1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Vehicle LFP Battery?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Electric Vehicle LFP Battery

Electric Vehicle LFP BatteryElectric Vehicle LFP Battery by Type (Prismatic LFP Battery, Soft Pack LFP Battery, Cylindrical LFP Battery, World Electric Vehicle LFP Battery Production ), by Application (PEV, HEV, World Electric Vehicle LFP Battery Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

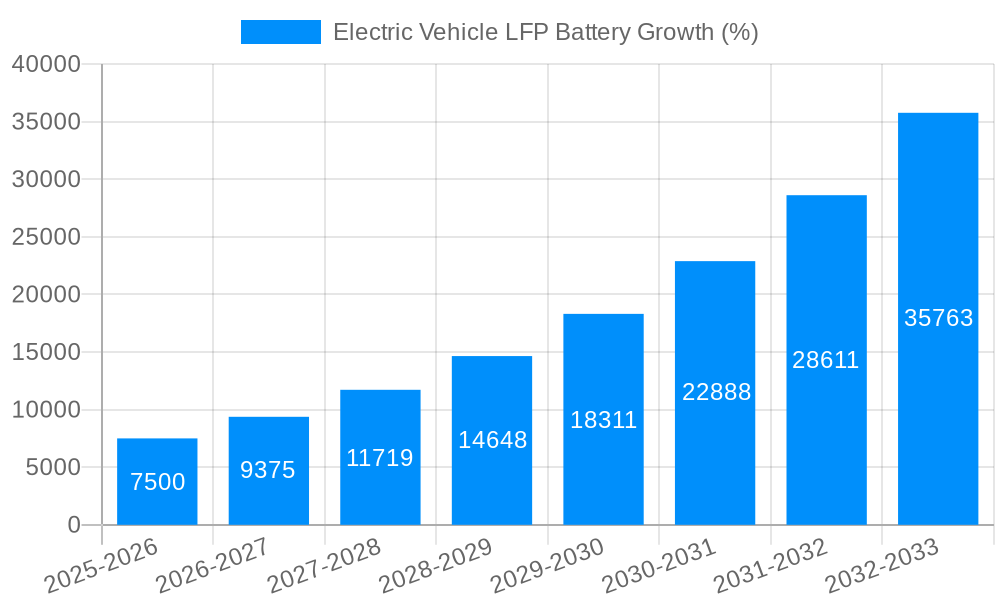

The Electric Vehicle (EV) Lithium Iron Phosphate (LFP) battery market is experiencing robust growth, driven by increasing demand for EVs globally and the cost-effectiveness and safety advantages of LFP technology compared to Nickel-based alternatives. The market, estimated at $50 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 25% from 2025 to 2033, reaching approximately $250 billion by 2033. This significant expansion is fueled by several key factors, including supportive government policies promoting EV adoption, the falling cost of LFP batteries, and improvements in energy density and performance. The dominant players, including CATL, BYD, and Gotion High-tech, are strategically expanding their manufacturing capacity to meet this burgeoning demand, leading to increased competition and further price reductions. Different battery formats like prismatic, soft pack, and cylindrical LFP batteries cater to various EV applications, including passenger electric vehicles (PEVs) and hybrid electric vehicles (HEVs). Geographic growth is particularly strong in Asia Pacific, especially China, driven by a large domestic market and established battery manufacturing infrastructure. However, challenges remain, including the potential for supply chain disruptions and the ongoing need to improve the cold-weather performance of LFP batteries.

The segmentation of the market reveals a strong preference for prismatic LFP batteries due to their cost-effectiveness and suitability for high-volume production. While cylindrical and soft pack LFP batteries hold their niche segments, the prismatic format is expected to maintain its market leadership throughout the forecast period. The application segment is dominated by PEVs, reflecting the strong growth in the global passenger EV market. North America and Europe are expected to experience substantial growth, driven by rising EV adoption rates and government incentives, although the Asia Pacific region will likely retain the largest market share owing to its strong manufacturing base and large domestic EV market. The competitive landscape is dynamic, with continuous innovation and expansion among key players. The long-term prospects for the EV LFP battery market remain highly positive, supported by the global transition towards sustainable transportation and the inherent advantages of LFP battery technology.

The electric vehicle (EV) LFP battery market is experiencing explosive growth, driven by the increasing demand for cost-effective and safe energy storage solutions for EVs. The study period from 2019 to 2033 reveals a dramatic upswing, with production figures projected to reach multi-million unit levels by 2033. The market's expansion is fueled by several key factors. Firstly, the inherent cost-effectiveness of LFP batteries compared to NMC (Nickel Manganese Cobalt) batteries makes them highly attractive for mass-market EV adoption, particularly in emerging markets. This price advantage is significantly impacting the overall affordability of EVs and boosting their appeal to a wider consumer base. Secondly, advancements in LFP battery technology have addressed previous concerns regarding energy density. While still lagging behind NMC in this area, recent innovations have led to noticeable improvements, making LFP batteries suitable for a broader range of EV applications, including passenger cars and commercial vehicles. Thirdly, the robust safety profile of LFP batteries, demonstrated by their inherent thermal stability, is attracting considerable interest from manufacturers and consumers alike, as safety is a primary concern in the EV sector. This is especially pertinent given the safety incidents reported with other battery chemistries. Finally, governmental incentives and policies worldwide are actively promoting the adoption of EVs, creating a highly favorable environment for LFP battery manufacturers. This multifaceted approach – combining cost competitiveness, technological advancements, safety, and supportive policy – positions the LFP battery market for sustained and significant growth throughout the forecast period (2025-2033). The estimated production for 2025 places the market firmly in the multi-million unit range, with further substantial increases expected in subsequent years.

