and growth prospects. The report will also meticulously dissect the market segmentation across key application areas including the Automotive Industry, Construction Industry, Mining, and broader Industrial applications, as well as a consideration for Other niche segments.

The global Electrohydraulic Pump Motor market is experiencing a significant paradigm shift, driven by a confluence of technological innovation, increasing industrial automation, and a growing emphasis on energy efficiency. A key trend observed throughout the study period (2019-2033) and particularly around the base year of 2025 is the accelerating adoption of electrohydraulic systems in applications demanding precise control and high performance. For instance, within the Automotive Industry, the integration of electrohydraulic power steering systems and active suspension technologies, powered by these specialized motors, is on the rise. This is not merely about replacing traditional hydraulic components but about achieving superior fuel efficiency, enhanced safety features, and a more refined driving experience. Similarly, in the Construction Industry, the move towards more sophisticated and automated heavy machinery, such as excavators and loaders, is fueling demand for electrohydraulic pump motors that offer variable displacement and responsive operation, leading to improved productivity and reduced operational costs. The Mining sector, with its inherent need for robust and reliable equipment in demanding environments, is increasingly leveraging electrohydraulic systems for enhanced safety and efficiency in operations like drilling and material handling.

Furthermore, the trend towards electrification across industries is directly impacting the electrohydraulic pump motor market. Manufacturers are increasingly focusing on developing compact, lightweight, and power-dense motor solutions that can seamlessly integrate into increasingly complex electrohydraulic circuits. This is particularly evident in the development of specialized AC and DC motor variants tailored for specific performance requirements, such as high torque density for heavy-duty applications or rapid response times for dynamic control systems. The Industrial segment, encompassing a vast array of manufacturing processes, material handling, and automation, is a consistent driver of demand. The push for Industry 4.0 and smart manufacturing initiatives necessitates highly efficient and controllable fluid power systems, where electrohydraulic pump motors play a central role. The focus on sustainability is also a significant undercurrent, with a growing demand for motors that exhibit reduced energy consumption and longer operational lifespans. This includes advancements in motor control algorithms and the integration of more efficient power electronics. The World Electrohydraulic Pump Motor Production is projected to witness consistent growth, with the million-unit mark serving as a key indicator of market scale and impact. The interplay between technological advancements, evolving application needs, and the overarching drive for efficiency and sustainability is shaping a dynamic and promising future for this critical market segment. The Other segment, while potentially smaller in individual scale, encompasses niche but high-value applications that contribute to the overall market diversification and innovation landscape.

The electrohydraulic pump motor market is experiencing robust growth, propelled by several interconnected driving forces. Foremost among these is the escalating demand for automation and efficiency across a wide spectrum of industries. As sectors like Automotive, Construction, and Industrial manufacturing strive for enhanced productivity, reduced operational costs, and improved product quality, electrohydraulic systems, powered by specialized motors, have become indispensable. These systems offer superior control, responsiveness, and energy efficiency compared to traditional hydraulic setups. For example, in the Construction Industry, the trend towards intelligent excavators and loaders, equipped with precise electrohydraulic controls for optimized digging and lifting operations, directly fuels the demand for these motors. The Automotive Industry's increasing adoption of advanced driver-assistance systems (ADAS) and increasingly electrified vehicle architectures also contributes significantly. Electrohydraulic power steering, active suspension systems, and electric vehicle braking systems often rely on these motors for their precise and rapid actuation.

Furthermore, the global push for energy conservation and reduced environmental impact is a significant propellant. Electrohydraulic pump motors, particularly when integrated with advanced variable speed drives and control systems, offer substantial energy savings by matching power output to real-time demand, thereby minimizing energy wastage. This is a critical factor in industries facing stricter environmental regulations and cost pressures. The Mining sector, characterized by its heavy-duty equipment operating in harsh conditions, is also increasingly adopting electrohydraulic solutions for improved safety, reliability, and operational efficiency, which translates to higher output and lower maintenance costs. The ongoing advancements in motor technology itself, including the development of more compact, lightweight, and powerful AC and DC motor designs, are also enabling new applications and improving the performance of existing ones. These technological leaps ensure that electrohydraulic pump motors can meet the ever-increasing demands for power density and operational flexibility. The consistent growth in World Electrohydraulic Pump Motor Production, projected to reach significant million-unit figures, is a direct reflection of these powerful market drivers.

Despite the promising growth trajectory, the electrohydraulic pump motor market faces several challenges and restraints that warrant careful consideration. One of the primary obstacles is the high initial cost of electrohydraulic systems compared to conventional hydraulic systems. While the long-term benefits in terms of energy efficiency and performance are undeniable, the upfront investment can be a significant deterrent for smaller businesses or those in sectors with tight capital expenditure budgets, particularly in price-sensitive markets or when considering applications outside of the major industries like Automotive and Construction. This can lead to a slower adoption rate in certain segments, even when the technological benefits are clear. The complexity of integration and the need for specialized expertise also pose a challenge. Implementing and maintaining electrohydraulic systems require a higher level of technical proficiency and specialized training, which may not be readily available in all regions or for all end-users. This can translate to higher maintenance costs and a potential shortage of skilled technicians, especially as the World Electrohydraulic Pump Motor Production scales up to meet demand.