The burgeoning electric vehicle LFP battery market is propelled by a convergence of factors. The primary driver is the escalating demand for cost-effective EVs. LFP batteries offer a significantly lower cost per kilowatt-hour compared to other battery chemistries, making them particularly appealing for budget-conscious consumers and manufacturers aiming for competitive pricing. This cost advantage translates into more affordable EVs, accelerating mass market adoption. Simultaneously, advancements in LFP battery technology are improving their energy density, range, and overall performance. These improvements are progressively addressing previous limitations, expanding the applicability of LFP batteries across a wider spectrum of EV segments, from smaller city cars to larger SUVs and commercial vehicles. Furthermore, the inherent safety profile of LFP batteries, characterized by enhanced thermal stability and reduced risk of thermal runaway, is a compelling factor for both manufacturers and consumers. This safety advantage is mitigating anxieties surrounding battery fires and improving overall consumer confidence in EVs. Lastly, government regulations and subsidies globally are aggressively promoting EV adoption, creating a supportive policy environment that further accelerates the growth of the LFP battery market. These concerted efforts – cost-effectiveness, technological progress, safety enhancements, and favorable policy – ensure the continued momentum of the EV LFP battery market.

Despite the substantial growth potential, the EV LFP battery market faces certain challenges. One key limitation is the comparatively lower energy density compared to NMC batteries. This directly translates to a shorter driving range for EVs utilizing LFP batteries, potentially hindering their appeal to consumers seeking maximum range. Furthermore, the sourcing and availability of raw materials needed for LFP battery production, such as lithium, phosphate, and graphite, pose significant supply chain risks. These materials are subject to price volatility and geopolitical factors, potentially impacting the overall cost competitiveness of LFP batteries. Moreover, while LFP batteries offer enhanced safety, they are not entirely immune to degradation and potential failure. Addressing long-term performance and extending battery lifespan remain areas of ongoing research and development. Finally, competition from other battery chemistries, such as solid-state batteries, presents a long-term challenge. These emerging technologies, while currently more expensive, offer the potential for superior performance and safety, potentially impacting the market share of LFP batteries in the future. These challenges necessitate continued innovation and strategic management within the LFP battery industry to ensure sustainable growth.

The Asia-Pacific region, particularly China, is poised to dominate the global EV LFP battery market throughout the forecast period. China's massive EV market, combined with its strong domestic LFP battery manufacturing capacity, creates a synergistic effect driving substantial growth.

China's dominance: China's aggressive push for EV adoption, coupled with supportive government policies and a robust domestic supply chain, firmly establishes its leading position. This includes significant investments in R&D and manufacturing facilities.

Prismatic LFP Battery Segment: The prismatic LFP battery segment is expected to hold the largest market share due to its cost-effectiveness and suitability for various EV applications. Their relatively high energy density and ease of packaging make them ideal for a wide range of EV configurations.

PEV (Pure Electric Vehicle) Application: The significant growth in the PEV segment is a major factor driving LFP battery demand. The increasing affordability of EVs due to lower battery costs is fueling this trend.

The paragraph below explains the dominance further.

China's leading role stems from a multitude of factors, including its robust domestic EV manufacturing base, readily available raw materials, favorable governmental policies that incentivize both production and adoption, and a well-established supply chain for LFP batteries. The dominance of the prismatic segment is attributable to its versatility, ease of manufacture, and suitability for various EV designs and applications. This segment offers a balance between cost, energy density, and performance, aligning well with the current market demands. Finally, the strong growth of the PEV market is intrinsically linked to the cost-effectiveness of LFP batteries, making them an ideal power source for a large and expanding segment of the EV sector. This synergy between technological advancement, production capabilities, supportive policy, and market demand propels both China and the prismatic PEV segment towards market dominance.

The EV LFP battery industry's growth is fueled by several key factors: increasing affordability of EVs driven by lower battery costs, improving energy density of LFP batteries, enhancing safety features, supportive governmental policies and subsidies globally promoting EV adoption, and continued technological advancements, including improvements in battery management systems and charging infrastructure. These combined forces are creating a highly favorable market environment, resulting in significant and sustained growth in the sector.

This report provides a comprehensive overview of the electric vehicle LFP battery market, covering market trends, driving forces, challenges, key players, and significant developments. It offers detailed analysis of different battery types, applications, and key geographical regions, providing invaluable insights for industry stakeholders and investors navigating this rapidly expanding market. The report's forecast extends to 2033, offering a long-term perspective on this critical component of the electric vehicle revolution.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include CATL, BYD, Gotion High-tech, EVE, REPT, CALB, Great Power, Lishen Battery, Wanxiang A123, ANC, Hithium, Lithion (Valence), .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Electric Vehicle LFP Battery," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Electric Vehicle LFP Battery, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.