Another restraint is the evolving regulatory landscape and standardization efforts. While efforts are underway to standardize components and interfaces, the lack of universally adopted standards can sometimes hinder interoperability and increase development costs for manufacturers. Ensuring compliance with various regional and industry-specific regulations related to electrical safety, emissions, and energy efficiency adds another layer of complexity. Furthermore, while advancements in AC and DC motor technology are driving innovation, the reliance on specific electronic components and the potential for supply chain disruptions can pose a risk. Geopolitical factors, material shortages, and manufacturing bottlenecks can impact the availability and cost of critical components, thereby affecting production timelines and pricing. The maintenance and repair infrastructure for these advanced systems also needs to be robust. While electrohydraulic systems can offer increased reliability, when failures do occur, the specialized nature of the components can make repairs more complex and time-consuming, potentially leading to extended downtime for critical operations in industries like Mining. Finally, the perception of reliability and durability compared to well-established mechanical systems, particularly in extremely harsh environments, can also be a factor influencing adoption, though this is increasingly being addressed through product development and real-world performance data.

Dominant Regions/Countries:

Asia-Pacific: This region is poised to dominate the electrohydraulic pump motor market due to its robust manufacturing base, significant industrial growth, and increasing adoption of automation across various sectors.

North America: The United States, in particular, stands out as a major player due to its advanced industrial infrastructure, significant demand from the Construction Industry for heavy machinery, and the presence of a large and technologically sophisticated Automotive Industry. The emphasis on automation, efficiency, and the adoption of new technologies contributes to sustained market leadership.

Europe: This region, with its strong automotive manufacturing base and a consistent focus on industrial automation and energy efficiency, also holds a significant share. Countries like Germany are leaders in advanced engineering and drive demand for high-performance electrohydraulic solutions. The growing emphasis on sustainability and electrification further fuels market growth.

Dominant Segments:

Application: Industrial Segment: The Industrial segment is expected to be a dominant force in the electrohydraulic pump motor market throughout the study period (2019-2033), with the base year 2025 serving as a snapshot of its significant market share. This broad segment encompasses a vast array of applications, including material handling, machine tools, robotics, hydraulic presses, and general automation within manufacturing facilities. The ongoing digital transformation of industries (Industry 4.0) necessitates precise, efficient, and reliable fluid power solutions, which electrohydraulic pump motors provide. The increasing implementation of automated production lines and the need for enhanced operational efficiency and reduced energy consumption in factories worldwide directly translate into substantial demand for these motors. The World Electrohydraulic Pump Motor Production is significantly influenced by the sheer volume and diversity of industrial applications.

Type: AC Motor: While DC motors play a crucial role in specific niche and mobile applications, AC motors are projected to hold a leading position within the electrohydraulic pump motor market. This is largely due to their suitability for stationary industrial applications, where they offer a balance of power, efficiency, and cost-effectiveness. Many industrial processes, such as those found in manufacturing plants and heavy machinery, are powered by AC grids, making AC motor-driven electrohydraulic systems a natural fit. Their robustness, ease of maintenance, and ability to deliver high power output make them ideal for continuous operation in demanding industrial environments. The advancements in Variable Frequency Drives (VFDs) have further enhanced the efficiency and controllability of AC motors, allowing them to match the performance of DC motors in many applications while often presenting a more economical solution for large-scale industrial deployments. The Industrial segment's reliance on robust, scalable, and efficient power solutions makes AC motors a key component driving market growth and dominance.

The electrohydraulic pump motor industry is experiencing several key growth catalysts that are shaping its future. The relentless pursuit of energy efficiency across all industrial sectors is a primary driver, as electrohydraulic systems, powered by advanced motors, offer significant power savings through precise control and reduced waste. Furthermore, the increasing demand for automation and smart manufacturing (Industry 4.0) necessitates the integration of highly responsive and controllable fluid power systems, with electrohydraulic pump motors playing a central role. The continuous innovation in motor technology, leading to more compact, powerful, and reliable designs, is enabling new applications and improving existing ones, particularly within the Automotive Industry for advanced features and the Construction Industry for more sophisticated machinery. Finally, growing investments in infrastructure and industrial development in emerging economies are creating substantial new markets for these essential components.

This report provides unparalleled comprehensive coverage of the Electrohydraulic Pump Motor market, delving into every facet of its dynamics. It meticulously analyzes market size, value, and volume projections, utilizing historical data from 2019-2024 and detailed forecasts for 2025-2033, with 2025 as the crucial base year. The report dissects the market by motor type (DC and AC) and across key application segments including the Automotive Industry, Construction Industry, Mining, Industrial, and Other applications. It identifies and quantifies the World Electrohydraulic Pump Motor Production in millions of units, offering a clear picture of global output. Furthermore, the report thoroughly investigates the driving forces behind market growth, such as the increasing demand for automation and energy efficiency, alongside the challenges and restraints that may impede expansion, such as high initial costs and complex integration. The analysis extends to identifying key regions and countries poised for market dominance, alongside the specific segments that will lead growth. It also highlights significant technological advancements, strategic initiatives by leading players, and emerging industry trends. This in-depth research equips stakeholders with the critical insights needed for strategic decision-making, investment planning, and competitive analysis within this vital industrial sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Allied Motion, Parker, Cembre, Rittal, Hansa-tmp, Vetus, Bosch Rexroth, WEG, HYDAC, Kwangrim, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Electrohydraulic Pump Motor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Electrohydraulic Pump Motor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.